Real Estate: PHYSICAL TO DIGITAL!

Did you know the wealthiest people in the world are no longer rich from REAL ESTATE?

They are rich from TECHNOLOGY.

Time for a thread 👇👇👇

Did you know the wealthiest people in the world are no longer rich from REAL ESTATE?

They are rich from TECHNOLOGY.

Time for a thread 👇👇👇

1/ NINJA LOANS.

After the financial crisis when housing ownership peaked in America — fuelled by NINJA MORTGAGES = NO INCOME, NO JOB, and NO ASSETS...

Technology titans quietly BUT swiftly moved into the top spot!

After the financial crisis when housing ownership peaked in America — fuelled by NINJA MORTGAGES = NO INCOME, NO JOB, and NO ASSETS...

Technology titans quietly BUT swiftly moved into the top spot!

2/ NO INNOVATION.

What’s even more fascinating is that the Real Estate sector has been the most resistant to innovation.

What’s even more fascinating is that the Real Estate sector has been the most resistant to innovation.

3/ WHY?

MAYBE cheap money has made it so easy to make money no one questions the sustainability of the status quo.

Or

MAYBE the illusion that physical moats = indestructible moats.

Whatever the case…

MAYBE cheap money has made it so easy to make money no one questions the sustainability of the status quo.

Or

MAYBE the illusion that physical moats = indestructible moats.

Whatever the case…

4/ DISRUPTION.

It’s inevitable that this TRILLION DOLLAR industry is disrupted.

The irony is that for the real estate barons to survive they need the very tech nerds who just blew past them.

And it’s already started!

It’s inevitable that this TRILLION DOLLAR industry is disrupted.

The irony is that for the real estate barons to survive they need the very tech nerds who just blew past them.

And it’s already started!

5/ DIGITAL REAL ESTATE.

I break it down:

1. LIVE 👉 PropTech

2. WORK 👉 Virtual Offices

3. PLAY 👉 Digital Playlands

I break it down:

1. LIVE 👉 PropTech

2. WORK 👉 Virtual Offices

3. PLAY 👉 Digital Playlands

6/ LIVE 👉 PropTech.

For most people, buying a home is the largest purchase of their life and the one that will make them the most money.

“90% of all millionaires become so through owning real estate.”

For most people, buying a home is the largest purchase of their life and the one that will make them the most money.

“90% of all millionaires become so through owning real estate.”

7/ FEES.

Every year in America, $1.6 TRILLION dollars worth of homes are bought & sold generating a whopping $100B in fees for real estate agents.

It’s a massive AND inefficient market

Every year in America, $1.6 TRILLION dollars worth of homes are bought & sold generating a whopping $100B in fees for real estate agents.

It’s a massive AND inefficient market

8/ DIGITIZATION

Luckily, Property Technology companies are fixing the 3 biggest problems by digitizing the process:

- Transparency 👉 ZILLOW

- Affordability 👉 DIVVY

- Liquidity 👉 OPENDOOR

Luckily, Property Technology companies are fixing the 3 biggest problems by digitizing the process:

- Transparency 👉 ZILLOW

- Affordability 👉 DIVVY

- Liquidity 👉 OPENDOOR

9/ TRANSPARENCY 👉 ZILLOW

Want to know how much the CEO of Goldman Sachs or your ex-gf paid for their house?

Zillow does this! Demystifies the price of homes.

It's America’s leading online real estate site w/+200MM people visiting +100MM homes a month.

Want to know how much the CEO of Goldman Sachs or your ex-gf paid for their house?

Zillow does this! Demystifies the price of homes.

It's America’s leading online real estate site w/+200MM people visiting +100MM homes a month.

10/ TRANSPARENCY 👉 ZILLOW

Founded in 2005, went public in 2011 and the stock is up 80x since its IPO.

It’s a massive eye-ball & demand aggregator.

“They now essentially have data on almost every home in the United States.”

