1/ From mountains of debt to financial freedom in 21 years

A 🧵 about a normal guy named Lennie ⬇️

A 🧵 about a normal guy named Lennie ⬇️

2/ The Motley Fool has a thriving discussion board that has been filled with wisdom over the last 20+ years

I recently came across a post by a Canadian named Lennie and was inspired to share

I recently came across a post by a Canadian named Lennie and was inspired to share

3/ In 1998, Lennie was 27 years-old

He and his wife "felt trapped" by student loan debt that consumed 30% of their income

They had "no visible path to financial health. Our finances were maxed out."

They could afford the basics, but nothing else

He and his wife "felt trapped" by student loan debt that consumed 30% of their income

They had "no visible path to financial health. Our finances were maxed out."

They could afford the basics, but nothing else

4/ With their back against the wall, they "took a big swing"

They quit their jobs and took a position in Saudi Arabia

A big, risky move, but the upside was no taxes, no rent, and no utility bills

They went for it

They quit their jobs and took a position in Saudi Arabia

A big, risky move, but the upside was no taxes, no rent, and no utility bills

They went for it

5/ With their expenses cut to the bone, they got to work

Within a year they paid off all of their student loan debt

Within a year they paid off all of their student loan debt

6/ After that, they had some money to save & invest

Lennie got interested in the stock market

This was December 1999, near the peak of the dot-com craze

Lennie got interested in the stock market

This was December 1999, near the peak of the dot-com craze

7/ Lennie didn't know much about investing

He bought popular hype stocks of the day like JDS Uniphase, Nortel, and Infosys

He used margin to "supercharge my gains"

In 3 months, he had $50,000 and felt like a genius

"I was the poster boy for the Dunning-Kruger effect"

He bought popular hype stocks of the day like JDS Uniphase, Nortel, and Infosys

He used margin to "supercharge my gains"

In 3 months, he had $50,000 and felt like a genius

"I was the poster boy for the Dunning-Kruger effect"

8/ 1 month later was the stock market peak

All the high-flyers started to crash

Lennie got a margin call that "essentially wiped me out"

He sold in April with just $2,000 left

A $48,000 loss -- 96% of his stock market wealth -- in just 6 weeks!

(why I avoid margin)

All the high-flyers started to crash

Lennie got a margin call that "essentially wiped me out"

He sold in April with just $2,000 left

A $48,000 loss -- 96% of his stock market wealth -- in just 6 weeks!

(why I avoid margin)

9/ Lennie swore off the stock market

Extra money was used to save for a down payment and to build his wife's online business

In 2003, they moved back to Canada with no loans and a house down payment

"We were definitely not rich, but our finances were secure"

Extra money was used to save for a down payment and to build his wife's online business

In 2003, they moved back to Canada with no loans and a house down payment

"We were definitely not rich, but our finances were secure"

10/ The new plan was to work for 30 years, pay off the mortgage, save for college (they had 2 kids), and collect a pension in 2035 at age 65

"The path was long and boring, but at least it was navigable."

"The path was long and boring, but at least it was navigable."

11/ In 2004, Lennie got over his fear of individual stocks and subscribed to @TMFStockAdvisor

He contributed money every 2 weeks to an RRSP (Canadian IRA), investing ~$5,000/year

He slowly built a portfolio of ~80 stocks, avoided margin, added to his winners, and sold rarely

He contributed money every 2 weeks to an RRSP (Canadian IRA), investing ~$5,000/year

He slowly built a portfolio of ~80 stocks, avoided margin, added to his winners, and sold rarely

12/ After 14 years of consistency, at age 48, Lennie was able to retire

"Considering where we stood in 1998, this seems nothing short of a financial miracle, but it’s not. It’s predictable and reproducible."

Here are Lennie's top5⃣lessons

"Considering where we stood in 1998, this seems nothing short of a financial miracle, but it’s not. It’s predictable and reproducible."

Here are Lennie's top5⃣lessons

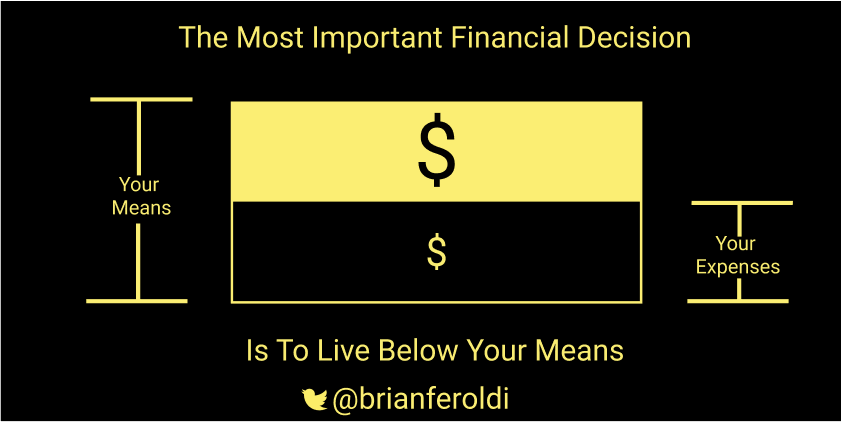

13/1⃣Be Frugal

"You need to pay off debt and spend less than you make"

