(1/n) The #inflation data just keeps coming in hot. Today it was the #Markit #PMIs that showed input prices rising to a record...by a long shot.

(2/n) Earlier in the week it was the core PPI data, which came in at 2%, fully twice the #WallSt estimates.

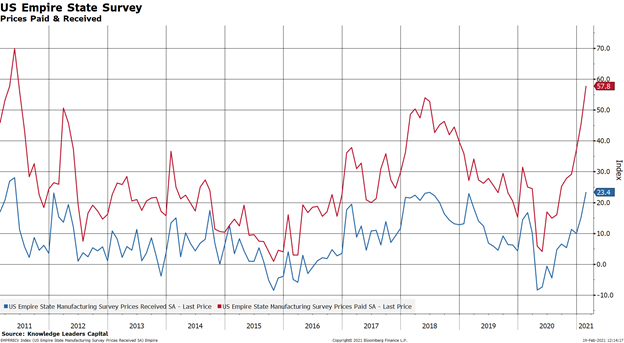

(3/n) On Monday the #Fed's Empire State manufacturing survey showed prices paid at the highest level in 10 years.

(4/n) Given these data and base effects (almost no price growth last March through May), it really is just a matter of time until the #inflation creeps into the #Fed's preferred inflation gauge: core personal consumption expenditures.

(5/n) FWIW, based on the level of services input prices in the just released PMI, core PCE will get to 2% (#Fed's target), within the next month or two.

(6/n) Of course, all this matters for markets. Inflation affects asset prices directly through rates and indirectly through volatility in sales and earnings. Longer duration assets (long #tbonds, #NASDAQ100) would generally underperform shorter bonds, #smallcaps, copper miners,

(7/n) etc, as inflation rises. YTD, that is definitely happening. 30Y rates up 40bps, 10s up 25, #NDX up 5%, #Russell2000 up 15%, #copper miners up 28%.

• • •

Missing some Tweet in this thread? You can try to

force a refresh