What makes a business great? – Identifying & solving an unsolved problem.

A platform company named Affle India is doing it.

@anujkumar13 @anujkhanna

A platform company named Affle India is doing it.

@anujkumar13 @anujkhanna

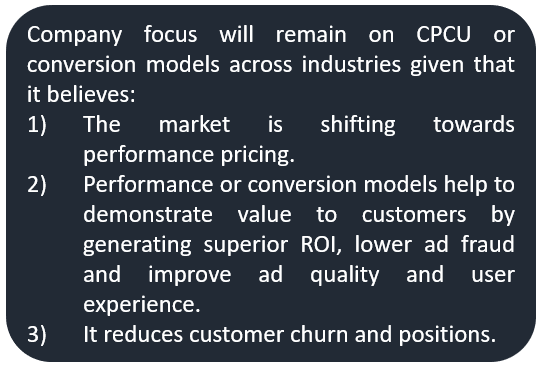

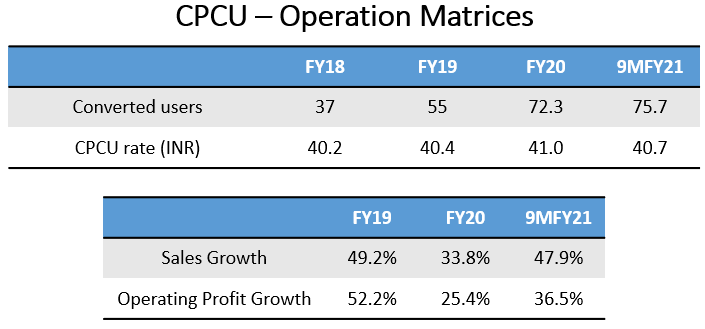

The genesis of this unique model comes from CEO’s early experience while building the application he learned that the most paramount thing for a client is anything that boosts sales, and thus he evolved his business into pay per acquisition model.

Why there is a need for Ad tech companies?

Online or digital ads function on the same principles i.e.

1. To drive sales and/or enable awareness of the product or service.

2. Publish the ad on the right platform at a nominal price to reach the target audience.

Online or digital ads function on the same principles i.e.

1. To drive sales and/or enable awareness of the product or service.

2. Publish the ad on the right platform at a nominal price to reach the target audience.

But because of the numerous avenues of publisher platforms such as (gaming, social media, videos, etc) the complexity of advertising online increases.

(Ad-tech) companies have simplified advertising in the digital world with the help of data analytics, AI & MI.

(Ad-tech) companies have simplified advertising in the digital world with the help of data analytics, AI & MI.

Ad tech companies enabled automation in the advertising process

Automation can happen at both ends – at the advertiser’s end, it enables the process of obtaining proper ad space across multiple platforms

at the publisher’s end, it enables the tracking of the impressions delivered

Automation can happen at both ends – at the advertiser’s end, it enables the process of obtaining proper ad space across multiple platforms

at the publisher’s end, it enables the tracking of the impressions delivered

Benefits of Digital Advertising

1. Improve measurability of ad spends

2. Leads to better ad quality

3. Enhances the ability of an advertiser to engage or connect to a wide range of audience

4. Allows brand to tweak marketing efforts

5. Is less expensive than traditional formats

1. Improve measurability of ad spends

2. Leads to better ad quality

3. Enhances the ability of an advertiser to engage or connect to a wide range of audience

4. Allows brand to tweak marketing efforts

5. Is less expensive than traditional formats

Earlier forms of digital advertising such as cost per thousand impressions (CPM) or views (CPV) suffer from three issues:

Affle is well placed with global peers in a performance-led pricing model, giving an edge in emerging countries.

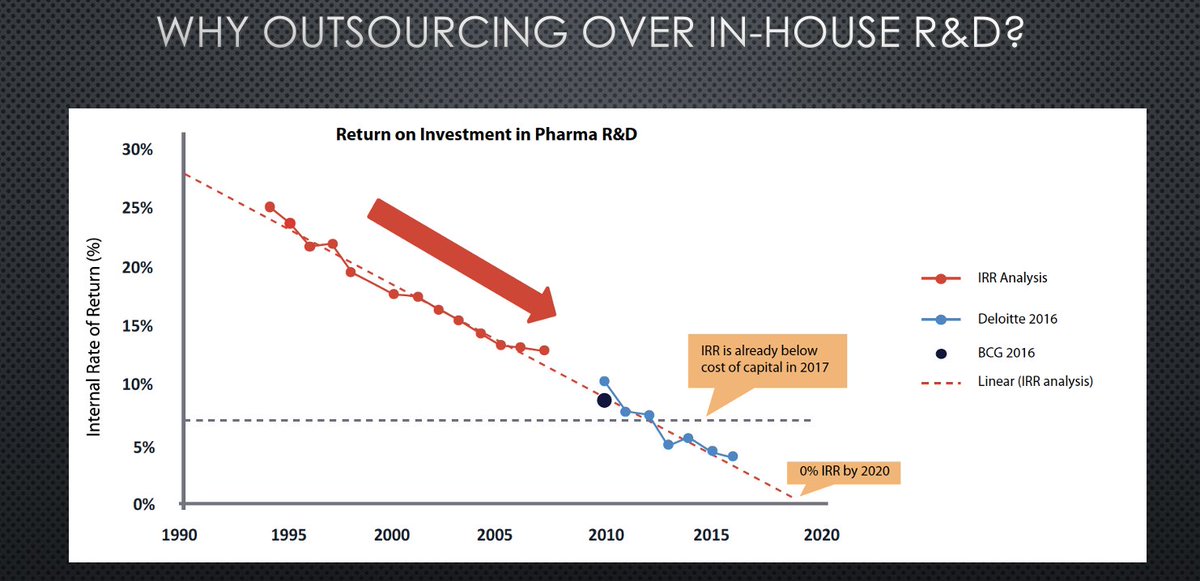

How difficult is it to customize self-served player Google & Facebook and why will they not enter into space?

@safiranand @hirenved @RBCGAMChiefEcon @GSpier @MohnishPabrai @SahilBloom @10kdiver @varinder_bansal @oraunak @ParveenBhansali @darshanvmehta1 @AnyBodyCanFly @deepakshenoy @investeek @Maaachaaa69 @anantladha25

• • •

Missing some Tweet in this thread? You can try to

force a refresh