$TWTR 💰💻

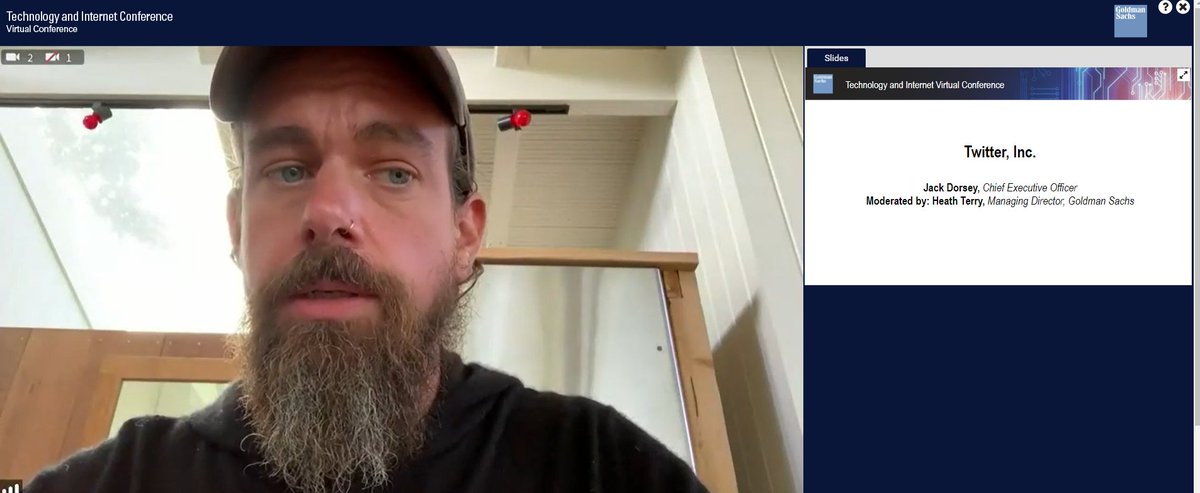

It's pretty clear @jack is fired up about what's coming at Twitter. The rebuild of $TWTR's tech stack & ad server have increased speed to market with new features.

Jack all but promised that Twitter's ability to innovate and iterate has accelerated dramatically.

1/n

It's pretty clear @jack is fired up about what's coming at Twitter. The rebuild of $TWTR's tech stack & ad server have increased speed to market with new features.

Jack all but promised that Twitter's ability to innovate and iterate has accelerated dramatically.

1/n

A few days ago, @kayvz hosted a Twitter Spaces event, where he was live testing the experience. Kayvon said many of the same things Jack did.

Below is a portion of my raw notes from Kayvon, if interested.

If the business of Twitter isn't your jam, no need to read on:

2/n

Below is a portion of my raw notes from Kayvon, if interested.

If the business of Twitter isn't your jam, no need to read on:

2/n

Kayvon runs Product at Twitter - the non-revenue side of Twitter, aka product development. He founded Periscope.

Recall: Spaces is Twitter's competitive response to Clubhouse. An audio hangout.

3/n

Recall: Spaces is Twitter's competitive response to Clubhouse. An audio hangout.

3/n

BIG PICTURE:

I cannot unsee the Spaces product - it fits perfectly with Twitter and will widely used. It was a seamless way to magnify the core Twitter experience.

Kayvon's host controls worked well & the integration w/ Twitter profiles will be a big plus.

4/n

I cannot unsee the Spaces product - it fits perfectly with Twitter and will widely used. It was a seamless way to magnify the core Twitter experience.

Kayvon's host controls worked well & the integration w/ Twitter profiles will be a big plus.

4/n

Example: The idea of @stoolpresidente hosting a Spaces during the Super Bowl where he & his buddies can rip each other, crack jokes, invite in guests, etc., side-by-side with their Tweeting is obvious. It's inevitable. Likewise any topic or personality that is compelling.

5/n

5/n

The quality of the product is pretty incredible. There were a couple hundred listeners simultaneously with no issues. People joined and left with no problems.

KB said it should scale effectively to infinity (ie, more listeners in a Space will not cause degradation).

6/n

KB said it should scale effectively to infinity (ie, more listeners in a Space will not cause degradation).

6/n

KB was very clear that over the coming month, we should expect a "massive" rollout of Spaces to allow more people to host Spaces conversations.

As of Monday, globally there were only 1000 authorized hosts (it's in new beta). On Tuesday, Twitter planned to quadruple that.

7/n

As of Monday, globally there were only 1000 authorized hosts (it's in new beta). On Tuesday, Twitter planned to quadruple that.

