Before discussing this company let us first understand the meaning and basic difference between some words which are often used interchangeably.

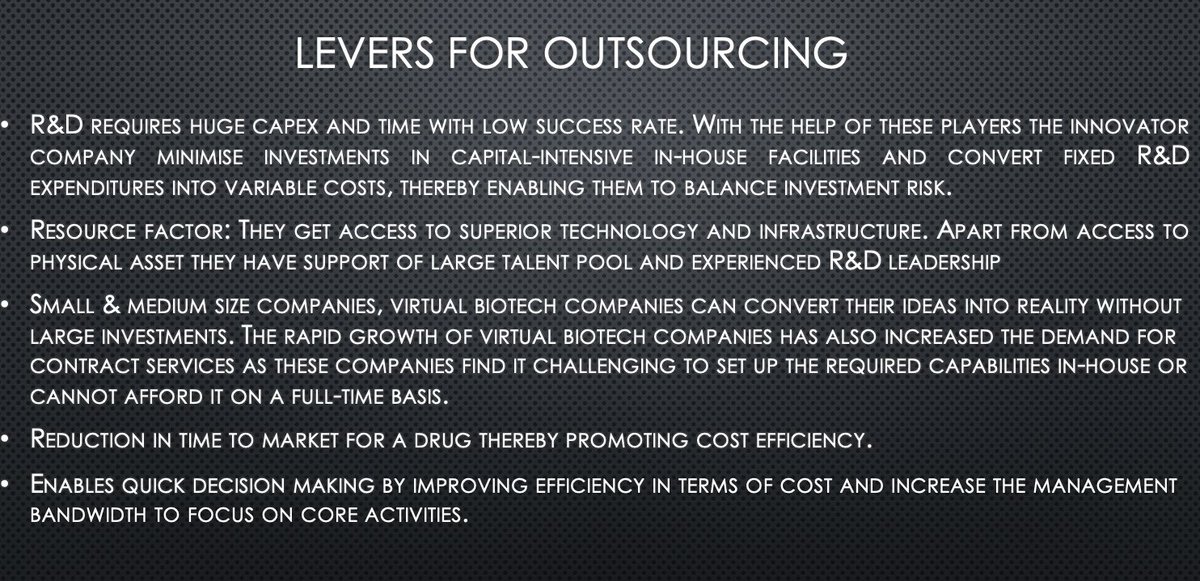

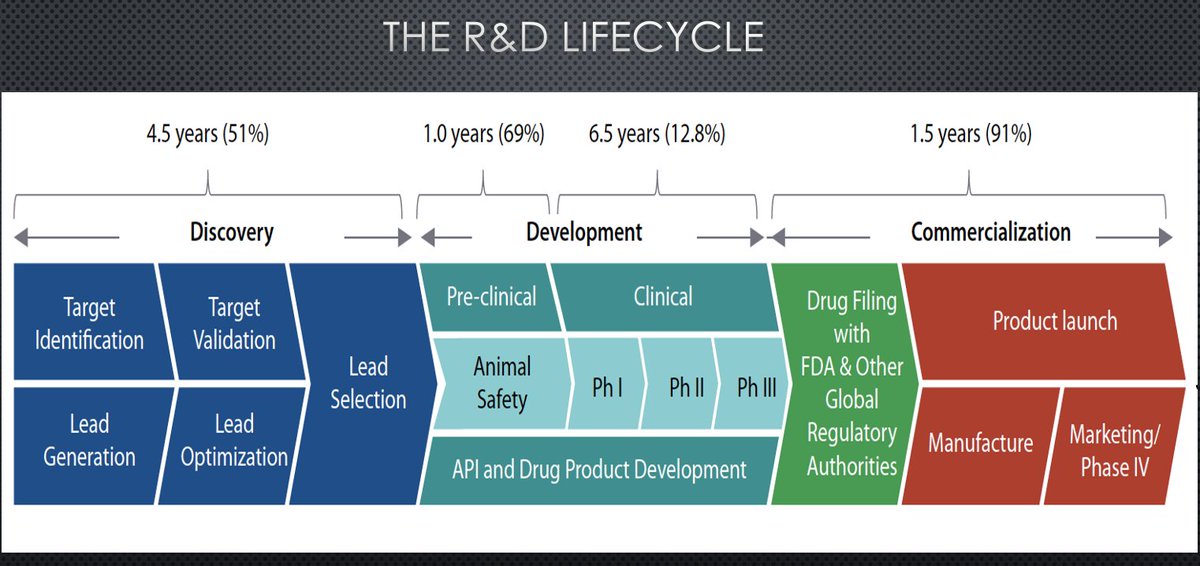

The need of such players arises as the R&D process to bring a product into market is expensive and time consuming.

