1/ Tom Engle is a phenomenal investor

He worked a "normal" job for 9 years and has lived off his portfolio ever since (since the 1980s)

How? His brilliant cash management strategy is a big reason why

Here's how it works:⬇️

He worked a "normal" job for 9 years and has lived off his portfolio ever since (since the 1980s)

How? His brilliant cash management strategy is a big reason why

Here's how it works:⬇️

2/ Let's say Tom's portfolio is $100,000 in the middle of a bull market

Tom is happy with this amount and he wants to protect it

He calls this $100,000 his "protected value"

All his cash management decisions are based on this number

Tom is happy with this amount and he wants to protect it

He calls this $100,000 his "protected value"

All his cash management decisions are based on this number

3/ If Tom thinks the market is "fairly valued" he keeps ~12% of his "protected value" in cash

That's $12,000

That's $12,000

4/ Let's say the bull market continues

The portfolio is now worth $130,000

Tom trims his holdings steadily on the way up, maxing out at 20% of the protected value

So the max cash position is $20,000

At this point, Tom usually can't find any stock bargains to buy

The portfolio is now worth $130,000

Tom trims his holdings steadily on the way up, maxing out at 20% of the protected value

So the max cash position is $20,000

At this point, Tom usually can't find any stock bargains to buy

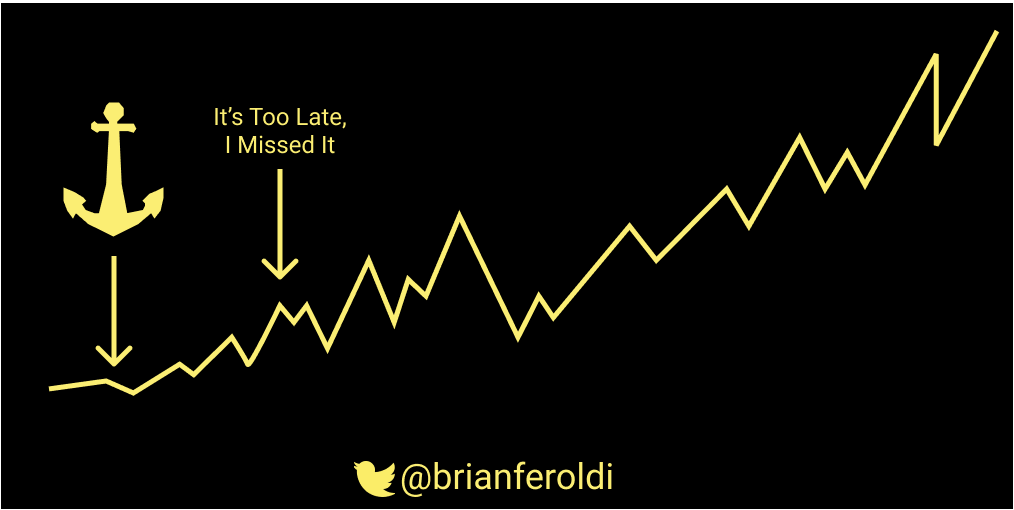

5/ The bull market eventually ends and the decline starts

He slowly buys his favorite stocks as valuations improve

He slowly buys his favorite stocks as valuations improve

6/ Tom adds as long as valuations continue to improve

Tom's even OK with his portfolio value falling below $100,000 (although it would take a BIG decline to get there)

If that happens, he knows he's getting TONS of great deals with his continually buying

Tom's even OK with his portfolio value falling below $100,000 (although it would take a BIG decline to get there)

If that happens, he knows he's getting TONS of great deals with his continually buying

7/ Let's say the bear market is really bad like 2008

Tom's portfolio falls to $80,000, well below his $100,000 protected value

At that point, HUGE bargains are everywhere, and his cash position would be down to 1% of the protected value