7/n

Twitter is going to grow authorized hosts to "10s & 100s" of thousands. "This will take days & weeks, not months & quarters."

TWTR is "laser-focused" on the broad opportunity in audio (not video). Audio is a "durable," wide palette.

Audio is an opportunity that fits $TWTR.

8/n

TWTR is "laser-focused" on the broad opportunity in audio (not video). Audio is a "durable," wide palette.

Audio is an opportunity that fits $TWTR.

8/n

[@compound248 Side Note: I'm very impressed with how rapidly Twitter developed Spaces. I expect it to become core to Twitter VERY fast. It's an immersive medium for connecting with Twitter groups, while maintaining your Twitter profile.]

9/n

9/n

KB talked about the fact Spaces was developed "fast and in public." This reflects the new development energy at Twitter.

To get dev to this place, it required a massive infrastructure rebuild, which was a frustrating time internally.

10/n

To get dev to this place, it required a massive infrastructure rebuild, which was a frustrating time internally.

10/n

"As much as our slow dev bothered users, it really dragged us internally. We've honestly been too slow." (Paraphrasing)

You should expect more "developing in public".

[@UXSuggestions]

11/n

You should expect more "developing in public".

[@UXSuggestions]

11/n

Public Dev creates a "raw feedback loop" from users. TWTR wants to hear directly from users earlier, driving faster iterations - less time wasted on features people don't want (& vice versa). Measure how people use it, not just what people say about how people use it.

12/n

12/n

Public Dev helps unearth & track quality issues. KB let us know engineers were closely tracking his Spaces event.

For example, one lady who was turned on as a Speaker had some microphone troubles. Some of us could hear her and - apparently - others couldn't.

13/n

For example, one lady who was turned on as a Speaker had some microphone troubles. Some of us could hear her and - apparently - others couldn't.

13/n

KB flagged that the engineers would be able to analyze the root cause of the issue she was experiencing and work on troubleshooting to improve the service going forward.

14/n

14/n

KB: Audio certainly isn't the only way, but it is a critical layer to enabling creators to connect more directly with their supporters/fans. Twitter wants to do a better job of empowering and driving value for creators that contribute to Twitter.

15/n

15/n

Q: Tipping?

KB: Absolutely - from the jump, we are building and prioritizing ways to give creators the ability to monetize (tipping is just one way, subscription is another). We'll explore lots of those paths. No silver bullet. Lots of openness to what works for creators.

16/n

KB: Absolutely - from the jump, we are building and prioritizing ways to give creators the ability to monetize (tipping is just one way, subscription is another). We'll explore lots of those paths. No silver bullet. Lots of openness to what works for creators.

16/n

KB emphasized several times that enabling a variety of creator monetization tools is VERY important (tie-ins to other subscriptions, like newsletters). He said Patreon's done a great job. Thinks TWTR has lots of opportunities.

"We are late, but it's never too late..."

17/n

"We are late, but it's never too late..."

17/n

Today, Spaces is mobile-only w/ iOS primacy. Android coming fast, then web listening (not speaking, initially). Today, not planning to separate Spaces from main Twitter app.

Dev Team has a new energy. Excited about our roadmap. Expect more, faster, better.

[end raw notes]

18/n

Dev Team has a new energy. Excited about our roadmap. Expect more, faster, better.

[end raw notes]

18/n

As a $TWTR owner, my view is it is on the verge of realizing it's not a social media business, per se. It is a content distribution platform.

TWTR should own the distribution of any content related to ideas, news, people, & events you find relevant.

[end]

TWTR should own the distribution of any content related to ideas, news, people, & events you find relevant.

[end]

https://twitter.com/compound248/status/1280947348680605696?s=20

Bonus:

Here's my Big Thread on $TWTR from back in mid-2020.

The stock was in the doldrums, but those watching closely could see its dev speed was nearing escape velocity at precisely the same time that its usage was taking off: a potent combo.

🚀🚀🎇💰

Here's my Big Thread on $TWTR from back in mid-2020.

The stock was in the doldrums, but those watching closely could see its dev speed was nearing escape velocity at precisely the same time that its usage was taking off: a potent combo.

🚀🚀🎇💰

https://twitter.com/compound248/status/1272898627728523264?s=20

Props to Twitter's leaders and the Tweeps in general: they've collectively shown their stuff during the past year.

If you're interested in following what's happening at $TWTR, from the perspective of those in the trenches, you may enjoy my "Tweeps" List.

twitter.com/i/lists/134352…

If you're interested in following what's happening at $TWTR, from the perspective of those in the trenches, you may enjoy my "Tweeps" List.

twitter.com/i/lists/134352…

• • •

Missing some Tweet in this thread? You can try to

force a refresh