1/ xDai STAKE, $STAKE, xdaichain.com. Given how crazy ETH fees have been recently it’s a good time to talk about what’s probably the most used L2 scaling solution for Ethereum right now with only a 150M Mcap, xDai $STAKE

2/ The xDai chain is an Ethereum sidechain where ETH smart contracts can be written and deployed in the same way as on the mainnet. So any asset on Ethereum can be bridged to the xDai chain and used there, with a fraction of the fees, and faster confirmation times (5s per block).

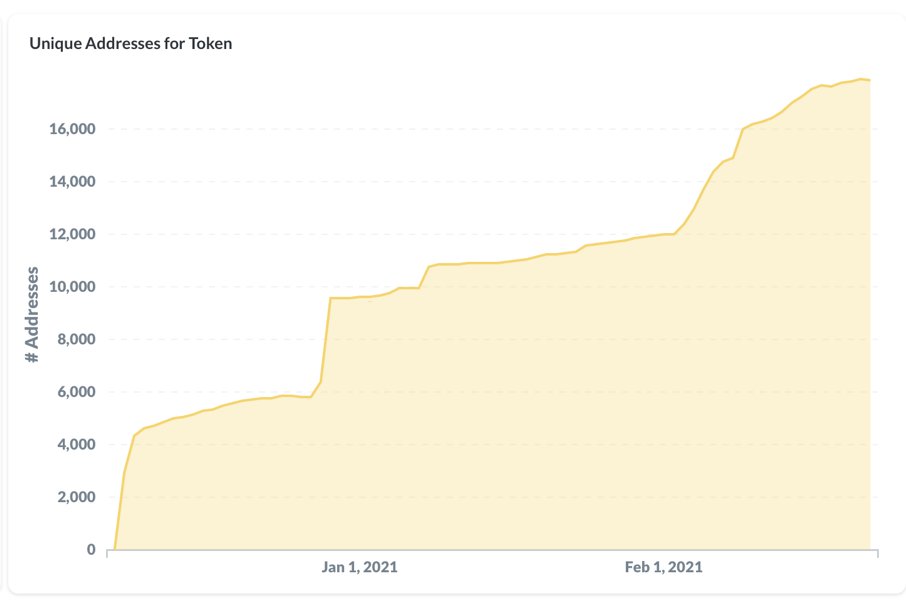

3/ xDai is not the only L2 side chain solution on Ethereum, but it is crazy how much adoption it has been getting lately and how undervalued their $STAKE token is compared to other L2 sidechain solutions

$MATIC $854M

$OMG $925M

$STAKE at only $150M

$MATIC $854M

$OMG $925M

$STAKE at only $150M

4/ Just to give an idea of the applications being built on xDai & the ETH main chain projects integrating with it:

- @gnosisPM ($GNO ) has announced all their applications will be deployed to xDai

- @origin_trail ($TRAC) announced the launch of OriginTrail Version 5 on xDai

- @gnosisPM ($GNO ) has announced all their applications will be deployed to xDai

- @origin_trail ($TRAC) announced the launch of OriginTrail Version 5 on xDai

5/

- @perpprotocol a DEX for margin trading on ETH, runs all trading activities on the xDai Chain (>45M daily vol).

- @Honeyswap (honeyswap.org), a Uniswap fork, migrated from mainnet to xDai

- Baoswap (@thebaoman), a Uniswap fork, announced it’s launching on xDai

- @perpprotocol a DEX for margin trading on ETH, runs all trading activities on the xDai Chain (>45M daily vol).

