1/

Get a cup of coffee.

In this thread, I'll show you a simple way to work out a fair price to pay for a wonderful business.

Get a cup of coffee.

In this thread, I'll show you a simple way to work out a fair price to pay for a wonderful business.

3/

So, whenever we buy a stock, it's a good idea to ask ourselves 2 questions:

a) Is this a wonderful business? And,

b) Is it available at a fair price?

So, whenever we buy a stock, it's a good idea to ask ourselves 2 questions:

a) Is this a wonderful business? And,

b) Is it available at a fair price?

4/

From an investing standpoint, a "wonderful business" is one that:

a) Earns high returns on the capital invested into it. And,

b) Has opportunities to re-invest these earnings back into itself at similarly high rates of return.

For more:

From an investing standpoint, a "wonderful business" is one that:

a) Earns high returns on the capital invested into it. And,

b) Has opportunities to re-invest these earnings back into itself at similarly high rates of return.

For more:

https://twitter.com/10kdiver/status/1337837824465281024

5/

Notice that Buffett didn't just say: buy a wonderful business.

Instead, he said: buy a wonderful business *AT A FAIR PRICE*.

So the question is: how do we calculate a "fair price" to pay for a wonderful business?

Notice that Buffett didn't just say: buy a wonderful business.

Instead, he said: buy a wonderful business *AT A FAIR PRICE*.

So the question is: how do we calculate a "fair price" to pay for a wonderful business?

6/

Let's put some numbers to it.

Suppose our business earns 30% per year on the capital invested into it.

In a zero interest rate world, this is a pretty, pretty, pretty good rate of return!

Let's put some numbers to it.

Suppose our business earns 30% per year on the capital invested into it.

In a zero interest rate world, this is a pretty, pretty, pretty good rate of return!

7/

And let's also say that the business has opportunities to re-invest every dollar of earnings back into itself -- at the same 30% rate of return.

Again, not bad!

And let's also say that the business has opportunities to re-invest every dollar of earnings back into itself -- at the same 30% rate of return.

Again, not bad!

8/

At the start of "Year 1", suppose the business had $1B of capital.

Then, during Year 1, the business will earn 30% of $1B = $300M.

The business will retain, and re-invest, this entire $300M of earnings back into itself.

At the start of "Year 1", suppose the business had $1B of capital.

Then, during Year 1, the business will earn 30% of $1B = $300M.

The business will retain, and re-invest, this entire $300M of earnings back into itself.

9/

So, at the start of Year 2, the business will have $1B + $300M = $1.3B of capital.

And during Year 2, the business will still earn 30% -- but on this expanded capital base. So, earnings will be 30% of $1.3B = $390M.

All of which will be re-invested in Year 3.

And so on.

So, at the start of Year 2, the business will have $1B + $300M = $1.3B of capital.

And during Year 2, the business will still earn 30% -- but on this expanded capital base. So, earnings will be 30% of $1.3B = $390M.

All of which will be re-invested in Year 3.

And so on.

