$ARKG Tweet series

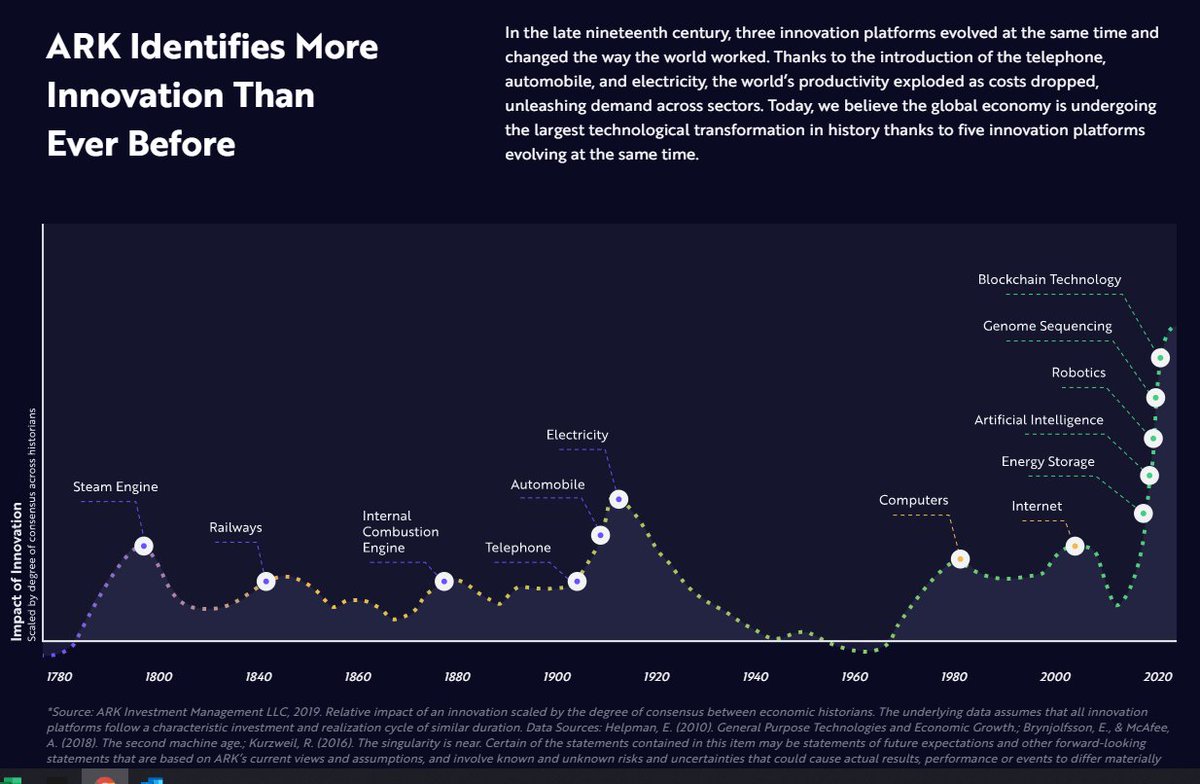

This series of tweets is my opinion only. Cathie Wood has created a group of ETFs that target the disruptive innovation that is both happening and accelerating. These funds have had stellar performance based upon innovation trends and economic theory.

1/

This series of tweets is my opinion only. Cathie Wood has created a group of ETFs that target the disruptive innovation that is both happening and accelerating. These funds have had stellar performance based upon innovation trends and economic theory.

1/

The $ARKG fund description is a good place to start. This has changed recently to a #CRISPR theme but started more with the sequencing cost declines which would drive diagnostics adoption and precision medicine

2/

2/

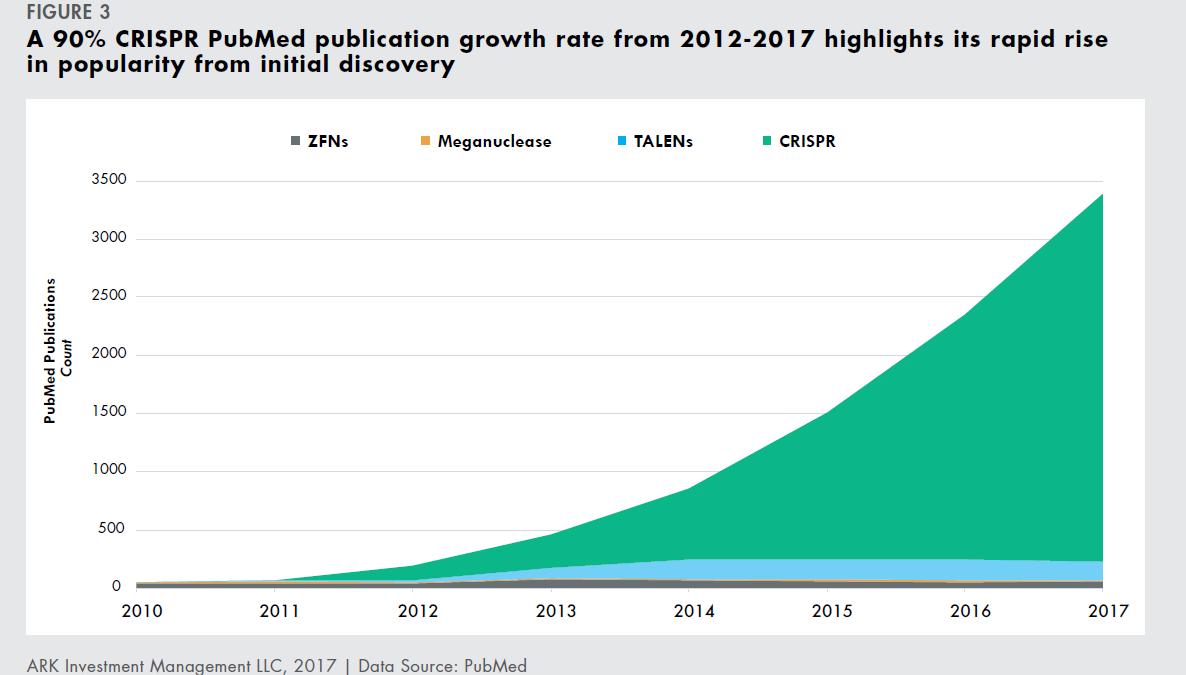

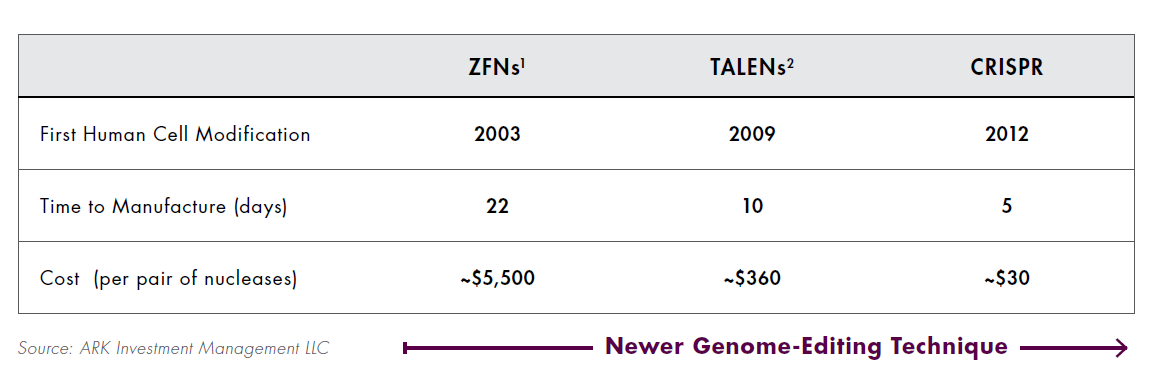

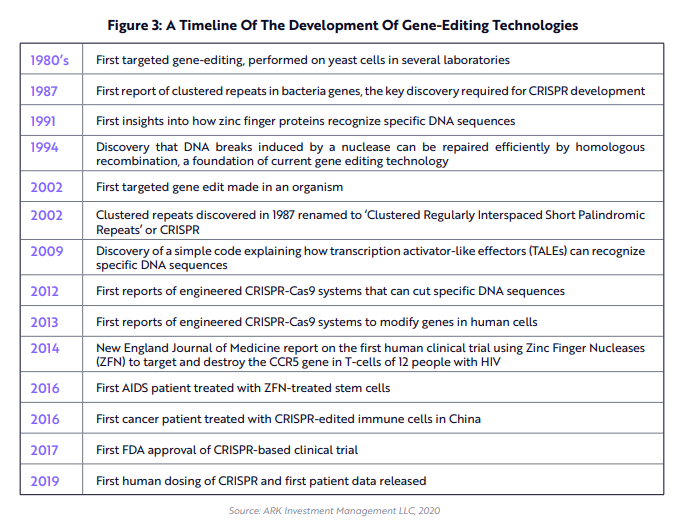

The economic driver of the Genomic Revolution is a multiplier. Not only sequencing cost declines but the impact of moving from #ZFN to #TALENs to #CRISPR is key. As the editing cost has dropped CRISPR is seeing a dominant increase in publications.

3/

3/

Table shows the economic cost advantage follows. #ZFN in 2003 to #TALENs to the current cost of #CRISPR has declined in a similar fashion to what has been seen with genomic sequencing declines. The ease of CRISPR use has led to exponential increases in volume driving cost

4/

4/

Pharma has been re-engineering their companies to return to a biopharma model primarily driven by this trend. I've written a couple articles on this lately. One example looked at $NVS. They see the opportunity and risk as seen in this chart

seekingalpha.com/article/439364…

5/

seekingalpha.com/article/439364…

5/

The early focus in the clinic has been #oncology. #Kymriah #Yescarta are a couple examples of #CRISPR ex vivo autologous #Celltherapy approvals and the cost-effectiveness of the approach.

6/

6/

