Real Estate: Value Play or Value Trap?

"$126 billion in commercial real estate will be forced to sell at distressed prices through 2022, more than the first 2 years after the global financial crisis" - Bloomberg

Time for a thread 👇👇👇

"$126 billion in commercial real estate will be forced to sell at distressed prices through 2022, more than the first 2 years after the global financial crisis" - Bloomberg

Time for a thread 👇👇👇

1/ Asset or Liability.

Investors believe REAL ESTATE is a never lose investment.

But what if something was brewing beneath the surface, that you and I & Harvard’s endowment fund couldn’t see coming?

When trillions of dollars move from being an ASSET to a LIABILITY?

Investors believe REAL ESTATE is a never lose investment.

But what if something was brewing beneath the surface, that you and I & Harvard’s endowment fund couldn’t see coming?

When trillions of dollars move from being an ASSET to a LIABILITY?

2/ Physical Real Estate.

Let’s breakdown it down:

- Bonds ‘Holding the Bag’ 😳

- Bad vs Good 🕵️♀️

- Physical to Digital 📲

Let’s breakdown it down:

- Bonds ‘Holding the Bag’ 😳

- Bad vs Good 🕵️♀️

- Physical to Digital 📲

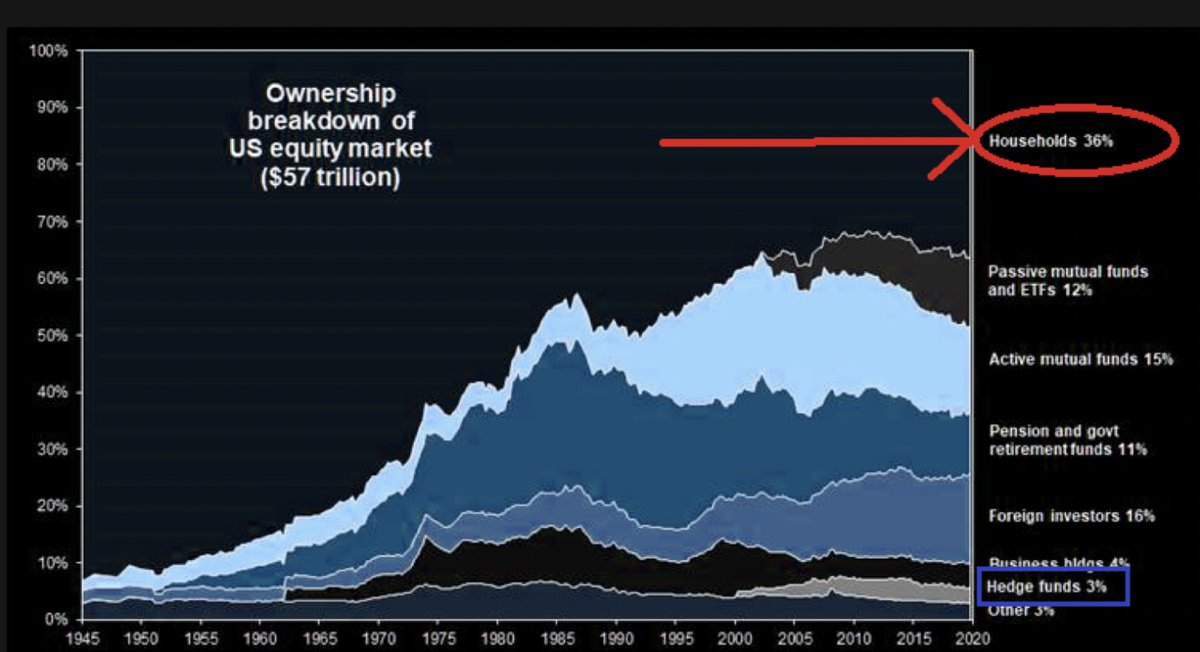

3/ Bonds ‘Holding the Bag’

Remember the scene in The Big Short when homeowners are defaulting on their mortgages yet the ‘Credit Default Swaps’ that Michael Burry holds don’t reflect this?

