1/

Get a cup of coffee.

In this thread, I'll help you understand Lifestyle Creep, and why it's important to minimize it to the extent possible.

This will help you answer *the* most important question in all of personal finance: should you get that daily latte or not?

Get a cup of coffee.

In this thread, I'll help you understand Lifestyle Creep, and why it's important to minimize it to the extent possible.

This will help you answer *the* most important question in all of personal finance: should you get that daily latte or not?

2/

As we get older, we tend to have more money.

At work, we become better skilled and more experienced at our jobs. So we get promotions and raises.

Also, our investment portfolios and 401(k)s become bigger -- as compounding starts to kick in.

So we feel richer.

As we get older, we tend to have more money.

At work, we become better skilled and more experienced at our jobs. So we get promotions and raises.

Also, our investment portfolios and 401(k)s become bigger -- as compounding starts to kick in.

So we feel richer.

3/

Over time, this feeling of being richer leads us to consume more (ie, spend more money).

We buy bigger houses. We drive nicer cars. We treat ourselves more often to nice meals at fine restaurants.

We splurge.

Over time, this feeling of being richer leads us to consume more (ie, spend more money).

We buy bigger houses. We drive nicer cars. We treat ourselves more often to nice meals at fine restaurants.

We splurge.

4/

As we splurge, we get accustomed to a more comfortable, more pampered, life.

And for most of us, this is a one-way street: it's hard to go back to our spartan ways of yesteryears.

Our new, more luxurious, lifestyle has slowly "crept up" on us.

This is Lifestyle Creep.

As we splurge, we get accustomed to a more comfortable, more pampered, life.

And for most of us, this is a one-way street: it's hard to go back to our spartan ways of yesteryears.

Our new, more luxurious, lifestyle has slowly "crept up" on us.

This is Lifestyle Creep.

5/

For example, when I was in college, all my things fit comfortably in a small room. I had no car. I lived with two other housemates in an apartment. We split the rent and utilities.

Compared to that, I live like a king now.

For example, when I was in college, all my things fit comfortably in a small room. I had no car. I lived with two other housemates in an apartment. We split the rent and utilities.

Compared to that, I live like a king now.

6/

My college days weren't that long ago.

I was perfectly happy then -- as I am now.

But if, for some reason, I had to go back to that lifestyle, I'd find it very difficult.

Because Lifestyle Creep has gotten to me.

My college days weren't that long ago.

I was perfectly happy then -- as I am now.

But if, for some reason, I had to go back to that lifestyle, I'd find it very difficult.

Because Lifestyle Creep has gotten to me.

7/

Lifestyle Creep is not necessarily a bad thing.

Sure, it increases our cost of living.

And if we stray too far, there's a risk that we'll start living beyond our means. Sooner or later, the consequences of this will catch up to us.

Lifestyle Creep is not necessarily a bad thing.

Sure, it increases our cost of living.

And if we stray too far, there's a risk that we'll start living beyond our means. Sooner or later, the consequences of this will catch up to us.

8/

But at the same time, our *standard* of living also improves.

We get to enjoy a more comfortable life. Nicer things. Good experiences and memories.

After all, containing costs and building net worth is not the only point of life.

But at the same time, our *standard* of living also improves.

We get to enjoy a more comfortable life. Nicer things. Good experiences and memories.

After all, containing costs and building net worth is not the only point of life.

9/

In optimization parlance, most of us are not trying to *minimize* cost of living.

Rather, we're trying to *maximize* quality of life *subject to constraints* on cost of living (eg, to ensure that we don't come close to running out of money in the future).

In optimization parlance, most of us are not trying to *minimize* cost of living.

Rather, we're trying to *maximize* quality of life *subject to constraints* on cost of living (eg, to ensure that we don't come close to running out of money in the future).

10/

So, understanding Lifestyle Creep boils down to a "cost benefit analysis".

We need to evaluate the costs of a more lavish lifestyle.

We need to ask ourselves whether the benefits offered by this lifestyle are worth it.

So, understanding Lifestyle Creep boils down to a "cost benefit analysis".

We need to evaluate the costs of a more lavish lifestyle.

We need to ask ourselves whether the benefits offered by this lifestyle are worth it.

11/

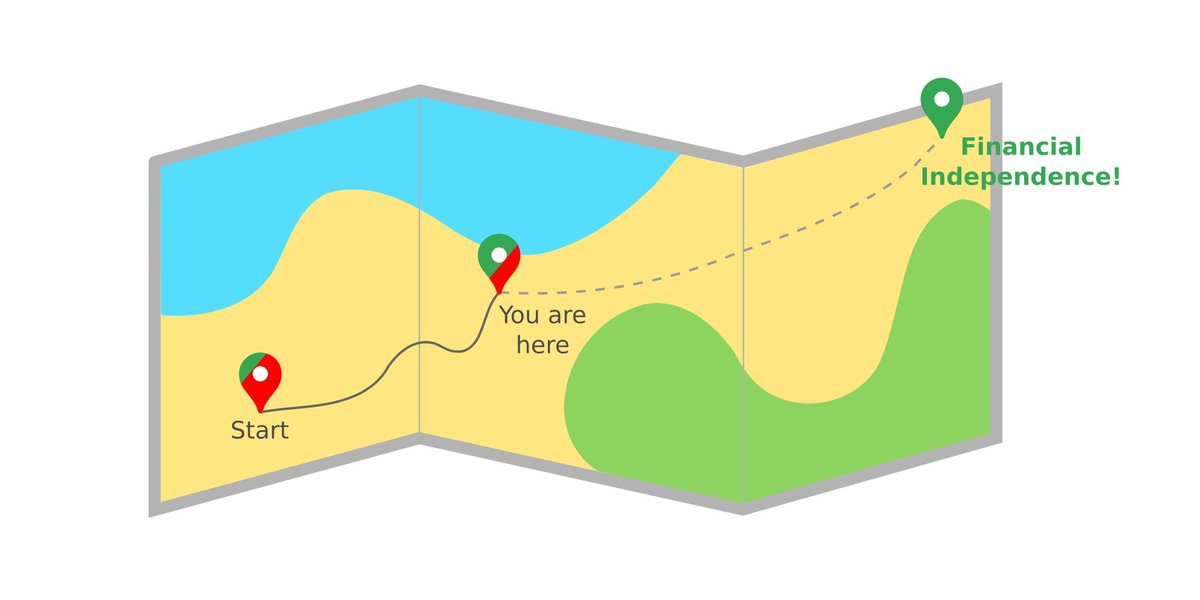

One way to think about the cost of Lifestyle Creep is to ask ourselves how much it will slow us down on the path to financial freedom.

Financial freedom can be summed up in one sentence:

We have all the money we need in life, without having to work another day.

One way to think about the cost of Lifestyle Creep is to ask ourselves how much it will slow us down on the path to financial freedom.

Financial freedom can be summed up in one sentence:

We have all the money we need in life, without having to work another day.

