1/ Unit economic for founders thread.

Despite being a founder and a student of the subject, I missed out on a key point growing up.

Length of relationship with your customers, order frequency, product usage and utility matter.

They didn't teach me this in business school.

Despite being a founder and a student of the subject, I missed out on a key point growing up.

Length of relationship with your customers, order frequency, product usage and utility matter.

They didn't teach me this in business school.

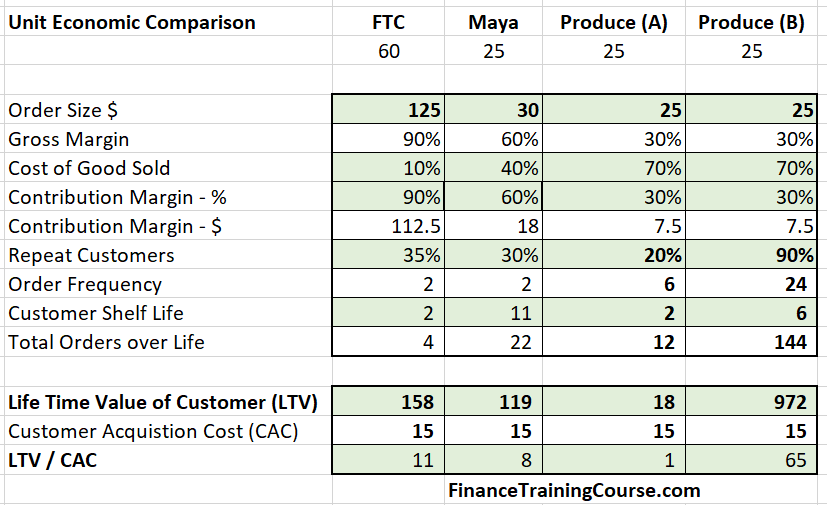

2/ Structured right, products used daily vs weekly vs monthly vs yearly lead to different profitability and scalability paths.

Quiz. Which business would you pick?

a) Enterprise software - US$ 250k one time license

b) Enterprise software - US$ 30k/month recurring subscription

Quiz. Which business would you pick?

a) Enterprise software - US$ 250k one time license

b) Enterprise software - US$ 30k/month recurring subscription

3/ Sound's obvious? Which one did you pick?

Twice in my life I picked A. They were both great businesses, but they didn't compare to B. Especially in the long run.

Looking back, with hindsight, I know I should have picked B.

Why?

Twice in my life I picked A. They were both great businesses, but they didn't compare to B. Especially in the long run.

Looking back, with hindsight, I know I should have picked B.

Why?

4/ Bringing in customers is hard.

When those customers leave after a few orders, your investment in that relationship is written off.

But it is not just about the relationship or investment. It is also about scale.

What are the easiest ways to scale a business?

When those customers leave after a few orders, your investment in that relationship is written off.

But it is not just about the relationship or investment. It is also about scale.

What are the easiest ways to scale a business?

5/ Think about it?

a) Get more customers - acquire

b) Get existing customers to order again - retain

c) Increase order size - up sell

d) Increase order frequency - cross sell / new use case

e) Get existing customers to get you new customers - referral

(b) to (e) are free.

a) Get more customers - acquire

b) Get existing customers to order again - retain

c) Increase order size - up sell

d) Increase order frequency - cross sell / new use case

e) Get existing customers to get you new customers - referral

(b) to (e) are free.

6/ This links back to Life time value (LTV) of a customer. LTV is a function of:

a) Length of relationship

b) Order frequency

c) Order Size

d) Contribution Margin

e) Retention rates

Crude approximation but it makes the point we want to make. Increase value by increasing these.

a) Length of relationship

b) Order frequency

c) Order Size

d) Contribution Margin

e) Retention rates

Crude approximation but it makes the point we want to make. Increase value by increasing these.

7/ How much of a difference can it make?

It takes 8 to 12 years to get a business to a point where it pays off for the founders. Given a choice of four different businesses which one would you pick?

a) FTC

b) Maya

c) Produce A

d) Product B

It takes 8 to 12 years to get a business to a point where it pays off for the founders. Given a choice of four different businesses which one would you pick?

a) FTC

b) Maya

c) Produce A

d) Product B

8/ (c) and (d) above are the same business. With one crucial difference.

(c) turns off customers because it delivers late with hit or miss product quality and has a terrible customer experience.

(d) is fanatical about customer service and experience.

Compare that with (a), (b)

(c) turns off customers because it delivers late with hit or miss product quality and has a terrible customer experience.

(d) is fanatical about customer service and experience.

Compare that with (a), (b)

9/ (a) has the highest price point, highest margins and a respectable LTV/CAC ratio but can only sell its product once or twice to customers.

In the long run it loses out to (d). If LTV was representative of franchise value, (d) would be 6 times more valuable than (a)

In the long run it loses out to (d). If LTV was representative of franchise value, (d) would be 6 times more valuable than (a)

10/ It would take you the same time to build both businesses. The same time to get to an exit.

(d) would be more operationally complex because of logistic, so perhaps more headaches. Also more points of failure.

But financially speaking, which one would you rather build?

(d) would be more operationally complex because of logistic, so perhaps more headaches. Also more points of failure.

But financially speaking, which one would you rather build?

11/ They didn't teach this at business school. 20 years to pick up this lesson in real life. I wish someone sat me down and explained this 30 years ago.

Order frequency and customer shelf life matters. Pick ideas where customers buy more frequently over ideas where they buy once

Order frequency and customer shelf life matters. Pick ideas where customers buy more frequently over ideas where they buy once

12/ From @HabibUniversity Tech Management and Entrepreneurship course (MGMT 301), lecture four, unit economics for founders and building businesses that scale.

Full lecture here

Full lecture here

• • •

Missing some Tweet in this thread? You can try to

force a refresh