1/ always a pleasure to chat with @MelissaLeeCNBC on @CNBCFastMoney - she’s an OG bitcoin bull!

wanted to share data around the three trends i highlighted:

1. fund and ETP inflows

2. retail v insto

3. record highs in derivatives market volume

wanted to share data around the three trends i highlighted:

1. fund and ETP inflows

2. retail v insto

3. record highs in derivatives market volume

2/ lets start with fund and ETP flows

we continue to see crypto products and funds gathering more AUM, with a record $56B in AUM across all platforms

our @CoinSharesCo research team produces a weekly Digital Asset Fund Flows report with excellent data - coinshares.com/research/digit…

we continue to see crypto products and funds gathering more AUM, with a record $56B in AUM across all platforms

our @CoinSharesCo research team produces a weekly Digital Asset Fund Flows report with excellent data - coinshares.com/research/digit…

3/ a large portion of inflows into fund flows are "one way" via US trust structures, like @Grayscale or @BitwiseInvest - meaning once the assets go in, they don't come out

investors also buy these in tax advantaged accounts or with the intent of holding for long term cap gains

investors also buy these in tax advantaged accounts or with the intent of holding for long term cap gains

4/ at @CoinSharesCo, we have $4.8B AUM in our ETPs,

@xbtprovider and CS Physical. the holdings referenced by these ETPs can be seen here: real-time-attest.trustexplorer.io/coinshares/xbt…

quarterly fund inflows across the industry for Q1 2021 are already at $4.2B so far compared to $7B in all of 2020.

@xbtprovider and CS Physical. the holdings referenced by these ETPs can be seen here: real-time-attest.trustexplorer.io/coinshares/xbt…

quarterly fund inflows across the industry for Q1 2021 are already at $4.2B so far compared to $7B in all of 2020.

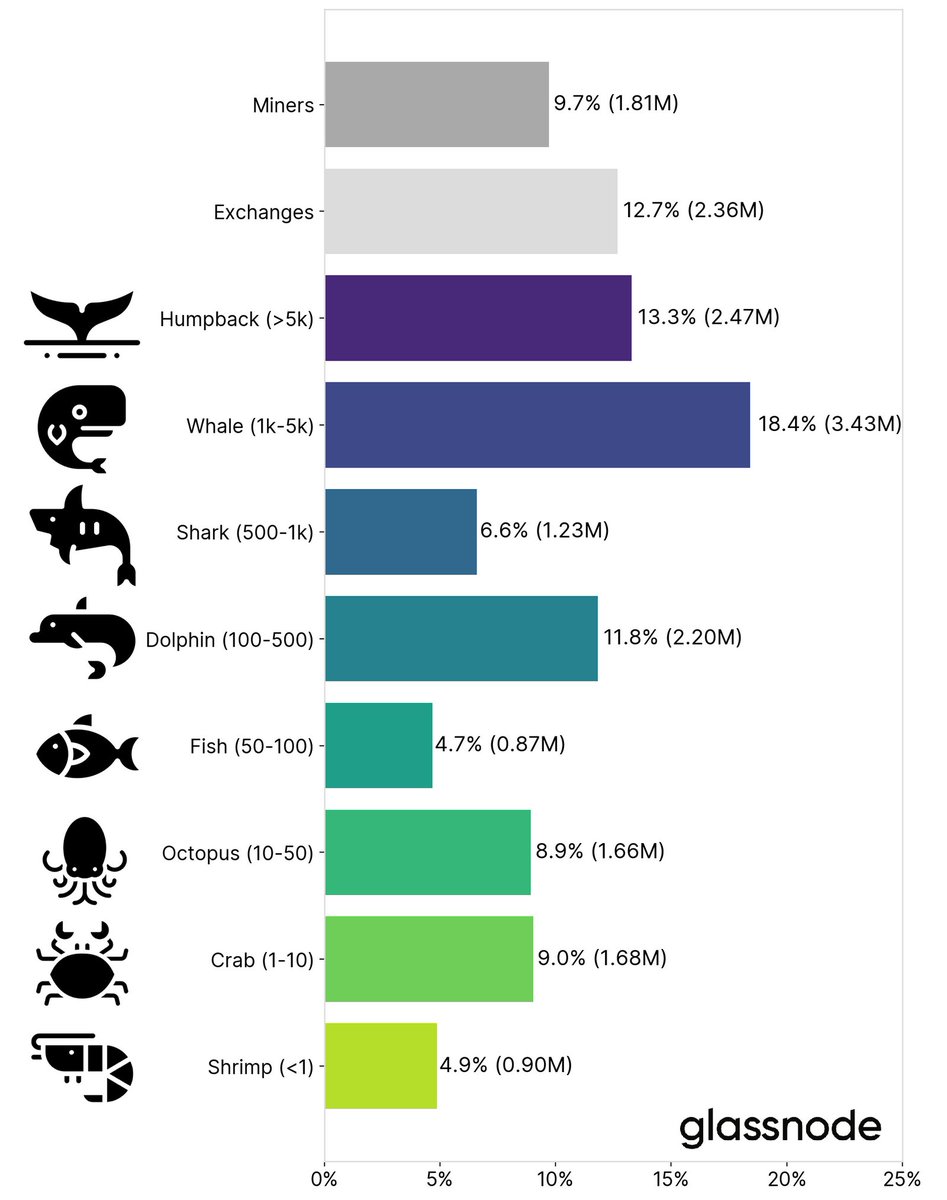

5/ next, let's talk retail v institutional activity.

crypto continues to be a retail-heavy market. @jpmorgan research published the below chart yesterday... (caution: research methodology is fairly rudimentary, so take this as directional guidance)

crypto continues to be a retail-heavy market. @jpmorgan research published the below chart yesterday... (caution: research methodology is fairly rudimentary, so take this as directional guidance)

6/ with stimulus checks or "stimmy" slated to go out on Friday and through the weekend, crypto twitter was abuzz with folks itching to spend their stimmy on #bitcoin

traders geared up for stimmy inflows - resulting in call options pricing higher as spot prices trended higher

traders geared up for stimmy inflows - resulting in call options pricing higher as spot prices trended higher

7/ crypto price volatility is largely a result of moves in derivatives markets

open interest for bitcoin futures hit all time highs of $23B on Saturday, and is currently sitting at around $21B

ethereum is also at record high OIs around $7B

open interest for bitcoin futures hit all time highs of $23B on Saturday, and is currently sitting at around $21B

ethereum is also at record high OIs around $7B

8/ note: crypto derivatives market are growing at an astounding pace, with increased participation and volume.

our @CoinSharesCo portfolio co @tradeparadigm accounts for 20-30% of global crypto derivative market share, their data is a treasure trove!

paradigm.co/platform-activ…

our @CoinSharesCo portfolio co @tradeparadigm accounts for 20-30% of global crypto derivative market share, their data is a treasure trove!

paradigm.co/platform-activ…

9/ when the Asian trading session opened on Monday morning, we saw profit taking. Market depth for the BTC-USD trade pair was heavily skewed towards the sell side early Monday morning.

ps: sub to @KaikoData's weekly newsletter to get these types of insights

ps: sub to @KaikoData's weekly newsletter to get these types of insights

10/ this resulted in some liquidations on Sunday and into Monday on the way down, which contributed to some of the market downturn.

this coupled with the CFTC / binance news and india's potential crypto ban contributed to deleveraging.

this coupled with the CFTC / binance news and india's potential crypto ban contributed to deleveraging.

11/ Important to note – leverage in crypto markets is very expensive.

This results in the market reacting strongly to volatility in either direction, as maintaining leveraged positions is extremely costly, much more so than in traditional markets.

This results in the market reacting strongly to volatility in either direction, as maintaining leveraged positions is extremely costly, much more so than in traditional markets.

12/ however, despite this recent dip, buy demand remains STRONG which translates into dips getting bought.

volatility has been very high over the last few months, with bitcoin trebling in price over a three month period, and traders are benefitting from that price action.

volatility has been very high over the last few months, with bitcoin trebling in price over a three month period, and traders are benefitting from that price action.

13/ this is one person's perspective, but highly recommend tracking derivatives markets to understand spot markets

traders position (L/S) around sentiment which they glean from a variety of sources incl twitter chatter, @KaikoData, @glassnode, @skewdotcom, @coinmetrics and more

traders position (L/S) around sentiment which they glean from a variety of sources incl twitter chatter, @KaikoData, @glassnode, @skewdotcom, @coinmetrics and more

14/ institutions and retail are less sensitive to sentiment - they tend to hold positions longer due to LT cap gains tax impact. for this group, fund flows and spot volumes are the place to watch!

hope this provides some context and let me know what i missed!

hope this provides some context and let me know what i missed!

• • •

Missing some Tweet in this thread? You can try to

force a refresh