My top takeaways from my chat with @JonahLupton & @saxena_puru ⬇️

Puru calls Hong Kong home. He loves living there.

0% tax rate on capital gains. That allows him to buy and sell as he pleases with no worries about the taxes

Puru was a professional trader in Asia for many years

Now, he's a full-time investor with his own capital

0% tax rate on capital gains. That allows him to buy and sell as he pleases with no worries about the taxes

Puru was a professional trader in Asia for many years

Now, he's a full-time investor with his own capital

Puru owns between 15 - 25 high growth stocks at any given time

He looks for strong revenue growth, a competitive advantage, and a massive opportunity

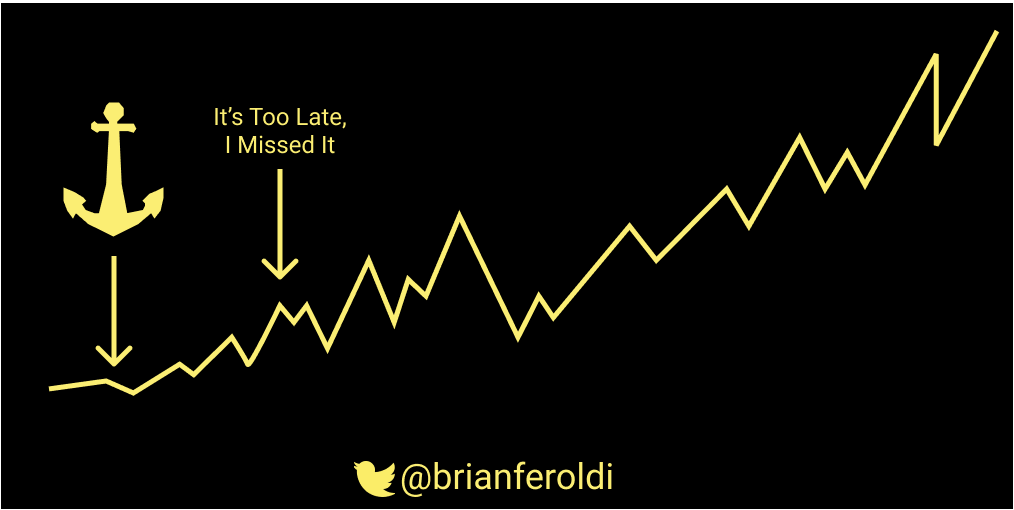

If he likes a stock, he doesn't let valuation keep him from investing

He looks for strong revenue growth, a competitive advantage, and a massive opportunity

If he likes a stock, he doesn't let valuation keep him from investing

Puru uses margin (about 20% of his portfolio)

He also uses hedges to cap his downside risk (we didn't get into details on this but is something I will ask him about in the future)

He also uses hedges to cap his downside risk (we didn't get into details on this but is something I will ask him about in the future)

Fav quotes:

"It's much more fun to buy on red days than green days"

"When stocks go down, my risk is lower"

"If you take care of the downside, the upside will take care of itself"

"It's much more fun to buy on red days than green days"

"When stocks go down, my risk is lower"

"If you take care of the downside, the upside will take care of itself"

Puru watches the Federal Reserve closely. As long as the money printing machine is in high-gear, Puru wants to own stocks

Puru will change his tune once:

1⃣The yield-curve inverts

2⃣When stocks begin to fall on good news

Puru will change his tune once:

1⃣The yield-curve inverts

2⃣When stocks begin to fall on good news

A few of Puru's favorite stocks right now

BlackSky - $SFTW

Carlotz - $LOTZ

Origin Materials - $AACQ

Matterport - $GHVI

BlackSky - $SFTW

Carlotz - $LOTZ

Origin Materials - $AACQ

Matterport - $GHVI

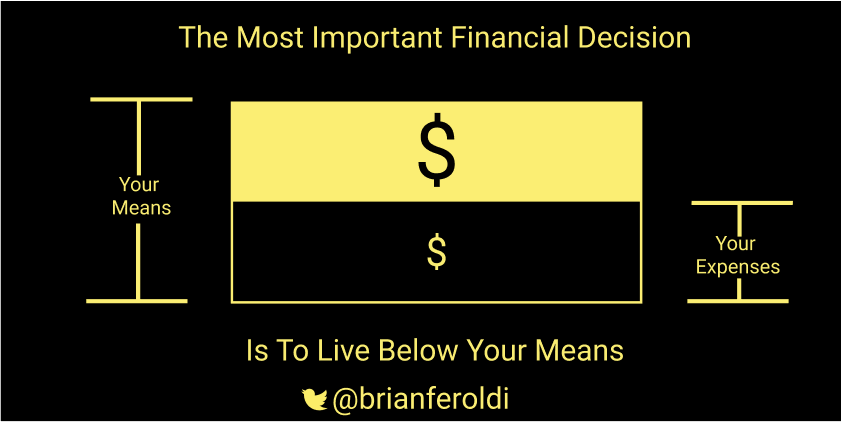

Puru has no loyalty to stocks. He views them as tools to help him accomplish his goals

He sells for 3 reasons:

1⃣He needs cash to buy something he likes more

2⃣Massive runup in a short period of time

3⃣New development at the company he doesn't like

He sells for 3 reasons:

1⃣He needs cash to buy something he likes more

2⃣Massive runup in a short period of time

3⃣New development at the company he doesn't like

A few sectors Puru likes for the long-term

✅Ecommerce

✅Fintech

✅Gaming

✅Green Energy

✅Software

✅Streaming

He avoids biotech, healthcare, and commodities

✅Ecommerce

✅Fintech

✅Gaming

✅Green Energy

✅Software

✅Streaming

He avoids biotech, healthcare, and commodities

Jonah was the host and asking questions, but I did take some notes on his thoughts too. (I look forward to interviewing him in the future)

Jonah believes that the stock market is way ahead of the economy right now

Jonah believes that the stock market is way ahead of the economy right now

Jonah's investing style has shifted over the last year

In 2020, he focused on companies that would benefit from COVID, such as

Fastly - $FSLY

Fiverr - $FVRR

Square - $SQ

Teladoc - $TDOC

In 2020, he focused on companies that would benefit from COVID, such as

Fastly - $FSLY

Fiverr - $FVRR

Square - $SQ

Teladoc - $TDOC

More recently, Jonah switched to focusing on high-growth stocks below $10 billion market cap

Jonah is seeing a lot of interesting healthcare/medical devices right now

His aim is to own stocks that he believes can 5x in 5 years

Jonah is seeing a lot of interesting healthcare/medical devices right now

His aim is to own stocks that he believes can 5x in 5 years

Jonah looks for stocks with growth catalysts that he believes will justify a higher valuation

Ex: New insurance contract wins at Dermtech $DMTK and new product launches/acquisitions with Mohawk Group $MWK

Ex: New insurance contract wins at Dermtech $DMTK and new product launches/acquisitions with Mohawk Group $MWK

A few of Jonah's favorite stocks right now:

App Harvest - $APPH

Dermtech - $DMTK

Mohawk Group - $MWK

TransMedics $TMDX

Upstart - $UPST

App Harvest - $APPH

Dermtech - $DMTK

Mohawk Group - $MWK

TransMedics $TMDX

Upstart - $UPST

I really enjoyed chatting with these guys

They invest differently than I do, which means that I can learn from them

Here's the full video

Hope to do it again sometime soon!

They invest differently than I do, which means that I can learn from them

Here's the full video

Hope to do it again sometime soon!

https://twitter.com/JonahLupton/status/1364760770697961472?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh