I turned 30 recently.

While far from old and wise, I have learned a few things along the way - on life, business, writing, investing, and growth.

Here are a few important lessons learned...

While far from old and wise, I have learned a few things along the way - on life, business, writing, investing, and growth.

Here are a few important lessons learned...

Embrace Failure

Put simply, failure leads to growth.

Do not hide from failure. Seek it out. Allow yourself to be uncomfortable. Embrace it.

The most transformative moments in your life will always come from failures.

Put simply, failure leads to growth.

Do not hide from failure. Seek it out. Allow yourself to be uncomfortable. Embrace it.

The most transformative moments in your life will always come from failures.

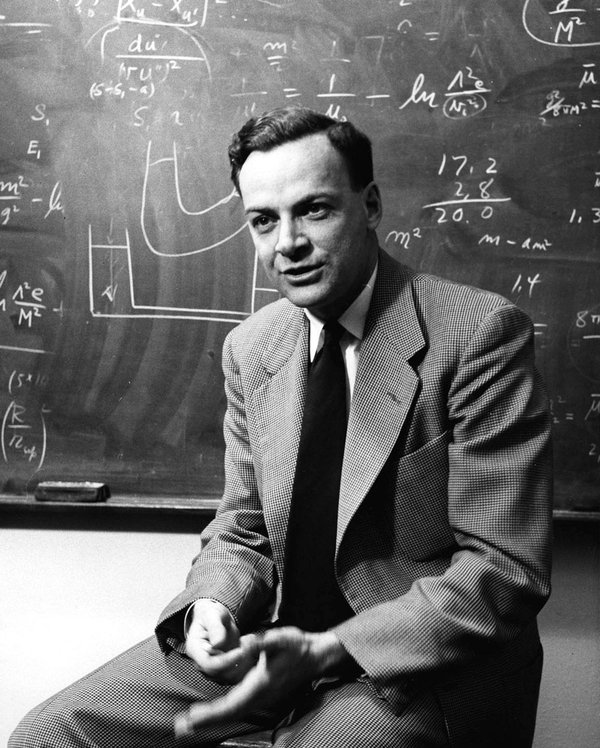

Stand on the Shoulders of Giants

As Isaac Newton famously wrote, “If I have seen further, it is by standing on the shoulders of giants.”

You will only go as far as you can see.

Seek out mentors who champion your cause and empower you to see further.

As Isaac Newton famously wrote, “If I have seen further, it is by standing on the shoulders of giants.”

You will only go as far as you can see.

Seek out mentors who champion your cause and empower you to see further.

Prioritize People

Everything in life comes down to people and relationships.

Networks compound as well as any financial investment.

Build an army that is deep and wide.

Cultivate deep relationships, but also learn to appreciate the power of weak ties.

Everything in life comes down to people and relationships.

Networks compound as well as any financial investment.

Build an army that is deep and wide.

Cultivate deep relationships, but also learn to appreciate the power of weak ties.

Give > Receive

Focus on what you can do for others, not what they can do for you.

Give more than you receive.

This mentality will lead to more success and growth, but also to more fulfillment and joy.

Focus on what you can do for others, not what they can do for you.

Give more than you receive.

This mentality will lead to more success and growth, but also to more fulfillment and joy.

Play the Long Game

“Play long-term games with long-term people.” - @naval

The greatest riches in life - personal or professional - come from compound interest.

But it takes time. Lots of time.

So always play the long game. Let the magical power of compounding work for you.

“Play long-term games with long-term people.” - @naval

The greatest riches in life - personal or professional - come from compound interest.

But it takes time. Lots of time.

So always play the long game. Let the magical power of compounding work for you.

Closed Mouths Don’t Get Fed

A little push goes a long way.

Don't sit back and wait for good things to happen.

If you want something (and you’ve put in the work for it), go ask for it.

Worst case - you’re told no and nothing has changed.

Best case - it’s yours.

A little push goes a long way.

Don't sit back and wait for good things to happen.

If you want something (and you’ve put in the work for it), go ask for it.

Worst case - you’re told no and nothing has changed.

Best case - it’s yours.

Pay It Forward

No matter how far you go, realize that you didn’t make it on your own.

So pay it forward.

Be a mentor. Be a champion for others.

Their growth should become a source of tremendous joy and pride.

No matter how far you go, realize that you didn’t make it on your own.

So pay it forward.

Be a mentor. Be a champion for others.

Their growth should become a source of tremendous joy and pride.

Those are a few of the most important lessons I’ve learned along the way. I hope they are helpful for you on your journey!

If you enjoyed this, follow me for more threads on life, business, money, finance, and economics. You can find all of my threads in the meta-thread below.

If you enjoyed this, follow me for more threads on life, business, money, finance, and economics. You can find all of my threads in the meta-thread below.

https://twitter.com/SahilBloom/status/1284583099775324161

And if you are less Twitter inclined, sign up for my newsletter here, where you can find all of my old threads and receive all of my new threads directly to your inbox. sahilbloom.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh