Deepak Nitrite Ltd conference call was today at 12:00 clock

"Expects to grow at about 25% growth in next couple of years"

Here are the key takeaways Thread

"Expects to grow at about 25% growth in next couple of years"

Here are the key takeaways Thread

Business Updates:

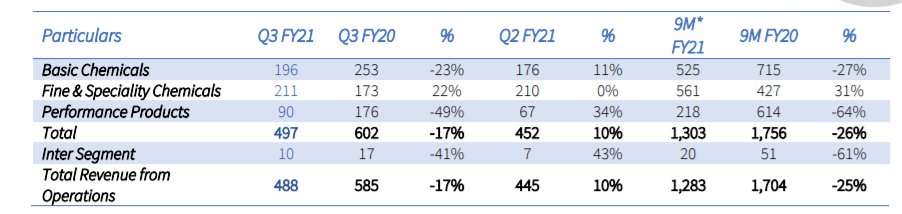

• Growth is from the segment of specialty chemical and Phenolics.

• Demand and utilization returning to pre-covid level.

• Recovery in domestic economic market (around 31% growth), with export revenue growth by 12.9%

• Segmental result shown in image

• Growth is from the segment of specialty chemical and Phenolics.

• Demand and utilization returning to pre-covid level.

• Recovery in domestic economic market (around 31% growth), with export revenue growth by 12.9%

• Segmental result shown in image

Development:

• Land development activity has commenced at the newly acquired site measuring 127 acres at Dahej.

• Balance Sheet of the company remains strong.

• Growth in Phenolics was majorly because of volume growth. Deepak Phenolics at D/E ratio of 0.28 times.

• Land development activity has commenced at the newly acquired site measuring 127 acres at Dahej.

• Balance Sheet of the company remains strong.

• Growth in Phenolics was majorly because of volume growth. Deepak Phenolics at D/E ratio of 0.28 times.

Future Growth Capex:

• Deepak Nitrite and Deepak Phenolics both in growth outlook

• Deepak Nitrite is looking for both down stream and upstream. Downstream for vertically integrated. Upstream is to add value added products.

• Phenolics growth to add more value added product.

• Deepak Nitrite and Deepak Phenolics both in growth outlook

• Deepak Nitrite is looking for both down stream and upstream. Downstream for vertically integrated. Upstream is to add value added products.

• Phenolics growth to add more value added product.

R&D

• Many product in a co-incidence are coming in agriculture.

• Main focus of the company remains of improving the product quality.

Maintenance Shutdown will be announced but this wont impact the Q4 sales number.

• Many product in a co-incidence are coming in agriculture.

• Main focus of the company remains of improving the product quality.

Maintenance Shutdown will be announced but this wont impact the Q4 sales number.

Phenolics:

• Segment in future looks for good mix with higher value product, and also higher value product with medium stream market

• PLI is helpful but without PLI too company will have good future

• Pehnol Derivative is in line, however there are many more derivate in focus

• Segment in future looks for good mix with higher value product, and also higher value product with medium stream market

• PLI is helpful but without PLI too company will have good future

• Pehnol Derivative is in line, however there are many more derivate in focus

Debt:

• There is no vision on zero debt, as growth remains the first priotity of the company.

• Looking at every growth opportunity, co. wont shy for taking debt with growth visible.

• There is no vision on zero debt, as growth remains the first priotity of the company.

• Looking at every growth opportunity, co. wont shy for taking debt with growth visible.

Plant:

• Q3 was 85% utilization, however Q4 is expected to deliver good growth, with stabilizing of raw material price and with reversal in the customer side business.

Margins over material and volume remains the key focus for every plant.

• Q3 was 85% utilization, however Q4 is expected to deliver good growth, with stabilizing of raw material price and with reversal in the customer side business.

Margins over material and volume remains the key focus for every plant.

New product:

• Product must have payback of 3 year. Deepak follows rigorous process of selecting the product.

• Co. is aggressive towards growth in the new value added product.

• There would be bias towards agro-chemical and Pharma, but focus remains to grow in every segment

• Product must have payback of 3 year. Deepak follows rigorous process of selecting the product.

• Co. is aggressive towards growth in the new value added product.

• There would be bias towards agro-chemical and Pharma, but focus remains to grow in every segment

There is expectation of increase in raw material price, with respect to increase in price of both basic and performance chemical. Main focus remains of passing the increase in raw material price and continue providing the require volume to the customer.

New site:

• These will have product both for higher value and higher volume product.

Raw Material:

Raw Material shortages were locally sourced during the time of shortages.

• These will have product both for higher value and higher volume product.

Raw Material:

Raw Material shortages were locally sourced during the time of shortages.

Performance:

The right number to target is 18-20%. Performance chemical is expected to be more stable. Deepak Cleantech will have higher value added product. This will be inline with growth from import-ban products as well. Right market interest and right growth will be in focus.

The right number to target is 18-20%. Performance chemical is expected to be more stable. Deepak Cleantech will have higher value added product. This will be inline with growth from import-ban products as well. Right market interest and right growth will be in focus.

China Competition:

• There is strong competition from China but company is not weak in terms of market share as well. There products are competitive in global space with China as well.

Company continuous to focus on the growth of the business, and still capable to compete China

• There is strong competition from China but company is not weak in terms of market share as well. There products are competitive in global space with China as well.

Company continuous to focus on the growth of the business, and still capable to compete China

• • •

Missing some Tweet in this thread? You can try to

force a refresh