On an average the R&D in pharma takes 14years with US$2.6Bn to bring a product to market with an overall success rate of ~4.1%

On an average the R&D in pharma takes 14years with US$2.6Bn to bring a product to market with an overall success rate of ~4.1%

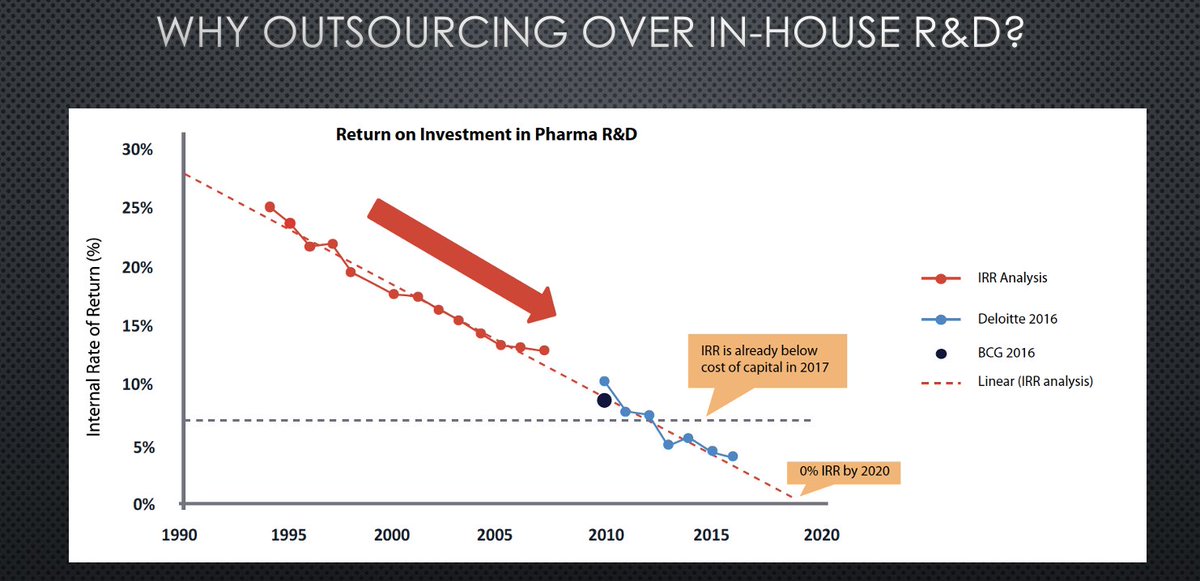

Even after investing substantial time and money, pharma companies are facing sustainability crisis due to dwindling ROI on R&D

Pharma companies invest around 15-20% of their revenues in R&D but in return the IIR < Cost of capital.

In 2020 it was expected to touch 0%

Pharma companies invest around 15-20% of their revenues in R&D but in return the IIR < Cost of capital.

