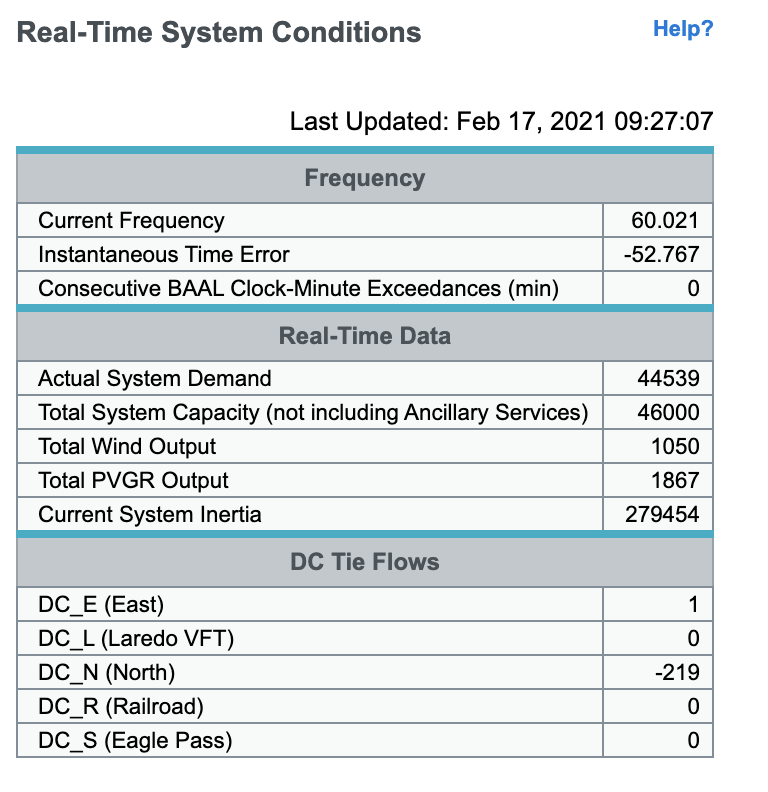

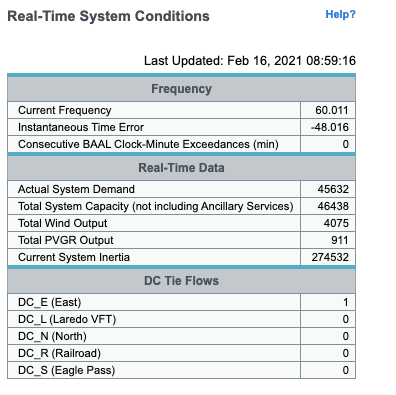

Confidential info from a market participant in ERCOT: As of ~10 AM Eastern time, the system has ~30 GW of capacity offline, ~26 GW of thermal -- mostly natural gas which cant get fuel deliveries which are being priorities for heating loads -- and ~4 GW of wind due to icing.

https://twitter.com/JesseJenkins/status/1361308086150049792

That is a HUGE amount of gas capacity offline, about 30% of total ERCOT capacity and ~half of the natural gas fleet, according to Dec 2020 Capacity Demand and Reserves report here: ercot.com/content/wcm/li…

Devastating for reliability.

Devastating for reliability.

