Not just as #coronavirus distraction, but for the window into a health tech solution that *could* be more aligned with the fundamental cost problem for employers and patients with private coverage (ahem...prices).

1/n

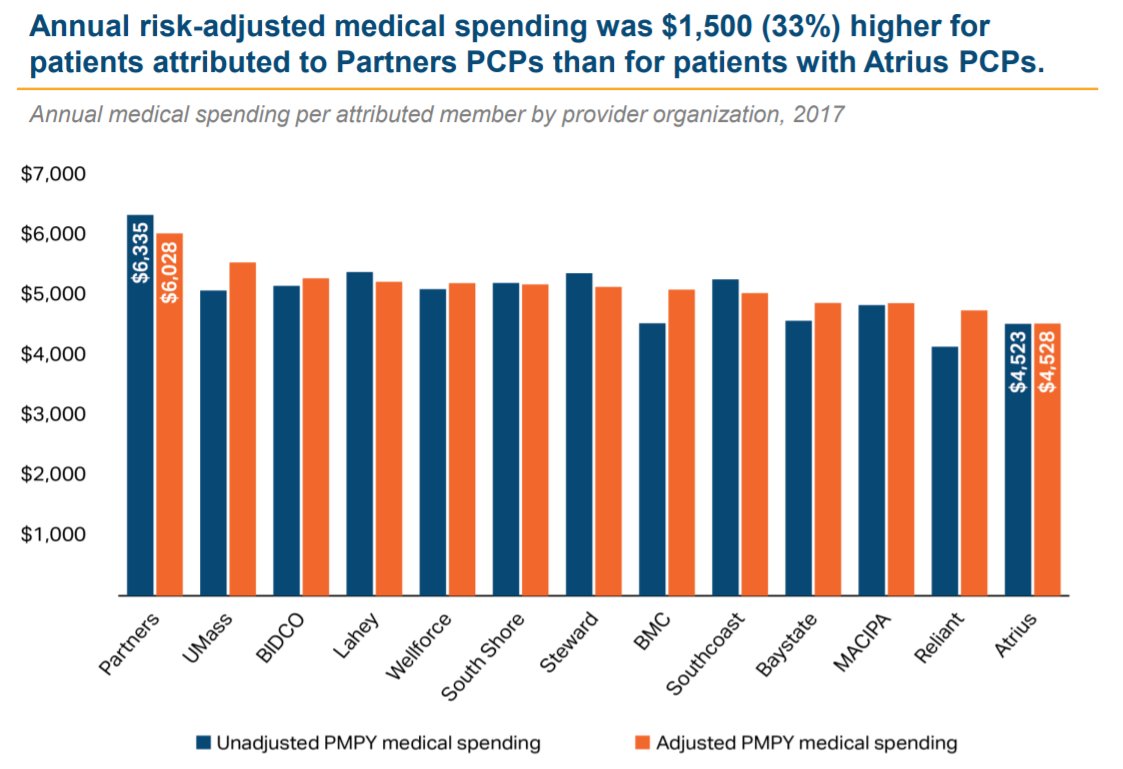

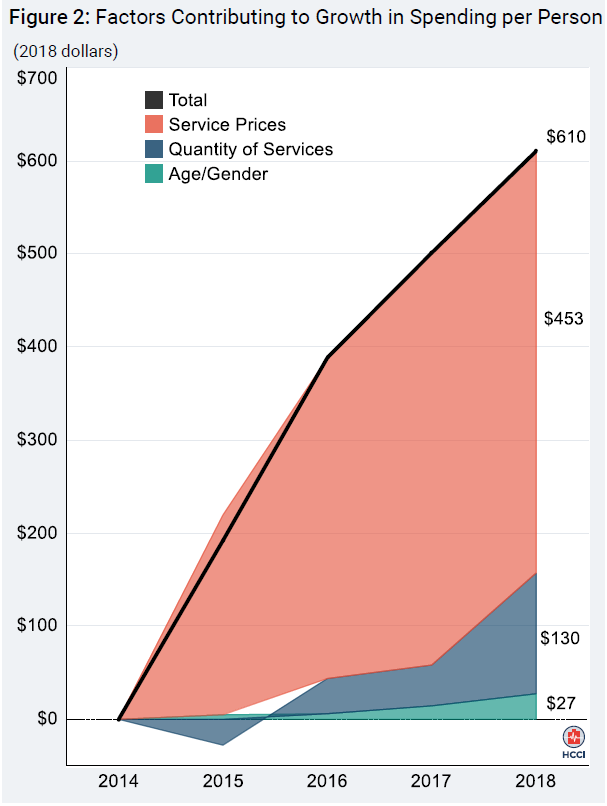

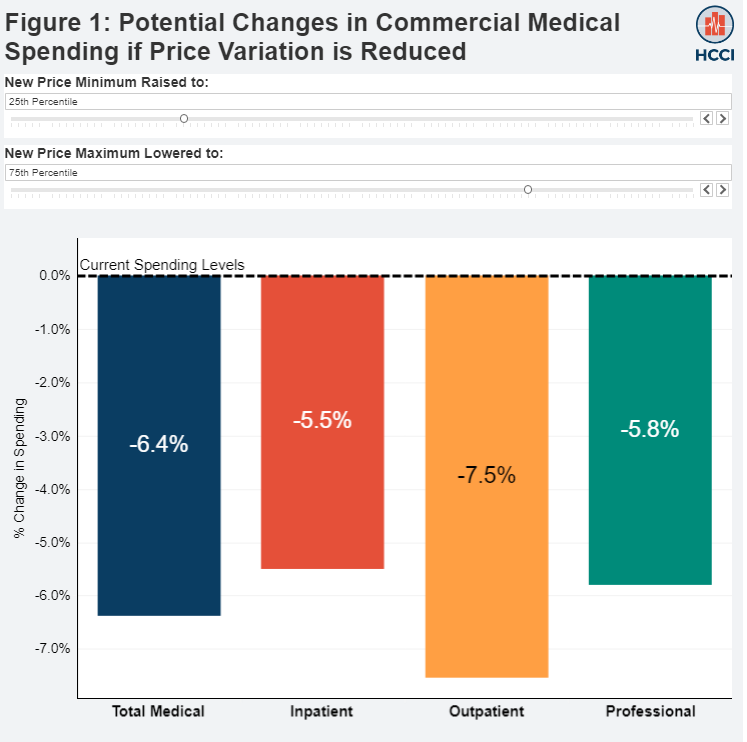

But for employers, price is the problem, not volume.

Revenue is up >40% YoY, but the company is losing $5M/mth on a GAAP basis, little changed from last year

They now say they have jumped to 53 clients, perhaps helped by the @Humana partnership

Note: Reports mention 60% / 35% for the Top 3 / Comcast, but this appears to refer to year-old #s; growth has since diluted concentration a bit

Seems to be decent bookings momentum, but these are expensive clients to acquire and serve.

That’s a gross #, which might be ~4% and $200 – 225 after netting out the cost of Accolade itself

