By the time "digital events software" finally gets good,

We won't need it anymore.

Not literally. But mostly.

We won't need it anymore.

Not literally. But mostly.

This will create a fascinating case study on what happens to high ACV products that go from necessary to merely helpful

Especially in a category with a lot of one-off buying

We small mobile events software explode a generation ago ... and then become a feature and a $0 category

Especially in a category with a lot of one-off buying

We small mobile events software explode a generation ago ... and then become a feature and a $0 category

The best advice I can give to digital events software companies is Do Not Be Arrogant

Most we talk to are arrogant, still

They have more business than they can handle

It takes a week to get a demo, etc.

Most we talk to are arrogant, still

They have more business than they can handle

It takes a week to get a demo, etc.

Events are a $1T+ category that requires software, but most of the money comes from IRL spend which evaporated

Budgets temporarily were re-allocated to digital, but this isn't going to last more than a cycle

Folks want leads, engagement, pipeline influence, etc.

Budgets temporarily were re-allocated to digital, but this isn't going to last more than a cycle

Folks want leads, engagement, pipeline influence, etc.

Still, there is no going back, and folks will still want to do digital events of some sort

Look at Clubhouse. A lot of it really is digital micro-events

But most vendors could be obsolete in a year if they don't rapidly evolve

And pick up the phone and >help< their customers

Look at Clubhouse. A lot of it really is digital micro-events

But most vendors could be obsolete in a year if they don't rapidly evolve

And pick up the phone and >help< their customers

Only one vendor has actually tried to help us since Covid ... and we have scale

Everyone else has just sent us crazy quotes and told us to take it or leave. Or claim their product does things it doesn't.

Everyone else has just sent us crazy quotes and told us to take it or leave. Or claim their product does things it doesn't.

Customers are loyal in SaaS.

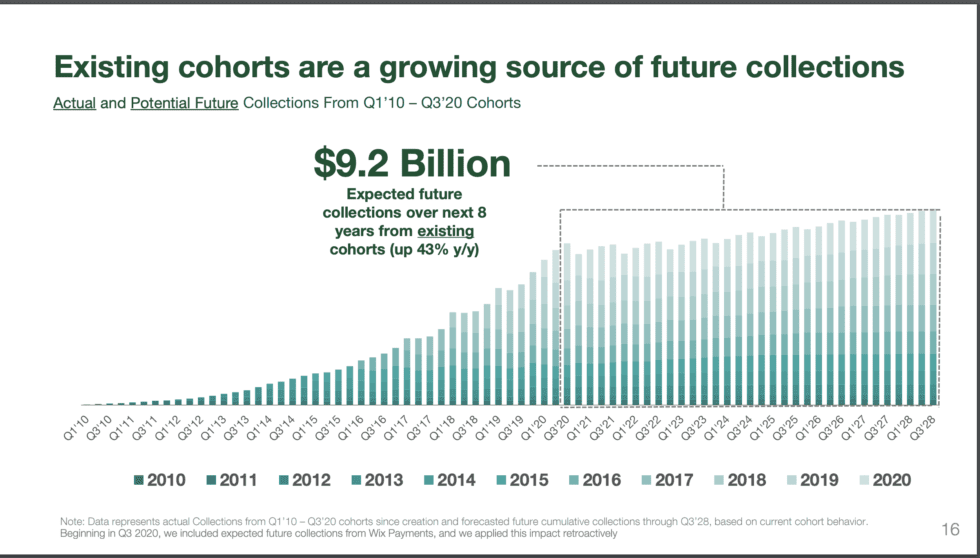

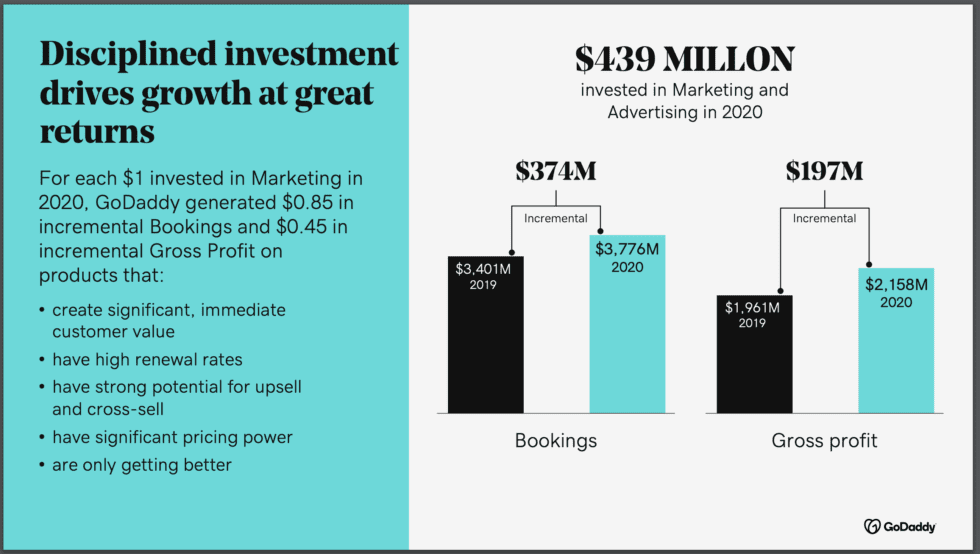

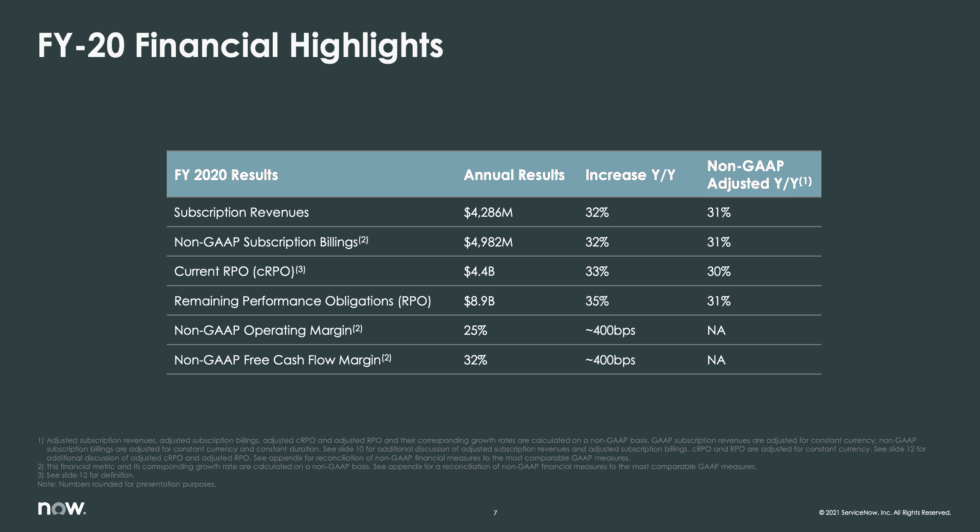

This is why NRR is > 130% at many SaaS leaders.

Customers just want their problems >solved<, at a fair price.

Do that, and they likely will stay for a decade or more.

This is why NRR is > 130% at many SaaS leaders.

Customers just want their problems >solved<, at a fair price.

Do that, and they likely will stay for a decade or more.

• • •

Missing some Tweet in this thread? You can try to

force a refresh