Something doesn't add up here. nytimes.com/live/2021/02/2…

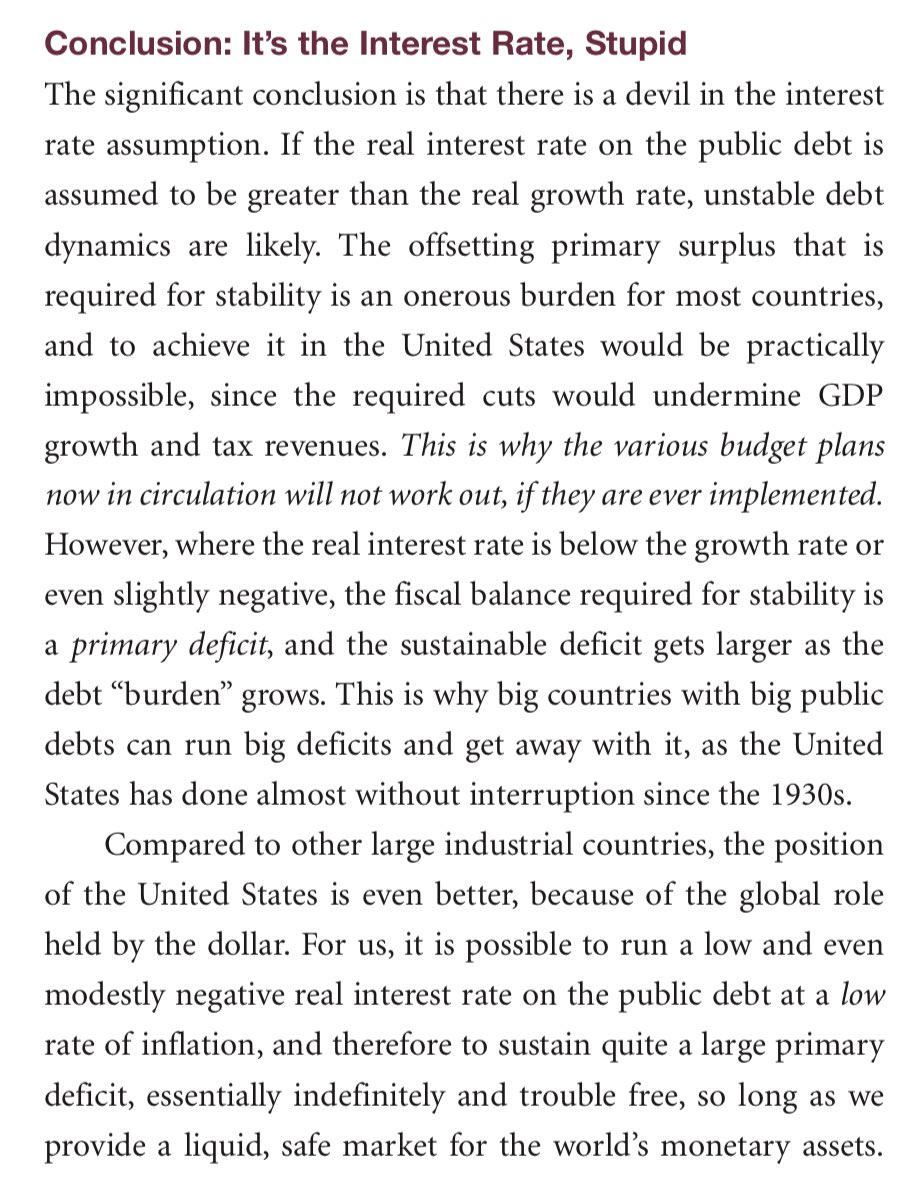

The weirdest bit, for me, is noting that interest as a share of GDP is "roughly the same" as during GFC, but somehow we are supposed to have more fiscal space today compared to what was available back then.

Like, if this was always the right way to think about fiscal space--and I don't agree that it is--then why didn't these people tell us that back in 2008/09/10?

Why did the most prominent economists (Obama advisors) who are now themselves pushing the *debt service* angle embrace Simpson-Bowles austerity when there was, under their own definition, ample fiscal space back then?

For the record, I don't agree that debt service is the right way to think about fiscal space. As James Galbraith put it, "the underlying economics are a mess." ineteconomics.org/perspectives/b…

• • •

Missing some Tweet in this thread? You can try to

force a refresh