Once Harshad Mehta's manipulated stock " Acc limited " conducted their conference call on 12th February around 11:00 Am.

"Company focusing growth with brand power"

Here are the key takeaways 😊

"Company focusing growth with brand power"

Here are the key takeaways 😊

- The company have taken various initiatives related to the wellbeing of employees.

- They had a key focus towards health cost and cash for their organisation.

- The company had tried to attain competitive advantage in areas of its product and technology.

- They had a key focus towards health cost and cash for their organisation.

- The company had tried to attain competitive advantage in areas of its product and technology.

- The Company believes in sustainable value creation to scale up and innovation.

- Currently Company has 17 operating cement plants , 80 readymade concrete plants.

- Annual level capacity utilisation of the plants is around 72 percent.

- Currently Company has 17 operating cement plants , 80 readymade concrete plants.

- Annual level capacity utilisation of the plants is around 72 percent.

- The company has a strong parenting support and they want to leverage it the most.

- Company have a basic focus towards retaining its name and making it more contemporary.

- In terms of presence it is well diversified covering 12 states with cement and 17 states with readymix

- Company have a basic focus towards retaining its name and making it more contemporary.

- In terms of presence it is well diversified covering 12 states with cement and 17 states with readymix

- As per company Management the cement sector will witness great surge in demand for following 4 years tentatively.

- To grow further the company is planning new concretes and new engines of growth like constructing chemicals.

- To grow further the company is planning new concretes and new engines of growth like constructing chemicals.

Margins

- key areas for margin growth are:-

Product mix optimization

Cost effeciency project on flagship program

Good working capital management leading to strong cash flow delivery

Launches done in ready mix space.

- key areas for margin growth are:-

Product mix optimization

Cost effeciency project on flagship program

Good working capital management leading to strong cash flow delivery

Launches done in ready mix space.

Business enablers

- The company have followed a path to gain technological advances co linked with logistics support making them cost effective and reach great masses.

- The company have followed a path to gain technological advances co linked with logistics support making them cost effective and reach great masses.

CSR activities

- Acc limited has a main aim of making its society a better place to live. For which they have taken many initiatives.

- Currently company focuses towards malnutrition and education areas.

- Acc limited has a main aim of making its society a better place to live. For which they have taken many initiatives.

- Currently company focuses towards malnutrition and education areas.

- On environmental protection Acc is one of the lowest carbon emission Companies.

- Currently the CO2 per tone is around 493 kgs.

- Along with that Company is trying new alternative methods to use organic fuels and generate energy in environmental friendly manner.

- Currently the CO2 per tone is around 493 kgs.

- Along with that Company is trying new alternative methods to use organic fuels and generate energy in environmental friendly manner.

- The Company has set its target to attain C02 levels around 400 kgs per ton in coming period.

Employees

- Company have shown a great support towards its staff.

- The company took care of their physical and mental well-being.

- Company have also initiated various talent review program as to get the most out of the employees.

- Company have shown a great support towards its staff.

- The company took care of their physical and mental well-being.

- Company have also initiated various talent review program as to get the most out of the employees.

Capex

- New plant at singuria of 1.4 million tons have already producing cement from month of Jan.

- Another project is on which will produce 3 million tons of klinkering.

Both plants together will be able to genetate 6.2 million tons of cement.

- New plant at singuria of 1.4 million tons have already producing cement from month of Jan.

- Another project is on which will produce 3 million tons of klinkering.

Both plants together will be able to genetate 6.2 million tons of cement.

- Balance capacity from project 2 is expected to be brought by Q2 of next year.

- More expansion plans are all linked to industry growth.

- With union budget in mind Company simply believes in India's growth story and will work as per that.

- More expansion plans are all linked to industry growth.

- With union budget in mind Company simply believes in India's growth story and will work as per that.

- The Capex outflow of about 500 cr is already decided by the company for its project.

- In mean time couple WHRS projects were initiated by the company.

- Company recently impaired it's tamilnadu plant due to poor book value and low limestone quality.

- In mean time couple WHRS projects were initiated by the company.

- Company recently impaired it's tamilnadu plant due to poor book value and low limestone quality.

Mergers

- As of now There is no confirmation regarding the companies merger.

- And management fails to answer any other questions related to mining ammendment.

- As of now There is no confirmation regarding the companies merger.

- And management fails to answer any other questions related to mining ammendment.

On cost and cost effeciency

- 200rs per ton was a target but will try to go above it.

- Input cost have been a pressure point for previous few quarters but company is handling it well.

- 200rs per ton was a target but will try to go above it.

- Input cost have been a pressure point for previous few quarters but company is handling it well.

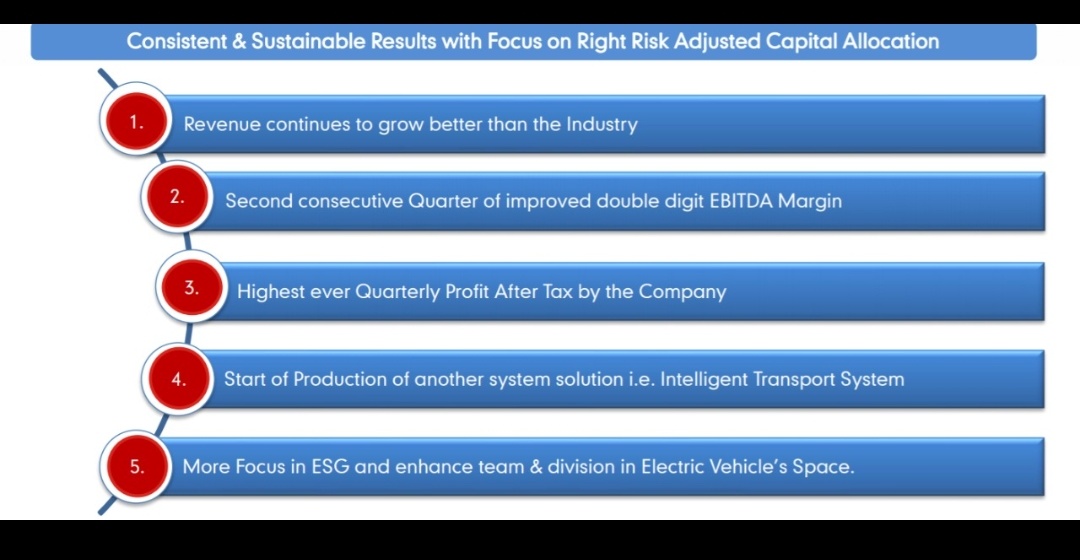

On capital allocation

- Major of the work can be done by internal accruals of Company. But major of it will be used for upcoming organic and inorganic opportunities.

- As covid haven't ended yet , they will invest as soon as time comes

- Major of the work can be done by internal accruals of Company. But major of it will be used for upcoming organic and inorganic opportunities.

- As covid haven't ended yet , they will invest as soon as time comes

Peer gap.

- Gap between acc and Ambuja is widening a lot but now acc is working on higest utilisation

Company is looking to bridge the gap soon.

- Gap between acc and Ambuja is widening a lot but now acc is working on higest utilisation

Company is looking to bridge the gap soon.

For more information about stock and happening around world,

Do follow our telegram channel.

t.me/thetycoonminds…

Do follow our telegram channel.

t.me/thetycoonminds…

• • •

Missing some Tweet in this thread? You can try to

force a refresh