The upcoming Injectable Story!

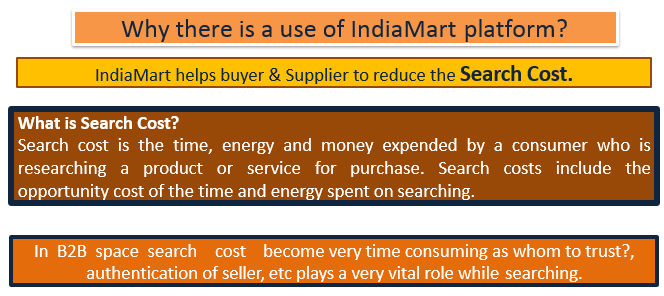

Gland Pharma Limited (GPL) is one of the fastest fastest-growing injectables-focused companies selling products primarily under a “B2B” model in over 60 countries as of March 31, 2020, including the US, Europe, Canada, Australia, India, & the ROW.

Gland Pharma Limited (GPL) is one of the fastest fastest-growing injectables-focused companies selling products primarily under a “B2B” model in over 60 countries as of March 31, 2020, including the US, Europe, Canada, Australia, India, & the ROW.

The Company operates in There four sub types: 1) IP led own ANDA filings, 2) IP led partner ANDA filings, 3) Tech-transfer and 4) Cost+margin led CMO model.

In FY20, 96% of Gland’s revenues were generated from B2B contracts. A large portion of these contracts is profit-sharing compared to cost+margin-led CMO companies. In such markets, it partners with leading co. with independent sales and distribution networks to market its product

The company's delivery systems include liquid vials, lyophilized vials, pre-filled syringes, ampoules, bags, and drops. Now the company has started focusing on new delivery systems such as pens and cartridges.

Sterile injectables represent 71% of Gland’s ANDAs filings in the US.

Sterile injectables represent 71% of Gland’s ANDAs filings in the US.

Gland has 7 USFDA approved manufacturing facilities, including 2 sterile injectables facility, 1 dedicated penem facility, 1 oncology facility, and 3 API plants.

Both Sterile Injectable plants are major contributors to revenue.

Both Sterile Injectable plants are major contributors to revenue.

Around 58% of the Gland’s revenue comes from the top 10 products and 44% of the revenue comes from the top 5 products. While the Top 10 products contributing 58% to the total revenue may be a concentration risk, but the actual top 10 products keep changing YoY.

Vertical integration capabilities give access to these APIs appear to be quite limited hardly seen in any Indian DMF filings. Gland has over 12-13 molecules that are currently listed on the US FDA drug shortage list and presents a market value of close to US$ 490mn.

Currently, the US is the largest contributor and we expect China to become the 2nd largest segment for the company over the next few years. 41% of Gland’s products in the US launched prior to 2019 still have less than 5 players as competition

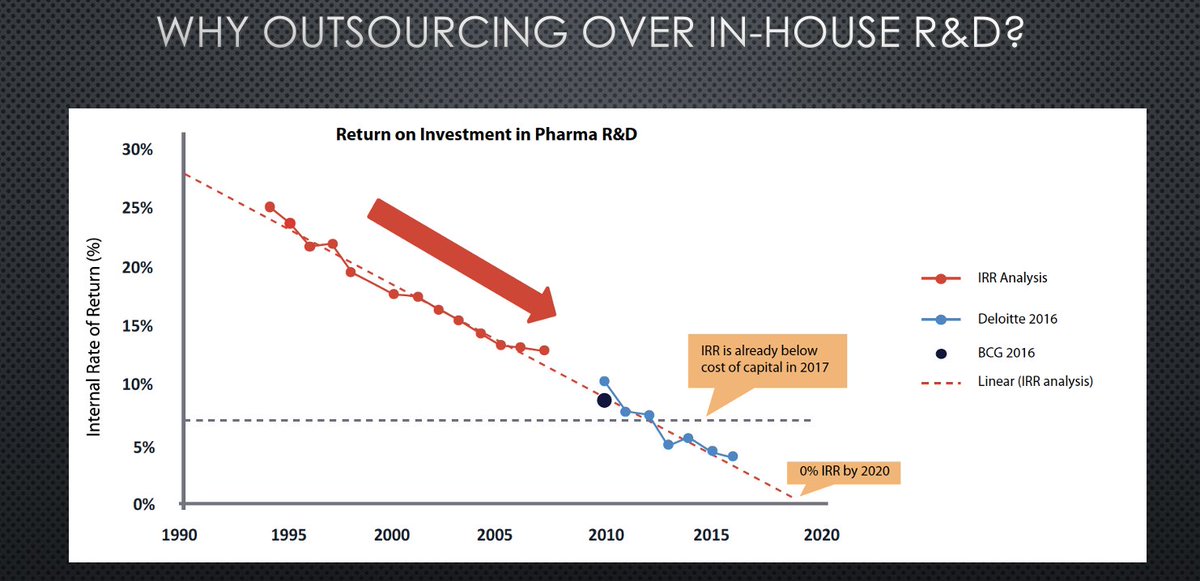

B2B players have a leaner cost profile as their SG&A/marketing expenses are significantly lower than the B2C marketing companies. They also share R&D development and litigation costs with their partners, which also leads to lower product development risk for companies like Gland.

Recipharm is the closest peer to Gland in order to draw a comparison. While growth has been quite robust for Recipharm in 2018 and 2019.

Gland’s 37% average EBITDA margin over the last 4 years is considerably ahead of Recipharm’s steriles/inhalation CDMO segmental margin

Gland’s 37% average EBITDA margin over the last 4 years is considerably ahead of Recipharm’s steriles/inhalation CDMO segmental margin

High earnings growth, return ratios, and strong B/S: Driven by 27.4% top-line and 36.9% EBITDA CAGR.

Due to high profitability and low requirement of CAPEX, the return ratios are also likely to remain

healthy. Gland is also likely to generate free cash flow consistently.

Due to high profitability and low requirement of CAPEX, the return ratios are also likely to remain

healthy. Gland is also likely to generate free cash flow consistently.

Competitive Advantages:

1.Extensive and vertically integrated injectables

2.Diversified B2B-led model across markets,

3.Complemented by a targeted B2C model in India

4.Ramp up in recently launched products

5.China can start delivering FY23 and beyond

6.Vaccine Opportunity

1.Extensive and vertically integrated injectables

2.Diversified B2B-led model across markets,

3.Complemented by a targeted B2C model in India

4.Ramp up in recently launched products

5.China can start delivering FY23 and beyond

6.Vaccine Opportunity

Key Risks:

1.High regulatory requirements

2.High dependence on key customers

3.Heparin is one of the key API’s where Gland has 4.dependence on China

5.High dependence on pharmaceuticals-marketing companies

1.High regulatory requirements

2.High dependence on key customers

3.Heparin is one of the key API’s where Gland has 4.dependence on China

5.High dependence on pharmaceuticals-marketing companies

@AdityaKhemka5 @arpit971 @finbloggers @alphaideas @Gautam__Baid @unseenvalue @darshanvmehta1 @soicfinance @FinMedium @ravidharamshi77 @contrarianEPS @KalpenParekh @oraunak @livemint

• • •

Missing some Tweet in this thread? You can try to

force a refresh