In 2020 it was expected to touch 0%

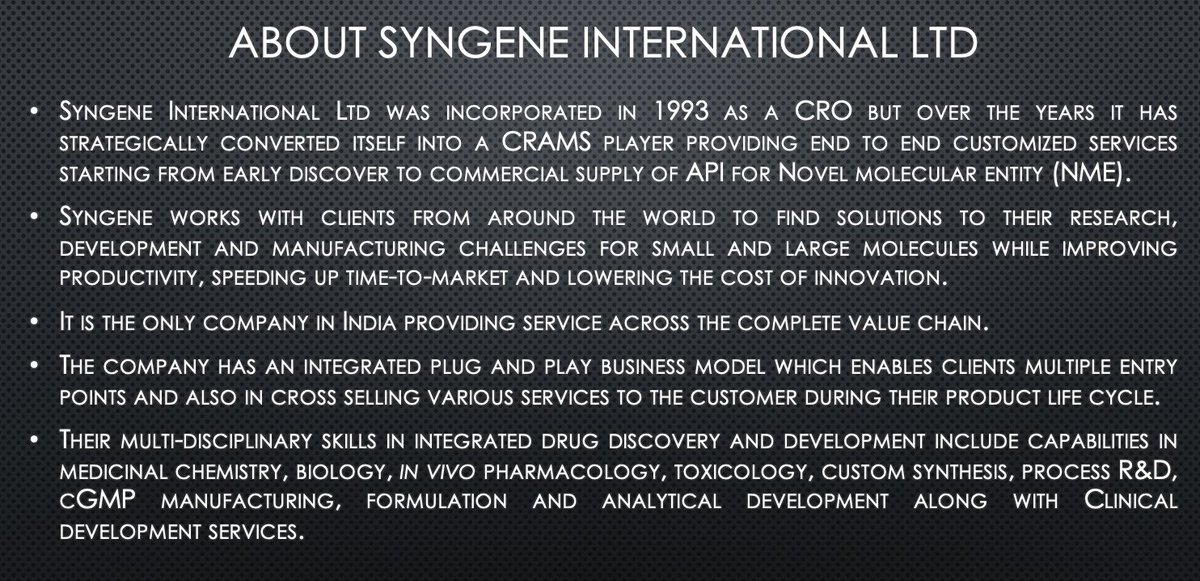

Syngene is a global CRAMS player providing end to end services in the entire value chain of forming a drug from a molecule.

It works with client around the world. Geography wise 76% revenue contribution is from US, followed by 12% from Europe.

It works with client around the world. Geography wise 76% revenue contribution is from US, followed by 12% from Europe.

Its plug and play business model gives various entry points to customer.

They have a strong customer base with 25% of them having long term relationship of more than 5years.

However, client concentration is high with top 10 clients contributing 65%.

They have a strong customer base with 25% of them having long term relationship of more than 5years.

However, client concentration is high with top 10 clients contributing 65%.

what about safety of clients data as Biocon (parent) is into similar business of syngene's client?

to ensure safety their DCs are Ring fenced which means every client’s test results are secret and safe for them and specifically restricted only to the teams that need to see it

to ensure safety their DCs are Ring fenced which means every client’s test results are secret and safe for them and specifically restricted only to the teams that need to see it

Because of DCs,the sponsor companies have access to additional services like shared(bioinformatics, viral testing etc) and enabling functions(HR, staffing, supply chain,ehss clearances etc)

result: operation efficiencies increases per FTE up to 25-30% and turnaround increases

result: operation efficiencies increases per FTE up to 25-30% and turnaround increases

An example of how their vertically integrated model helps them in forming long term relationship with the clients.

In this stated example the Japanese client had the molecule but did not had the capacity to take it further.

In this stated example the Japanese client had the molecule but did not had the capacity to take it further.

but over the years their relationship with this client has evolved from working with below 1Kg level to now at >1000kgs commercial manufacturing.

win-win situation for both the parties.

win-win situation for both the parties.

Just like IT companies, employee are an important asset for CRO.

Syngene is the largest CRO employer in India having largely qualified personnel.

Employee cost is at 27-29% of revenue which is a major expense

This expense will come down once the manufacturing operations starts

Syngene is the largest CRO employer in India having largely qualified personnel.

Employee cost is at 27-29% of revenue which is a major expense

This expense will come down once the manufacturing operations starts

Starting FY15, the management had guided capex of 550mn$ which is expected to complete by FY21, out of which most have been already done.

Around 200mn$ have been done primarily on four facilities : Syngene Research Center (Bengaluru) , Formulation development and Manufacturing

Around 200mn$ have been done primarily on four facilities : Syngene Research Center (Bengaluru) , Formulation development and Manufacturing

Plant, Biologics Manufacturing Plant and API Manufacturing plant.

Apart from this company has also invested in other facilities such as pilot finish facility for injectables, oral solid manufacturing, viral testing facility, bioinformatics, Gene therapy, microbiology lab etc.

Apart from this company has also invested in other facilities such as pilot finish facility for injectables, oral solid manufacturing, viral testing facility, bioinformatics, Gene therapy, microbiology lab etc.

The inherent advantage of having one outsourcing partner: a single trusted supplier to manage all process steps; a flexible resource to accommodate rapid scale-up or wind-down as needed; end-to-end project management and tighter project delivery

As companies right from small start-ups to large global organisations turn to external partners to drive innovation and R&D productivity, the demand to fulfil the complete R&D lifecyle using a single service provider is growing.

@unseenvalue @ishmohit1 @ravidharamshi77 @punitbansal14 @varinder_bansal @SamitVartak @safiranand @FinMedium @finshots

• • •

Missing some Tweet in this thread? You can try to

force a refresh