My contribution to #FinTwit trivia.

The Alphabet soup of single letter ticker symbols on American Exchanges.

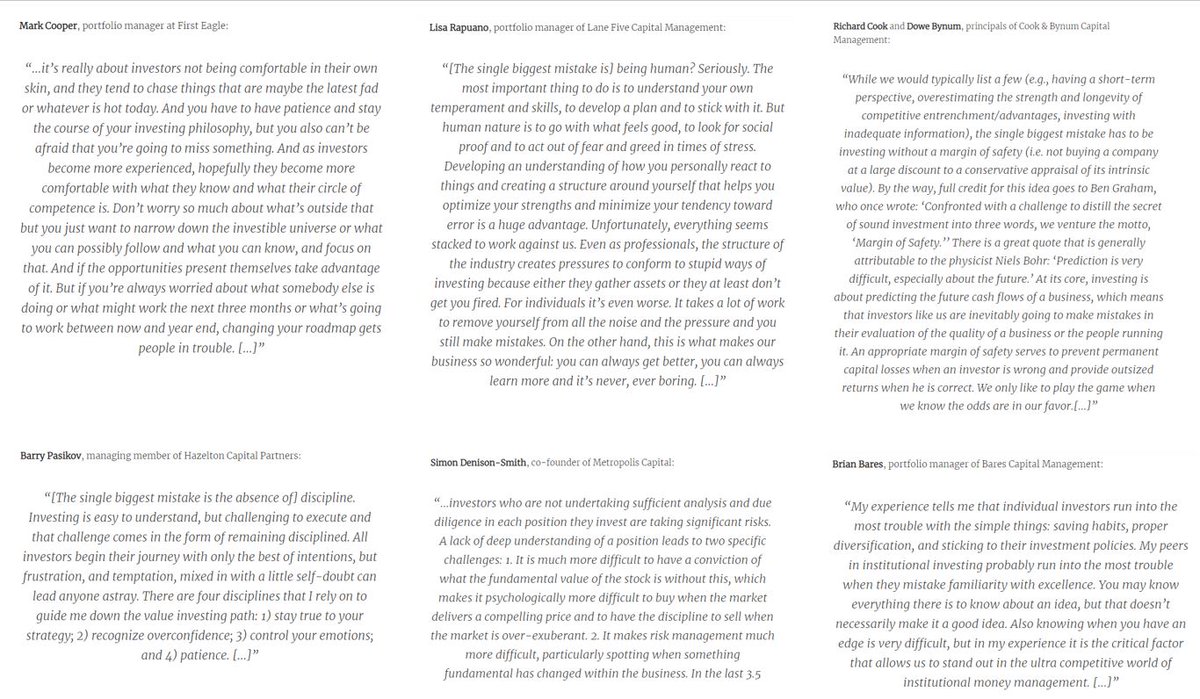

How many of these can you guess correctly? My score was only 12 out of 21. Not a single one that was down today.😀

cc: @DavidGFool @TMFJMo @TMFChrisHill

The Alphabet soup of single letter ticker symbols on American Exchanges.

How many of these can you guess correctly? My score was only 12 out of 21. Not a single one that was down today.😀

cc: @DavidGFool @TMFJMo @TMFChrisHill

The only ones available are I, N, P, Q and S (in case you have a Company to take public😀).

Below are the names of these Co's and the description for some of the unfamiliar ones.

Below are the names of these Co's and the description for some of the unfamiliar ones.

$A : Agilent Technologies (Lab/Diagnostic equipment)

$B : Barnes Group (Industrial/Aerospace)

$C : Citigroup

$D : Dominion Energy

$E : Eni SpA (Energy)

$F: Ford

$G : Genpact (SW)

$H : Hyatt Hotels

$J : Jacobs Engineering Group

$K : Kellogg

$L : Loews Corp (Insurance)

$B : Barnes Group (Industrial/Aerospace)

$C : Citigroup

$D : Dominion Energy

$E : Eni SpA (Energy)

$F: Ford

$G : Genpact (SW)

$H : Hyatt Hotels

$J : Jacobs Engineering Group

$K : Kellogg

$L : Loews Corp (Insurance)

$M : Macy's

$O : Realty Income (REIT)

$R : Ryder System (Transportation)

$T : AT&T

$U : Unity Software

$V : Visa

$W : Wayfair

$X : US Steel

$Y : Alleghany Corp (Insurance)

$Z : Zillow

$O : Realty Income (REIT)

$R : Ryder System (Transportation)

$T : AT&T

$U : Unity Software

$V : Visa

$W : Wayfair

$X : US Steel

$Y : Alleghany Corp (Insurance)

$Z : Zillow

Why did I do this (semi) useless exercise?

I own $U $V $W and wanted to know all the other ones. Looks like $Z is the only other one I would be interested in adding to the mix.

/END

I own $U $V $W and wanted to know all the other ones. Looks like $Z is the only other one I would be interested in adding to the mix.

/END

• • •

Missing some Tweet in this thread? You can try to

force a refresh