12/

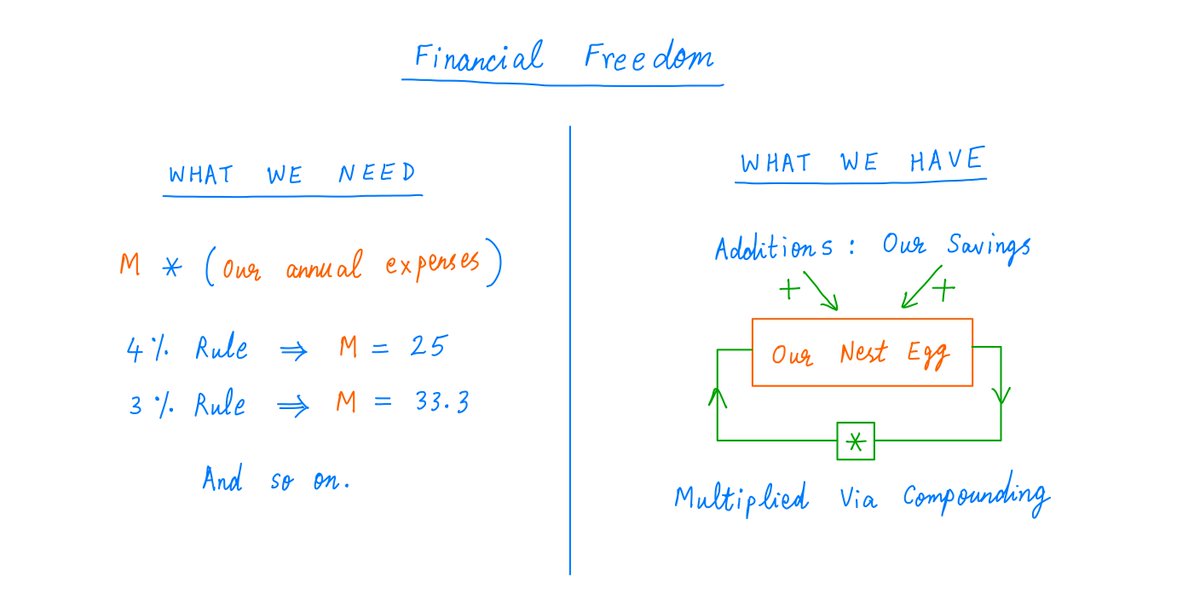

Typically, "what we need" for financial freedom is a nest egg that's many times our annual expenses.

For example, if we're following the 4% Rule, we need 25x our annual expenses.

With the 3% Rule, we need 33.3x. And so on.

For more on such "Rules":

Typically, "what we need" for financial freedom is a nest egg that's many times our annual expenses.

For example, if we're following the 4% Rule, we need 25x our annual expenses.

With the 3% Rule, we need 33.3x. And so on.

For more on such "Rules":

https://twitter.com/10kdiver/status/1287043526153273344

13/

So, that's "what we need".

The other side of that coin is "what we have" -- our nest egg.

Typically, we build up our nest egg by contributing our savings into it over time.

And assuming the nest egg is reasonably well invested, it will *compound* over time.

So, that's "what we need".

The other side of that coin is "what we have" -- our nest egg.

Typically, we build up our nest egg by contributing our savings into it over time.

And assuming the nest egg is reasonably well invested, it will *compound* over time.

14/

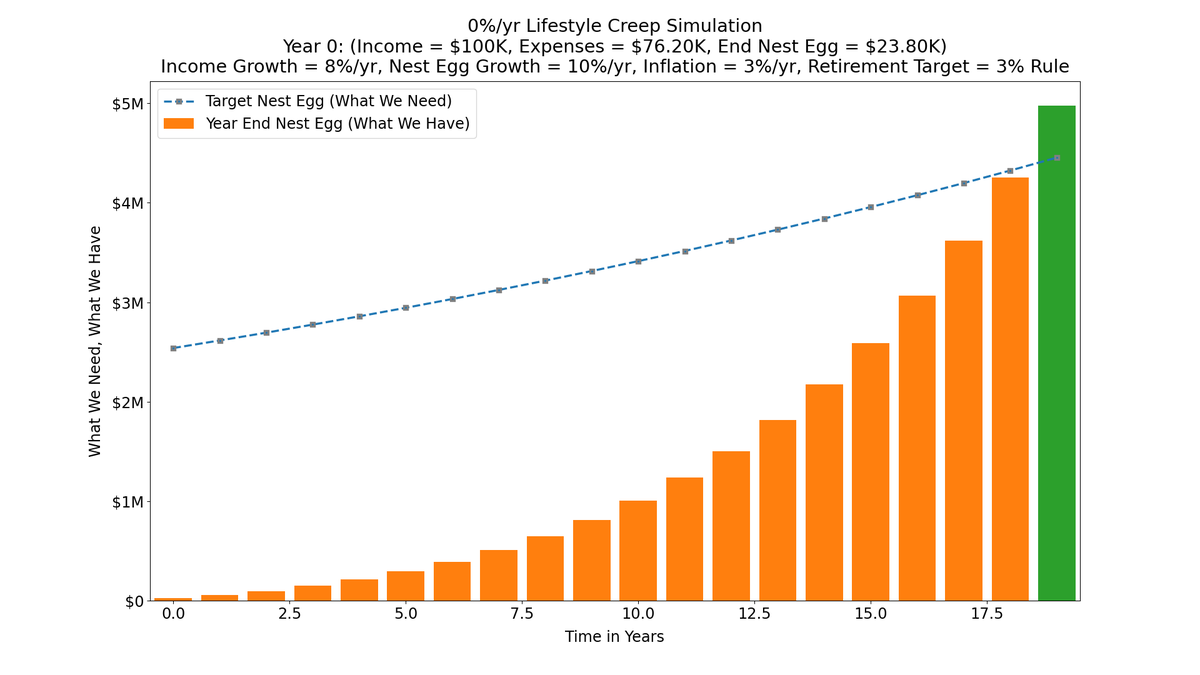

Here's a picture illustrating these ideas.