Lennie & his wife averaged just $52k/year from 2003-2018

"The only way that we could save to invest was to live frugally"

"You need to pay off debt and spend less than you make"

Lennie & his wife averaged just $52k/year from 2003-2018

"The only way that we could save to invest was to live frugally"

14/ 2⃣Be Patient

"Compounding really is the 8th wonder of the world, especially when you’re beating the market over a very long period of time,

but the first decade or so is not all that impressive."

"Compounding really is the 8th wonder of the world, especially when you’re beating the market over a very long period of time,

but the first decade or so is not all that impressive."

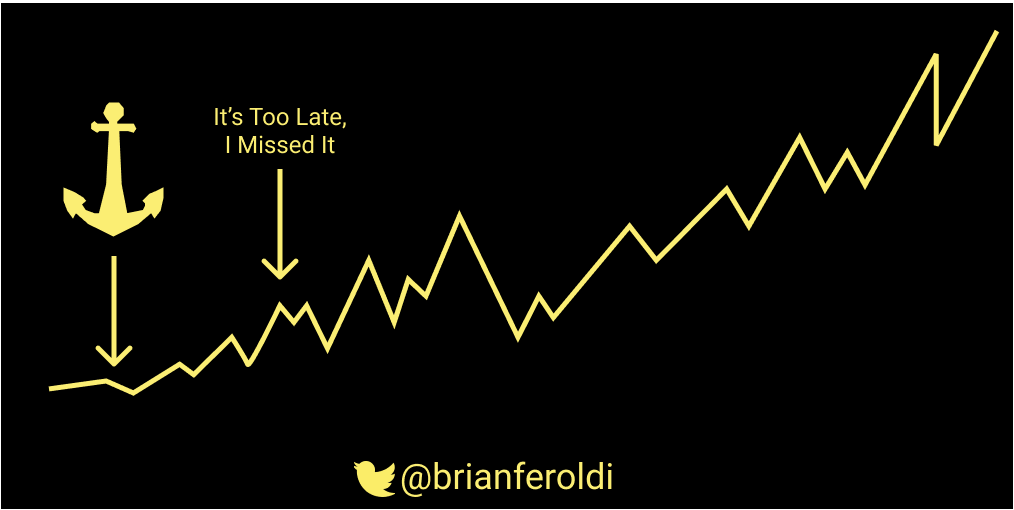

15/ 3⃣Rarely sell

"Every one of my biggest mistakes over the last decade is related to selling"

Lennie sold $BKNG at $100 (now $2,350)

I've made tons of selling mistakes myself!

"Every one of my biggest mistakes over the last decade is related to selling"

Lennie sold $BKNG at $100 (now $2,350)

I've made tons of selling mistakes myself!

15/4⃣Invest with a long-term mindset

"steer your mind away from all short-term price changes.

Many stocks you own will do poorly – it’s unavoidable.

But the multi-baggers will carry the day."

"steer your mind away from all short-term price changes.

Many stocks you own will do poorly – it’s unavoidable.

But the multi-baggers will carry the day."

16/5⃣Don’t be afraid to take big swings on stocks (and in life)

Taking the job in the Middle East was a "big swing" that paid off

"Similarly, our greatest stock returns have come from the big swings taken on the little rule breakers"

Taking the job in the Middle East was a "big swing" that paid off

"Similarly, our greatest stock returns have come from the big swings taken on the little rule breakers"

17/ You don't have to buy individual stocks if you don't want to

You can do great financially through regular savings & index funds

You can do great financially through regular savings & index funds

18/ Stock picking can be fun & financially rewarding

but make sure you get your financial house in order first

but make sure you get your financial house in order first

https://twitter.com/BrianFeroldi/status/1337050556628656129?s=20

19/ Thanks for sharing, Lennie!

If you like these financial graphics, I email them daily for free

brianferoldi.substack.com

If you like these financial graphics, I email them daily for free

brianferoldi.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh