Eight years ago, I told an OLD portfolio manager that FinTech would CRUSH banks.

He told me that banks have infinite capital, and will buy any FinTech they see as a threat.

Turns out, we were both right.

Time for a thread 👇👇👇

He told me that banks have infinite capital, and will buy any FinTech they see as a threat.

Turns out, we were both right.

Time for a thread 👇👇👇

Bank stocks went up +140%, they strategically acquired many FinTech competitors and even incubated their own technology.

BUT...

Quietly, the FinTech industry was CHIPPING AWAY. Gradually, then suddenly, this happened…

BUT...

Quietly, the FinTech industry was CHIPPING AWAY. Gradually, then suddenly, this happened…

They took a +30% bite of the finance pie. And the size of that bite is growing at an accelerating pace.

“Technological change is always slower than we think. BUT it’s always more profound than we could have ever imagined.”

“Technological change is always slower than we think. BUT it’s always more profound than we could have ever imagined.”

This week, let’s breakdown DIGITAL WALLETS in 1 MIN!

1.DIGITAL WALLETS 👉 What are they?

2.COMPETITIVE LANDSCAPE 👉 How will banks compete?

3.FUTURE 👉 One wallet to rule them all!

Let’s get started!

1.DIGITAL WALLETS 👉 What are they?

2.COMPETITIVE LANDSCAPE 👉 How will banks compete?

3.FUTURE 👉 One wallet to rule them all!

Let’s get started!

1.1/ DIGITAL WALLETS 👉 What are they?

Digital wallets are a digital version of your physical wallet.

It allows you to pay for things, usually through a mobile phone app, and even stores gift cards, tickets and more.

Digital wallets are a digital version of your physical wallet.

It allows you to pay for things, usually through a mobile phone app, and even stores gift cards, tickets and more.

1.2/ Why have they become so popular?

Because we’ve been spoiled by ONLINE SHOPPING and SOCIAL MEDIA.

We are now demanding the same user experience from our financial services.

Because we’ve been spoiled by ONLINE SHOPPING and SOCIAL MEDIA.

We are now demanding the same user experience from our financial services.

1.3/ How did they start?

Back in the late 90s, we started sending money on the internet - the birth of Digital Payments.

Let’s take a quick peek back — it didn’t happen overnight!

Back in the late 90s, we started sending money on the internet - the birth of Digital Payments.

Let’s take a quick peek back — it didn’t happen overnight!

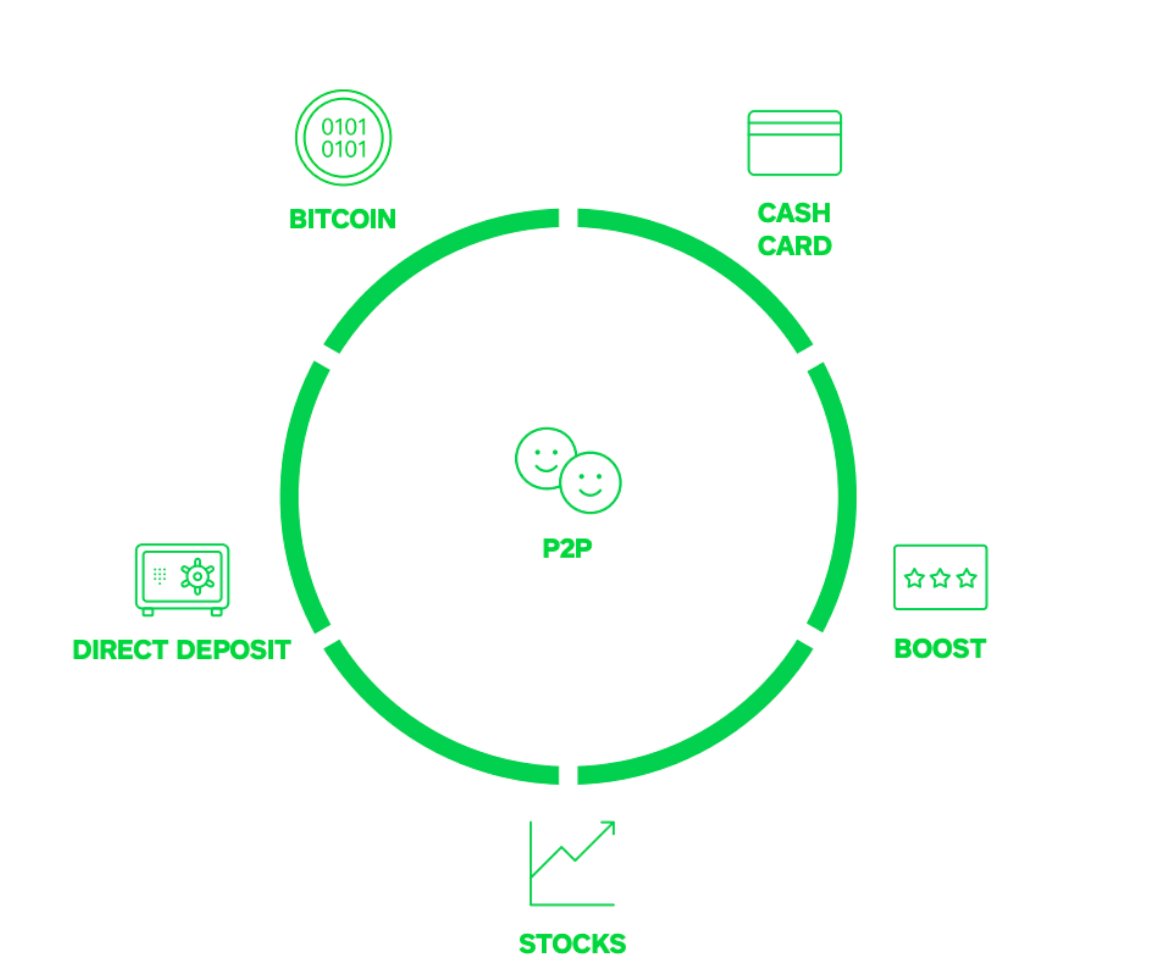

1.4/ VENMO & CASH APP

Square’s Cash App & PayPal’s Venmo are the two most POPULAR consumer digital wallets in the U.S.

