A low-profile healthcare IPO on Thursday (@InnovAge) probably deserves a bit more attention, both as a case study in value-based care and given recent research on private equity investment in nursing homes.

Headline: $3.2B market cap, for just 6,600 patients under mgmt. 🧐

1/n

Headline: $3.2B market cap, for just 6,600 patients under mgmt. 🧐

1/n

InnovAge is a PACE program, a form of capitated care for frail, elderly patients w/ extensive needs. PACE grew out of care models pioneered in San Francisco in the 1970s, and became a CMS program in 1986, but remains a niche model, with just ~55K enrollees nationwide.

In the late '90s, legislation opened PACE to for-profit players, pending a review of quality & access

In 2015, HHS delivered a rather “lightly powered” study (seemingly of just one for-profit operator in PA), found no significant differences, and…voila.

innovation.cms.gov/files/reports/…

In 2015, HHS delivered a rather “lightly powered” study (seemingly of just one for-profit operator in PA), found no significant differences, and…voila.

innovation.cms.gov/files/reports/…

The next year, a non-profit PACE program in Colorado converted to for-profit status, with an investment from a large PE firm (Welsh Carson, later joined by Apax). Since then, InnovAge has doubled its # of centers, patient count, and revenue. It currently operates in 5 states.

The unit economics here are eye-catching, since these are some of the highest-cost patients in the system.

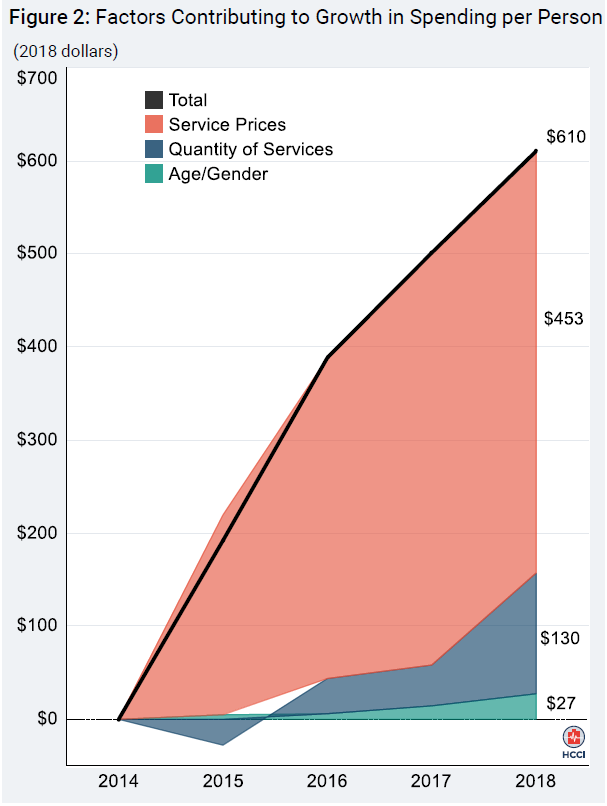

In 2H20, InnovAge appears to have collected ~$7,900 PMPM in cap revenue, while spending ~$2K PMPM on its own care delivery ops and $3,800 on claims from other providers.

In 2H20, InnovAge appears to have collected ~$7,900 PMPM in cap revenue, while spending ~$2K PMPM on its own care delivery ops and $3,800 on claims from other providers.

That leaves room for some hefty patient acquisition costs.

In FY 2020, it looks like the company spent $19M on sales & marketing, and acquired ~800 patients, while losing ~300 to “disenrollment.”

So… CAC seems to be running ~$24,000, if my math checks out.

In FY 2020, it looks like the company spent $19M on sales & marketing, and acquired ~800 patients, while losing ~300 to “disenrollment.”

So… CAC seems to be running ~$24,000, if my math checks out.

Despite that expense, InnovAge is chalking up 10 – 15% EBITDA margins, and reports contribution margins from its most mature clinics that reach as high as 37%.

Definitely the highest number I have seen from a risk-bearing provider operating physical clinics + home care.

Definitely the highest number I have seen from a risk-bearing provider operating physical clinics + home care.