Remember the scene in The Big Short when homeowners are defaulting on their mortgages yet the ‘Credit Default Swaps’ that Michael Burry holds don’t reflect this?

4/ Bonds ‘Holding the Bag’

Some are saying a version of this is happening with Commercial Real Estate.

Except, it’s central banks printing endless money rather than the rating agencies covering up the value deterioration and heightened risk.

Some are saying a version of this is happening with Commercial Real Estate.

Except, it’s central banks printing endless money rather than the rating agencies covering up the value deterioration and heightened risk.

5/ Bonds ‘Holding the Bag’

“Thanks to widely available credit, only 1% of the overall commercial real estate dollar volume during the third quarter were sales of properties out of distressed situations.” -WSJ

But cracks are starting to show...

“Thanks to widely available credit, only 1% of the overall commercial real estate dollar volume during the third quarter were sales of properties out of distressed situations.” -WSJ

But cracks are starting to show...

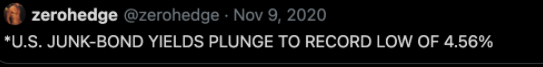

6/ Bonds ‘Holding the Bag’

1. Junk Bond market (which contains many REITs) is starting to look like a ticking time bomb!

2. Second, two large REITs declared bankruptcy in 2020 on the same day - a historical first.

1. Junk Bond market (which contains many REITs) is starting to look like a ticking time bomb!

2. Second, two large REITs declared bankruptcy in 2020 on the same day - a historical first.

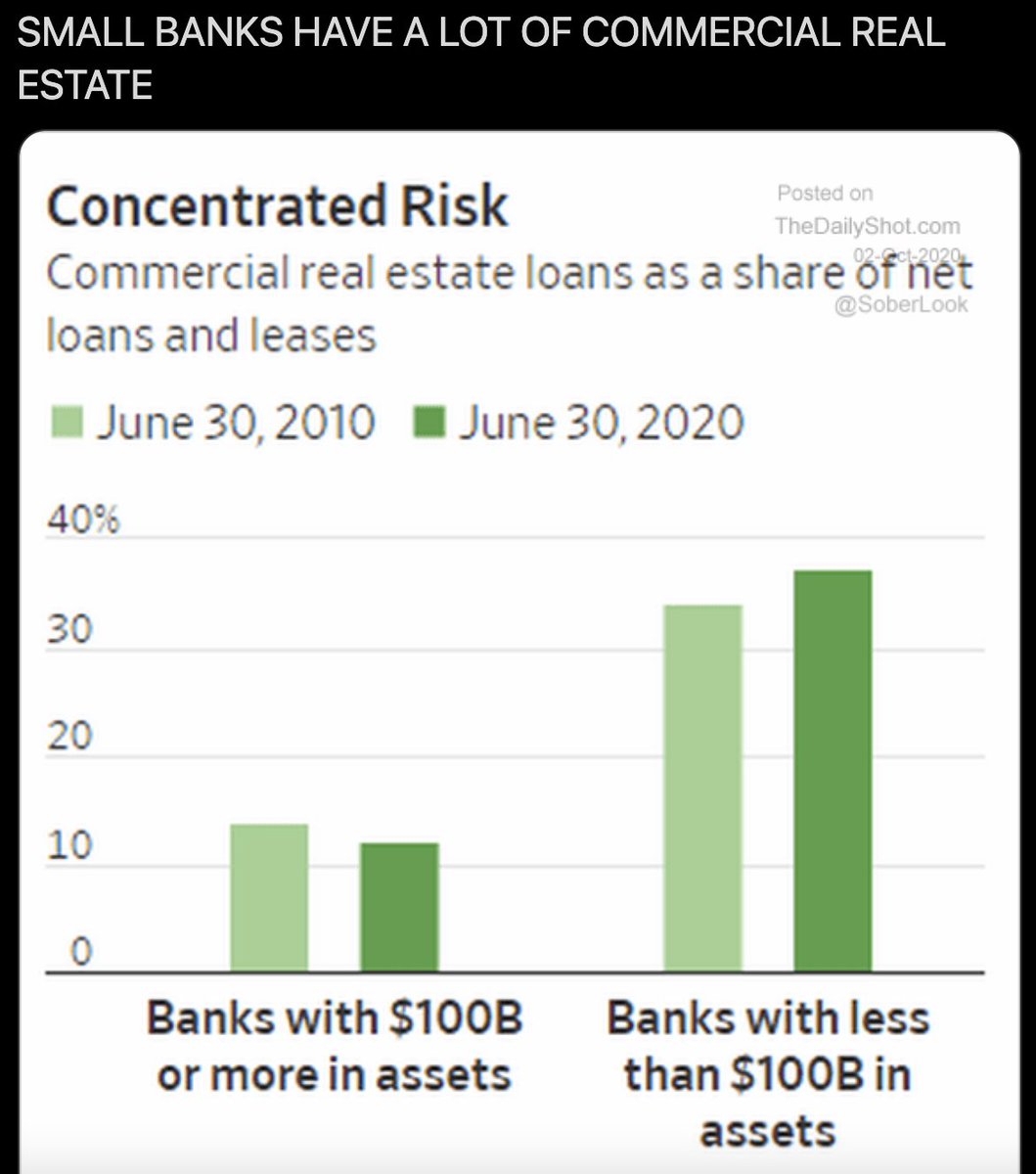

7/ Bonds ‘Holding the Bag’

Commercial real estate is a $20 trillion dollar market in North America and banks have big exposure.

Specifically small banks, they have 4x more exposure and far less resiliency.

What could go wrong?

Commercial real estate is a $20 trillion dollar market in North America and banks have big exposure.

Specifically small banks, they have 4x more exposure and far less resiliency.

What could go wrong?

8/ Bonds ‘Holding the Bag’

But great wealth transfers happen in times of turbulence.

If Baron Rothschild who famously said — "the time to buy is when there's blood in the streets.” — were alive today, I would ask him:

What if people don’t go out in the streets anymore?

But great wealth transfers happen in times of turbulence.

If Baron Rothschild who famously said — "the time to buy is when there's blood in the streets.” — were alive today, I would ask him:

What if people don’t go out in the streets anymore?