The combination of clinical initiations and covid-19 disruption has led to what Peter Atwater in Moods and Markets said: "as always, nothing exceeds like success". Money is flowing in which is creating a multiplier effect.

Sep $ARKG up 90% YTD. Dec 24th incr to 203%

7/

Sep $ARKG up 90% YTD. Dec 24th incr to 203%

7/

The issue of concern for investors is not the premise but the conclusion. Investors assume that $CRSP $EDIT and $NTLA are the winners. $ARKG is seeing the underlying technology as the winner. Consider the change in fund weight and accum in $TAK $NVS $RHHBY

8/

8/

$CRSP $EDIT $NTLA are platform advantages that will eventually be acquired or cos will need to rent the platform to third parties. Hundreds of INDs means hundreds of competitors. Smartly $ARKG has reduced weighting for $EDIT from 5.2% to 1.9%. $NTLA from 5.3% to 1.7%

One limiting factor for #CRISPR is the IP landscape though $ARKG believes eventually this will be consolidated in a way that facilitates the growth

10/

10/

The Genomics Revolution is real but the ability to monetize is driven by appr meds. The $ARKG premise is driven by econ more than lab results but the econ adv are real. Don't be surprised if at least one of these three get acq'd in 2021 but be careful with valuations

11/

11/

I'm invested in $NVS $RHHBY $PFE primarily because they are bigpharma leaders in this new era. They all have been investing heavily + have been acquiring component tech. I'm building a position in $BIIB for the same reason along with their lead in neuroscience = largest TAM

