Uflex Ltd conference call was on 11th November

"Expects to grow at about 25% growth in next couple of years"

Here are the key takeaways 🧵👇

"Expects to grow at about 25% growth in next couple of years"

Here are the key takeaways 🧵👇

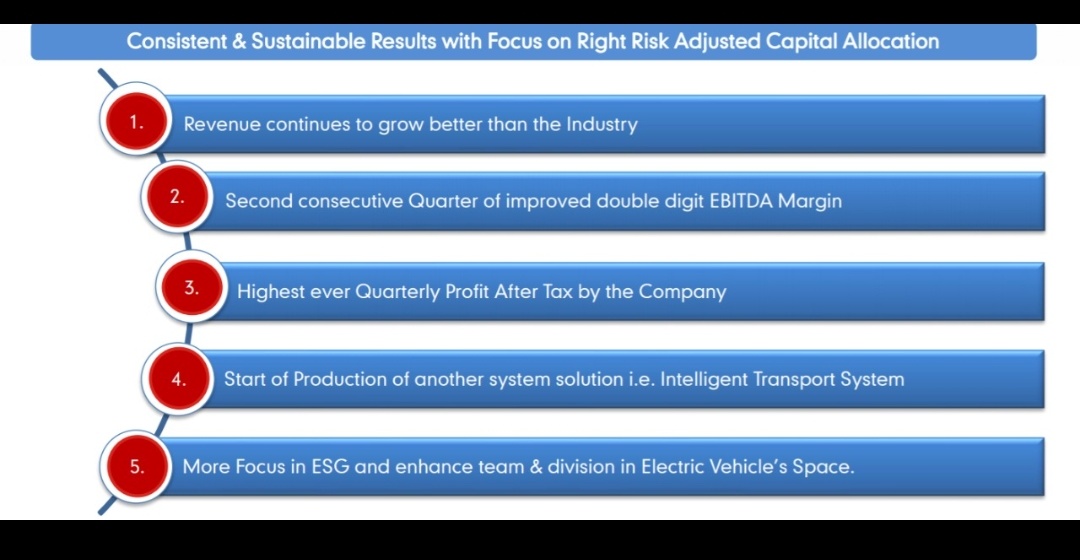

Business Updates:

• Sales and PAT grewt by 89% and 50.8% YoY

• Green field plant expansion in Karnataka

• Brown field CTP line to be set up in UAE and a BOPET line in Poland

• Started trial runs in Poland plans.

• Mgmt expects largest volume gwth with completion of expansion

• Sales and PAT grewt by 89% and 50.8% YoY

• Green field plant expansion in Karnataka

• Brown field CTP line to be set up in UAE and a BOPET line in Poland

• Started trial runs in Poland plans.

• Mgmt expects largest volume gwth with completion of expansion

• Margin and Packing business were but lower in QoQ basis, because of reversal of decline in raw material prices which was there in Q1 and Q2.

• Hence the margins on these front were lower compare to Q1 and Q2.

• Focus remains now on value added products.

• Hence the margins on these front were lower compare to Q1 and Q2.

• Focus remains now on value added products.

Target:

• Expected 25% gwth in revenue with respect to volume and value added product in next couple of years

Margins:

• Mgmt dont expects lag with respect to competitive levels. Polyplex, SRF is in films business. While Uflex, has many value streams which makes margins better

• Expected 25% gwth in revenue with respect to volume and value added product in next couple of years

Margins:

• Mgmt dont expects lag with respect to competitive levels. Polyplex, SRF is in films business. While Uflex, has many value streams which makes margins better

Return Matrix- Investment

• Uflex looks for 20%. IRR But there could be situation where margins got squeeze for certain period of time.

• After 2011, there was lull period with limited margins exposure and then again growth puck up in 2017 and everyone expands during this time.

• Uflex looks for 20%. IRR But there could be situation where margins got squeeze for certain period of time.

• After 2011, there was lull period with limited margins exposure and then again growth puck up in 2017 and everyone expands during this time.

• In India, most of the players works on 10-11% margins which is not sustainable.

ROE Still in single digit:

• Looking at the expansion point of view one cannot expect higher ROE, while on Uflex point of view mgmt would wait for 1-2 year for higher growth ratios.

