I'd like to delve a bit further into my Twitter thread from yesterday, both to explain why what the Fed is communicating here is interesting and valuable right now, and also to explain more why it runs into trouble over longer periods. /1

https://twitter.com/ernietedeschi/status/1363949305816580104

First, for background on how the Fed is communicating alternatives to the headline unemployment rate, read this nice @jeannasmialek piece from the other day. /2

https://twitter.com/jeannasmialek/status/1363915202316632067

Now, right upfront, we need to be cautious about calling some alternative calculation the "real" unemployment rate. Unemployment measures a very specific thing: the share of people who are with or actively looking for a job who are jobless. It's been done this way for decades. /3

There's no silver bullet labor market measure of joblessness. The unemployment rate has big downsides, primarily because, since it's a share of the labor force, not the population, it doesn't capture labor market slack that comes in the form of lower participation. /4

But the unemployment rate has upsides too. It's a long-standing metric that has libraries of economic research behind it. The very share-of-labor-force calculation that keeps it from capturing participation slack also makes it more resistant to being skewed by demographic change.

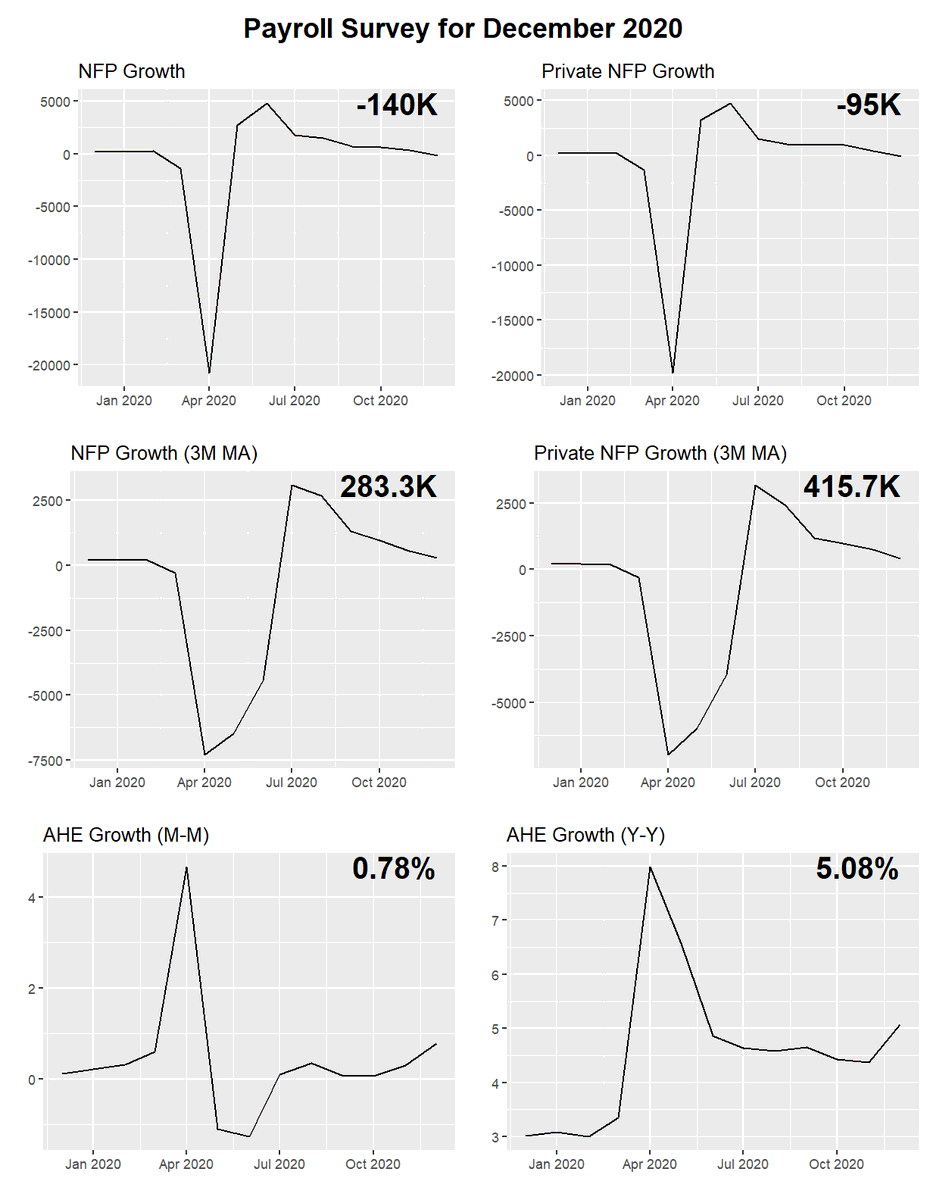

Enter the Fed, who these days face a conundrum. Their past communications, models, and intellectual economic foundation have been rooted in the unemployment rate for decades now. Their projections still show it. It's just how many economists and observers think. /6

But the Fed's mandate is for maximum *employment*, and in recent months they've become more explicit that this must account for both unemployment and labor force participation margins of slack. Powell was crystal clear on this just today to Congress. /7

