1/ You don't have to trade every day to make good money. In fact, shorter term time frames can actually be more challenging because signals are influence by higher time and lower time frames. Let things line up and take the few trades that REALLY skew things in your favor.

2/ Commodities are about to hit a brick wall. Everyone says inflation. NO!! Weeklies are awesome for long term. Line up RSI and buyer/seller ADX spikes for best results. Throw in some trend lines which correlate and you have a perfect set up.

3/ Time frames are absolutely critical. Buyer/seller or RSI spikes on the monthly may be good for more than a year. Weekly for 6-12 months. Daily for 1-4 months. 60 min - 1-3 weeks. Don't overplay signals

4/ Buyers and sellers are in constant battle. When one group takes control, the ADX overall rises. Even if a correction follows, the trend will likely continue when ADX is high. However, a falling ADX means the trend is TERMINAL

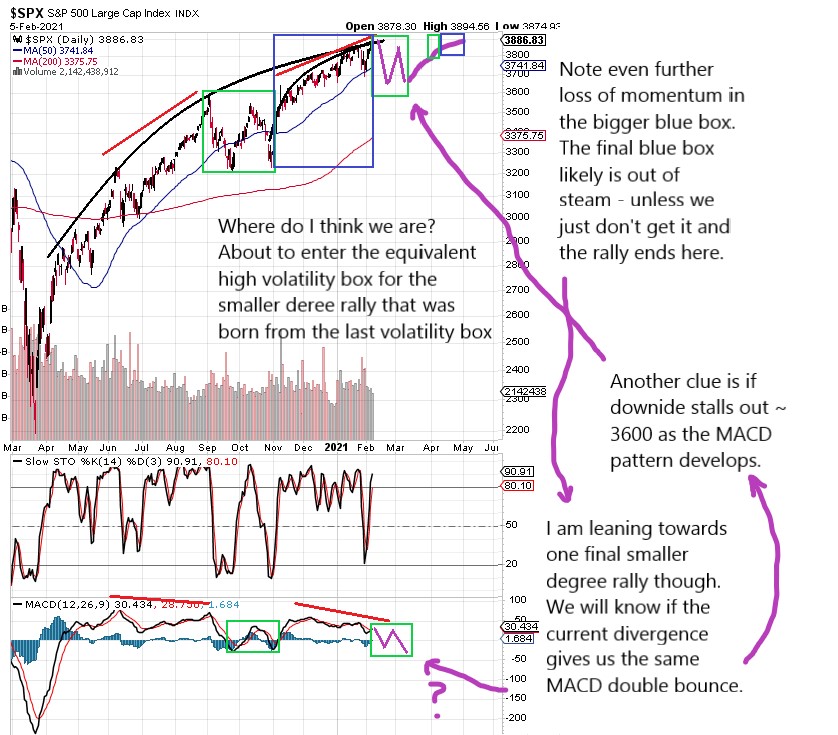

5/ This is a weekly time frame. The higher the time, the more solid the play. Note extremely high MACD but ADX fell entire rally. This fckr is dead as a door nail and we WILL absolutely retrace all of the last year rally in time.

6/ In fact, if ADX spikes while doing so, you can expect even MORE lower prices after retrace. Hence my call for S&P 600 in a few years. Long term investors need to get out NOW. Many about to get rolled over.

6/ Sorry that was monthly time frame so even more extreme long term.

7/ This is also not a timing play. Top could be tomorrow or a few weeks from now. But main point is that within 2-4 years, prices on a lot of things will be decimated and many WILL be crushed.

• • •

Missing some Tweet in this thread? You can try to

force a refresh