What do they do?

-They manufacture custom designed, hi chrome, casted grinding balls for crushing purpose, mill liners & vertical mill parts used inside grinding machinery

-They manufacture custom designed, hi chrome, casted grinding balls for crushing purpose, mill liners & vertical mill parts used inside grinding machinery

Few Customer names:

Note: It is not easy to get new customer. They are sticky in nature. It generally takes 18-24 months time to convert 1 customer

Note: It is not easy to get new customer. They are sticky in nature. It generally takes 18-24 months time to convert 1 customer

VEGA Industries is the international distribution arm of AIA Engineering. They believe in Hub & Spoke model where India is the manufacturing hub (AIA E) and Vega is distribution arm across globe. Welcast was Raw material supplier for company, recently got shut down.

It is always important to know what is the size of opportunity to understand how big can company become

*There are 2 ways to create Final product (Casted & Forged) so its necessary to know the difference between them

*There are 2 ways to create Final product (Casted & Forged) so its necessary to know the difference between them

When it comes to manufacturing companies, it is important to see if company works on improving its process or product through technological upgradation, which can help them to improve their margins

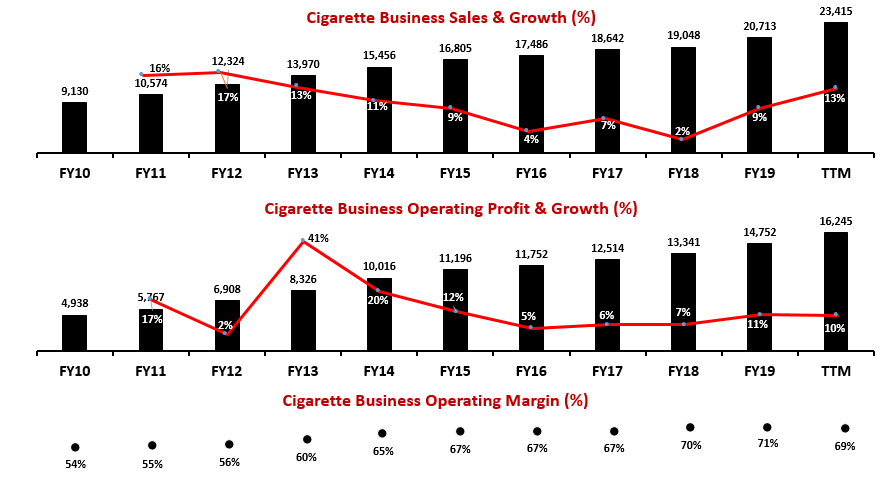

In last 9 years, company's sales have increased at a CAGR of 10.46%.

Note: There is a lag when it comes to passing on Raw Material price fluctuations to customer. This creates certain abnormality in numbers. Certain points mentioned beside the chart.

Note: There is a lag when it comes to passing on Raw Material price fluctuations to customer. This creates certain abnormality in numbers. Certain points mentioned beside the chart.

In last 5 yrs, sales volume has grown by 7.44% CAGR. Total volume sold are in black box with annual growth. Chart specifies growth in mining & others.

Note: Mining is the focus since last 10 yrs for the company and future growth would come from here

Note: Mining is the focus since last 10 yrs for the company and future growth would come from here

company had always targeted exports over domestic sales, since last 8yrs domestic sales has grown by 1.01% CAGR whereas export sales have grown by 12.57%. This lead to exports as a % of total sales increase from 62% in FY12 to 80% in FY20

Breaking P&L into per KG analysis will help us to know that is company able to pass on cost & between what bandwidth can company charge to their customer

Through historical numbers & management commentary, it becomes easy to understand that Sales per KG can stay between Rs105-115

Through historical numbers & management commentary, it becomes easy to understand that Sales per KG can stay between Rs105-115

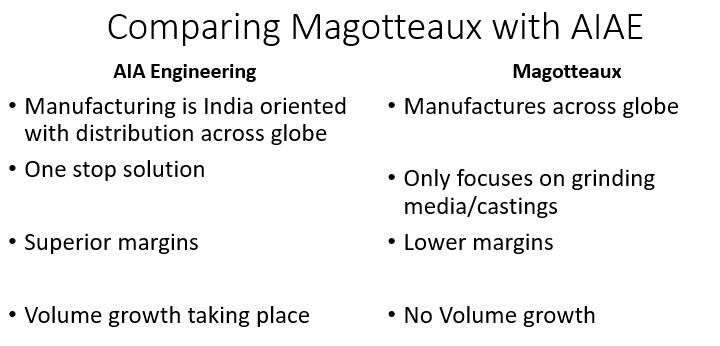

Hi chrome casted grinding media (final product) is a duopoly market. The table gives us better clarity that the competitor Magotteaux has not been able to grow their volume whereas AIA Engineering is able to that with better margins, giving them a better edge

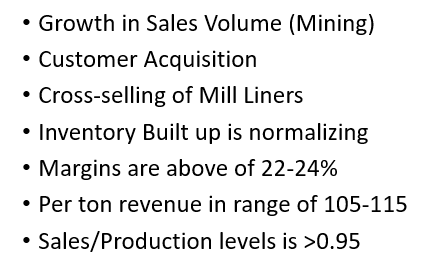

There are always certain track points which helps us to understand how the company is doing, if these checklist points are getting a tick mark✅ means things are good

List for AIA Engineering is mentioned below

List for AIA Engineering is mentioned below

@amey_candor @Vivek_Investor @alphaideas @finbloggers @FinMedium @FinsenseG @moneymanage @safiranand

@jitenkparmar @thesanjaydutt @nbalajiv @tapak7 @niteen_india @arpitranka @RahulSaraogi @SaketLohia5 @VallumConnect @leading_nowhere

• • •

Missing some Tweet in this thread? You can try to

force a refresh