Interesting to see Substack, Teachable (or Didactic from @wes_kao @gaganbiyani where @Lennysan is offering this cohort-based course) as the initial tiles of a larger revenue jigsaw (puzzle).

https://twitter.com/lennysan/status/1356278817489240070

The core theme is of course @kevin2kelly's famous making a living of your 1,000 or (more) true fans. All of these (Substack, Teachable, Patreon, BuyMeaCoffee etc.) can be seen as ways to enable different route of making a living via your 1k fans

kk.org/thetechnium/10…

kk.org/thetechnium/10…

Before the internet, you had to go through gatekeepers (editors, music co CEOs etc) to reach your fans.

Then, in the first phase of the internet you had marketplaces (Skillshare, Udemy, itunes) where you dont have emails or even direct connects with your fans.

Then, in the first phase of the internet you had marketplaces (Skillshare, Udemy, itunes) where you dont have emails or even direct connects with your fans.

Now the rise of tool apps (essentially business in a box apps), where for a fee (10% in substack’s case) they help you set up and run different revenue-generating models.

Publishing - Substack

Education - Teachable, Didactic (Bitclass in India)

Consulting - Clarity, PickMyBrain

Publishing - Substack

Education - Teachable, Didactic (Bitclass in India)

Consulting - Clarity, PickMyBrain

Essentially what these tool apps are doing is helping me run 1-person businesses effectively. But why stop here?

Why cant a creator / microinfluencer run other ventures?

e.g., ecommerce - what if an influencer could curate her storefront - say her fave products that her fans could buy & get her affiliate rev

e.g., uk.bookshop.org/shop/peterfran…

e.g., ecommerce - what if an influencer could curate her storefront - say her fave products that her fans could buy & get her affiliate rev

e.g., uk.bookshop.org/shop/peterfran…

There is a startup waiting to do this at scale, i.e., help any influencer set up their storefront easily, and market the offering.

If you are building one and are in India then DM me.

If you are building one and are in India then DM me.

Another variant: a popular model is collaborations where an influencer collaborates with a brand - this is popular in the beauty space. But now as @MrBeastYT Burger shows, you can also create a brand in a new category.

There is a slot for a startup that makes it easypeasy for influencers to connect w manufacturers to build a product, and w distributors to reach it to consumers. Happy to chat if anyone is building this.

Imagine a @sejalkumar1195 lipstick manufactured by the same co which does for @trySUGAR @letspurplle & shipped by Shadowfax / ExpressBees….(the key Q here is inventory risk; so my guess is this will first be popular in made per order categories)

What else?

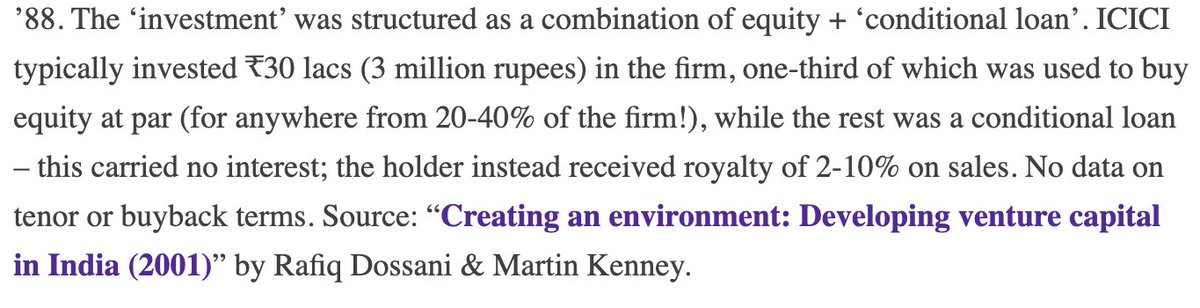

Fintech - capital to invest in influencer's fans / friends / colleagues - today’s Operator VC models via Rolling Funds is exactly that but in the coming years we will see more and more democratization.

Fintech - capital to invest in influencer's fans / friends / colleagues - today’s Operator VC models via Rolling Funds is exactly that but in the coming years we will see more and more democratization.

5+ yrs from now, a smart PM or CXO (or founders) in a Series B co with a decent social brand will easily get $200k to invest in hot startups (scout and bring it to VC funds).

Will think of more streams, but the key theme is startups emerging to help influencers run 1-person companies to generate newer revenue streams, with all of the physical work outsourced and disintermediated. The influencer provides access / brand, content, curation etc.

A term I am thinking of for these is revenualization startups, i.e., startups enabling influencers / creators to tap revenues from diverse plural streams - membership (patreon), writing (substack), consulting (pickmybrain), edu (teachable, cbcs), storefronts / ecommerce etc.

• • •

Missing some Tweet in this thread? You can try to

force a refresh