3 months ago, I announced I was buying Bitcoin.

It was at $13k.

Today, it’s $49k.

Why am I still BULLISH?

Time for a thread 👇👇👇

It was at $13k.

Today, it’s $49k.

Why am I still BULLISH?

Time for a thread 👇👇👇

1/ $1 TRILLION MARKET CAP

Bitcoin can now buy you:

- A Tesla

- A down payment on a house

- A new financial advisor ; )

And it’s bigger than the top financial institutions in the world.

Bitcoin can now buy you:

- A Tesla

- A down payment on a house

- A new financial advisor ; )

And it’s bigger than the top financial institutions in the world.

2/ THE FED.

The FED printing an ungodly amount of money in response to COVID — tanking the US dollar — has helped spark the run.

But it's much more than that...

The FED printing an ungodly amount of money in response to COVID — tanking the US dollar — has helped spark the run.

But it's much more than that...

3/ BULLS.

Naysayers are becoming believers, corporations & the world's largest endowment funds are getting in!

Let's Break It Down!

👉10 Reasons I am BULLISH On Bitcoin

Naysayers are becoming believers, corporations & the world's largest endowment funds are getting in!

Let's Break It Down!

👉10 Reasons I am BULLISH On Bitcoin

4.1/ CORPORATIONS.

Tesla buys $1.5B. They have now made ~$1B off their Bitcoin purchase.

Prompting CFOs around the world to ask themselves: ‘Should we be buying BTC too?’

+$4 Trillion of cash on corporate balance sheets in the U.S alone!

Tesla buys $1.5B. They have now made ~$1B off their Bitcoin purchase.

Prompting CFOs around the world to ask themselves: ‘Should we be buying BTC too?’

+$4 Trillion of cash on corporate balance sheets in the U.S alone!

4.2/ ENDOWMENTS.

Harvard, Yale & Brown endowments have been buying for over 1 year.

These schools do extensive due diligence. Some of the brightest capital allocators in the world.

No joking around with YOLO TRADING here!

Harvard, Yale & Brown endowments have been buying for over 1 year.

These schools do extensive due diligence. Some of the brightest capital allocators in the world.

No joking around with YOLO TRADING here!

4.3/ VISA & MASTERCARD

The 2 largest payment processing networks in the world announced they will enable their merchants & clients to transact with BTC.

This will unlock TRILLIONS in transaction volume!

The 2 largest payment processing networks in the world announced they will enable their merchants & clients to transact with BTC.

This will unlock TRILLIONS in transaction volume!

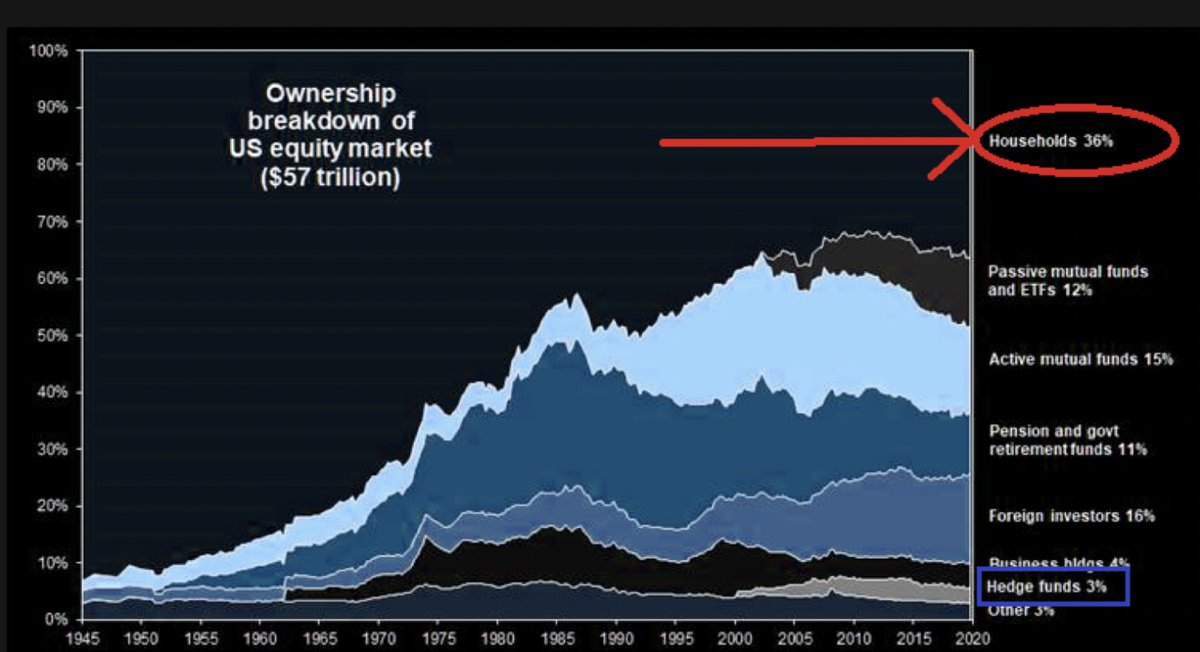

4.4/ WALL STREET IS SHORT.

First, because they simply don’t own enough as most is held by retail.

Second, hedge funds are currently short BTC via CME futures contracts which seems rather dangerous.

First, because they simply don’t own enough as most is held by retail.

Second, hedge funds are currently short BTC via CME futures contracts which seems rather dangerous.

4.5/ BLACKROCK.

Blackrock, the world’s largest asset manager, has started to buy Bitcoin!

Intriguingly, it’s their CIO of Fixed Income who is leading the charge. I guess he got bored with bonds ; )

Blackrock, the world’s largest asset manager, has started to buy Bitcoin!

Intriguingly, it’s their CIO of Fixed Income who is leading the charge. I guess he got bored with bonds ; )

4.6/ COINBASE IPO.

The second-largest crypto exchange is going public under the SEC’s watch.

With the SEC approving Coinbase’s +$100B IPO, it is very unlikely that cryptocurrencies will be banned!

The second-largest crypto exchange is going public under the SEC’s watch.

With the SEC approving Coinbase’s +$100B IPO, it is very unlikely that cryptocurrencies will be banned!

4.7/ BITCOIN ETF

North America’s first Bitcoin ETF launches with record-breaking AUM.

Most institutions can’t buy BTC directly & complain that their only access is through closed-end funds that trade at big premiums.

ETFs are a solution to this problem.

North America’s first Bitcoin ETF launches with record-breaking AUM.

Most institutions can’t buy BTC directly & complain that their only access is through closed-end funds that trade at big premiums.

ETFs are a solution to this problem.

4.8/ WALLETS.

Investors are opening Bitcoin wallets in record amounts.

January saw the highest ever figures with +22MM ACTIVE wallets.

Investors are opening Bitcoin wallets in record amounts.

January saw the highest ever figures with +22MM ACTIVE wallets.

4.9/ SEC.

SEC have green-lighted banks to custody Stablecoins. This legitimizes crypto assets.

It was a quiet announcement not caught by many.

Very bullish in my opinion!

SEC have green-lighted banks to custody Stablecoins. This legitimizes crypto assets.

It was a quiet announcement not caught by many.

Very bullish in my opinion!

4.10/ VOLATILITY 👇

BTC volatility is going down.

85% corrections used to be the norm but, in a sign that the asset class is maturing, the sell-offs are becoming more orderly.

There are now more investors, more sophisticated investors & less overall fear.

BTC volatility is going down.

85% corrections used to be the norm but, in a sign that the asset class is maturing, the sell-offs are becoming more orderly.

There are now more investors, more sophisticated investors & less overall fear.

5/ BEARS.

Some BEARISH announcements too:

1. India prepares bill to ban crypto in favour of its own digital currency.

2. FinCEN trying to impose new reporting requirements

3. Man can't access +$330M BTC highlighting risk & friction of self-custody.

Some BEARISH announcements too:

1. India prepares bill to ban crypto in favour of its own digital currency.

2. FinCEN trying to impose new reporting requirements

3. Man can't access +$330M BTC highlighting risk & friction of self-custody.

6/ FINANCIAL PLUMBING.

Between the $GME T+3 fiasco and yesterday's stress... it seems the financial system could use some new plumbing!

Bitcoin might be the answer..

Between the $GME T+3 fiasco and yesterday's stress... it seems the financial system could use some new plumbing!

Bitcoin might be the answer..

8/ GRIT NEWSLETTER.

Want more?

Every week I write a newsletter to +11k investors, including hedge funds, billionaires, institutions & retail investors.

SUBSCRIBE (it's Free!) 👇👇👇

gritcapital.substack.com/welcome

Want more?

Every week I write a newsletter to +11k investors, including hedge funds, billionaires, institutions & retail investors.

SUBSCRIBE (it's Free!) 👇👇👇

gritcapital.substack.com/welcome

9/ YOUTUBE.

Also, SUBSCRIBE to my YouTube channel for more insights!

Also, SUBSCRIBE to my YouTube channel for more insights!

10/ SHOUTOUTS.

To all my #BITCOIN believers.

A special thanks to @APompliano for his diamond hands through it all.

Been some cold & dark bitcoin winters.

To all my #BITCOIN believers.

A special thanks to @APompliano for his diamond hands through it all.

Been some cold & dark bitcoin winters.

• • •

Missing some Tweet in this thread? You can try to

force a refresh