Founded in 2005, went public in 2011 and the stock is up 80x since its IPO.

It’s a massive eye-ball & demand aggregator.

“They now essentially have data on almost every home in the United States.”

11/ AFFORDABILITY 👉 DIVVY

“Buying A Typical Home in Canada? Cities now require incomes of up to $230,000”

Housing prices in most major cities are at record highs. Great for those who own homes, horrible for those who don’t.

“Buying A Typical Home in Canada? Cities now require incomes of up to $230,000”

Housing prices in most major cities are at record highs. Great for those who own homes, horrible for those who don’t.

12/ AFFORDABILITY 👉 DIVVY

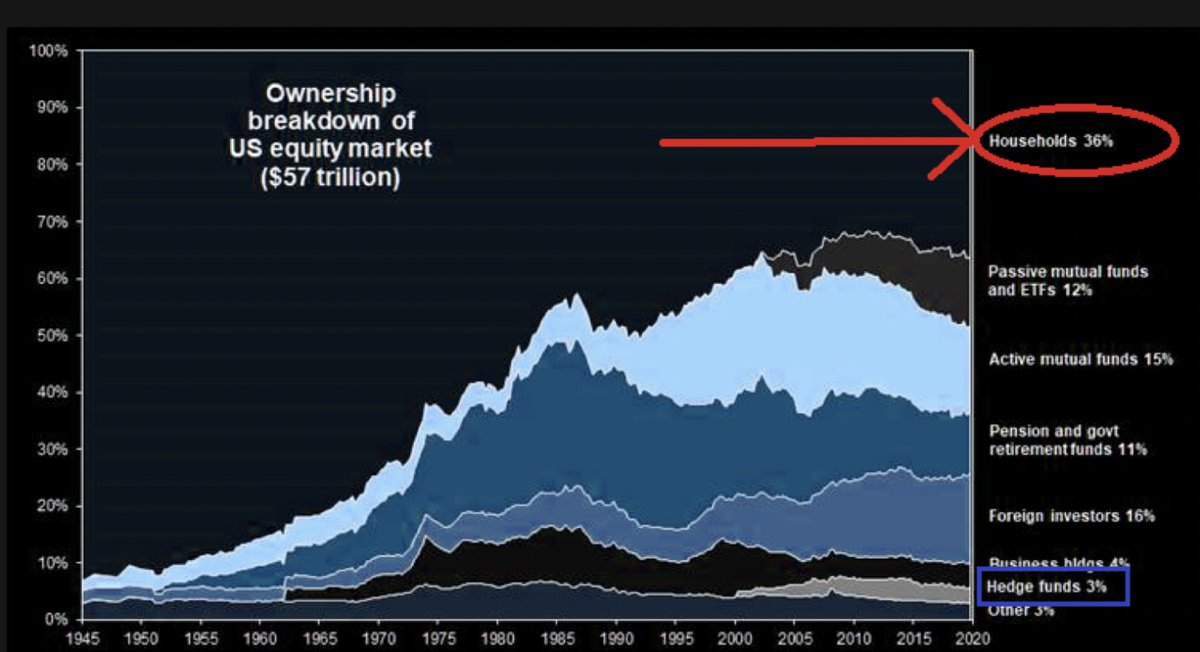

Beyond affordability, millions of Americans can’t get a mortgage, banks won't lend to:

+25M Credit Invisible 👉 no credit information

+60M ‘Thin-Filed’ 👉 not enough credit information

+60M Freelancers 👉 fluctuating income too risky

Beyond affordability, millions of Americans can’t get a mortgage, banks won't lend to:

+25M Credit Invisible 👉 no credit information

+60M ‘Thin-Filed’ 👉 not enough credit information

+60M Freelancers 👉 fluctuating income too risky

13/ DIVVY 👉 A ‘Rent-to-Own’ startup raises +$100M and may be that solution.

“Buyers choose their home & pay 2% of the value. They make monthly rental payments, 25% goes to a down payment. They are usually able to build up a 10% down payment via a 3-year lease and can then buy"

“Buyers choose their home & pay 2% of the value. They make monthly rental payments, 25% goes to a down payment. They are usually able to build up a 10% down payment via a 3-year lease and can then buy"

14/ LIQUIDITY 👉 iBUYERS

iBuyers are the new cool kids on the block.

They buy your property directly from you ALL DIGITALLY!

iBuyers are the new cool kids on the block.

They buy your property directly from you ALL DIGITALLY!

15/ LIQUIDITY 👉 iBUYERS

I AM BULLISH BECAUSE:

1) Size & Stage: Top players have less than 3% market share.

2) WFH: Labour market is more mobile as people move to optimize for cost of living & quality of life.

3) Interest Rates: Not going up anytime soon.

I AM BULLISH BECAUSE:

1) Size & Stage: Top players have less than 3% market share.

2) WFH: Labour market is more mobile as people move to optimize for cost of living & quality of life.

3) Interest Rates: Not going up anytime soon.

16/ LIQUIDITY 👉 iBUYERS

4) Transaction: “U.S. housing market gained $2.5 trillion in value last year, the most since 2005. Median sale prices are +13% YoY, and number of homes sold is up 20%.”

5) Millennials: +75MM entering the housing market want to do it ALL on their phone.

4) Transaction: “U.S. housing market gained $2.5 trillion in value last year, the most since 2005. Median sale prices are +13% YoY, and number of homes sold is up 20%.”

5) Millennials: +75MM entering the housing market want to do it ALL on their phone.

17/ LIQUIDITY 👉 OPENDOOR

Opendoor ($OPEN, $25B) is the leading iBuyer and one of the largest PropTech companies to ever go public.

- Founded in 2014

- Revenue +500% 2017 to 2019 to $5B

Opendoor ($OPEN, $25B) is the leading iBuyer and one of the largest PropTech companies to ever go public.

- Founded in 2014

- Revenue +500% 2017 to 2019 to $5B

18/ LIQUIDITY 👉 OPENDOOR

During COVID, the company halted buying homes and their revenue is expected to take a -50% hit.

@chamath saw an opportunity to help them through this tough period — raised $1B for $OPEN SPAC in Dec. 2020.

During COVID, the company halted buying homes and their revenue is expected to take a -50% hit.

@chamath saw an opportunity to help them through this tough period — raised $1B for $OPEN SPAC in Dec. 2020.

19/ LIQUIDITY 👉 OPENDOOR

@chamath on CNBC talking about iBuyer market:

“The times I have come on, I try and find asymmetric upside opportunities and present them to you. This to me feels like Bitcoin in 2012, Amazon in 2015, Tesla in 2016 and Virgin Galactic in 2019.”

@chamath on CNBC talking about iBuyer market:

“The times I have come on, I try and find asymmetric upside opportunities and present them to you. This to me feels like Bitcoin in 2012, Amazon in 2015, Tesla in 2016 and Virgin Galactic in 2019.”

20/ RISKS.

I am a Chamath fan but a few risks you should know about $OPEN.

- Not Profitable: Expected to lose $120MM in 2020.

- Competition: Pre-pandemic $OPEN was 4x bigger than its next competitor but competition is gaining ground now.

I am a Chamath fan but a few risks you should know about $OPEN.

- Not Profitable: Expected to lose $120MM in 2020.

- Competition: Pre-pandemic $OPEN was 4x bigger than its next competitor but competition is gaining ground now.

21/ OTHER COOL PROPTECH.

- United Dwelling: Turn your backyard or garage into affordable housing.

- Neighbour: AirBnB for storage.

- Bungalow: Find a cool house or mansion and use app to find roommates to rent together.

- Matterport. Create virtual tours of their properties.

- United Dwelling: Turn your backyard or garage into affordable housing.

- Neighbour: AirBnB for storage.