When "what we have" is more than "what we need", that's financial freedom.

Here's a picture illustrating these ideas.

When "what we have" is more than "what we need", that's financial freedom.

15/

So, how does Lifestyle Creep affect our path towards financial freedom?

Unfortunately, it's a double whammy.

On the one hand, Lifestyle Creep increases our expenses. This raises the bar on "what we need".

So, how does Lifestyle Creep affect our path towards financial freedom?

Unfortunately, it's a double whammy.

On the one hand, Lifestyle Creep increases our expenses. This raises the bar on "what we need".

16/

On the other hand, Lifestyle Creep lowers our savings -- the raw material that goes into our compounding engine.

This slows down the rate of growth of our nest egg.

So, "what we have" takes a hit as well.

On the other hand, Lifestyle Creep lowers our savings -- the raw material that goes into our compounding engine.

This slows down the rate of growth of our nest egg.

So, "what we have" takes a hit as well.

17/

Therefore, as we allow more Lifestyle Creep into our lives, our progress towards financial freedom (that happy state where "what we have" exceeds "what we need") becomes slower.

This is one of the main costs of Lifestyle Creep.

Therefore, as we allow more Lifestyle Creep into our lives, our progress towards financial freedom (that happy state where "what we have" exceeds "what we need") becomes slower.

This is one of the main costs of Lifestyle Creep.

18/

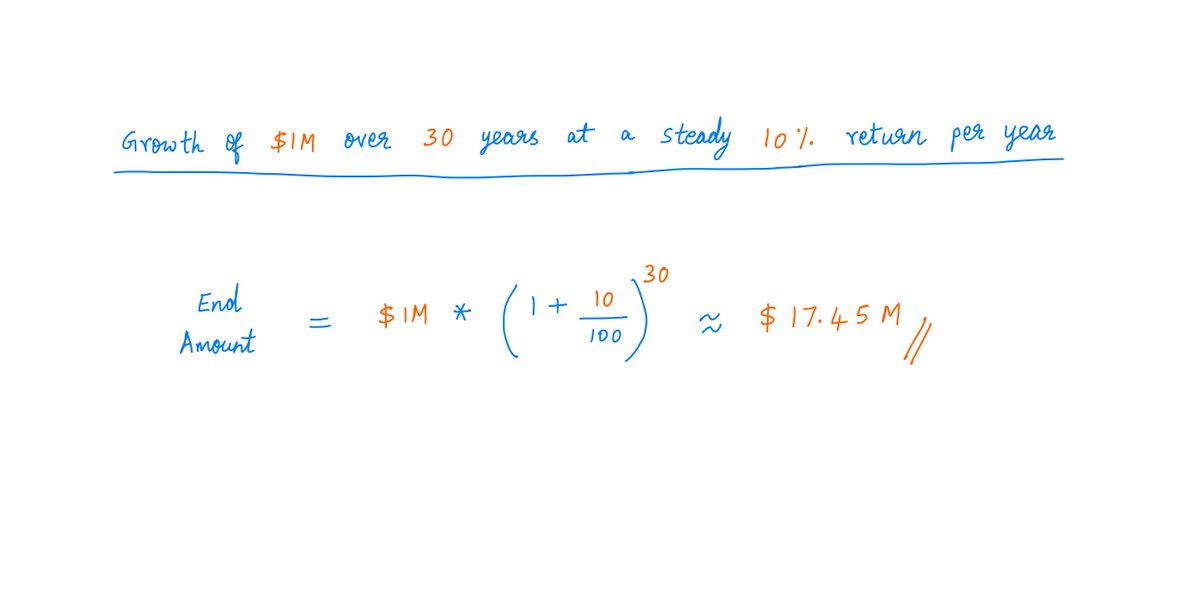

Let's put some numbers to all this.

Let's assume that we currently earn $100K per year (after taxes).

We spend $75K of it and save the other $25K.

These savings go into our nest egg, which compounds at 10% per year.

Let's put some numbers to all this.

Let's assume that we currently earn $100K per year (after taxes).

We spend $75K of it and save the other $25K.