- @Honeyswap (honeyswap.org), a Uniswap fork, migrated from mainnet to xDai

- Baoswap (@thebaoman), a Uniswap fork, announced it’s launching on xDai

6/

-Unicrypt @UNCX_token launched on xDai, making it easier for projects to launch directly on xDai using decentralized pre-sales & liquidity lockers

-@CirclesUBI has launched on xDai

-Partnership with @chainlink for natively integrating Chainlink’s oracle network into xDai

-Unicrypt @UNCX_token launched on xDai, making it easier for projects to launch directly on xDai using decentralized pre-sales & liquidity lockers

-@CirclesUBI has launched on xDai

-Partnership with @chainlink for natively integrating Chainlink’s oracle network into xDai

7/ xDAI has also established a strong use case for event currencies (currencies to buy food, merch, etc at single events) and has been used at EthDenver 2019 and 2020, Etheral NYC 2019, Devcon V (2019) and splunk19 (non-crypto IT conference which hosted over 25k wallets).

8/ Not to mention many other projects incl. NFTs (@withFND, @poapxyz, @NiftyInk), games (@darkforest_eth), prediction markets (@Omen_eth), voting (@vocdoni), etc. My point being, adoption of xDai chain is increasing, and FAST!

9/ And if we imagine that even a small part of the current Uniswap , NFTs, DeFi action will migrate to xDai (and the building blocks for this are certainly being deployed), we can imagine the growth potential ahead. Now let’s go into the project presentation:

10/ The xDai chain has a dual token architecture with $XDAI as the stable transactional token, and $STAKE as the staking consensus token. Each $XDAI is a bridged $DAI (so pegged to $1), and tx fees are paid in $XDAI, so fees remain predictable and VERY low (a fraction of a cent).

11/ The $STAKE token is used to secure the chain, allowing block producers (validators and their delegators) to reach consensus in exchange for staking rewards. $STAKE is not required for everyday transactions (as tx fees are paid in $XDAI), but only for consensus and governance.

12/ However, while $XDAI is a stable token, $STAKE is certainly not, and it is expected to increase in value as xDai adoption increases (given $STAKE holders have governance power and the fact that they also earn tx fees and bridge fees)

13/ xDai uses a POSDAO consensus, a delegated proof of stake mechanism where validators stake $STAKE tokens both to become block producers (and earn block rewards) and for governance voting rights, while delegators may delegate their voting power to validators.

14/ The link between Ethereum mainnet tokens and xDai is ensured through bridges, which lock a mainnet token to release the xDAI one, or vice-versa. There are two bridge implementations: the xDai Bridge used for Dai <-> xDai transfers and the Omnibridge used for other eth tokens

15/ The $STAKE token has an initial supply of 8.5M released over time (current circ. supply: 4.06M), and additional $STAKE tokens are minted as block rewards paid to stakers (~15% APR). Staking rewards also include the chain’s tx fees and bridge fees, paid in $XDAI.

16/ Allocation of the initial supply is shown below, noting that Liquidity, Private, Seed & Public round tokens have all been fully distributed. Foundation + Advisor token distribution will end on March 31st.

Ecosystem token distribution will start on March 31st and last for 1y

Ecosystem token distribution will start on March 31st and last for 1y

17/ Roadmap for 2021 includes Universal NFT Bridge, Optimistic Bridge, privacy preserving transactions, synthetic assets (based on the UMA protocol), and research on further scalability solutions using Polkadot, Cosmos, optimistic rollups etc.

18/ Last but not least, once ETH 2.0 is fully realised, xDai is expected to join ETH 2.0 either as a shard or in a rollup-type capacity.

19/ Some useful links:

List of projects on xDai: xdaichain.com/about-xdai/pro…

Bankless article on the project: newsletter.banklesshq.com/p/an-intro-to-…

Dune analytics: duneanalytics.com/maxaleks/xdai-…

Dextools: dextools.io/app/uniswap/pa…

List of projects on xDai: xdaichain.com/about-xdai/pro…

Bankless article on the project: newsletter.banklesshq.com/p/an-intro-to-…

Dune analytics: duneanalytics.com/maxaleks/xdai-…

Dextools: dextools.io/app/uniswap/pa…

• • •

Missing some Tweet in this thread? You can try to

force a refresh