https://twitter.com/ernietedeschi/status/1364257596828487682

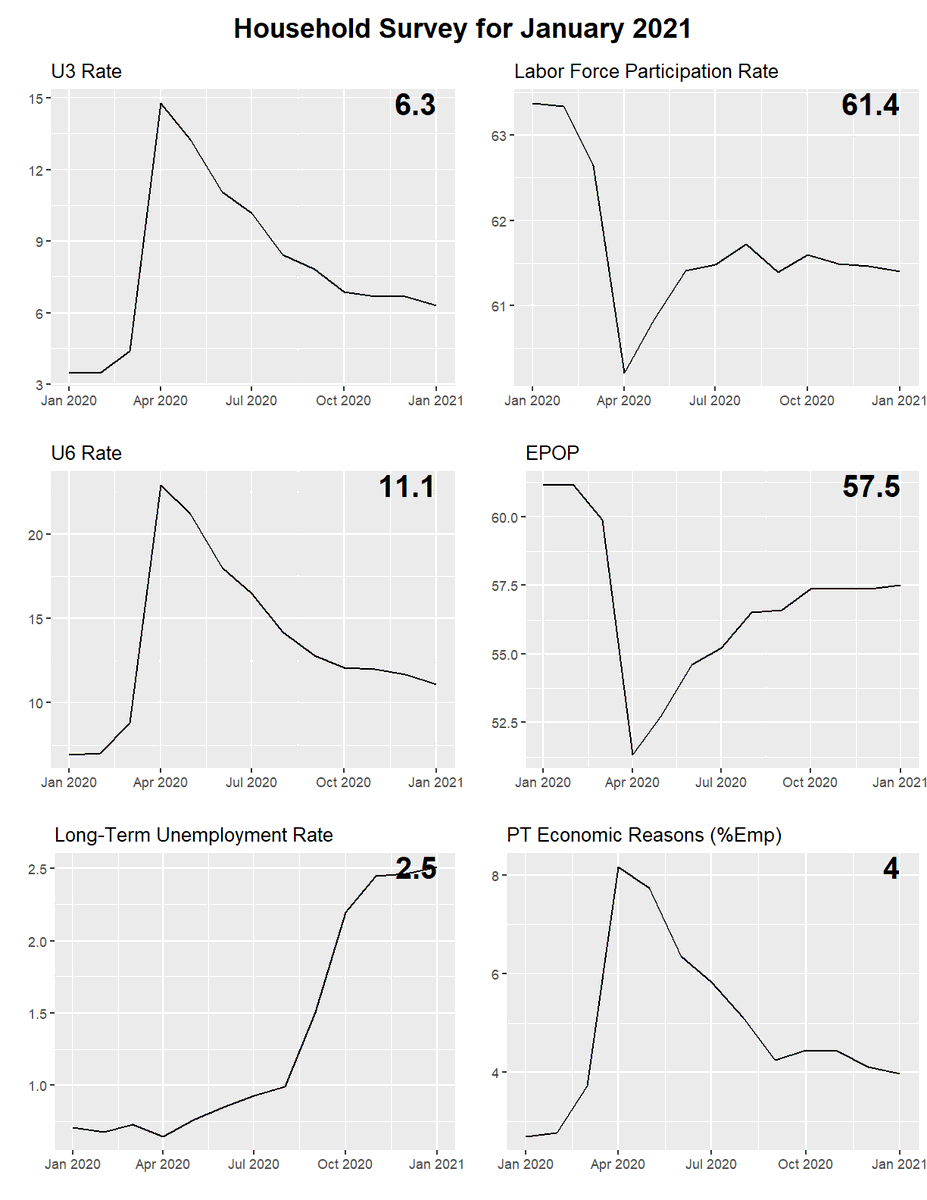

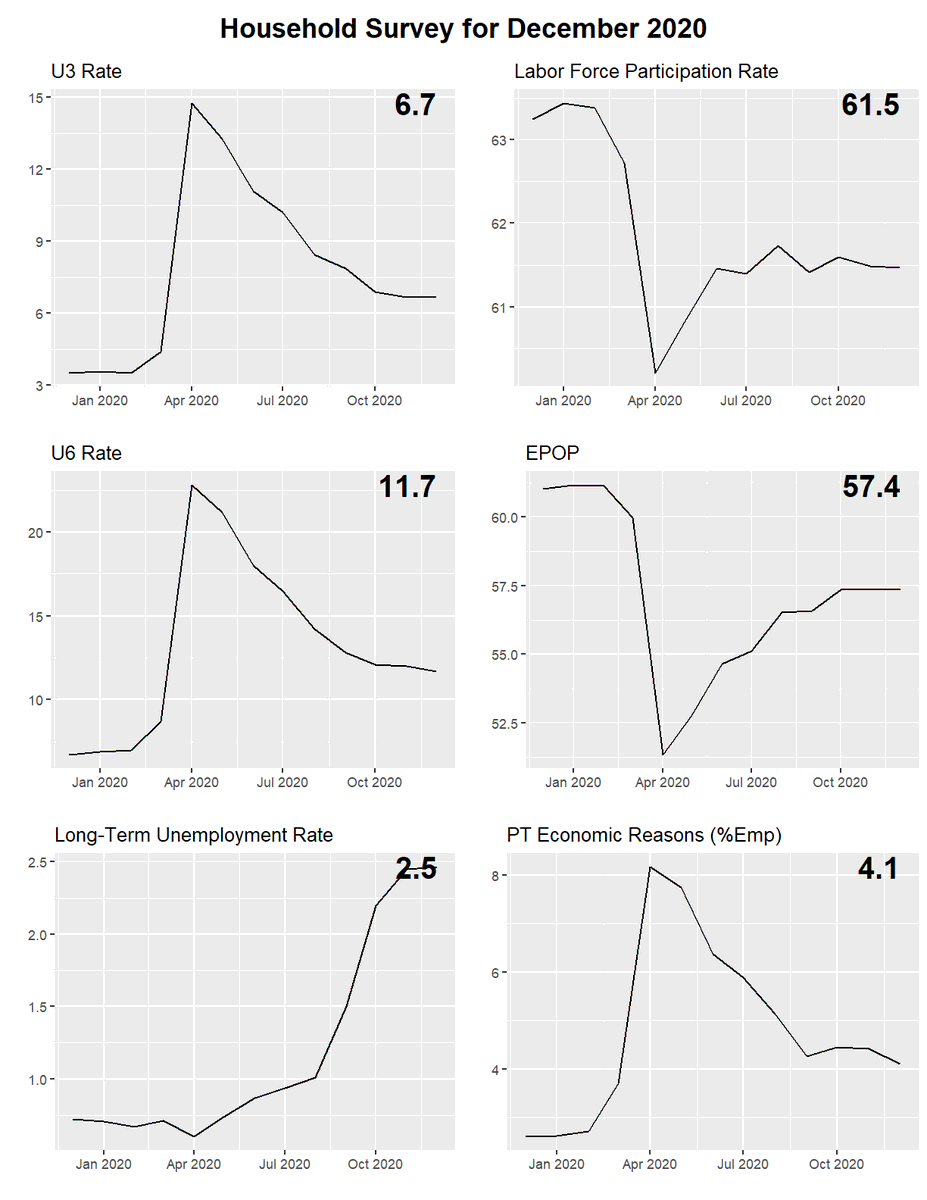

So Fed officials are increasingly citing an "adjusted" unemployment rate that accounts for 1) potential employment misclassification (an issue early on in the pandemic that has waned but not completely disappeared) and 2) the change in labor force participation since Feb 2020. /8

For labor market nerds out there, the actual equation is

1 - EPOP/63.3%

Where EPOP is the actual employment-to-population ratio each month (adjusted for misclassification) and 63.3% is the labor force participation rate as of February 2020. /9

1 - EPOP/63.3%

Where EPOP is the actual employment-to-population ratio each month (adjusted for misclassification) and 63.3% is the labor force participation rate as of February 2020. /9

In January 2021, that equation yields an adjusted unemployment rate of 9.6%, versus an official unemployment rate of 6.3%. /10

In other words, *if* the demographic makeup of the population hadn't changed since Feb, and *if* all of the labor force participation fall since Feb were expected to return, then the amount of U and L slack in the economy would be the equivalent of 9.6% of the labor force. /11

So what the Fed is communicating is a nice short-run data compromise: it shows the severity of labor market underutilization while still keeping numbers in terms most observers are familiar with.

But it runs into issues over the longer-term. /12

But it runs into issues over the longer-term. /12

Remember that the Fed's calculation is benchmarked to a static, unchanging labor force participation rate: 63.3% in Feb 2020. If the demographics of the population were static, then that'd be a plausible target for participation.

The problem is, demographics aren't constant./13

The problem is, demographics aren't constant./13

In particular, the population is getting older. That means that we'd naturally expect the participation rate to fall over time, since older Americans are less likely to work. /14

Some of this has been offset by the fact that the US population is more educated than in prior decades. But even this is a double-edged sword since higher college attainment in middle-age has meant higher college enrollment for the young, and so lower participation for them. /15

In recent years, aging has shaved about -0.25 percentage points each year off of the overall trend labor force participation rate. In other words, each year that goes by, the LFPR consistent with full employment falls a bit more. /16