ROE Still in single digit:

• Looking at the expansion point of view one cannot expect higher ROE, while on Uflex point of view mgmt would wait for 1-2 year for higher growth ratios.

Capital Allocation:

"This CAPEX was not announced in previous quarter call"

• Mgmt states most of the returns would be invested in business.

• Investment made with intention to correct past ratios which were subdued.

• After this expansion revenue is expected to be double.

"This CAPEX was not announced in previous quarter call"

• Mgmt states most of the returns would be invested in business.

• Investment made with intention to correct past ratios which were subdued.

• After this expansion revenue is expected to be double.

Packing business:

• Uflex is running at high utlization level, but there is no point of investing more in these business, as packing business commands less margins, and these less space available.

• While films are getting on higher margins business which is also the focus.

• Uflex is running at high utlization level, but there is no point of investing more in these business, as packing business commands less margins, and these less space available.

• While films are getting on higher margins business which is also the focus.

BOPET:

• Dips in the margins in month of November, as post Diwali was the lull period, but Dec and Jan its is back to Oct level, and now indicates stable margins.

• Raw material price decrease due to drastic lower demand in petrochemical.

• Dips in the margins in month of November, as post Diwali was the lull period, but Dec and Jan its is back to Oct level, and now indicates stable margins.

• Raw material price decrease due to drastic lower demand in petrochemical.

Expansion:

• Overseas capacity is 1,25,000 MTPA.

• FY 22,23 will have left about minimum CAPEX of around 600 crore.

• There is not stated organised vs unorganised market share, and looking at packaging consumption Uflex is market leader as well.

• Overseas capacity is 1,25,000 MTPA.

• FY 22,23 will have left about minimum CAPEX of around 600 crore.

• There is not stated organised vs unorganised market share, and looking at packaging consumption Uflex is market leader as well.

Debt:

• Ideal situation in case of no growth is to pay off debt or dividends.

• India debt is 750 crore, while India EBIDTA is 750 crores, which is conservative.

• Next year co. expects EBIDTA of 2,000cr, hence new debt too will have ratio of lower than 2 (EBIDTA/Debt)

• Ideal situation in case of no growth is to pay off debt or dividends.

• India debt is 750 crore, while India EBIDTA is 750 crores, which is conservative.

• Next year co. expects EBIDTA of 2,000cr, hence new debt too will have ratio of lower than 2 (EBIDTA/Debt)

Huhtamaki:

• Uflex is a integrated players while Huhtmaki is not a integrated players, as they buy packing films, inks, adhesives from the market, which makes Uflex margin better than Huhtamaki.

• Uflex is a integrated players while Huhtmaki is not a integrated players, as they buy packing films, inks, adhesives from the market, which makes Uflex margin better than Huhtamaki.

Acquisition:

• Acquisition usually in packing business have EBIDTA multiple of 12-14x.

• Hence the cos who do not have different use of capital they usually go for acquisition.

• While, the market is itself is small (fragmented market), and there is plenty space for growth.

• Acquisition usually in packing business have EBIDTA multiple of 12-14x.

• Hence the cos who do not have different use of capital they usually go for acquisition.

• While, the market is itself is small (fragmented market), and there is plenty space for growth.

Geographic result:

• Q3 Poland was less as there was some balancing work left in the plant.

• Russia in this quarter is about 6,500 tones.

• Q3 Poland was less as there was some balancing work left in the plant.

• Russia in this quarter is about 6,500 tones.

Promoter Holding:

• Mgmt focus more on growing the pie, and increase the share and no intent to cash out the money and stop the growth.

• There is no need to making institutional investor happier by taking the buyback.

• Mgmt focus more on business.

• Mgmt focus more on growing the pie, and increase the share and no intent to cash out the money and stop the growth.

• There is no need to making institutional investor happier by taking the buyback.

• Mgmt focus more on business.

Next 2-3 year:

• It is a commodity business. There is cheap money available. Margins currently are lucrative as well. This will lead to expansion from other companies as well. This will sub-due the margins in the next 2-3 year. But this shod

• It is a commodity business. There is cheap money available. Margins currently are lucrative as well. This will lead to expansion from other companies as well. This will sub-due the margins in the next 2-3 year. But this shod

• • •

Missing some Tweet in this thread? You can try to

force a refresh