Interesting that Bytedance is targeting edtech through hardware - this smart lamp for instance.

Clever way to hack into the crowded edtech space in China, buy distribution.

gizmochina.com/2020/10/29/byt…

Clever way to hack into the crowded edtech space in China, buy distribution.

gizmochina.com/2020/10/29/byt…

Of course hardware in edtech isnt new. Byju's for instance has thus far sold its content via tabs.

Incl MBA Prep, not just high school tuition.

Incl MBA Prep, not just high school tuition.

Hardware is a great way to build a pipe / enable access in markets where internet bandwidth is iffy. As this SD card play from Nigerian startup @uLessonApp by @SimShagaya shows...

It is not just electronics....there is also @flintobox and similar edu kits.

Hardware is harder of course, but as the edtech space gets crowded and CACs keep rising, the startup that solves for acquisition cleverly or builds a new pipe (like @ClassplusApps for instance) and owns distribution, has an advantage.

Curious as to what else I am missing....

Curious as to what else I am missing....

• • •

Missing some Tweet in this thread? You can try to

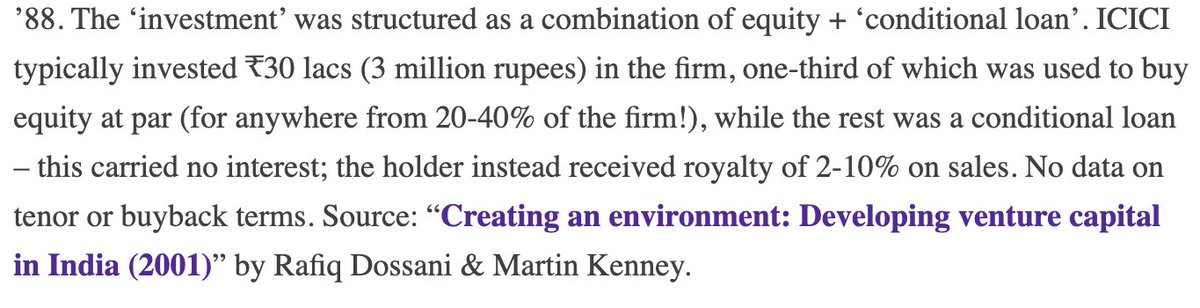

force a refresh