1/ Underrated post from @afterwt - a genuinely fresh take on an famous case study, Buffett's original 1987 investment in Coke

https://twitter.com/afterwt/status/1366927390870548483

2/ Most investors know 1980s-era Coke was an example of untapped pricing power - but *why* was this the case?

Turns out Coke was subject to a 100-year-old bottling agreement that had fixed its syrup pricing at $1 per gallon... in perpetuity! (+ later adjustments for inflation)

Turns out Coke was subject to a 100-year-old bottling agreement that had fixed its syrup pricing at $1 per gallon... in perpetuity! (+ later adjustments for inflation)

3/ The turning point was 1986: that's when Doug Ivester invented the "49% solution," a scheme to acquire Coke's old US bottlers and install discretionary pricing for the first time ever

Not coincidentally, Buffett starts buying stock a year later

Not coincidentally, Buffett starts buying stock a year later

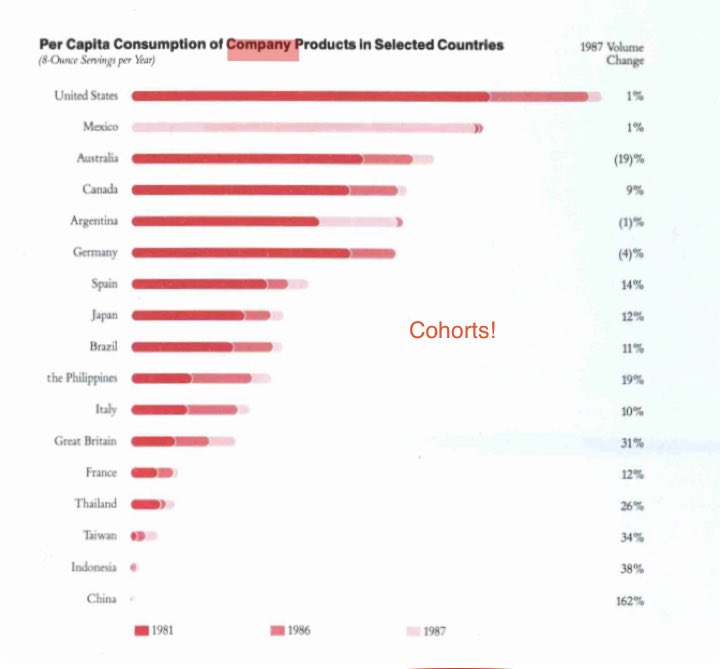

4/ Every 2 cent increase in Coke's royalty per serving would ultimately double net income... couple this with underpenetrated international markets (see the chart below - basically customer cohort curves circa 1987), and the rest is history!

• • •

Missing some Tweet in this thread? You can try to

force a refresh