S-1 data seem to imply that clients may pay something like $75-90, but this could well be wrong. There are also hints that Comcast – also an investor in the company - may be paying materially more (perhaps as much as $150 PMPY)

And, in the ONEM case, their own high prices (and referrals) offset the savings, so net employer savings seem unlikely.

Significant, but if diabetes prevalence runs at ~5% for commercial lives, it probably equates to $50 – 60 PMPY (gross) across the employee base.

tandfonline.com/doi/full/10.10…

1) Why have insurers been so slow to build a similar navigation layer? After all, health plans have infamously low customer satisfaction/NPS, and this might help.

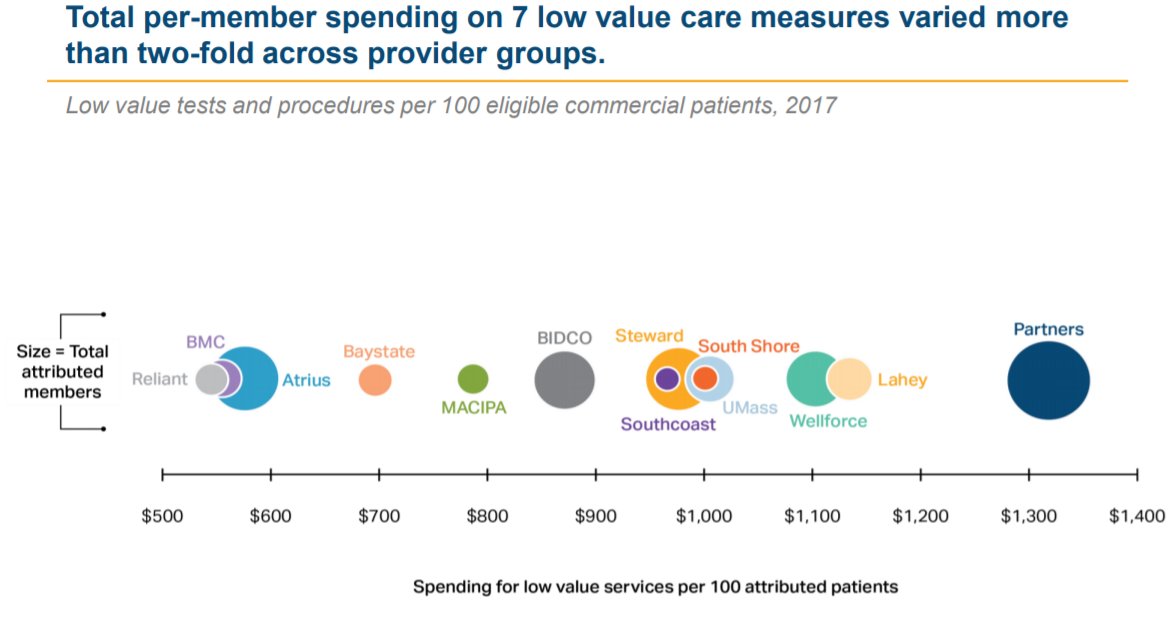

Capturing half of the $300 PMPY savings here could probably boost PCP revenue per attributed commercial member by 30 - 50%.

/n