These savings go into our nest egg, which compounds at 10% per year.

19/

Suppose our income grows at 8% per year (via raises, promotions at work, etc.).

And suppose inflation is 3% per year.

That is, even with *zero* Lifestyle Creep, our expenses will grow at 3% per year -- just because of inflation.

Suppose our income grows at 8% per year (via raises, promotions at work, etc.).

And suppose inflation is 3% per year.

That is, even with *zero* Lifestyle Creep, our expenses will grow at 3% per year -- just because of inflation.

20/

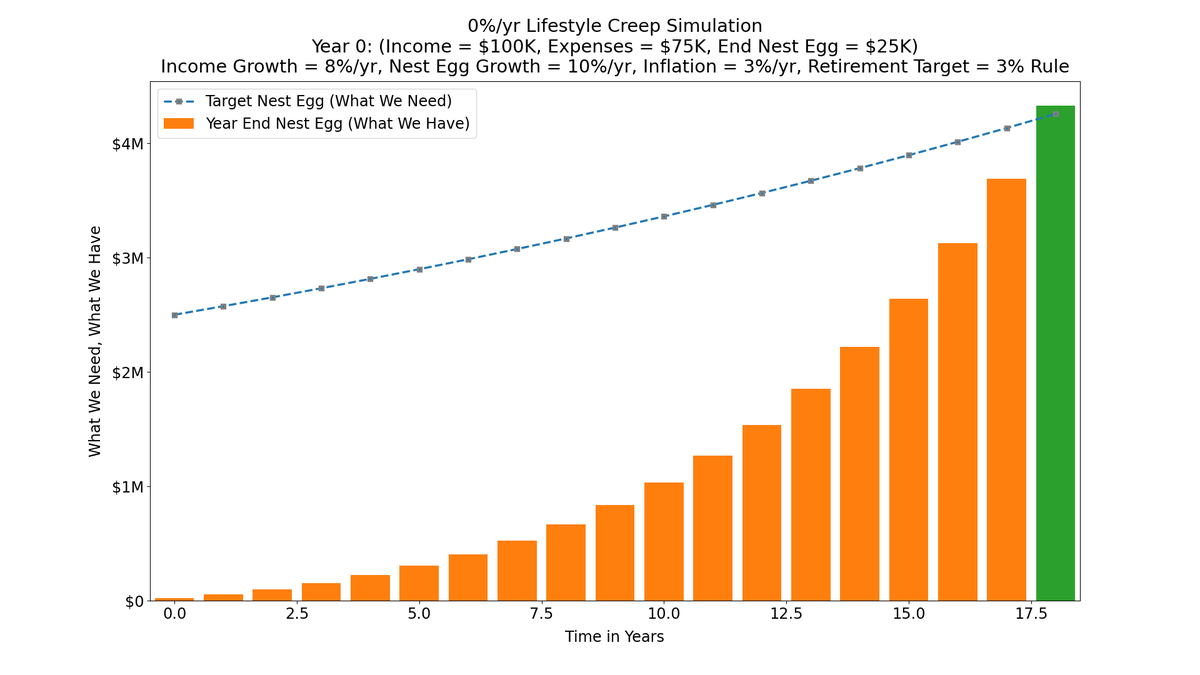

How long will it take for us to achieve financial freedom?

This depends on how much Lifestyle Creep we allow into our lives.

With *zero* Lifestyle Creep, if we follow the 3% Rule, it will take us 18 years to achieve financial freedom ($4.26M).

Here's the simulation:

How long will it take for us to achieve financial freedom?

This depends on how much Lifestyle Creep we allow into our lives.

With *zero* Lifestyle Creep, if we follow the 3% Rule, it will take us 18 years to achieve financial freedom ($4.26M).

Here's the simulation:

21/

Here's an animation showing "what we need" and "what we have" from this simulation, and how they both increase over the years.

Note that "what we need" increases over time *solely* due to inflation -- as there's no Lifestyle Creep in this simulation.

Here's an animation showing "what we need" and "what we have" from this simulation, and how they both increase over the years.

Note that "what we need" increases over time *solely* due to inflation -- as there's no Lifestyle Creep in this simulation.

22/

So, that's with zero Lifestyle Creep.

What if we allow a small amount of Lifestyle Creep into our lives -- say, 2% per year?

