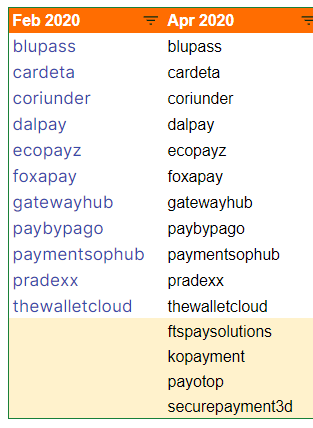

@FinTelegram In your #itradefx article I see you were able to confirm #pradexx as their payment processor. I looked at the sub-domain uiservices.pradexx.com checking its IP address 107.154.133.66 provides a pretty interesting list of other 'brands'

fintelegram.com/pradexx-again-…

fintelegram.com/pradexx-again-…

@FinTelegram I see #pradex and their dodgy partners are still spinning up new reskins of their scammy sites. Keep an eye out for #ftspaysolutions #kopayment #payotop #securepayment3d

Great to see that $ISX subdomain for Nextpayway is still operational even though their scammy client has taken the site offline....I'm guessing one of the 'refresh' brands will appear as an ISX client sometime soon.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh