When an asset class grows 60x in 1 year from $1B to $60B and you’ve got:

Mark Cuban saying it reminds him of the beginning of the Internet.

…It’s worth tuning into.

Time for a thread 👇👇👇

Mark Cuban saying it reminds him of the beginning of the Internet.

…It’s worth tuning into.

Time for a thread 👇👇👇

This week, I break down Decentralized Finance!

1. DeFi 👉 What is it & why should you care?

2. Four Big Uses 👉 Lending, Stablecoins, Trading & NFTs

1. DeFi 👉 What is it & why should you care?

2. Four Big Uses 👉 Lending, Stablecoins, Trading & NFTs

1/ DEFI: WHAT IS IT?

In a nutshell, DeFi is doing finance activities OUTSIDE the financial system.

Like lending, trading, crowdfunding, insurance, derivatives, digital collectibles etc.

It has the potential to disrupt the ENTIRE financial economy.

In a nutshell, DeFi is doing finance activities OUTSIDE the financial system.

Like lending, trading, crowdfunding, insurance, derivatives, digital collectibles etc.

It has the potential to disrupt the ENTIRE financial economy.

2/ Ethereum (ETH)

Most DeFi projects are built on ETH, the world’s 2nd largest cryptocurrency, which allows for the creation of 'smart contracts.’

Here’s a simple analogy to understand the difference between BTC & ETH...

Most DeFi projects are built on ETH, the world’s 2nd largest cryptocurrency, which allows for the creation of 'smart contracts.’

Here’s a simple analogy to understand the difference between BTC & ETH...

3/ BTC vs ETH.

BTC is a basic phone it enables you to send & receive calls/texts. BTC enables you to send/receive value.

ETH is a smartphone with apps with different & complex uses.

Think of ETH as ‘programmable money.’

Smart contracts are the tool used to program it.

BTC is a basic phone it enables you to send & receive calls/texts. BTC enables you to send/receive value.

ETH is a smartphone with apps with different & complex uses.

Think of ETH as ‘programmable money.’

Smart contracts are the tool used to program it.

4/ FOUR BIG USES:

Now, let’s breakdown the BIG uses of DeFi:

1. Lending

2. Stablecoins

3. Trading

4. Digital Collectibles (NFTs)

Now, let’s breakdown the BIG uses of DeFi:

1. Lending

2. Stablecoins

3. Trading

4. Digital Collectibles (NFTs)

5.1/ LENDING

People can now make fees lending their crypto, which dramatically increases its utility.

Previously your only two options were either TRADE or HODL.

Now, you can earn up to 15% lending crypto versus less than 1% in a savings account.

People can now make fees lending their crypto, which dramatically increases its utility.

Previously your only two options were either TRADE or HODL.

Now, you can earn up to 15% lending crypto versus less than 1% in a savings account.

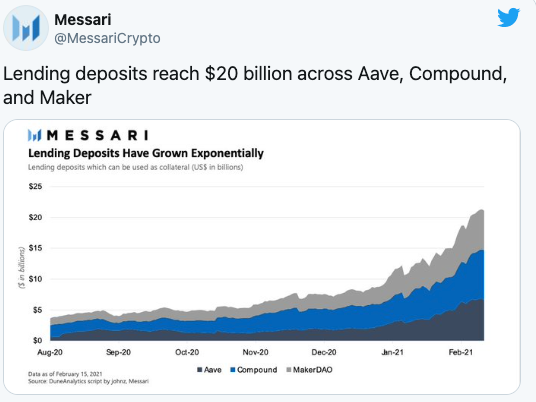

5.2/ LENDING.

You can also borrow fiat with your crypto.

For those with wealth tied-up in crypto who need cash, a fiat loan can be a great way to get liquidity while not losing investment exposure or needing to pay taxes on your gains.

Crypto lending is now a +$20B business.

You can also borrow fiat with your crypto.

For those with wealth tied-up in crypto who need cash, a fiat loan can be a great way to get liquidity while not losing investment exposure or needing to pay taxes on your gains.

Crypto lending is now a +$20B business.

6.1/ STABLECOINS.

Bitcoin is bashed for being too volatile.

Enter stablecoins. Created to reduce volatility.

Coins pegged to another asset. USD being the most popular.

“Put simply, if there are 500k USD-pegged coins in circulation, there should be $500k sitting in a bank.”

Bitcoin is bashed for being too volatile.

Enter stablecoins. Created to reduce volatility.

Coins pegged to another asset. USD being the most popular.

“Put simply, if there are 500k USD-pegged coins in circulation, there should be $500k sitting in a bank.”

6.2/ STABLECOINS.

The knock on stablecoins is that you can’t have full decentralization if your coin is tied to the value of a fiat asset sitting in a bank account in a centralized system.

BUT, it’s helping bridge the gap between traditional finance and the crypto world.

The knock on stablecoins is that you can’t have full decentralization if your coin is tied to the value of a fiat asset sitting in a bank account in a centralized system.

BUT, it’s helping bridge the gap between traditional finance and the crypto world.

7.1/ TRADING.

Stocks trade on stock exchanges (NASDAQ, NYSE).

Cryptocurrencies trade on their own exchanges (Coinbase, Binance).

Both of these types of exchanges are CENTRALIZED.

There’s a ‘middle-man’ who owns & operates it and users place funds under their control.

Stocks trade on stock exchanges (NASDAQ, NYSE).

Cryptocurrencies trade on their own exchanges (Coinbase, Binance).

Both of these types of exchanges are CENTRALIZED.

There’s a ‘middle-man’ who owns & operates it and users place funds under their control.

7.2/ TRADING.

Now, we have DECENTRALIZED exchanges.

- Transaction is peer-to-peer

- Users control their own funds

- No middlemen

The leader is Uniswap.

It’s the largest decentralized exchange & the 4th largest cryptocurrency exchange by volume in the world.

Now, we have DECENTRALIZED exchanges.

- Transaction is peer-to-peer

- Users control their own funds

- No middlemen

The leader is Uniswap.

It’s the largest decentralized exchange & the 4th largest cryptocurrency exchange by volume in the world.

7.3/ TRADING.

I highlight it because the sheer size in average daily trading volume compared to other major financial assets is noteworthy:

- S&P: $149B

- Gold: $145B

- Bitcoin: $75B

- Uniswap: $1B (in Jan. 2021)

I highlight it because the sheer size in average daily trading volume compared to other major financial assets is noteworthy:

- S&P: $149B

- Gold: $145B

- Bitcoin: $75B

- Uniswap: $1B (in Jan. 2021)

7.4/ TRADING.

What does DeFi mean for the world of stocks?

Take Fairmint. Their tech allows “investors to buy equity in a company, at any time. Companies can add an INVEST button as easily as they add a BUY W/APPLE PAY button.”

I predict financings one day will be LIVE 24/7 !

What does DeFi mean for the world of stocks?

Take Fairmint. Their tech allows “investors to buy equity in a company, at any time. Companies can add an INVEST button as easily as they add a BUY W/APPLE PAY button.”

I predict financings one day will be LIVE 24/7 !

8.1/ NFT.

Digital collectibles are the hottest new trend.

They are creating and selling Non-Fungible Tokens (NFTs):

“NFT is a special type of cryptographic token which represents something unique; NFTs are thus not mutually interchangeable.”

Digital collectibles are the hottest new trend.

They are creating and selling Non-Fungible Tokens (NFTs):

“NFT is a special type of cryptographic token which represents something unique; NFTs are thus not mutually interchangeable.”

8.2/ NFT.

NFTs initially took off in 2017 with popularity in buying digital cats (Cryptokitties) for hundreds of thousands of dollars.

NOW, it’s attracting serious interest from collectors & investors.

$100MM sold in the last 30 days and a total market size of +$350MM.

NFTs initially took off in 2017 with popularity in buying digital cats (Cryptokitties) for hundreds of thousands of dollars.

NOW, it’s attracting serious interest from collectors & investors.

$100MM sold in the last 30 days and a total market size of +$350MM.

8.3/ NFT.

Big names like the NBA, NIKE, Christie's Auction House & the bank BNP Paribas are all getting in on the action...

“The Complete MF Collection comprised of 20 pieces, sold in Dec for $3.5MM on a blockchain-based platform.”

Big names like the NBA, NIKE, Christie's Auction House & the bank BNP Paribas are all getting in on the action...

“The Complete MF Collection comprised of 20 pieces, sold in Dec for $3.5MM on a blockchain-based platform.”

8.4/ NFT.

NBA: Fans can buy, sell & collect limited-edition NBA highlight videos.

NIKE: Buy a pair of ‘CryptoKicks’ and receive a unique digital identifier attached to that shoe.

BNP PARIBAS: Investment Bank wrote a 140-page report on the flourishing NFT industry.

NBA: Fans can buy, sell & collect limited-edition NBA highlight videos.

NIKE: Buy a pair of ‘CryptoKicks’ and receive a unique digital identifier attached to that shoe.

BNP PARIBAS: Investment Bank wrote a 140-page report on the flourishing NFT industry.

8.5/ NFT.

In a newsletter in December, I wrote about how the wealthy top 1% love buying high-end art, antique cars & wine.

It helps diversify their portfolios into private uncorrelated & unique assets.

Now, thanks to NFTs it seems the other 99% can, too!

In a newsletter in December, I wrote about how the wealthy top 1% love buying high-end art, antique cars & wine.

It helps diversify their portfolios into private uncorrelated & unique assets.

Now, thanks to NFTs it seems the other 99% can, too!

9/ GRIT NEWSLETTER.

Want more?

Every week I write a newsletter to +13k investors, including hedge funds, billionaires, institutions & retail investors.

SUBSCRIBE (it's Free!) 👇👇👇

gritcapital.substack.com/welcome

Want more?

Every week I write a newsletter to +13k investors, including hedge funds, billionaires, institutions & retail investors.

SUBSCRIBE (it's Free!) 👇👇👇

gritcapital.substack.com/welcome

10/ YOUTUBE.

Also, SUBSCRIBE to my YouTube channel for more insights!

#DEFI #NFT #BITCOIN #ETHEREUM #NBA #NIKE #TOPSHOT #UNISWAP @Uniswap @mcuban @APompliano @NBA @nba_topshot @trevorkoverko @alex_sterk @CryptoKitties @dapperlabs

Also, SUBSCRIBE to my YouTube channel for more insights!

#DEFI #NFT #BITCOIN #ETHEREUM #NBA #NIKE #TOPSHOT #UNISWAP @Uniswap @mcuban @APompliano @NBA @nba_topshot @trevorkoverko @alex_sterk @CryptoKitties @dapperlabs

• • •

Missing some Tweet in this thread? You can try to

force a refresh