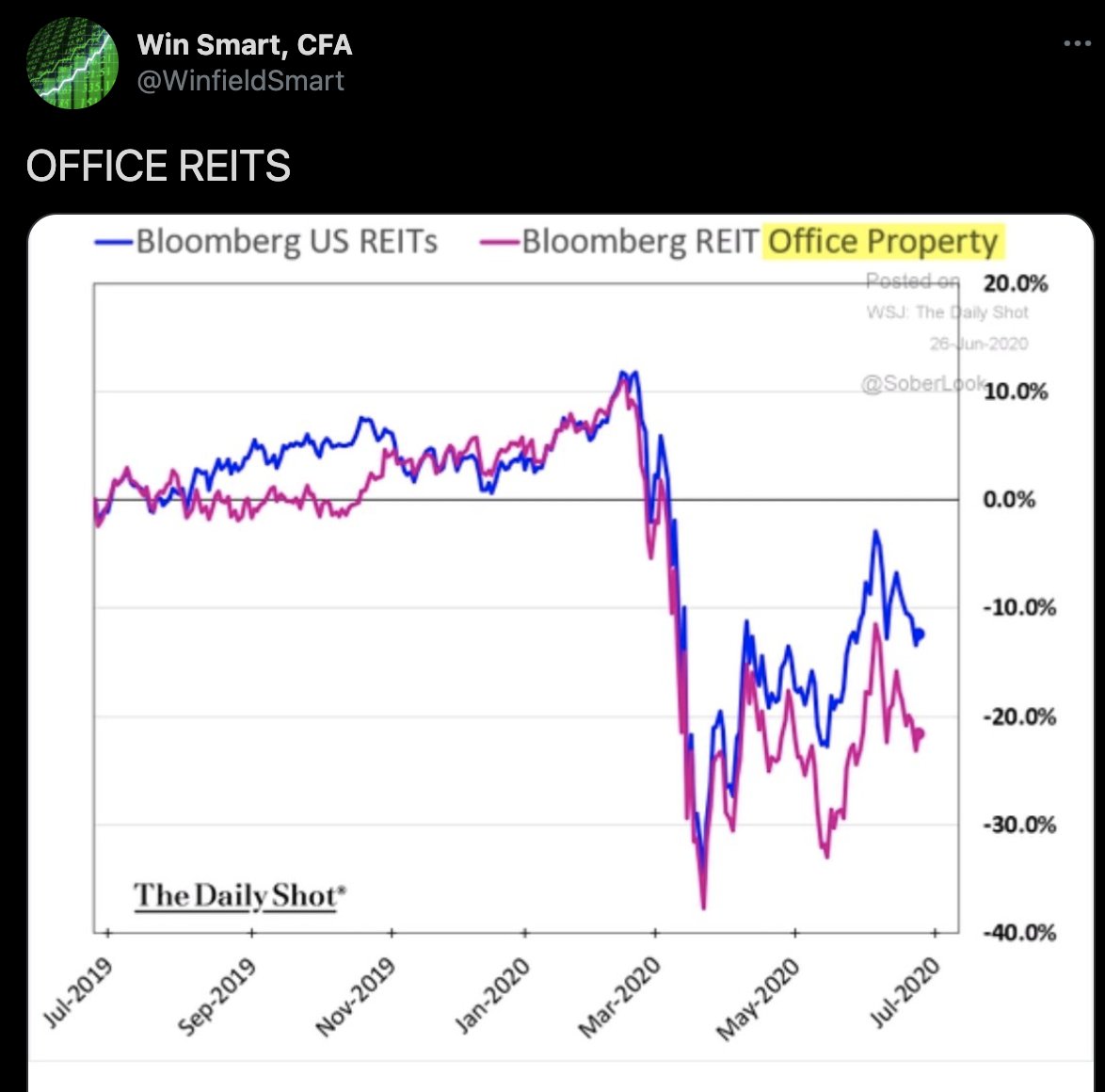

10/ Office (BAD)

"One of the great humanistic discoveries from COVID-19 is that we can work remotely.” — Blackrock

100% of people aren't going back to the office.

The MATH doesn’t make sense.

"One of the great humanistic discoveries from COVID-19 is that we can work remotely.” — Blackrock

100% of people aren't going back to the office.

The MATH doesn’t make sense.

11/ Office (BAD)

Time: Remote gives employees back 2 weeks per year in commute times. Add another 2 weeks for ‘getting ready’ and we’ve just bought back 1/12 of the year.

Brain Power: Commuting to work expends mental effort that could be used to solve bigger problems.

Time: Remote gives employees back 2 weeks per year in commute times. Add another 2 weeks for ‘getting ready’ and we’ve just bought back 1/12 of the year.

Brain Power: Commuting to work expends mental effort that could be used to solve bigger problems.

12/ Office (BAD)

Expenses: “On average, companies in major cities spend $1-2k per month to keep their employees at a desk in an office”

Environment: “If just 50% of workers returned to offices, traffic in cities would be eased and employees’ quality of life would be improved.”

Expenses: “On average, companies in major cities spend $1-2k per month to keep their employees at a desk in an office”

Environment: “If just 50% of workers returned to offices, traffic in cities would be eased and employees’ quality of life would be improved.”

