A primer on Small Savings Scheme

Do re-tweet & help us educate more investors

Join telegram at – t.me/kirtanshahcfp (1/n)

Do re-tweet & help us educate more investors

Join telegram at – t.me/kirtanshahcfp (1/n)

Central Governments have been running a fiscal deficit for decades together. Fiscal deficit means that the government’s income is less than the expense. 100 of income & 120 of expense, you call the 20 as fiscal deficit (2/n)

How do governments fund the gap of 20? Where do you get it from?

Majorly by borrowing

-Issues a 10 year maturity bond every year (G-Sec)

-Small saving schemes (3/n)

Majorly by borrowing

-Issues a 10 year maturity bond every year (G-Sec)

-Small saving schemes (3/n)

Generally institutions participate in the 10 years G-sec borrowing of the government, Banks, NBFC’s, MF’s, Insurance Companies, and Corporates. Government is trying to increase the retail participation. Retail lends to the government through the small savings schemes (4/n)

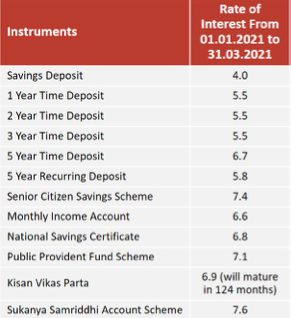

There are multiple products in the small savings space. The below table talks about the basic data you need on them (5/n)

FM just announced that the rates won't change as published yesterday

So the rates will still stay as attached (6/n)

https://twitter.com/nsitharaman/status/1377446641356087297?s=20

So the rates will still stay as attached (6/n)

- Time deposits, NSC, KVP exactly work like cumulative FD’s

- Recurring deposits, PPF, Sukanya works like SIPs. You invest at regular intervals & receive a maturity proceed (7/n)

- Recurring deposits, PPF, Sukanya works like SIPs. You invest at regular intervals & receive a maturity proceed (7/n)

- Senior citizen savings scheme & Monthly income scheme gives you payout at regular intervals after you deposit a lumpsum for investment (8/n)

PPF & Sukanya Samriddhi rates are floating. Which means, every time the rate changes, your accumulated corpus would receive that new changed rate of interest and hence falling rates affect both of them (9/n)

Others are fixed. You lock your return at the time of investing and receive the same till maturity. So any change in rates won't affect already invested investments (10/n)

You also get 80C advantage of 1,50,000 in the below schemes

-Sukanya Samriddhi

-PPF

-Senior Citizen Savings Scheme

-NSC

-National Savings Time Deposit (5 years) (11/n)

-Sukanya Samriddhi

-PPF

-Senior Citizen Savings Scheme

-NSC

-National Savings Time Deposit (5 years) (11/n)

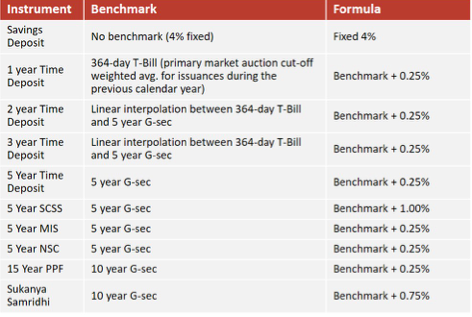

Is there a point in abusing the government (past, present, future) for the change in rates? NO

With India growing from developing to develop, rates are going to fall and it is not random but decided based on a formula by the Shyamala Gopinath report (12/n)

With India growing from developing to develop, rates are going to fall and it is not random but decided based on a formula by the Shyamala Gopinath report (12/n)

So the thread had detailed suggestions on what to do now when rates are revised lower. But now that FM has rolled back the rate reduction, will stop here :)

Have written multiple such threads in the past,link below if personal finance interests you (END)

Have written multiple such threads in the past,link below if personal finance interests you (END)

https://twitter.com/KirtanShahCFP/status/1337953717274832896?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh