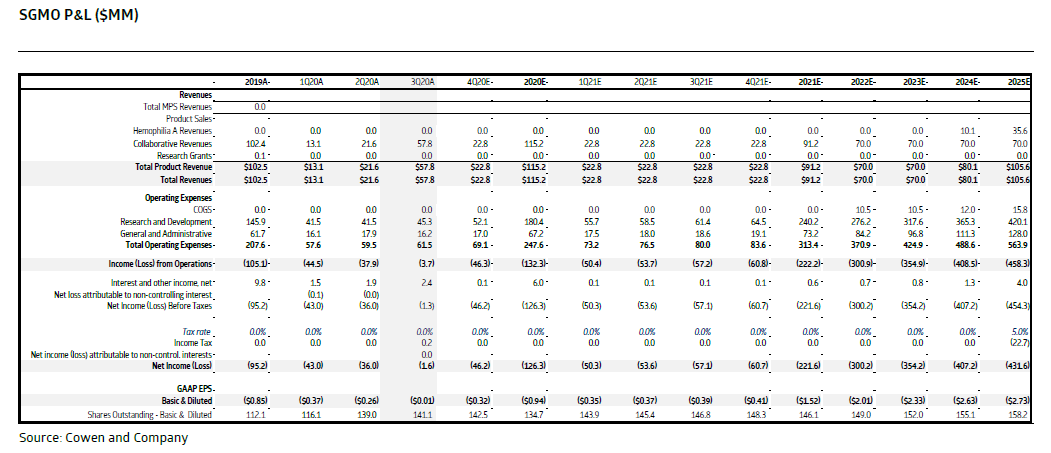

Appears Cowen published a useful courtesy $SGMO rept for investors prior to their annual HC conference. Most of the verbiage is an accumulation of prior reports. They have higher model royalties for $PFE and $SNY royalties than mine. Not a SOTP or full blown model

Cowen states that though the prelim data on $SNY collab was unimpressive, they are cautiously optimistic. My fcst was pushed out several years consistent with $BLUE issues and probability that more issues will crop up for $CRSP and $SGMO programs.

Attached screenshot of Cowen P&L is consistent with reported $SGMO revenue in C19 including:

- Research reimbursement $16m (mostly Gilead/Sanofi)

- Upfront amort $46m

- Milestones $39m

- Research reimbursement $16m (mostly Gilead/Sanofi)

- Upfront amort $46m

- Milestones $39m

Cowen: See the 2Q20 $SGMO revenue of $21.6m. This includes upfront & research reim rec'd that Q. 3Q increased due to the milestone earned but 4Q returns to the 2Q level which is used for all of C21. Conclusion: This model excludes any milestones or $BIIB $NVS collab increases

• • •

Missing some Tweet in this thread? You can try to

force a refresh