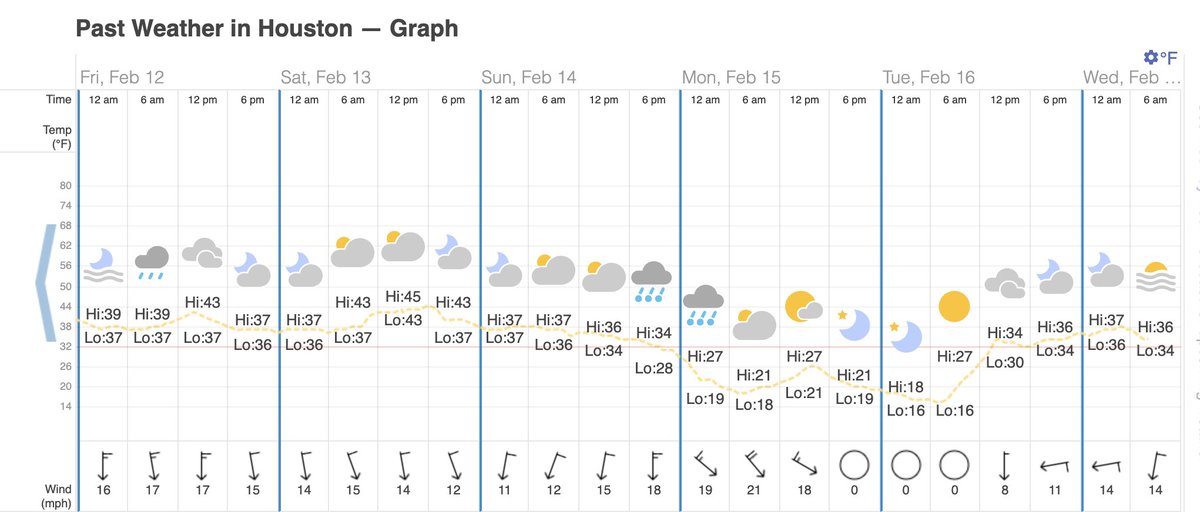

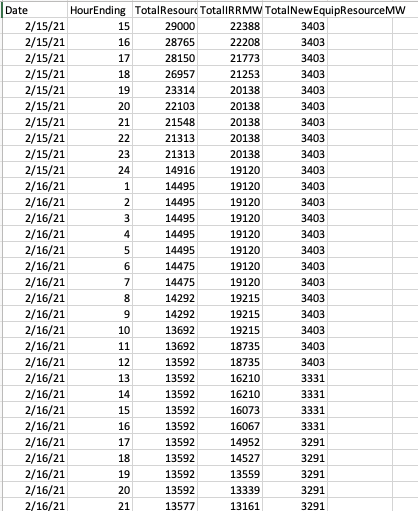

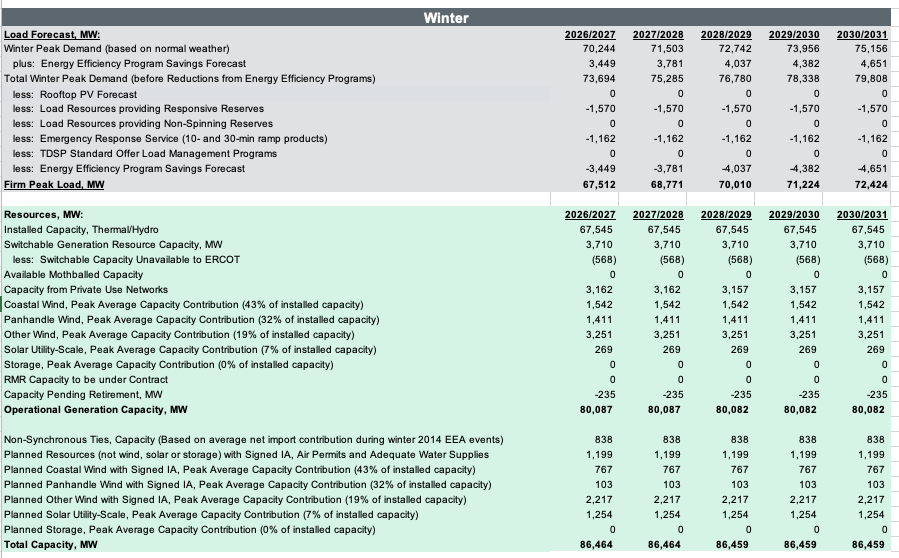

If we look at Winter planning scenerio ERCOT was using for 2026/27 (table below), they were planning for a peak demand of 67,512 "based on normal weather." Demand last night (in 2021 not 2026/27!) was 69,150

30,000 MW of outages right now = 42% of demand!

https://twitter.com/JesseJenkins/status/1361308086150049792

30,000 MW of outages right now = 42% of demand!

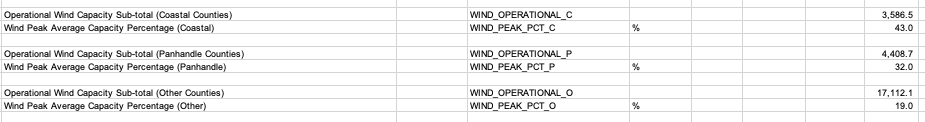

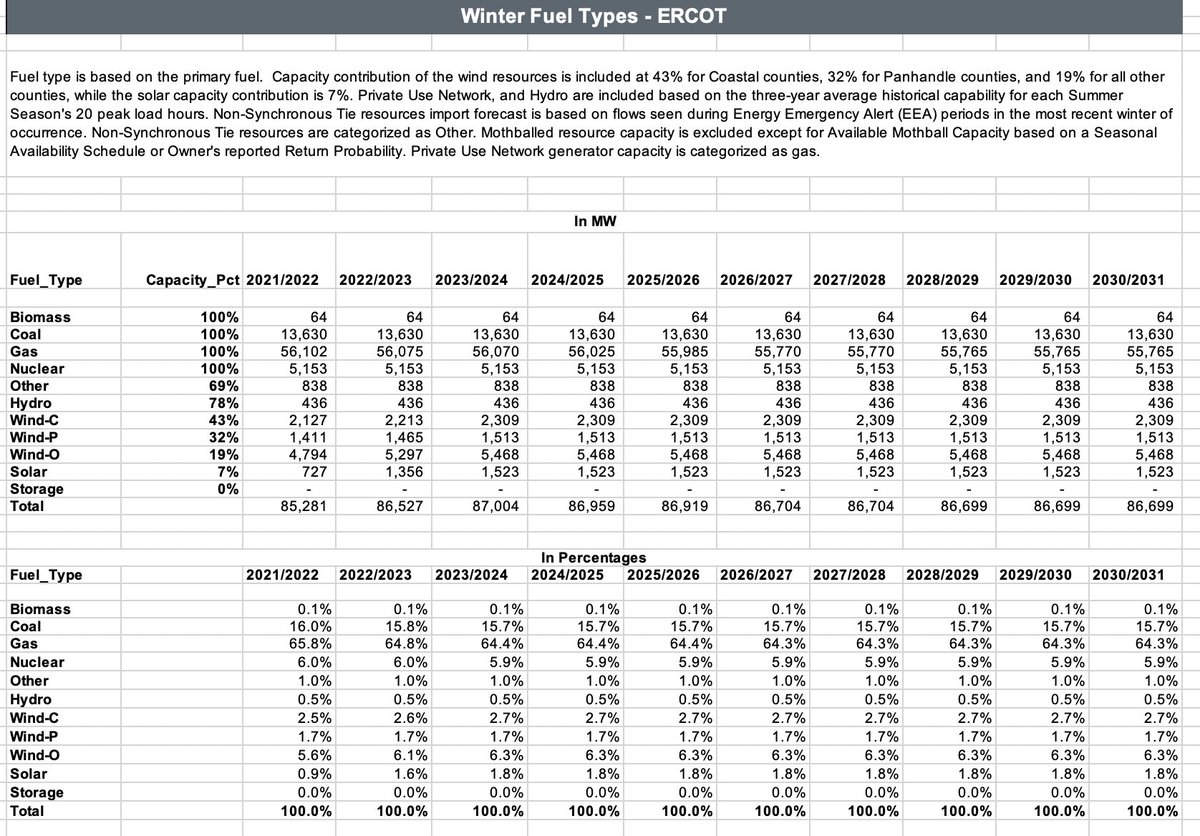

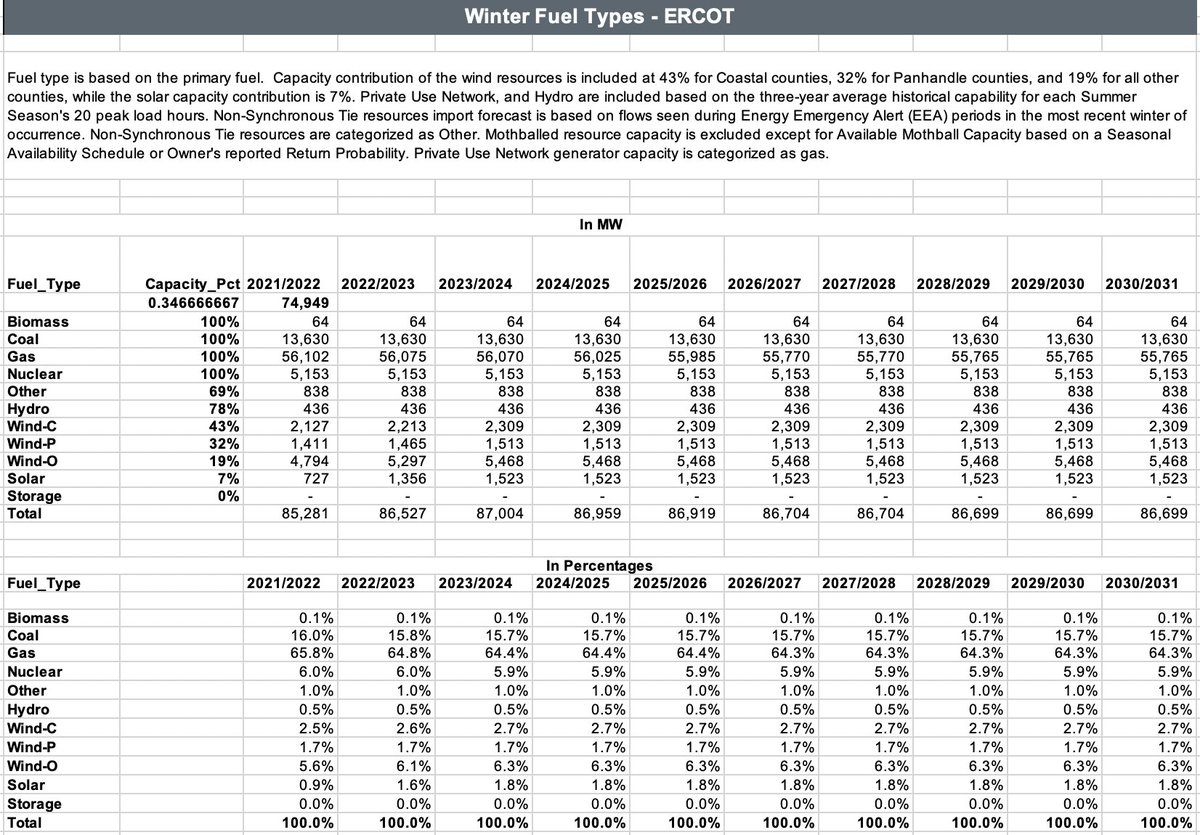

If we look closer at the ERCOT Capacity, Demand and Reserves report, it also shows how much wind capacity they count on in winter peaking events (below). They plan on different % of installed capacity to be avialable in each region: 43% for coast, 32% panhandle & 19% for other

In total, that means ERCOT is counting on 1,542 MW of coastal wind output, 1,411 MW of panhandle wind and 3,251 MW of other wind for a total of 6,204 MW of wind from currently operational facilities. 6.2 GW. Use that to track how wind performs during this emergency.

Now if we look at another table, we can see how ERCOT thinks it will get its winter capacity by fuel type. They assume 100% of thermal units are available during winter peaking events. In reality, they lost 26 GW (if my source is correct) = 35% of total 75 GW of total thermal.

You can also see in that table they count on wind for <10% of total winter capacity + thermal for 89%. No matter how wind performs this week -- important for future planning! -- it is the big failure of thermal plants, mostly gas units, that is causing such widespread outages now

As a New Englander until 2019, I know the region has long contended with -- & planned to address -- constraints on natural gas delivery in winter peaking events. They maintain large duel fuel capacity (gas units that switch to oil if needed) w/onsite storage. TX has clearly not.

Texas relies overwhelmingly on natural gas units for winter peaking capacity, 66% of the total or 56.1 GW. If ~26 GW is offline due to inability to procure fuel (as I've been told), that is a devastating indictment of ERCOT winter planning & major cause of rotating outages.

We'll learn a lot more as this winter emergency progresses, and as we get public reporting. That will inform how much of this was due to market design v planning failures. But counting on gas units to all be there there during extreme winter events is a clear recipe for failure.

The primary issues now appear to be lack of fuel delivery to natural gas units, both due to frozen gas lines and to supply prioritization for gas heating demand over electric generators. Some wind generators out due to icing too, but that's second order by far.

I'll end this here as I have to get back to work. I wish everyone in Texas best as they weather this emergency!