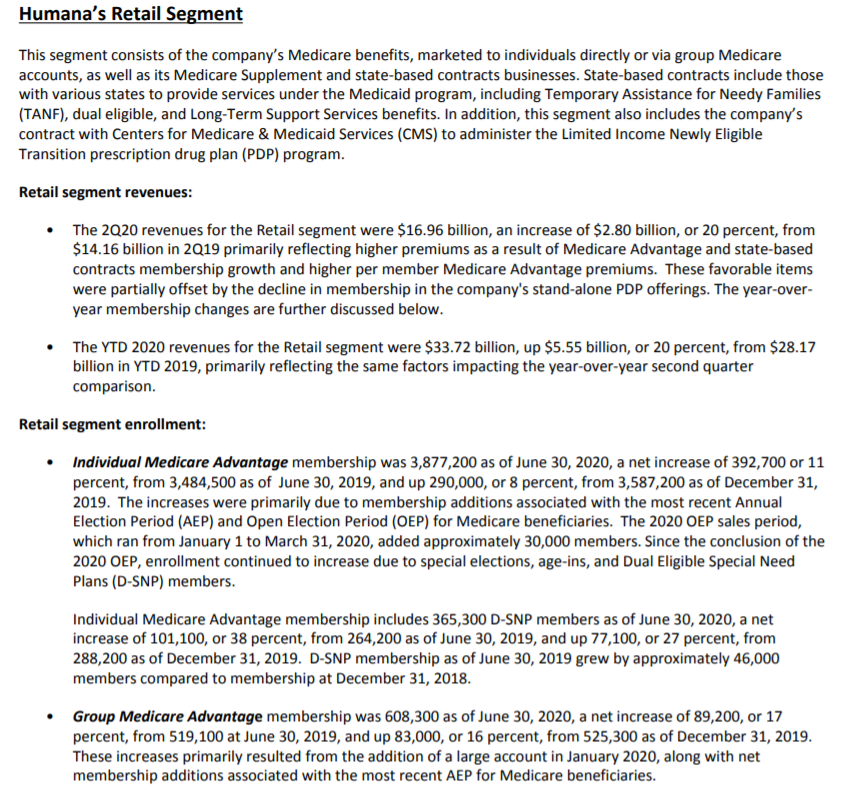

Some of this is expected. High-needs patients generate higher margins in other capitated/risk-adjusted programs as well, and PACE patients are generally quite ill. Industry-wide, the avg. PACE patient has 5.8 chronic conditions.

InnovAge, FWIW, cites a 2.53 RAF for its panel.

InnovAge, FWIW, cites a 2.53 RAF for its panel.

And some of this is about the structure of the program, in which the care delivery organization contracts directly with CMS & state Medicaid agencies, without an insurer as an intermediary. That can free up 10 – 15 percentage points of the “premium dollar” (i.e. the CMS payment)

Not accidental, then, that 10 – 15 pts is about what separates the contribution margins at mature InnovAge clinics from Oak or Cano clinics that are operating at scale. Oak & Cano contract through MA plans.

From Oak’s S-1:

From Oak’s S-1:

This is part of the buzz around Direct Contracting, whose structure looks somewhat like PACE, but with a simpler, nationally consistent model that can (potentially) apply to >30M traditional Medicare enrollees. Most of whom, to be fair, are (much) lower cost, and so lower margin.

InnovAge extrapolates from its current economics to tout a $200 billion TAM, but this looks overstated.

Data in California – by far the largest PACE mkt – suggests $5 – 6K is a more typical PMPM rate. And many “PACE eligible” patient are prob already enrolled in SNP plans or MA.

Data in California – by far the largest PACE mkt – suggests $5 – 6K is a more typical PMPM rate. And many “PACE eligible” patient are prob already enrolled in SNP plans or MA.

TAM aside, this IPO could raise a few eyebrows.

Bringing investment to needy patients is good. However, PACE is designed for patients who need a “nursing home level of care,” and research has linked PE investment in nursing homes to more patient deaths.

vox.com/policy-and-pol…

Bringing investment to needy patients is good. However, PACE is designed for patients who need a “nursing home level of care,” and research has linked PE investment in nursing homes to more patient deaths.

vox.com/policy-and-pol…

The same issues may not occur in PACE programs, where patients are treated at home or in outpatient clinics. But the authors in that study attributed the increased nursing home mortality to “a systematic shift in operating costs away from patient care.”

That assessment sits awkwardly with an unusual $58M expense that InnovAge incurred last Fall.

Footnotes describe this as the “Apax transaction,” which apparently involved “the cancellation of options and the redemption of shares,” plus some bonuses and transaction-related fees.

Footnotes describe this as the “Apax transaction,” which apparently involved “the cancellation of options and the redemption of shares,” plus some bonuses and transaction-related fees.

Seems odd to see a de facto equity repurchase embedded in G&A, if that’s what this was, but I’m not a CPA. In any case, it left InnovAge w/ almost $300M of debt, or $40 – 50K per patient. Easily serviceable w/ $60M of EBITDA, but you can imagine how this might become problematic.

All-in, the InnovAge numbers are a stark reminder just how much $$ is sloshing through the U.S. healthcare system, and the rich profit margins available through some of these risk contracting programs.

~$600M of LTM revenue, and a 15% EBITDA margin, with just 6,600 patients. 🤯

~$600M of LTM revenue, and a 15% EBITDA margin, with just 6,600 patients. 🤯

• • •

Missing some Tweet in this thread? You can try to

force a refresh