Interesting batch of data from Cano Health this morning, for those following the risk-bearing provider segment (or Medicare Advantage in general).

>110K patients under management, with a clear focus on the Hispanic population. And (twist!), the company is highly profitable.

>110K patients under management, with a clear focus on the Hispanic population. And (twist!), the company is highly profitable.

Cano might be the clearest example I've seen of a large risk-bearing provider focused on a specific demographic group: elderly Hispanic patients.

In practice, that means that, per Cano, 80% of patients *and staff* come from minority groups, and 85% of employees are bilingual.

In practice, that means that, per Cano, 80% of patients *and staff* come from minority groups, and 85% of employees are bilingual.

That focus fits pretty nicely in the MA segment, and it clearly tracks with their geographic expansion from a Florida base to Texas, Nevada, California and Puerto Rico. All very large MA markets.

MA penetration in PR exceeds 70%, which dwarfs the 40-45% in FL, CA etc.

MA penetration in PR exceeds 70%, which dwarfs the 40-45% in FL, CA etc.

As it stands, they have ~110K patients under management, which is 10 - 15K more than OSH and roughly double Clover's MA enrollment. But the financials look much healthier...with some pretty rich EBITDA margins in their mature markets.

To be fair, there are several venture-stage risk-bearing PCP chains with substantially larger patient panels.

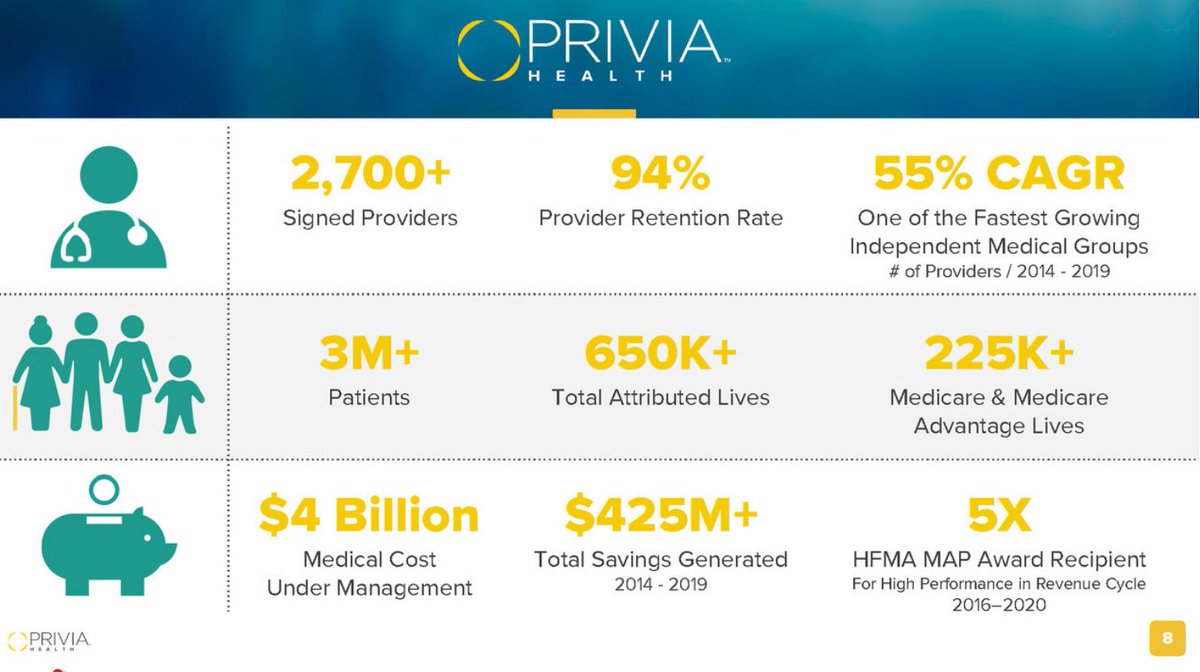

Privia and VillageMD, for example, have cited numbers in the 600 - 700K range, though only a subset of patients are in risk contracts.

From Privia's #JPM21 preso:

Privia and VillageMD, for example, have cited numbers in the 600 - 700K range, though only a subset of patients are in risk contracts.

From Privia's #JPM21 preso:

Two observations of note, from Cano's CEO:

(paraphrasing)

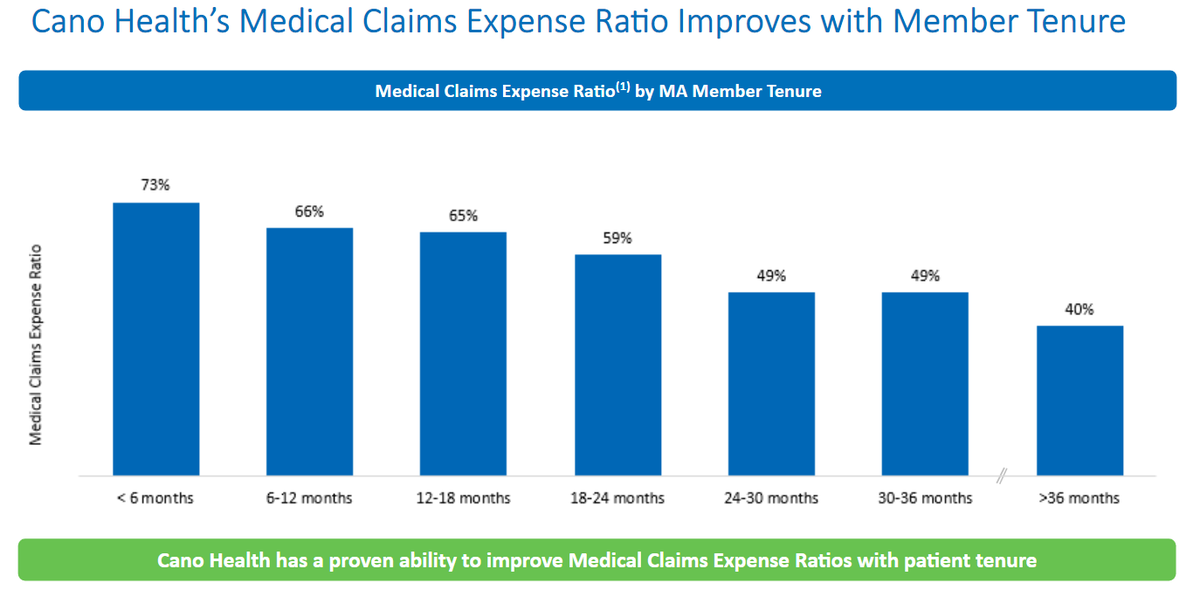

1) The longer the relationship [with the patient], the more impact we have [on costs]

2) The older the patient, the higher the margins

To put some data behind those points:

(paraphrasing)

1) The longer the relationship [with the patient], the more impact we have [on costs]

2) The older the patient, the higher the margins

To put some data behind those points:

Last, there was an interesting discussion around Direct Contracting, which the CFO described as "complete upside." At the same time, seems like a lower priority than for OSH, largely due to patient preference.

Cano has signed up for DC in four states (FL, CA, TX and NV), but...

Cano has signed up for DC in four states (FL, CA, TX and NV), but...

...the company noted that their target patients have historically opted for MA at pretty high rates (true). And, as patients enroll with Cano, they expect many to still choose the zero premium / copay options, prefer the SilverSneakers programs, etc. That is, stick with MA. /n

• • •

Missing some Tweet in this thread? You can try to

force a refresh