The problem with $ETH is that the more users there are, the slower and more expensive it gets. ETH's continued dominance as the de-facto smart contract layer depends on its ability to scale.

Let me ELI5 the scaling solutions & projects. 1/

Let me ELI5 the scaling solutions & projects. 1/

@ethereum Power users: Even if you don't know about ZK-Rollups, Sharding, or Plasma, the future of the most active blockchain depends on it.

@VitalikButerin has been thinking about it for 7 years

2/

@VitalikButerin has been thinking about it for 7 years

2/

Scaling is a priority for ETH. Miners have been cashing in, seeing a 50% increase in revenues compared to the highs of 2017.

For users, ETH can be prohibitively expensive. This has been terrific for competitors like #BSC, $SOL and $DOT

3/

For users, ETH can be prohibitively expensive. This has been terrific for competitors like #BSC, $SOL and $DOT

3/

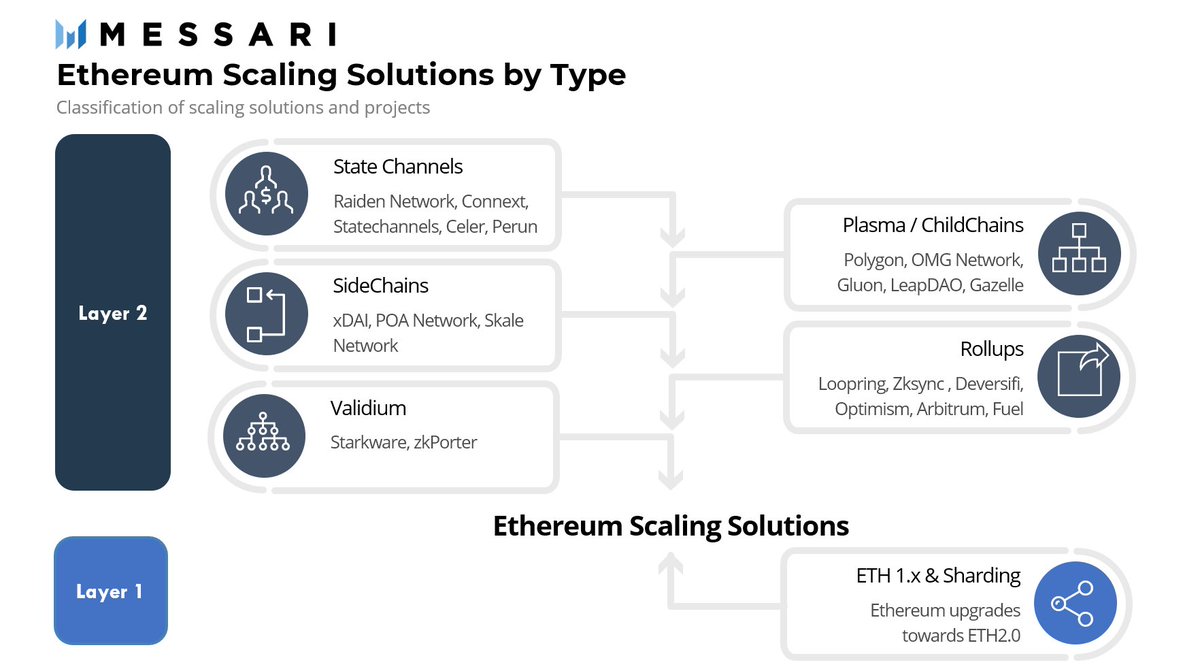

There are 2 types of scaling solutions: Layer 1 (onchain, everything on ETH) and Layer 2 (data and computation done offchain). The different types are

1. State Channels

2. Plasma / Childchains

3. Sidechains

4. Rollups

5. Validium

6. Sharding (part of ETH2)

4/11

1. State Channels

2. Plasma / Childchains

3. Sidechains

4. Rollups

5. Validium

6. Sharding (part of ETH2)

4/11

For a list of projects using these techs, see the report messari.io/article/ecosys…