That is, our expenses now grow at 5% per year (3% due to inflation, 2% due to Lifestyle Creep).

But our income grows faster at 8% per year.

So, that's with zero Lifestyle Creep.

What if we allow a small amount of Lifestyle Creep into our lives -- say, 2% per year?

That is, our expenses now grow at 5% per year (3% due to inflation, 2% due to Lifestyle Creep).

But our income grows faster at 8% per year.

23/

Now, it'll take us 24 years to achieve financial freedom, which in this case means a nest egg of $8.06M.

So, we need 6 more years, and a nest egg that's almost twice as big, to get there.

That's the price we pay for our 2% per year Lifestyle Creep indulgence.

Now, it'll take us 24 years to achieve financial freedom, which in this case means a nest egg of $8.06M.

So, we need 6 more years, and a nest egg that's almost twice as big, to get there.

That's the price we pay for our 2% per year Lifestyle Creep indulgence.

24/

What if our Lifestyle Creep is even higher -- say, 5% per year?

Now, both our income and our expenses will grow at 8% per year -- so our savings rate will remain constant.

That is, we'll save 25% of our income each year -- and our income itself will grow at 8% per year.

What if our Lifestyle Creep is even higher -- say, 5% per year?

Now, both our income and our expenses will grow at 8% per year -- so our savings rate will remain constant.

That is, we'll save 25% of our income each year -- and our income itself will grow at 8% per year.

25/

That doesn't sound so bad.

Until we do the simulation, and realize that it'll now take us 57 years (and a nest egg of more than $200M) to achieve financial freedom!

A steep price indeed.

That doesn't sound so bad.

Until we do the simulation, and realize that it'll now take us 57 years (and a nest egg of more than $200M) to achieve financial freedom!

A steep price indeed.

26/

That's why we need to be vigilant.

Even a small amount of Lifestyle Creep can add years to our journey towards financial freedom.

We should allow Lifestyle Creep into our lives only when it's worth this cost.

That's why we need to be vigilant.

Even a small amount of Lifestyle Creep can add years to our journey towards financial freedom.

We should allow Lifestyle Creep into our lives only when it's worth this cost.

27/

So, should we get that daily latte or not?

For the uninitiated, let me explain.

FinTwit is made up of two kinds of people: Lattephiles and Lattephobes.

Lattephiles maintain that indulging in a latte everyday is a fundamental human right, and that it costs next to nothing.

So, should we get that daily latte or not?

For the uninitiated, let me explain.

FinTwit is made up of two kinds of people: Lattephiles and Lattephobes.

Lattephiles maintain that indulging in a latte everyday is a fundamental human right, and that it costs next to nothing.

28/

Lattephobes, on the other hand, believe that a daily latte habit is the root cause of all financial problems -- the scourge that's preventing so many people from achieving financial freedom.

Lattephobes, on the other hand, believe that a daily latte habit is the root cause of all financial problems -- the scourge that's preventing so many people from achieving financial freedom.

29/

So, which group is right -- the Lattephiles or the Lattephobes?

Let's do the math.

Suppose we don't get the latte.

In this case, we know we'll get to financial freedom in 18 years (or more precisely, 17.8919 years).

So, which group is right -- the Lattephiles or the Lattephobes?

Let's do the math.

Suppose we don't get the latte.

In this case, we know we'll get to financial freedom in 18 years (or more precisely, 17.8919 years).

30/

What happens if we *do* get the latte?

Let's say we get one on all working days -- roughly 20 days a month.

Let's say a latte costs $5.

That's (20 days per month) * ($5 per day) = $100 per month. Or $1200 per year.

What happens if we *do* get the latte?

Let's say we get one on all working days -- roughly 20 days a month.

Let's say a latte costs $5.

That's (20 days per month) * ($5 per day) = $100 per month. Or $1200 per year.

31/

So, instead of spending $75K and saving $25K, we'll spend $76.2K and save $23.8K -- in Year 0.

In subsequent years, the figures will rise depending on income growth, inflation, etc.

With the latte habit, it'll take us approximately 18.2845 years to reach financial freedom.

So, instead of spending $75K and saving $25K, we'll spend $76.2K and save $23.8K -- in Year 0.

In subsequent years, the figures will rise depending on income growth, inflation, etc.