So just $1,000 in cash left

Tom's portfolio falls to $80,000, well below his $100,000 protected value

At that point, HUGE bargains are everywhere, and his cash position would be down to 1% of the protected value

So just $1,000 in cash left

8/ Eventually, the bear market ends and the next bull market starts

Tom's returns skyrocket, especially from bargains when his portfolio was $80k - $100k

He slowly rebuilds build cash once $100k is reached using historic market valuation ranges (which he studies) as guides

Tom's returns skyrocket, especially from bargains when his portfolio was $80k - $100k

He slowly rebuilds build cash once $100k is reached using historic market valuation ranges (which he studies) as guides

9/ Within 3 to 5 years, his portfolio doubles to $200,000, powered by his bargain buying during last bear market

He's happy with this number, so it becomes his new "protected value"

His cash balance is now $24,000 -- 12% of the $200,000

He's happy with this number, so it becomes his new "protected value"

His cash balance is now $24,000 -- 12% of the $200,000

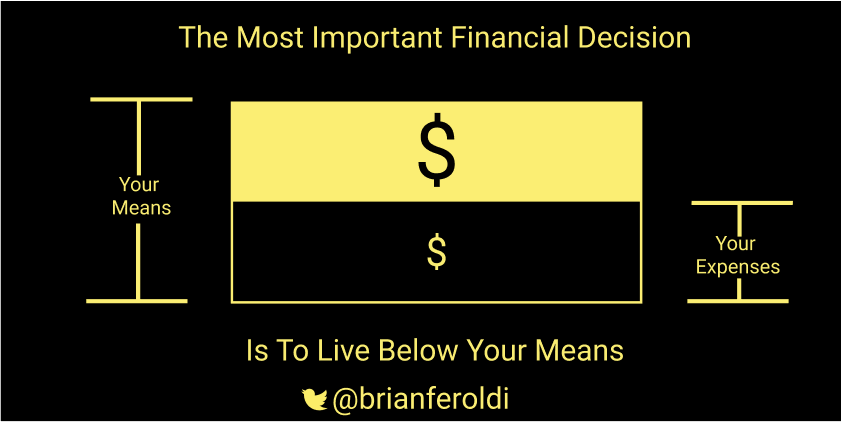

10/ Tom rinses and repeats for each market cycle

He builds cash when valuations are high

He builds positions when valuations are low

He builds cash when valuations are high

He builds positions when valuations are low

11/ This strategy allows Tom's cash position to "grow at the same rate as my portfolio"

Both are not growing at the same time (cash balance moves inverse to portfolio value)

But they are growing at the same rate

Both are not growing at the same time (cash balance moves inverse to portfolio value)

But they are growing at the same rate

12/ The example above is an extreme bull/bear market

Tom's cash balance has only been 1% once (Feb 2009)

And it's rare for it to be 20%

He's usually between 5% and 15% of the protected value based on the number of bargains that he finds at any given time

Tom's cash balance has only been 1% once (Feb 2009)

And it's rare for it to be 20%

He's usually between 5% and 15% of the protected value based on the number of bargains that he finds at any given time

13/ I love the idea of a "protected value"

It gives Tom a target to focus the cash in his portfolio around

Tom also says that the protected value "never goes down -- it only moves up"

Tom increases it every few years

It gives Tom a target to focus the cash in his portfolio around

Tom also says that the protected value "never goes down -- it only moves up"

Tom increases it every few years

14/ Thanks Tom, as always, for sharing your secrets so generously

15/ Here's how Tom builds positions in stocks using "value points"

https://twitter.com/BrianFeroldi/status/1275752033325330433?s=20

16/ My strategy for finding quality stocks to buy is based on Tom's excellent work

Here's how I do it:

Here's how I do it:

https://twitter.com/BrianFeroldi/status/1324359239469588485?s=20

17/ If you liked this thread, I turn my best tweets into simple graphics and email them daily for free

Interested?

brianferoldi.substack.com

Interested?

brianferoldi.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh