Bonds explained in 90 seconds! [Thread]

Wait, what's a bond?

Very simply, it's a loan.

Instead of borrowing money from a bank, a company (or government) will borrow from investors. So investors will give the company money & in exchange they get paid interest (called coupons)

Fancy term for the IOU is "bond issuance"

Very simply, it's a loan.

Instead of borrowing money from a bank, a company (or government) will borrow from investors. So investors will give the company money & in exchange they get paid interest (called coupons)

Fancy term for the IOU is "bond issuance"

I'm an investor, how do the mechanics work?

Company sells you a bond for $100 and promises you 5% every year for 3 years. They also pay you $100 at the end.

Yr 1: $5

Yr 2: $5

Yr 3: $5 + $100

That's $115 (or a 15% return) after 3 years. Right?

The real return is closer to 10%

Company sells you a bond for $100 and promises you 5% every year for 3 years. They also pay you $100 at the end.

Yr 1: $5

Yr 2: $5

Yr 3: $5 + $100

That's $115 (or a 15% return) after 3 years. Right?

The real return is closer to 10%

Why are my returns so much lower?

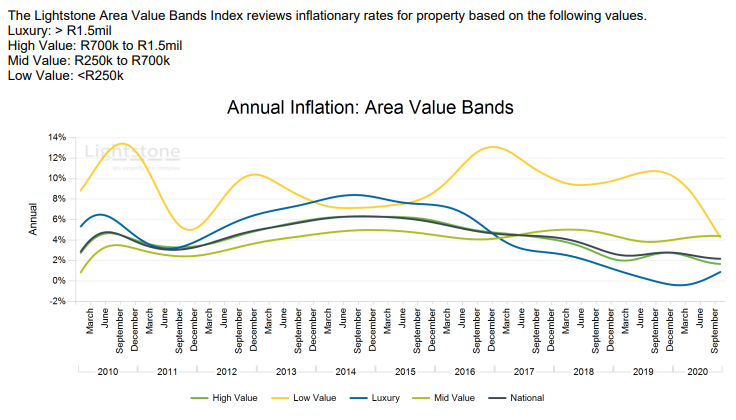

$100 today is worth more than $100 in 3 years from now - yes, inflation!

Even at a modest 1.5% inflation each year, the $100 you give up today is worth less than $96 in 3 years from now.

ILBs (inflation linked bonds) try & help solve this.

$100 today is worth more than $100 in 3 years from now - yes, inflation!

Even at a modest 1.5% inflation each year, the $100 you give up today is worth less than $96 in 3 years from now.

ILBs (inflation linked bonds) try & help solve this.

How come bonds are always quoted in yields (%s) instead of actual prices like shares?

Bonds have different maturities* & coupons - quoting a percentage makes it easy to compare different bonds & compare against other assets.

*Maturity = time to get paid back (3yrs in example)

Bonds have different maturities* & coupons - quoting a percentage makes it easy to compare different bonds & compare against other assets.

*Maturity = time to get paid back (3yrs in example)

Bond yields are inversely related to bond prices

Here's how it works. You paid $100 upfront for the bond. Remember that $5 coupon? Your coupon rate is 5% - that's the interest rate the company pays you. It's fixed

But bond prices MOVE depending on demand & supply in the market.

Here's how it works. You paid $100 upfront for the bond. Remember that $5 coupon? Your coupon rate is 5% - that's the interest rate the company pays you. It's fixed

But bond prices MOVE depending on demand & supply in the market.

Suddenly there's a huge demand for these company bonds and the price shoots up to $120... but investors are still only getting a $5 coupon!