10/

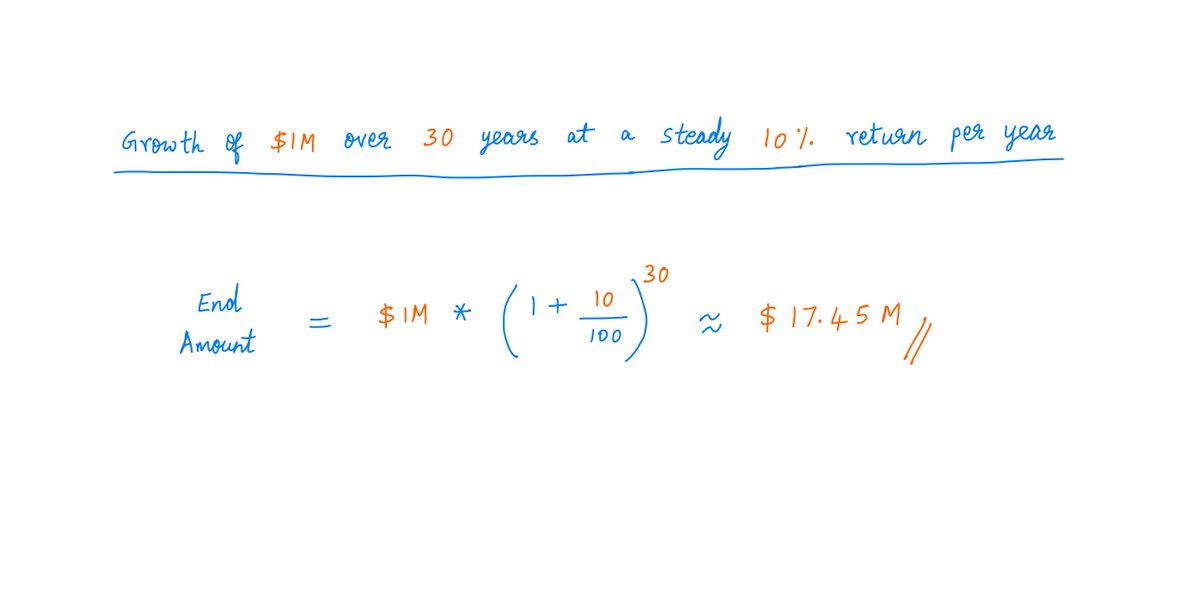

Let's say this continues for 20 years.

In Year 21, the company will earn about $57B, as the table below shows:

Let's say this continues for 20 years.

In Year 21, the company will earn about $57B, as the table below shows:

11/

20 years down the line, suppose the company is trading at a forward P/E of 20 -- a reasonable multiple for a wonderful business like this.

That means the company's market cap (ie, the total value of all its shares taken together) at the time will be $57B * 20 = ~$1.14T.

20 years down the line, suppose the company is trading at a forward P/E of 20 -- a reasonable multiple for a wonderful business like this.

That means the company's market cap (ie, the total value of all its shares taken together) at the time will be $57B * 20 = ~$1.14T.

12/

Suppose we buy the stock today, and we want to make a 25% (pre-tax) annualized return over the next 20 years on this investment.

How much can we pay for the stock today?

Working backwards from our ~$1.14T figure, we see that we can pay ~$13B for the whole company today:

Suppose we buy the stock today, and we want to make a 25% (pre-tax) annualized return over the next 20 years on this investment.

How much can we pay for the stock today?

Working backwards from our ~$1.14T figure, we see that we can pay ~$13B for the whole company today:

13/

This is a P/E of roughly $13B/$300M = 43.

So, we can pay up to ~43 times earnings for the company's shares today, and we're still likely to get a ~25% return over the next 20 years -- assuming we have a wonderful business and it stays that way.

This is a P/E of roughly $13B/$300M = 43.

So, we can pay up to ~43 times earnings for the company's shares today, and we're still likely to get a ~25% return over the next 20 years -- assuming we have a wonderful business and it stays that way.

14/

43 times earnings seems "optically" high.

But for such a wonderful business, even paying this expensive looking price is likely worth it -- because the business earns such good returns on capital and has good prospects for re-investing earnings.

As Charlie Munger said:

43 times earnings seems "optically" high.

But for such a wonderful business, even paying this expensive looking price is likely worth it -- because the business earns such good returns on capital and has good prospects for re-investing earnings.

As Charlie Munger said:

15/

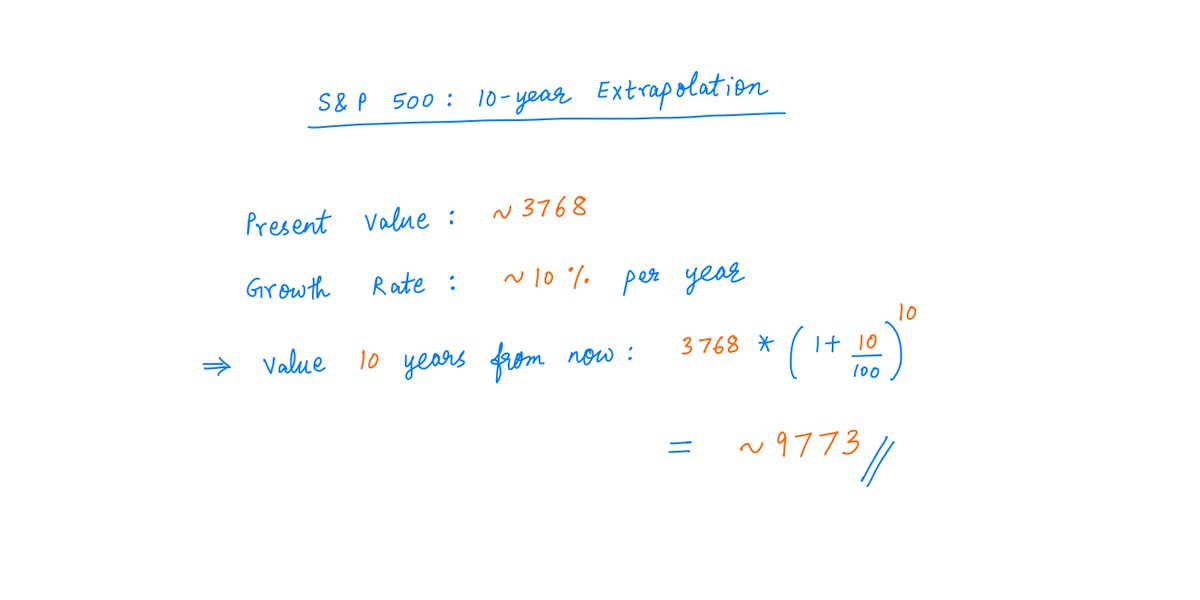

But of course, the more we pay for the business today, the lower our 20-year returns will be.

For example, if we pay 100 times earnings, our returns will go from ~25% to ~20% annualized.

At 200 times earnings, our returns will only be ~16% annualized.

And so on.

But of course, the more we pay for the business today, the lower our 20-year returns will be.

For example, if we pay 100 times earnings, our returns will go from ~25% to ~20% annualized.

At 200 times earnings, our returns will only be ~16% annualized.

And so on.

16/

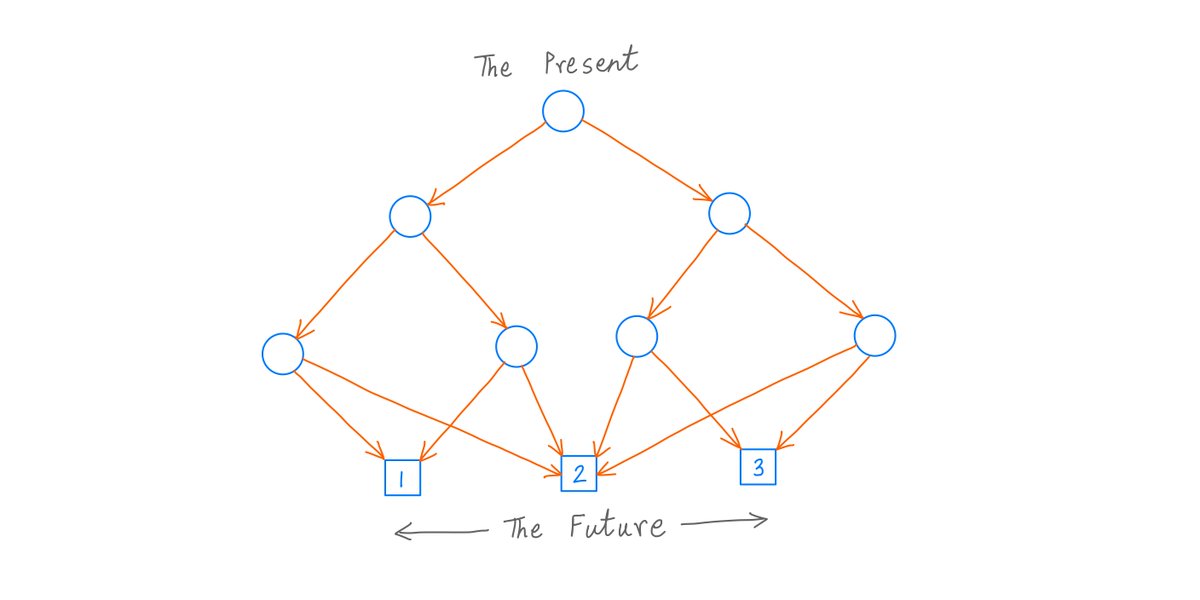

So that's our method for calculating a "fair price" for a wonderful business.

Step 1. We estimate the business's return on capital, earnings, and re-investments for the next several years.

For example, we assumed a 30% return on capital, with all earnings re-invested.

So that's our method for calculating a "fair price" for a wonderful business.

Step 1. We estimate the business's return on capital, earnings, and re-investments for the next several years.

For example, we assumed a 30% return on capital, with all earnings re-invested.

17/

Step 2. We set a reasonably conservative "end multiple" for our business.

For example, we assumed that our business will trade at "20 times earnings" 20 years down the line.

Step 2. We set a reasonably conservative "end multiple" for our business.

For example, we assumed that our business will trade at "20 times earnings" 20 years down the line.

18/

Step 3. We work backwards. How much we can pay for the business today -- and still end up with the return we want?

For example, to get a 25% (pre-tax) annualized return over 20 years, we concluded that we can pay up to ~43 times earnings for our business today.

Step 3. We work backwards. How much we can pay for the business today -- and still end up with the return we want?

For example, to get a 25% (pre-tax) annualized return over 20 years, we concluded that we can pay up to ~43 times earnings for our business today.

19/

Dividends complicate the picture somewhat.

For example, what if our business will earn 30% on all invested capital over the next 20 years, but it can only reinvest half its earnings at this return? (The other half is returned to shareholders as dividends each year.)

Dividends complicate the picture somewhat.

For example, what if our business will earn 30% on all invested capital over the next 20 years, but it can only reinvest half its earnings at this return? (The other half is returned to shareholders as dividends each year.)

20/

Now the calculations are more complicated.

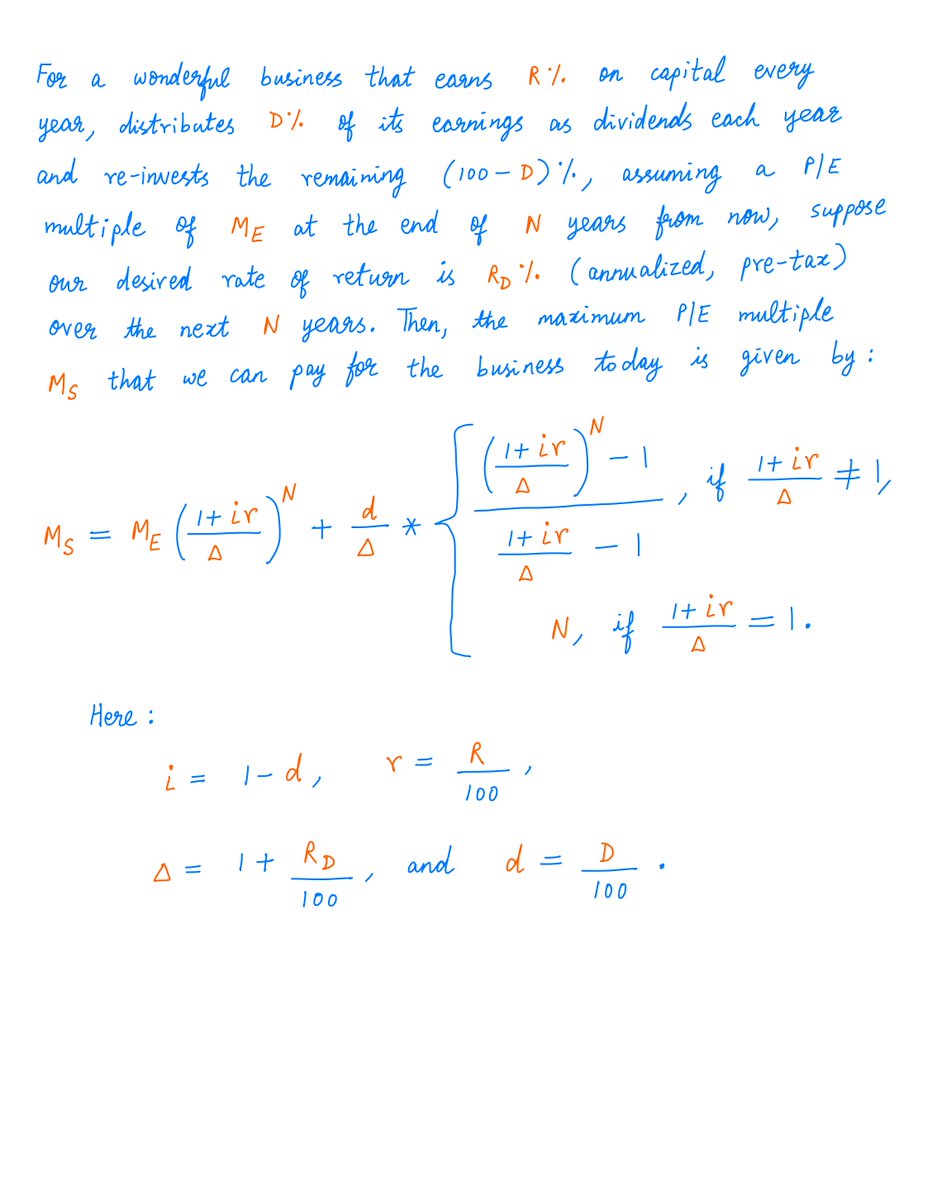

Here's a formula for the maximum P/E multiple we can pay for a wonderful business -- given its return on capital, dividend payout, "end multiple", and our desired rate of return over the next several years:

Now the calculations are more complicated.

Here's a formula for the maximum P/E multiple we can pay for a wonderful business -- given its return on capital, dividend payout, "end multiple", and our desired rate of return over the next several years:

22/

The second example tells us that if our business is able to only re-invest half its earnings each year (with the other half returned as dividends), the P/E we can pay drops from ~43 to just ~8 -- for us to bag the same 25% (pre-tax) annualized return over the next 20 years.

