1/ Something that keeps me excited about $UBER is it’s global operations. One of the secret sauces to scaling up Uber Eats so quickly was that we had small teams around the world ready to help launch a new product.

2/ Unlike a $GOOG or $FB, Uber is extremely decentralized. Partly because it’s a physical product and partly because execution and strategy require a lot of “boots on the ground” for localization (regulations, marketing, competition, etc).

3/ You have some centralized resources such as engineering, product, etc., largely based in San Fransisco. Then there’s Central Operations, they run scaled processes better done at a continental level (Latam, Europe, etc). And then you have Local Operations.

4/ Large countries like France, Brazil, etc tend to have dedicated Local Operations on top of managing other smaller markets in the region. The “primitive” or basic make up of these teams is a GM, an Ops Manager, a Marketing Manager, and a Restaurant Manager (for Eats only).

5/ Together, with a modular and flexible tech infrastructure, these teams create an almost “Operations-as-a-Service”. You can build (or acquire) new products and use these teams as a platform to quickly iterate and scale new businesses.

6/ Which is one of the reasons why I’m excited by Uber’s recent acquisitions of Postmates (white label delivery), Cornershop (grocery), and Drizzly (alcohol). Integrating a business globally is hard but having teams around the world to use as a springboard is a big advantage.

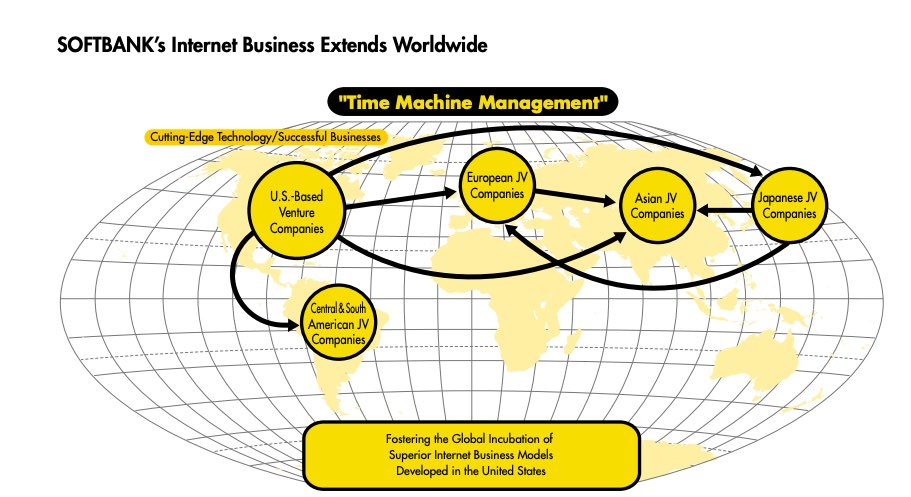

7/ The last piece I’ll add is that Uber to a certain extent is borrowing a page from Masa’s “time machine”. Local teams find products, tactics, etc that work well (sometimes from competitors) in one country and export them globally.

H/t @lillianmli

H/t @lillianmli

8/ Ie Uber’s been implementing parts of DoorDash’s US playbook globally such as “over the top” and Dashpass.

So, I think there are some real headwinds to the biz such as regs and competition but I think the real optionality from global Ops tends to go under appreciated.

So, I think there are some real headwinds to the biz such as regs and competition but I think the real optionality from global Ops tends to go under appreciated.

• • •

Missing some Tweet in this thread? You can try to

force a refresh