A thread to explain how Reliance Industries Limited can lose the premium valuations in years to come. 🧵👇 (1/n)

Recently Reliance decided to hive off its O2C (O to C) business which is nothing but its Refinery and Petrochemical business. For starters O2C is when a company performs all the functions from order of a customer to payment of cash by him. (2/n)

business-standard.com/article/compan…

business-standard.com/article/compan…

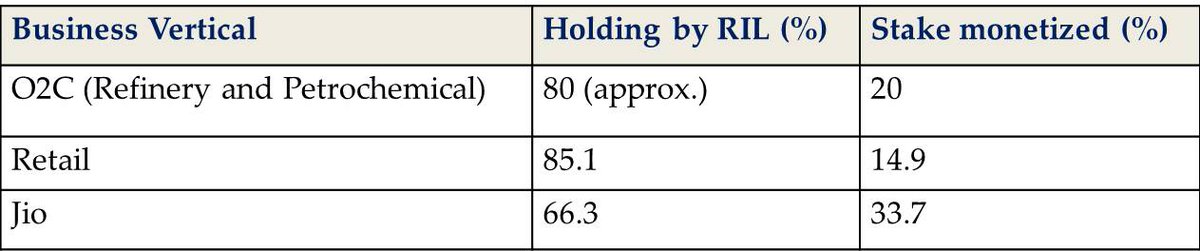

The main reason for hiving off this business is to monetize it just like it did with Jio and Retail. Hence, now RIL will become purely a holding company. (3/n)

The problem with being just a holding company is that market never gives premium valuations to holding companies.

Let us have some current examples of holding companies and how they are trading at discount. (4/n)

Let us have some current examples of holding companies and how they are trading at discount. (4/n)

Vedanta holds 65 % in Hindustan Zinc. The market cap of Hindustan Zinc is 1.35 lakh cr. So, Vedanta’s stake in it comes to around 87k cr. However, Vedanta’s valuation is 80k cr and it has debt of just 20k cr. Vedanta also has other businesses (power, aluminum, coal, etc). (5/n)

Grasim holds 57.5% stake in ultratech cement which has the market cap of 1.88 lakh cr. Grasim’s stake comes to 1.08 lakh cr. Grasim’s market cap is just 87k cr with zero debt. Plus it has its other businesses too. (6/n)

To sum up,

👉Grasim is trading at 60% discount for its stake in Ultratech.

👉Vedanta is trading at 55% discount for its stake in Hindustan Zinc.

So, I do not see any reason why markets should value RIL at premium. (7/n)

👉Grasim is trading at 60% discount for its stake in Ultratech.

👉Vedanta is trading at 55% discount for its stake in Hindustan Zinc.

So, I do not see any reason why markets should value RIL at premium. (7/n)

@gvkreddi, @manurishiguptha, @contrarianEPS, @Dinesh_Sairam, @aditya_kondawar I would appreciate your views 😀

• • •

Missing some Tweet in this thread? You can try to

force a refresh