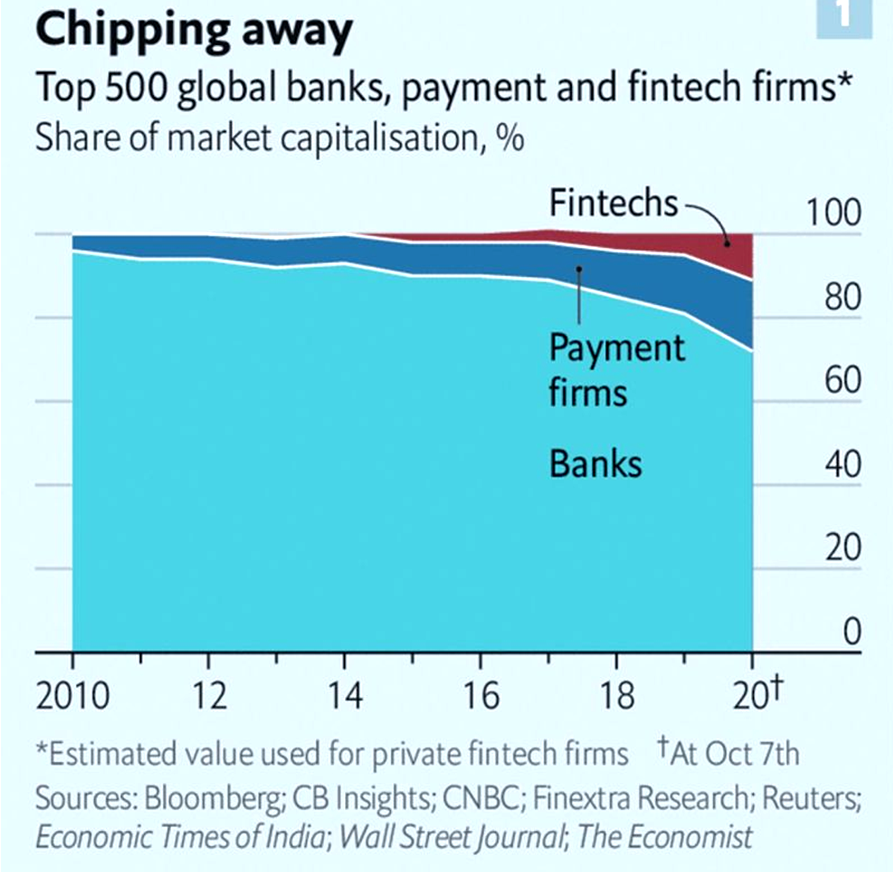

13/ Financial Institutions (BAD)

Fancy bank branches in fancy parts of town are a dinosaur concept.

“The cost of operating a bank branch are near all-time highs, due to the cost of maintaining the biggest buildings in the best parts of town.” @ARKInvest

Fancy bank branches in fancy parts of town are a dinosaur concept.

“The cost of operating a bank branch are near all-time highs, due to the cost of maintaining the biggest buildings in the best parts of town.” @ARKInvest

14/ Financial Institutions (BAD)

Branches account for a large part of banks’ operating costs, rendering their customer acquisition cost (CAC) significantly higher than their FinTech competitors.

“CAC of $2k/customer for banks versus $20/customer for Cash App (owned by Square).”

Branches account for a large part of banks’ operating costs, rendering their customer acquisition cost (CAC) significantly higher than their FinTech competitors.

“CAC of $2k/customer for banks versus $20/customer for Cash App (owned by Square).”

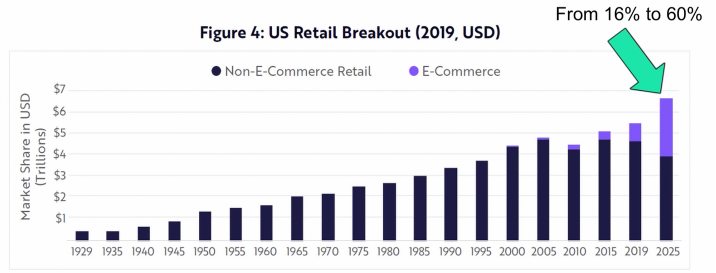

15/ Retail (BAD)

The U.S has 10x the retail square footage footprint than the rest of the world.

eCommerce is expected to reach 60% of retail by 2025 — there is trillions of dollars in physical retail at risk.

The U.S has 10x the retail square footage footprint than the rest of the world.

eCommerce is expected to reach 60% of retail by 2025 — there is trillions of dollars in physical retail at risk.

16/ Retail (BAD)

In Dec 2020 I wrote an entire newsletter on eCommerce.

Now, I am seeing my predictions about the re-purposing of malls play out. Malls are:

- Becoming Warehouses

- Becoming Affordable Housing

- Becoming eSports Centres

In Dec 2020 I wrote an entire newsletter on eCommerce.