With the latte habit, it'll take us approximately 18.2845 years to reach financial freedom.

32/

So, getting a latte every working day for 18 years will delay us by approximately 5 months.

Each of us must decide individually whether the latte is worth this cost or not.

So, getting a latte every working day for 18 years will delay us by approximately 5 months.

Each of us must decide individually whether the latte is worth this cost or not.

33/

Of course, this is for one specific set of assumptions regarding income, income growth, etc.

For someone with lower income and/or income growth, the consequences of a daily latte habit may be more severe.

Of course, this is for one specific set of assumptions regarding income, income growth, etc.

For someone with lower income and/or income growth, the consequences of a daily latte habit may be more severe.

34/

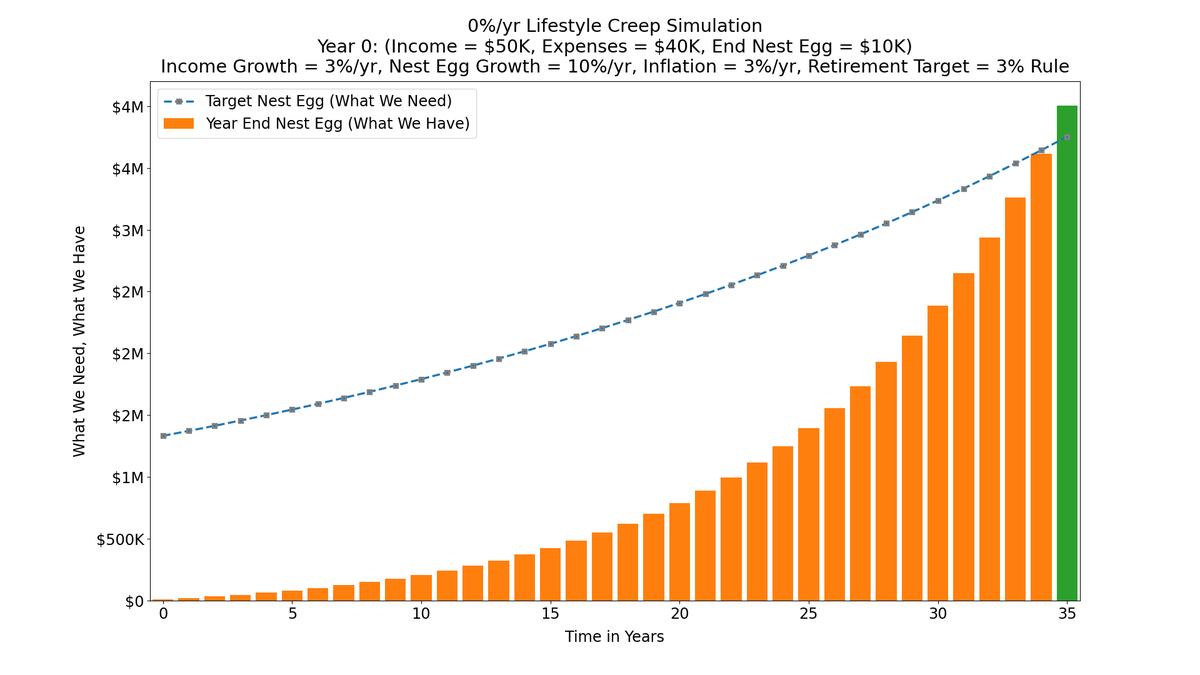

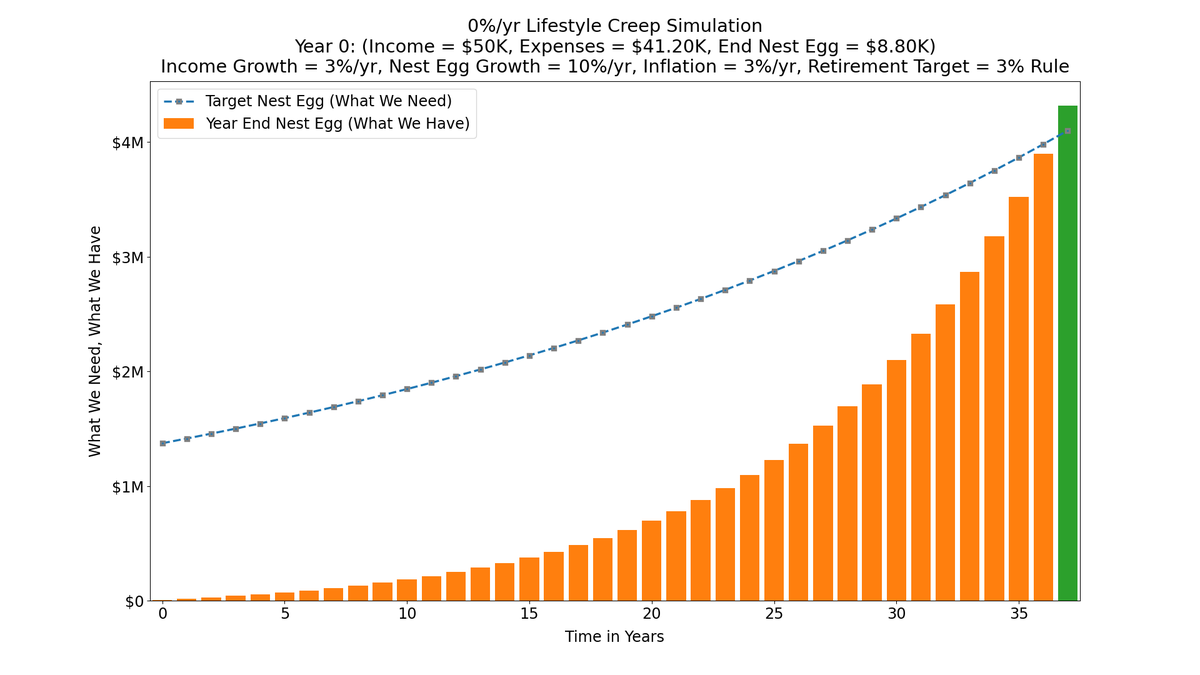

For example, let's take someone with income $50K and expenses $40K (without the latte) in Year 0, and income growth just enough to offset inflation.

Being in a lower income bracket with no real income growth, a daily latte habit is a bigger luxury for this person.

For example, let's take someone with income $50K and expenses $40K (without the latte) in Year 0, and income growth just enough to offset inflation.

Being in a lower income bracket with no real income growth, a daily latte habit is a bigger luxury for this person.

35/

Indeed, a daily latte habit delays this person by more than *2 years* on their journey towards financial freedom:

Indeed, a daily latte habit delays this person by more than *2 years* on their journey towards financial freedom:

36/

The moral of the story is:

We all have to live within our means.

For some of us, that means watching our lattes.