Let's go through a few of the types... 5/11

Let's go through a few of the types... 5/11

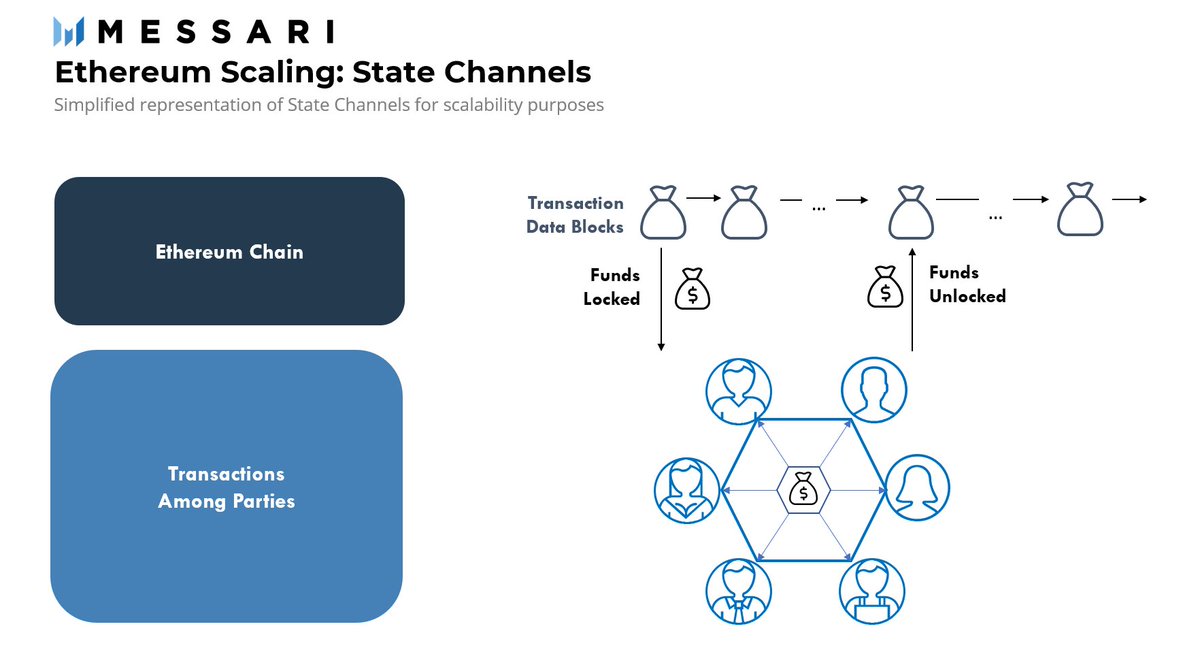

State Channels: allow users to transact many times off-chain while only submitting two transactions to the Ethereum network -one at the time of opening and one at the time of closing the channel.

6/11

6/11

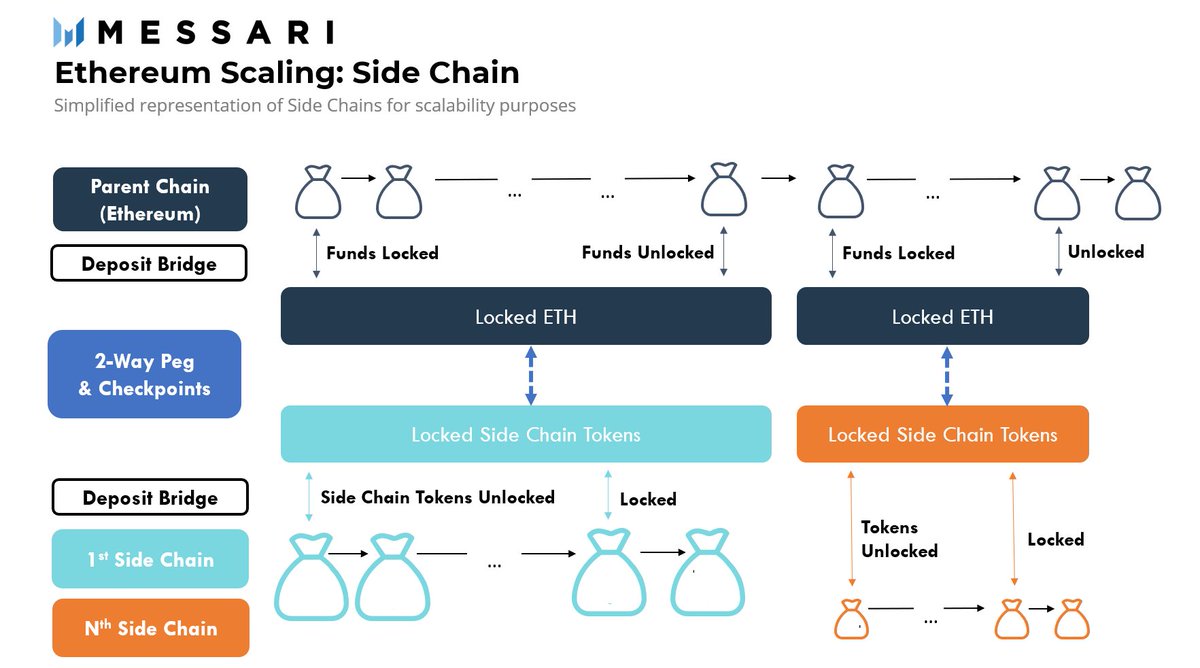

Sidechains: are a separate blockchain running alongside and communicating with Ethereum. It’s connected to Ethereum using a peg with another token, creating a two-way bridge.

7/11

7/11

Rollups allow thousands of transactions to be bundled in a single Rollup block.

We cover Optimistic Rollups and ZK Rollups in the report messari.io/article/ecosys…

8/11

We cover Optimistic Rollups and ZK Rollups in the report messari.io/article/ecosys…

8/11

Sharding simply means a network can be split into many rails to process transactions in parallel. There are also no deposits or funds staked in shards, as it’s part of the mainchain

9/11

9/11

ETH is migrating to ETH2.0, as complex as sailing a boat while trying to build a new boat attached to it.

Importantly, it's moving from PoW to PoS. Here's how they compare:

10/11

Importantly, it's moving from PoW to PoS. Here's how they compare:

10/11

While Ethereum is working towards ETH2, projects are concurrently offering a hybrid of technologies to provide the best scaling solutions.

Composability and network effects will create a multiper effect on scaling.

Read more about the ecosystem:

messari.io/article/ecosys…

11/11

Composability and network effects will create a multiper effect on scaling.

Read more about the ecosystem:

messari.io/article/ecosys…

11/11

• • •

Missing some Tweet in this thread? You can try to

force a refresh