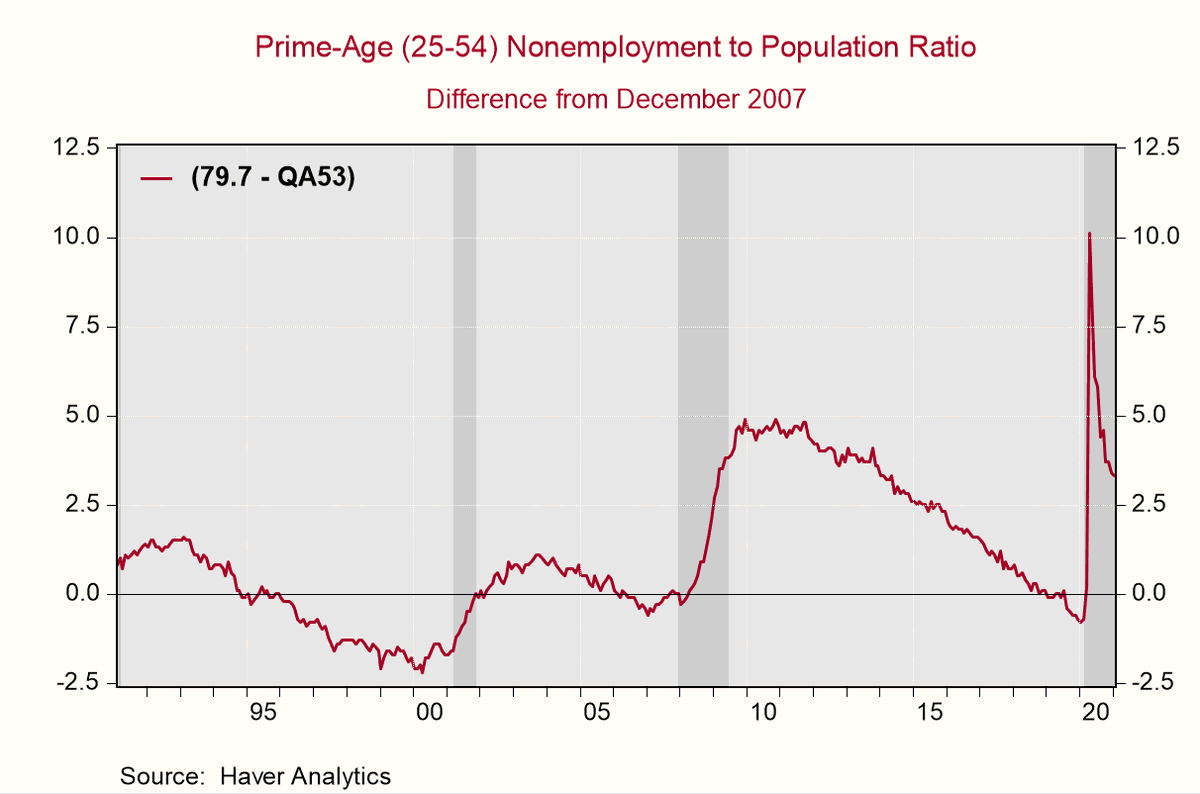

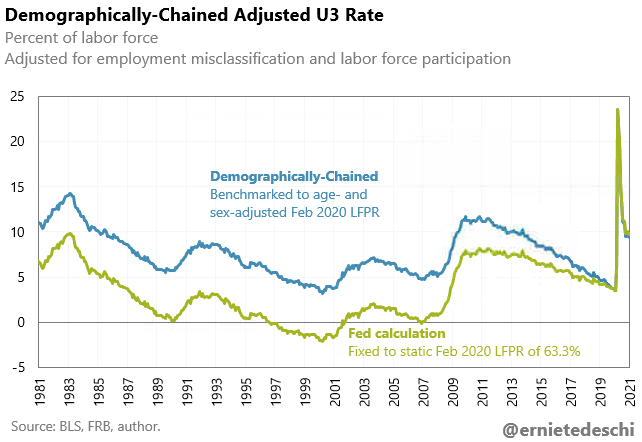

To illustrate how long periods can confound the Fed's approach, I've used its methodology but benchmarked the U rate to the 66% labor force participation rate in Dec 2007, just before the Great Recession. As time goes on that 66% LFPR benchmark becomes less & less realistic. /17

So much so that the Fed's approach leads one to conclude that the 2007-consistent unemployment rate in Feb 2020 was 7.4%. I happen to believe there was still slack in the economy as of February, especially relative to 2000, but 7.4% is not a useful summary statistic of that slack

By contrast, prime-age nonemployment—an alternative slack measure that is resistant to the largest demographic shifts in recent times—had fully recovered back to Dec 2007 levels, and then some, by Feb 2020, though still had some distance to go before reaching 2000 levels. /19

In fact, even over short periods, the Fed's measure can start to drift off. I find that if the labor force participation rate of Feb 2020 had been adjusted for just 11 months of aging, the Fed's adjusted unemployment rate would have been -0.35 perc points lower. /20

So what are the solutions? I'm a broken record about the benefits of prime-age EPOP which is a nice model-free, off-the-shelf way to capture both the unemployment and participation margins without getting bogged down by demographic shifts. /21

But it's not a silver bullet: in particular it's not stationary around a consistent mean or maximum before the 1990s, when female LFPR was rising. And using prime-age EPOP for policy would require a shift in how policymakers communicate; that's not a quick or easy process. /22

An alternative would be to use the Fed's U rate approach, but benchmark it to a time-varying demographically-adjusted LFPR. I've done that here, adjusting U by a Feb 2020 LFPR that keeps sex- & age-cohort LFPR rates constant. That yields a more historically-consistent metric. /23

For example, my approach would tell us that an unemployment rate demographically-consistent with Feb 2020 LFPR would have been 3.2% in April 2000, versus -2.1% using the Fed's static approach. The Fed's negative unemployment rate is impossible to interpret here. /24

Of course, demographically-adjusting is not easy to do and requires important choices—what about adjusting for race? Education?—but it allows one to communicate broad labor market slack in both unemployment rate-space and in a way that's historically consistent. /25

There are other approaches too. @jasonfurman & Willie Powell solve the historical consistency problem by explicitly modeling the relationship between the unemployment rate and LFPR, and using that to calculate a "realistic" rate. /26 piie.com/blogs/realtime…

TL;DR: The Fed faces a major data communication challenge with their broader employment mandate. Their alternative unemployment rate is a valuable short-run solution, but they'll need to develop & invest in a different approach over the long-term. /FIN

• • •

Missing some Tweet in this thread? You can try to

force a refresh