Before we get into a comparison of the two, let’s look at the competitive landscape and how banks are going to compete.

Square’s Cash App & PayPal’s Venmo are the two most POPULAR consumer digital wallets in the U.S.

Before we get into a comparison of the two, let’s look at the competitive landscape and how banks are going to compete.

2.1/ COMPETITIVE LANDSCAPE

The global digital wallet market is now a >$1 TRILLION sector.

To put that in perspective, it’s basically equivalent to the Top 10 largest banks in the US.

The global digital wallet market is now a >$1 TRILLION sector.

To put that in perspective, it’s basically equivalent to the Top 10 largest banks in the US.

2.2/ How will banks compete?

The digital wallet sector is expected to grow at nearly 30% a year to reach over $7 trillion by 2027.

It’s going to be hard and expensive for banks to compete.

The digital wallet sector is expected to grow at nearly 30% a year to reach over $7 trillion by 2027.

It’s going to be hard and expensive for banks to compete.

2.3/ BANK STRATEGY

In a nutshell, banks are using old & tired ways of landing customers.

“Advertising and promotion, postage, stationery and supplies”

In a nutshell, banks are using old & tired ways of landing customers.

“Advertising and promotion, postage, stationery and supplies”

2.4/ DIGITAL WALLET STRATEGY

Digital Wallet companies are using edgy social media marketing & influencers as well as unique “branded” identifiers.

This pulls in new customers cheaply.

Digital Wallet companies are using edgy social media marketing & influencers as well as unique “branded” identifiers.

This pulls in new customers cheaply.

2.5/ BANKS vs. DIGITAL

These tactics are working so well the numbers speak for themselves.

The customer acquisition cost for Digital Wallets is $20 versus Banks at $925!

These tactics are working so well the numbers speak for themselves.

The customer acquisition cost for Digital Wallets is $20 versus Banks at $925!

3/ CASH APP vs. VENMO

Even though CASH APP is bigger and has more growth, I won't be buying it YET.

See WHY (and a full analysis) below!

gritcapital.substack.com/welcome

Even though CASH APP is bigger and has more growth, I won't be buying it YET.

See WHY (and a full analysis) below!

gritcapital.substack.com/welcome

4.1/ Future: One Digital Wallet to Rule them All!

I imagine a future where holding, sending, realizing & borrowing value whether in the form of fiat, crypto, NFT’s, stocks, real estate etc...

is possible from ONE digital wallet.

I imagine a future where holding, sending, realizing & borrowing value whether in the form of fiat, crypto, NFT’s, stocks, real estate etc...

is possible from ONE digital wallet.

4.2/ THE FUTURE

A push of a button would enable powerful transactions like these:

- SEND stocks or crypto as gifts to my friends’ kids for Christmas

- INVEST in new start-ups in real-time after falling in love with their product

A push of a button would enable powerful transactions like these:

- SEND stocks or crypto as gifts to my friends’ kids for Christmas

- INVEST in new start-ups in real-time after falling in love with their product

4.3/ THE FUTURE

- TRADE those points to pay for anything from AirBnB rental to buying Stocks

- BUY/SELL a house instantaneously

- BORROW from my home equity to invest in stocks

- TRADE those points to pay for anything from AirBnB rental to buying Stocks

- BUY/SELL a house instantaneously

- BORROW from my home equity to invest in stocks

4.4/ THE FUTURE

- LIST & SELL content I have created instantly via NFT (Non-Fungible Tokens)

- DONATE to charity using any method in my wallet

All settlements and accounting would be built in. No fuss or headaches at tax time!

- LIST & SELL content I have created instantly via NFT (Non-Fungible Tokens)

- DONATE to charity using any method in my wallet

All settlements and accounting would be built in. No fuss or headaches at tax time!

4.5/ TIMELINE

To make this all possible you would have to API all the different platforms (brokerage, bank, crypto, lending etc) into one platform.

The world when we have ONE DIGITAL WALLET TO RULE THEM ALL👇

To make this all possible you would have to API all the different platforms (brokerage, bank, crypto, lending etc) into one platform.

The world when we have ONE DIGITAL WALLET TO RULE THEM ALL👇

5/ GRIT NEWSLETTER

Every week I write a newsletter to ~20k investors including hedge funds, pension funds, investment advisors & billionaires.

SUBSCRIBE to see how we’re playing this! 👇

gritcapital.substack.com/welcome

Every week I write a newsletter to ~20k investors including hedge funds, pension funds, investment advisors & billionaires.

SUBSCRIBE to see how we’re playing this! 👇

gritcapital.substack.com/welcome

• • •

Missing some Tweet in this thread? You can try to

force a refresh