Quarterly earnings reports are a catalyst in rewarding short term-ism, introducing volatility, soaking up management time & distorting strategic focus.

Against the lifespan of a company, 3 months is inconsequential, yetyou're expected to deliver a certain outcome.

You're facing return hungry shareholders & Wall Street analysts with massive expectations.

It's the equivalent of stepping on a scale every single day on a diet.

You're facing return hungry shareholders & Wall Street analysts with massive expectations.

It's the equivalent of stepping on a scale every single day on a diet.

The worst part of short term-ism are the incentives that accompany it.

Many exec compensation schemes are tied to targets short term in nature.

Rewarded for a higher EPS?

Ah, let's go out & trigger a buyback

Rewarded for scale?

Ah, less do some value dilutive M&A

Many exec compensation schemes are tied to targets short term in nature.

Rewarded for a higher EPS?

Ah, let's go out & trigger a buyback

Rewarded for scale?

Ah, less do some value dilutive M&A

If there's one thing I've seen spending time of time with management teams

C-suite execs are terrible judges of their own performance. They consistently overestimate the company's ability to meet ambitious targets & overrate the role they play in driving a company's performance.

C-suite execs are terrible judges of their own performance. They consistently overestimate the company's ability to meet ambitious targets & overrate the role they play in driving a company's performance.

I would have longer windows between detailed reporting, regular updates on 1/2 headline metrics and more focus on the roadmap towards milestones... as opposed to an obsession with adjustments to an EPS line which we all know is bullshit & dressed up for reporting.

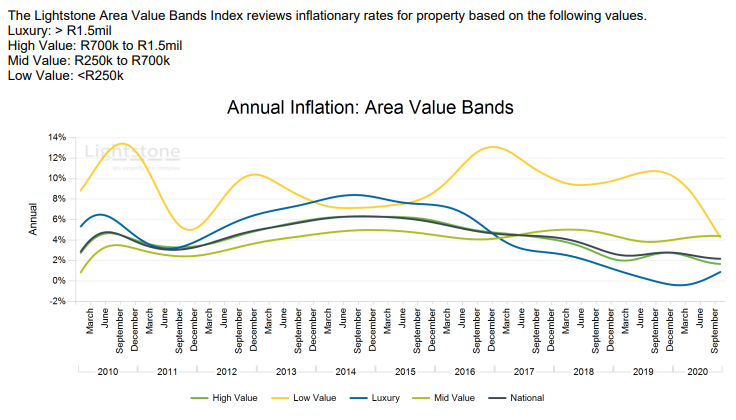

If anyone is interested there's a great chart we would include in every investment banking pitch deck covering a company worth checking out

It's company earnings forecast vs. wall street guidance. Basically a measure of how well the company is able to communicate to the market

It's company earnings forecast vs. wall street guidance. Basically a measure of how well the company is able to communicate to the market

This is an example. Many analysts are pretty bad at forecasting. They will say management is terrible at communicating. They're both right.

• • •

Missing some Tweet in this thread? You can try to

force a refresh