For others, it means watching more expensive sources of Lifestyle Creep -- frequent trips abroad, costly cars, etc.

The moral of the story is:

We all have to live within our means.

For some of us, that means watching our lattes.

For others, it means watching more expensive sources of Lifestyle Creep -- frequent trips abroad, costly cars, etc.

37/

For more on Lifestyle Creep, I recommend this excellent article by my friend Nick Maggiulli (@dollarsanddata).

It recommends that we contain our Lifestyle Creep to no more than half our real income growth.

ofdollarsanddata.com/lifestyle-cree…

For more on Lifestyle Creep, I recommend this excellent article by my friend Nick Maggiulli (@dollarsanddata).

It recommends that we contain our Lifestyle Creep to no more than half our real income growth.

ofdollarsanddata.com/lifestyle-cree…

38/

I also recommend reading about Lifestyle Creep on @mrmoneymustache's blog.

For example, this article outlines the Rules of 752 and 173, for daily and weekly expenses compounded over 10 years. Bonus points if you figure out the growth rate he's using! mrmoneymustache.com/2011/04/15/get…

I also recommend reading about Lifestyle Creep on @mrmoneymustache's blog.

For example, this article outlines the Rules of 752 and 173, for daily and weekly expenses compounded over 10 years. Bonus points if you figure out the growth rate he's using! mrmoneymustache.com/2011/04/15/get…

39/

Thank you very much for reading all the way to the end!

I hope this thread showed you how to assess the cost of Lifestyle Creep for your own specific situation.

Stay safe, and enjoy your weekend!

/End

Thank you very much for reading all the way to the end!

I hope this thread showed you how to assess the cost of Lifestyle Creep for your own specific situation.

Stay safe, and enjoy your weekend!

/End

• • •

Missing some Tweet in this thread? You can try to

force a refresh