1/ $BONDLY bouncing back nicely after the dip

>Great marketing and mainstream exposure - 1st #NFT album in history!

>This coming Saturday is another @LoganPaul event which will increase exposure further

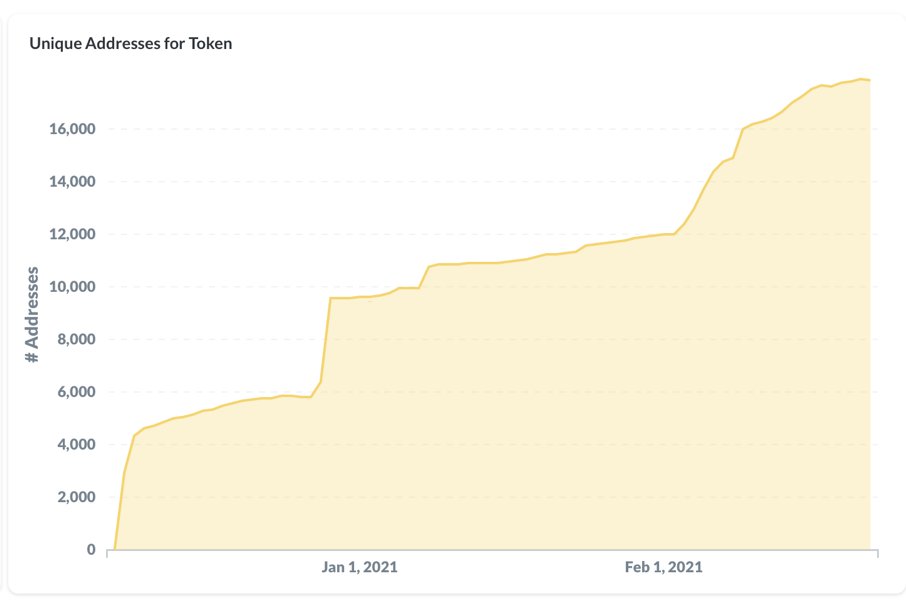

>Some @nansen_ai analytics below to get you feeling even more confident...

>Great marketing and mainstream exposure - 1st #NFT album in history!

>This coming Saturday is another @LoganPaul event which will increase exposure further

>Some @nansen_ai analytics below to get you feeling even more confident...

https://twitter.com/BondlyFinance/status/1363877239989788673

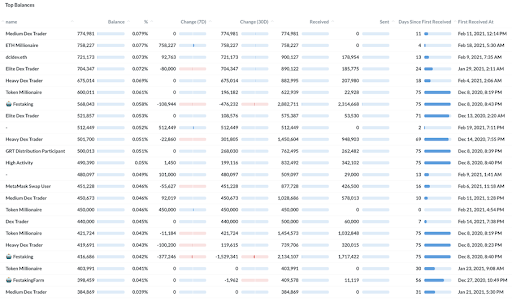

3/ Now a spot of $BONDLY whale watching...excluding project reserves, team wallets, staking pools etc)..

25 out of the 30 top $BONDLY balances have either been buying (13) or hodling (12) over the past 7 days...

25 out of the 30 top $BONDLY balances have either been buying (13) or hodling (12) over the past 7 days...

4/ And the few wallets whose balances have decreased, have only decreased by 10-20% max

In summary, almost no one is selling $BONDLY!

In summary, almost no one is selling $BONDLY!

• • •

Missing some Tweet in this thread? You can try to

force a refresh