12/

12/

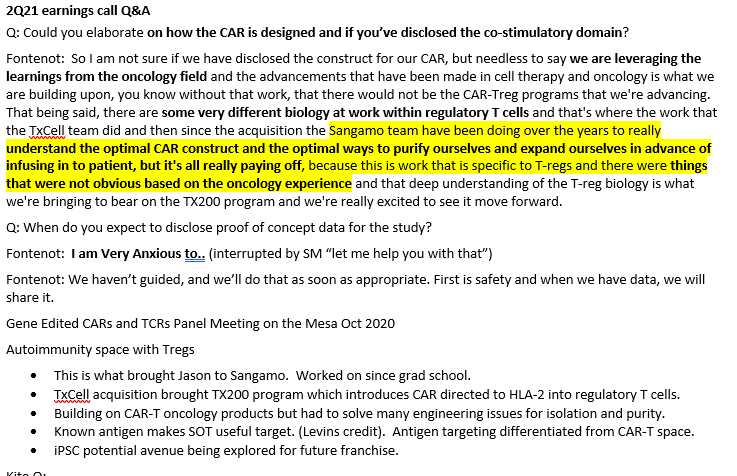

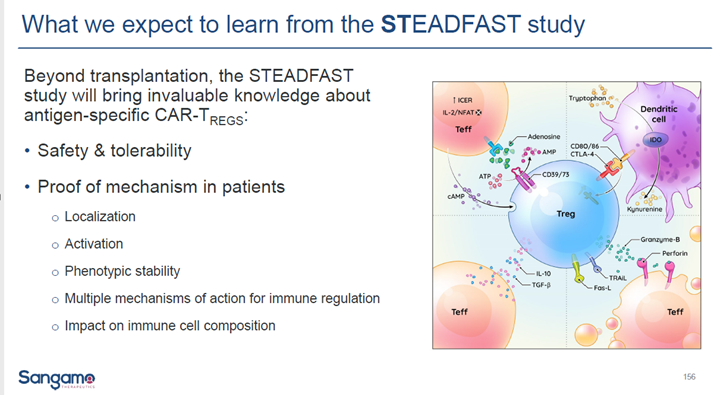

I'm invested in $SGMO for combination of platform and pipeline. Far and away superior today. Eventually #CRISRP will overtake them so they need to stay ahead which is why the advancement of ZFP-TF and CAR Tregs is so key. Next Mitochondria which again puts them in lead.

13/

13/

I've been in $CRSP $EDIT and $NTLA in past but now feel they are all over valued due to "success excess" while acknowledging that there today are only 3 leading platforms with a lot of potential interest, but M&A doesn't drive my investment decisions. Waiting for pullback

14/

14/

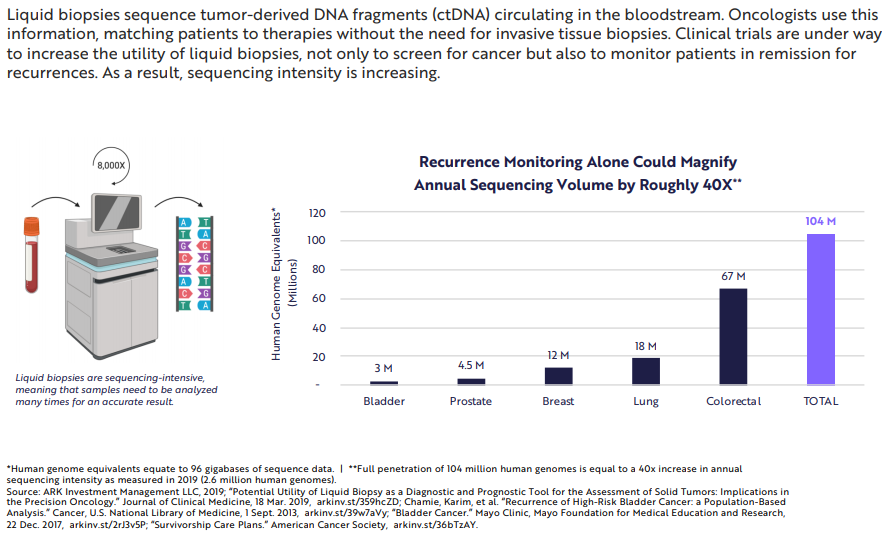

Just as an aside, I started writing about genomic disruptive innovation back in 2013 with #NIPT and later with #Liquidbiopsy. Way too early just like $ARKG if you look at their NAV chart.