You paid $100 & got $5 => 5% yield

If you buy at $120, you still get $5 => 4% yield

As the price went up, the yield went down

You paid $100 & got $5 => 5% yield

If you buy at $120, you still get $5 => 4% yield

As the price went up, the yield went down

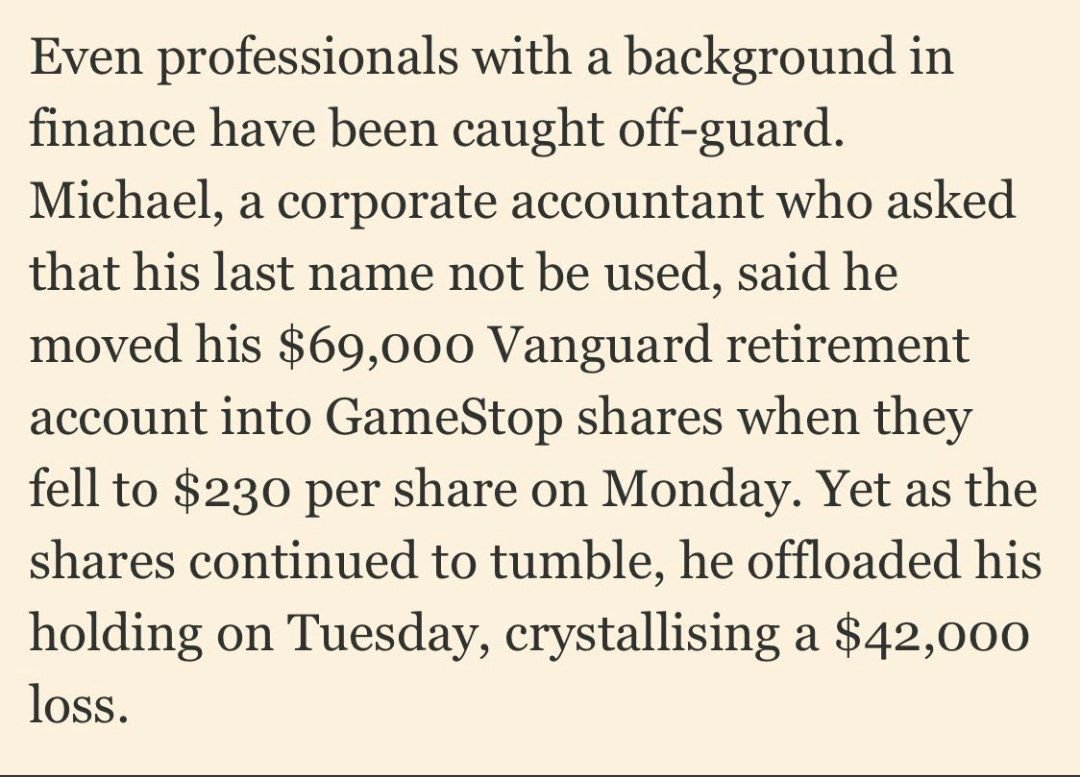

"I'm about to go & buy all the bonds with high yields"

No. Wait!

There's a reason for bonds being high yielding - there's a great chance the company who issued them could default on these "junk" bonds and you won't get paid! The market is pricing this in

High risk, high reward

No. Wait!

There's a reason for bonds being high yielding - there's a great chance the company who issued them could default on these "junk" bonds and you won't get paid! The market is pricing this in

High risk, high reward

How do I know if a company will default and not pay me?

Each bond comes with a sticker label called a credit rating. These are assigned by credit ratings agencies & usually have letter ratings. AAA is peak quality, C is poor

Agencies have mispriced risk in the past (think GFC)

Each bond comes with a sticker label called a credit rating. These are assigned by credit ratings agencies & usually have letter ratings. AAA is peak quality, C is poor

Agencies have mispriced risk in the past (think GFC)

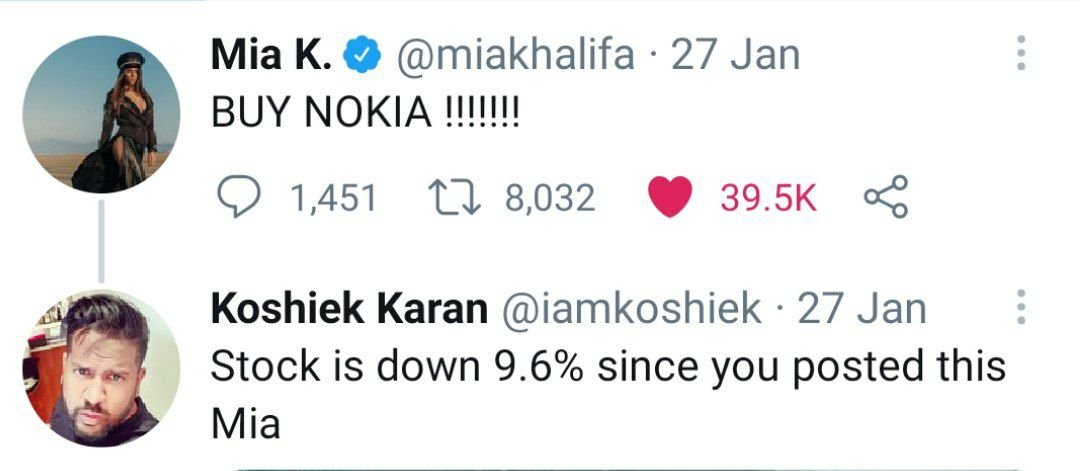

When you switch on CNBC or Bloomberg tonight & hear them shouting about "yields continue to uptick as treasuries (bonds) sell-off" - you know exactly what they mean...

Shout-out for making it to the end!

Shout-out for making it to the end!

Additional thread: the oil price explained in 90 seconds

https://twitter.com/iamkoshiek/status/1252328581742637062?s=20

Additional thread: dark side of credit ratings agencies

https://twitter.com/iamkoshiek/status/1111923278774497280?s=20

What it's like to issue a bond as an investment banker deserves it's own thread, here's some insights:

- LOTS of paperwork + hours of lawyer calls

- Marketing to investors is a huge part of the process

- Timing makes a massive difference

- Use of proceeds is super important

- LOTS of paperwork + hours of lawyer calls

- Marketing to investors is a huge part of the process

- Timing makes a massive difference

- Use of proceeds is super important

I need a challenge! Cool, if you know at least 10 of these terms, you're a heavy hitter in the bond game

Yield curve inversion

Dirty price

Zero coupon

Duration

Convexity

Companion tranche

WAM

Jump Z tranche

Forward cap

CPR

Index Ratio

Inverse Floater

Yield curve inversion

Dirty price

Zero coupon

Duration

Convexity

Companion tranche

WAM

Jump Z tranche

Forward cap

CPR

Index Ratio

Inverse Floater

For more 90 second explainers and a ton of memes, feel free to join our Telegram channel: t.me/BankerX or check out @Banker__X

• • •

Missing some Tweet in this thread? You can try to

force a refresh