The second example tells us that if our business is able to only re-invest half its earnings each year (with the other half returned as dividends), the P/E we can pay drops from ~43 to just ~8 -- for us to bag the same 25% (pre-tax) annualized return over the next 20 years.

23/

This is an 80% drop in the price we can pay!

That's the power of a business re-investing earnings at high returns.

If a business can only re-invest *half* its earnings each year, it's worth *much* less than a business that can re-invest *all* its earnings.

This is an 80% drop in the price we can pay!

That's the power of a business re-investing earnings at high returns.

If a business can only re-invest *half* its earnings each year, it's worth *much* less than a business that can re-invest *all* its earnings.

24/

Here are some key lessons from this thread.

Key lesson 1: The more we pay for a business at the outset, the worse our returns will be over the next several years.

Here are some key lessons from this thread.

Key lesson 1: The more we pay for a business at the outset, the worse our returns will be over the next several years.

25/

For example, Microsoft is a wonderful business. But in spite of this, those who paid a hefty price for Microsoft shares in 1999 had to endure decades of poor returns.

As @ChrisBloomstran recounts in his excellent 2020 Semper Augustus letter:

For example, Microsoft is a wonderful business. But in spite of this, those who paid a hefty price for Microsoft shares in 1999 had to endure decades of poor returns.

As @ChrisBloomstran recounts in his excellent 2020 Semper Augustus letter:

26/

Key lesson 2: The more wonderful a business is (ie, the higher its return on invested capital, and the more opportunities it has for reinvesting earnings), the more we can pay for it and still get a good return over time.

Key lesson 2: The more wonderful a business is (ie, the higher its return on invested capital, and the more opportunities it has for reinvesting earnings), the more we can pay for it and still get a good return over time.

27/

Key lesson 3: The real danger lies in misjudging business quality, not miscalculating price.

If the business is truly wonderful, it will eventually reward us for holding it -- even if we paid an optically high (but not crazy!) price for it at the outset.

Key lesson 3: The real danger lies in misjudging business quality, not miscalculating price.

If the business is truly wonderful, it will eventually reward us for holding it -- even if we paid an optically high (but not crazy!) price for it at the outset.

28/

But if we misjudged business quality (eg, we mistook a mediocre business for a wonderful one), there's no such "bailout" over time.

In this case, only the capriciousness of Mr. Market can bail us out -- and that may never happen.

But if we misjudged business quality (eg, we mistook a mediocre business for a wonderful one), there's no such "bailout" over time.

In this case, only the capriciousness of Mr. Market can bail us out -- and that may never happen.

29/

As Buffett wrote in his 1989 letter: Time is the friend of the wonderful business, the enemy of the mediocre.

In the same vein, time is also a friend of the *shareholder* of a wonderful business, even if that shareholder got a bit carried away with his purchase price.

As Buffett wrote in his 1989 letter: Time is the friend of the wonderful business, the enemy of the mediocre.

In the same vein, time is also a friend of the *shareholder* of a wonderful business, even if that shareholder got a bit carried away with his purchase price.

30/

This ~1 hr, 30 min talk by Terry Smith describes these concepts beautifully. Please do watch it if you have the time:

This ~1 hr, 30 min talk by Terry Smith describes these concepts beautifully. Please do watch it if you have the time:

31/

I also very much like @ChrisBloomstran's "dual margins of safety" idea -- where safety comes from both *high business quality* and *a sensible purchase price*, not one or the other.

From Chris's 2019 Semper Augustus letter:

I also very much like @ChrisBloomstran's "dual margins of safety" idea -- where safety comes from both *high business quality* and *a sensible purchase price*, not one or the other.

From Chris's 2019 Semper Augustus letter:

32/

As Ben Graham says in The Intelligent Investor, in any stock transaction, it's always a good idea to think about *both* "price" and "value".

I hope this thread was able to quantify this connection and make it a bit more concrete.

As Ben Graham says in The Intelligent Investor, in any stock transaction, it's always a good idea to think about *both* "price" and "value".

I hope this thread was able to quantify this connection and make it a bit more concrete.

33/

If you're still with me, thank you so much!

Your unwavering support and encouragement are priceless. (For everything else, there's MasterCard.)

Please stay safe. Enjoy your weekend!

/End

If you're still with me, thank you so much!

Your unwavering support and encouragement are priceless. (For everything else, there's MasterCard.)

Please stay safe. Enjoy your weekend!

/End

• • •

Missing some Tweet in this thread? You can try to

force a refresh