Now, I am seeing my predictions about the re-purposing of malls play out. Malls are:

- Becoming Warehouses

- Becoming Affordable Housing

- Becoming eSports Centres

17/ Retail (BAD)

The good news is, “one man’s trash is another man’s treasure”

Great innovation can be born from dire circumstances.

For example, Tesla’s first plant in California was bought from GM for a bargain price just after the financial crisis.

The good news is, “one man’s trash is another man’s treasure”

Great innovation can be born from dire circumstances.

For example, Tesla’s first plant in California was bought from GM for a bargain price just after the financial crisis.

18/ Schools (BAD)

60 year old university in Canada filed for creditor protection. Owes +$90MM to 3 of the country’s top banks.

Virtual schools with lower costs have a bright future. EdTech only has 5% market penetration.

Major disruption is coming.

60 year old university in Canada filed for creditor protection. Owes +$90MM to 3 of the country’s top banks.

Virtual schools with lower costs have a bright future. EdTech only has 5% market penetration.

Major disruption is coming.

19/ Other Bad Real Estate

- Movie Theatres

- Car Dealerships

- Business Hotels (Marriott, Hilton etc).

- Movie Theatres

- Car Dealerships

- Business Hotels (Marriott, Hilton etc).

20/ AirBnBs & Glamping (GOOD)

I predict business travel, especially the <3hr trips, will die a swift death and so will business hotels.

Working from anywhere will mean more time and flexibility to travel. Which means AirBnB and luxury ‘glamping’ will continue to flourish.

I predict business travel, especially the <3hr trips, will die a swift death and so will business hotels.

Working from anywhere will mean more time and flexibility to travel. Which means AirBnB and luxury ‘glamping’ will continue to flourish.

21/ Home Ownership (GOOD)

Cheap money and inflation have made people who own homes significantly richer.

The median housing price in America is at an all-time high of +$320,000.

“90% of all millionaires become so through owning real estate.”— Andrew Carnegie

Cheap money and inflation have made people who own homes significantly richer.

The median housing price in America is at an all-time high of +$320,000.

