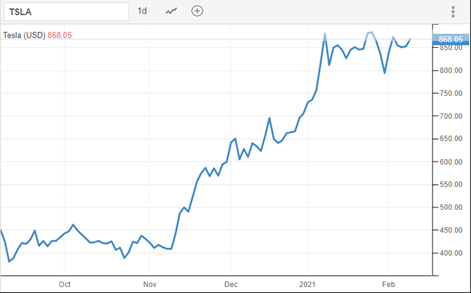

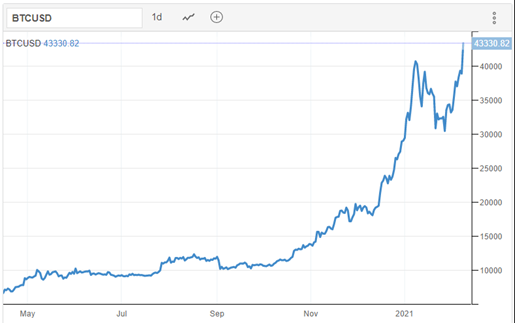

Tesla just announced that it had bought 1.5 billion dollars of bitcoin and could in the future sell cars in bitcoins. Since this morning both Bitcoin and Tesla are going up in the market. Maybe there is afterall something in the saying that“Bitcoin is Tesla without the cars”1/ 20

Musk is seen as a genius, a true Midas, by many investors and millennials. For them he can never go wrong. He became recently the richest man in the world dur to Tesla stock valuation (+353% yoy). He moves markets and today´s announcement is “kind of legitimise “ bitcoin 2/

Tesla shares attained $870 which represents a Price/ Earnings ratio of 1.747 (!) on the basis of last year´s profits. Apple is at 37 and the S&P firms average is 23 (against a historical average ≈16). Future profits would have to increase a lot to justify a more normal ratio 3/

Tesla has a good product but the question is if it will sell enough cars to get such profits in face of coming fierce competition. However, this is not the question I want to comment upon. It is also not about what may interest the SEC and market conduct…4/

It was not disclosed when Tesla had made this investment. In December, Musk said that Tesla could buy bitcoin, and this was followed by many statements that he supported bitcoin. Bitcoin kept going up & Tesla investment has appreciated. The SEC will look into this 5/

What is important is what all this means for bitcoin's nature and prospects, the abundant misconceptions going around, and authorities and central banks thinking. Among bitcoin and technologic buffs, there is the unshakable belief that bitcoin is the future 6/

First, let´s look at the Tesla announcement that they did it to: “..further diversify and maximize returns on our cash.”. “We expect to begin accepting Bitcoin as a form of payment for our products..subject to applicable laws and initially on a limited basis” 7/

The 1st sentence means that they bought bitcoin as an asset. The 2nd means that the promise to sell cars in bitcoins is limited. Still, any firm can sell in bitcoins at the market exchange rate and immediately go back to dollars on which its production is conducted 8/ 20

There are some costs involved that firms will pass to prices, which would be a problem in small transactions. This and other factors limits the use of bitcoin in transactions which is now negligible. However, even this use will not make a currency out of bitcoin 9/20

With its huge volatility (it is 375 % higher in relation to last October) bitcoin cannot be used as a stable unit of account to take and plan price decisions. No firm could operate a budget or do financial planning based on a unit that can vary as much in 3 months. 10/

It should be clear by now that bitcoin cannot be a currency allowing a STABLE use as a unit of account, a means of payments and a store of value (- 35% between 8 and 27 of January). It is now only another speculative new asset to be compared with the role of gold (!) . 11/

More institutions are investing in bitcoin. A market player said: it is now a matter for allocators. Given that bitcoins are limited to 21 million units (3 million to go), he “calculated” that if all large portfolios would have 0.xx% in bitcoin, its value could go to $400000.12/

Bitcoin is just a series of zeros and ones in a network of computers. It has no fundamental use-value because it will never be a currency. At least gold, that “barbarous relic” (Keynes), has some industrial and jewellery uses that would never justify its historical prices 13/

Speculative assets are valued based only on beliefs. Investors believe that, because of some risk, there will be more or less future buyers, and buy or sell accordingly to that expectation. Bitcoin prices should appear in “commodities” lists not in forex columns 14/

Authorities are condoning the continuation of the public being misled by technological buffs that have no idea of what is money. As Keynes endorsed, the main role of money is to be a stable unit of account defined and managed by the State that creates primary liquidity 15/

Authorities should also make clear that they are thinking of creating central bank digital currency not because of fearing the competition of those crypto-assets. Unlike Monsieur Jourdan, CBs know that they already speak and do digital currencies 16/

If CBs will create digital currencies for the people, they must explain exactly why. Cannot be because “ everything goes digital” or “bitcoin exists” or “we are not technological dinosaurs” or “digital payments don´t work well in advanced countries” or “China is doing it”. 17/

I already live well in a digital currency world that I use for everything̶. I know the arguments of those who want to end the creation of credit/money by the banks. I am very cautious because that is a radical upending of the financial system prone to unwanted consequences 18/

I am not completely against CBs creating their own digital currencies for the people if they protect the essential role of something like banks ensuring credit/money creation and maturity transformation, i.e. credit with long maturities and deposits with short ones. 19/

So, regulate bitcoin and its clones as assets (crypto-assets), explain why the digital currency that the central banks already have should be accessible to the public and in what conditions and try to put a stop to all the irrationalities that surround these issues 20/20’

• • •

Missing some Tweet in this thread? You can try to

force a refresh