15/

seekingalpha.com/article/147814…

15/

seekingalpha.com/article/147814…

Also wrote about #disruption driven by #Cloud #IoT and #Digitaltransformation. One example from 2017. Point is that this is a loooong lead and longer tail. The cloud/iot TAM was estimated in the #trillions per $MSFT at which point I stopped tracking.

seekingalpha.com/article/407897…

seekingalpha.com/article/407897…

Woods $ARKG interview comments worth noting:

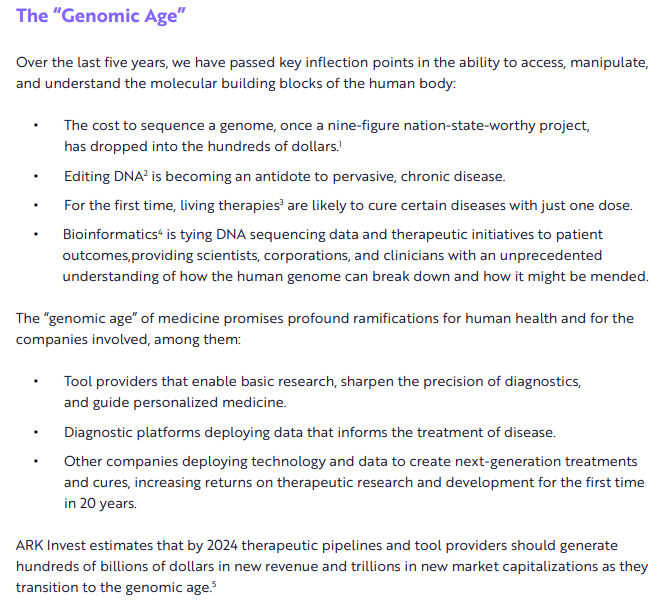

- #Genomics the most inefficiently priced segment. Healthcare the most misunderstood.

- cost declines leading H/C into golden era similar Genentech emerging in 1980s w/20 yrs of rising returns.

bloomberg.com/opinion/articl…

16/

- #Genomics the most inefficiently priced segment. Healthcare the most misunderstood.

- cost declines leading H/C into golden era similar Genentech emerging in 1980s w/20 yrs of rising returns.

bloomberg.com/opinion/articl…

16/

$ARKG has been accumulating: $NVS $RHHBY $TAK now at 2-3% weight. Don't follow Takeda but other two are leading the transition of big pharma to #GeneTherapy #biopharma.

Top 4 holdings of portfolio: $PACB $TDOC $CRSP $TWST

17/

Top 4 holdings of portfolio: $PACB $TDOC $CRSP $TWST

17/

The $ARKG investment case was updated in Sept. Mostly new but expect to see more about #liquidbiopsy going forward as cost effectiveness drives reimbursement catalyst

18/

18/

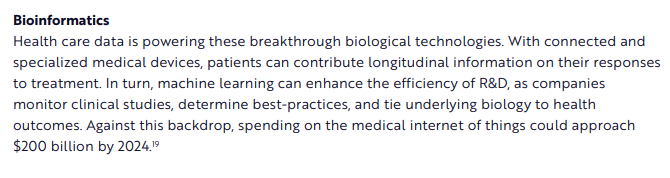

$ARKG white paper last year also quantified the impacts of #GenomicAge:

- Create trillions in market cap

- Significant decrease in clinical failure rates

- #Diagnostic tests generate tens of billions in C24 rev

- medical #IoT $200b spending C24

- Timeline shows #ZFN contr

19/

- Create trillions in market cap

- Significant decrease in clinical failure rates

- #Diagnostic tests generate tens of billions in C24 rev

- medical #IoT $200b spending C24

- Timeline shows #ZFN contr

19/

@threadreaderapp unroll please

• • •

Missing some Tweet in this thread? You can try to

force a refresh