“90% of all millionaires become so through owning real estate.”— Andrew Carnegie

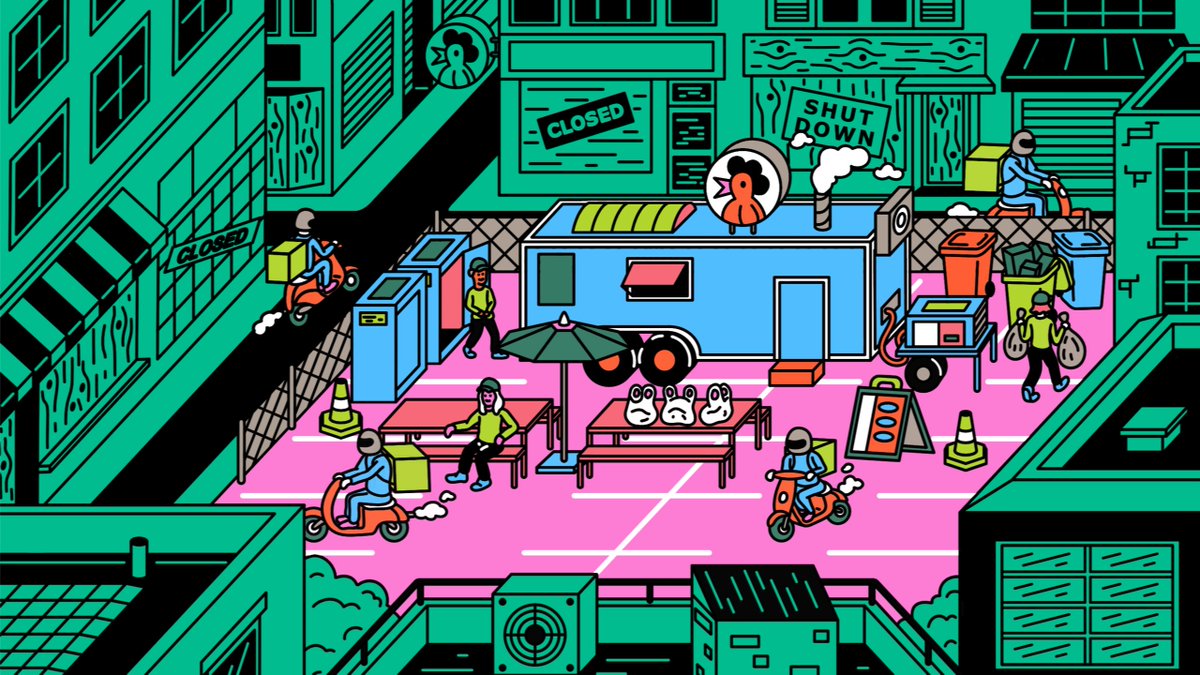

22/ Ghost Kitchens (GOOD)

Warehouses, restaurants and even parking lots are being turned into temporary rentable kitchens.

Giving chefs a place to cook without worrying about the dine-in portion of a brick-and-mortar location.

This is the new major trend in food.

Warehouses, restaurants and even parking lots are being turned into temporary rentable kitchens.

Giving chefs a place to cook without worrying about the dine-in portion of a brick-and-mortar location.

This is the new major trend in food.

23/ Industrial (GOOD)

“U.S. may need another 1 billion square feet of warehouse space by 2025 as e-commerce booms.”

Smart money has been selling commercial REITs and buying industrial REITs. Now seen as safer yield with growth!

“U.S. may need another 1 billion square feet of warehouse space by 2025 as e-commerce booms.”

Smart money has been selling commercial REITs and buying industrial REITs. Now seen as safer yield with growth!

24/ OTHER GOOD REAL ESTATE:

- Co-Working Spaces

- Retirement Homes

- Funeral Homes/Cemeteries

- Self-Storage

- Co-Working Spaces

- Retirement Homes

- Funeral Homes/Cemeteries

- Self-Storage

25/ Digital Real Estate.

AWS is the world’s largest provider of cloud computing aka DIGITAL REAL ESTATE.

“A confluence of multiple digital technologies are expected to define this decade: billions of internet connected devices will transmit zettabytes of data"

AWS is the world’s largest provider of cloud computing aka DIGITAL REAL ESTATE.

“A confluence of multiple digital technologies are expected to define this decade: billions of internet connected devices will transmit zettabytes of data"

26/ Digital Real Estate.

Digital real estate is going to outperform physical real estate going forward.

Bandwidth demand is exploding!

Which should bode well for Cell Towers & Data Centres - two of the industries tied to this theme.

Digital real estate is going to outperform physical real estate going forward.

Bandwidth demand is exploding!

Which should bode well for Cell Towers & Data Centres - two of the industries tied to this theme.

27/ Digital Real Estate.

Tech companies reported big Q4 earnings beats. It's clear we are more addicted to our devices than ever.

Earnings for Tech companies were up +21% vs +2.5% for the S&P 500 (of the companies that had reported to date).

Record capital is flowing!

Tech companies reported big Q4 earnings beats. It's clear we are more addicted to our devices than ever.

Earnings for Tech companies were up +21% vs +2.5% for the S&P 500 (of the companies that had reported to date).

Record capital is flowing!

28/ Grit Newsletter!

Every week I write a newsletter to +10k investors including hedge funds, pension funds, investment advisors & billionaires.

SUBSCRIBE to find out which real estate stock I bought this week! 👇

gritcapital.substack.com/welcome

Every week I write a newsletter to +10k investors including hedge funds, pension funds, investment advisors & billionaires.

SUBSCRIBE to find out which real estate stock I bought this week! 👇

gritcapital.substack.com/welcome

28/ YouTube!

And subscribe to my YouTube channel for more insights! 👇

#investing #stocks #realestate

youtube.com/channel/UCgyQn…

And subscribe to my YouTube channel for more insights! 👇

#investing #stocks #realestate

youtube.com/channel/UCgyQn…

• • •

Missing some Tweet in this thread? You can try to

force a refresh