- Bungalow: Find a cool house or mansion and use app to find roommates to rent together.

- Matterport. Create virtual tours of their properties.

22/ WORK 👉 Virtual Offices

"$126B in distressed commercial real estate expected to hit the market in the next 2 years."

With a big chunk of that being office space.

THE WORKPLACE IS ABOUT TO CHANGE FOREVER!

"$126B in distressed commercial real estate expected to hit the market in the next 2 years."

With a big chunk of that being office space.

THE WORKPLACE IS ABOUT TO CHANGE FOREVER!

23/ WORK 👉 Virtual Offices

Companies like Twitter & Square are moving to permanent #WFH

Others going heavy on the HYBRID model. Which makes sense as people miss the social aspects of the workplace.

And it's hard to brainstorm on Zoom.

Companies like Twitter & Square are moving to permanent #WFH

Others going heavy on the HYBRID model. Which makes sense as people miss the social aspects of the workplace.

And it's hard to brainstorm on Zoom.

24/ WORK 👉 Virtual Offices

A radical rethinking of office space which fosters collaborative activities is key.

There are also cool tools that mimic the office environment virtually.

Check out @getTeamflow

A radical rethinking of office space which fosters collaborative activities is key.

There are also cool tools that mimic the office environment virtually.

Check out @getTeamflow

25/ Work

There needs to be a greater focus on offsite trips, where deeper relationships can be forged, leading to higher job satisfaction & productivity.

This week Nissan unveiled its NV350 Office Pod van.

Imagine renting a bunch of these and doing a team offsite!

There needs to be a greater focus on offsite trips, where deeper relationships can be forged, leading to higher job satisfaction & productivity.

This week Nissan unveiled its NV350 Office Pod van.

Imagine renting a bunch of these and doing a team offsite!

26/ ‘Space-as-a-Service’

For all the empty office space that will hit the market, I bet we see apps developed that match supply with demand.

We may be entering a whole new era of “Space-as-a-Service” and ‘dynamic yield maximization for otherwise static assets’.

For all the empty office space that will hit the market, I bet we see apps developed that match supply with demand.

We may be entering a whole new era of “Space-as-a-Service” and ‘dynamic yield maximization for otherwise static assets’.

27/ PLAY 👉 Digital Playlands

It was impossible to predict how the Internet would come to permeate every aspect of our lives.

The same can be said of the ‘Metaverse’, a crazy new world we will all — in some fashion — have a presence or avatar in soon!

It was impossible to predict how the Internet would come to permeate every aspect of our lives.

The same can be said of the ‘Metaverse’, a crazy new world we will all — in some fashion — have a presence or avatar in soon!

28/ Grit Newsletter!

Want more?

Every week I write a newsletter to +10k hedge funds, pension funds, investment advisors, billionaires & retail investors.

SUBSCRIBE (it's free!)

gritcapital.substack.com/p/digital-real…

Want more?

Every week I write a newsletter to +10k hedge funds, pension funds, investment advisors, billionaires & retail investors.

SUBSCRIBE (it's free!)

gritcapital.substack.com/p/digital-real…

30/ CREDIT & SHOUT-OUTS:

@Zillow

@divvyhomes

@ParikPatelCFA

@chamath

@Opendoor

@uniteddwelling

@pointfinance

@neighborstorage

@a16z

@arampell

@livebungalow

@PorchDotCom

@Matterport

@getTeamflow

@joinClubhouse

@ballmatthew

@TristanAhumada1

@PaulMarkMorris

@Zillow

@divvyhomes

@ParikPatelCFA

@chamath

@Opendoor

@uniteddwelling

@pointfinance

@neighborstorage

@a16z

@arampell

@livebungalow

@PorchDotCom

@Matterport

@getTeamflow

@joinClubhouse

@ballmatthew

@TristanAhumada1

@PaulMarkMorris

• • •

Missing some Tweet in this thread? You can try to

force a refresh