For those interested in the source of the data above (also linked above), see ercot.com/news/releases/…. & spreadsheet here ercot.com/content/wcm/li…

For those interested in the source of the data above (also linked above), see ercot.com/news/releases/…. & spreadsheet here ercot.com/content/wcm/li…

Clarification: Info from a confidential market participant/source. Not that the info is confidential! Sorry.

p.s. there's a #climatechange angle in here, as usual. The polar vortex is breaking down due to Arctic warming, which is allowing cold weather to spread down into North America more often, including today's cold snap carbonbrief.org/qa-how-is-arct…

More on frozen gas pipes claimsjournal.com/news/national/…

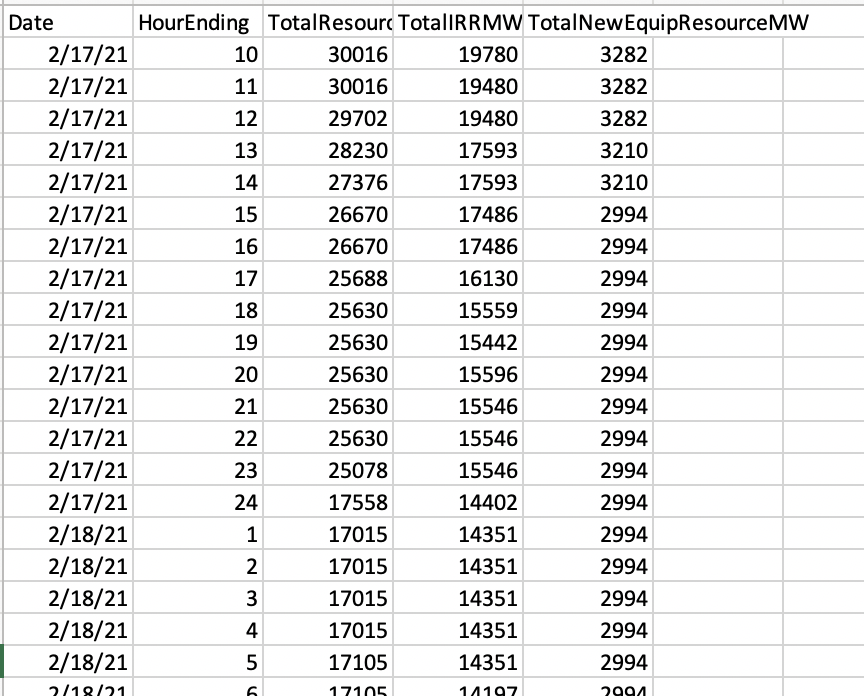

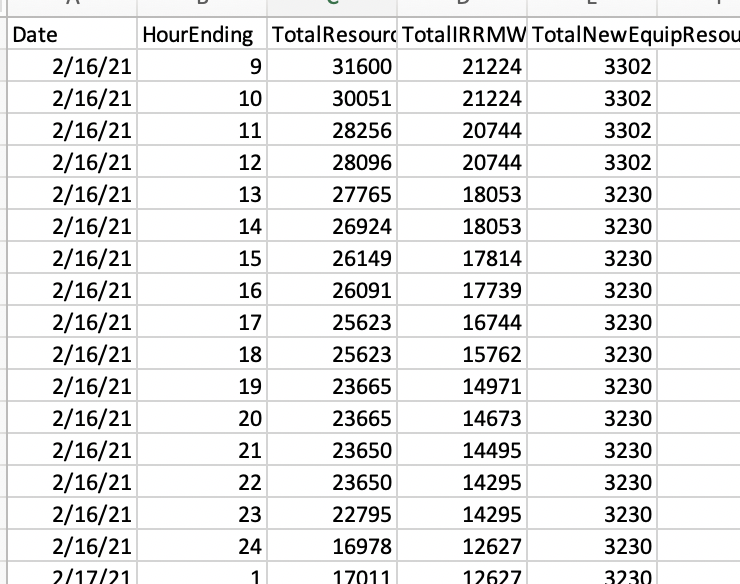

Update: My source's data is confirmed by public ERCOT reporting available at mis.ercot.com/misapp/GetRepo…

Hat tip @joshdr83

Hat tip @joshdr83

https://twitter.com/joshdr83/status/1361365665089785864

• • •

Missing some Tweet in this thread? You can try to

force a refresh