Sheffield United’s 2019/20 financial results covered a season when they finished 9th in the Premier League following promotion and reached the FA Cup quarter-finals, which was described by the club as “a respectable achievement”. Some thoughts follow #SUFC #twitterblades

This is the first year under new #SUFC owner Prince Abdullah after the High Court ruled that Kevin McCabe had to sell his 50% share to the Prince. This also triggered an agreement whereby the club had to purchase the stadium, training facility, gym, hotel and offices for £38m.

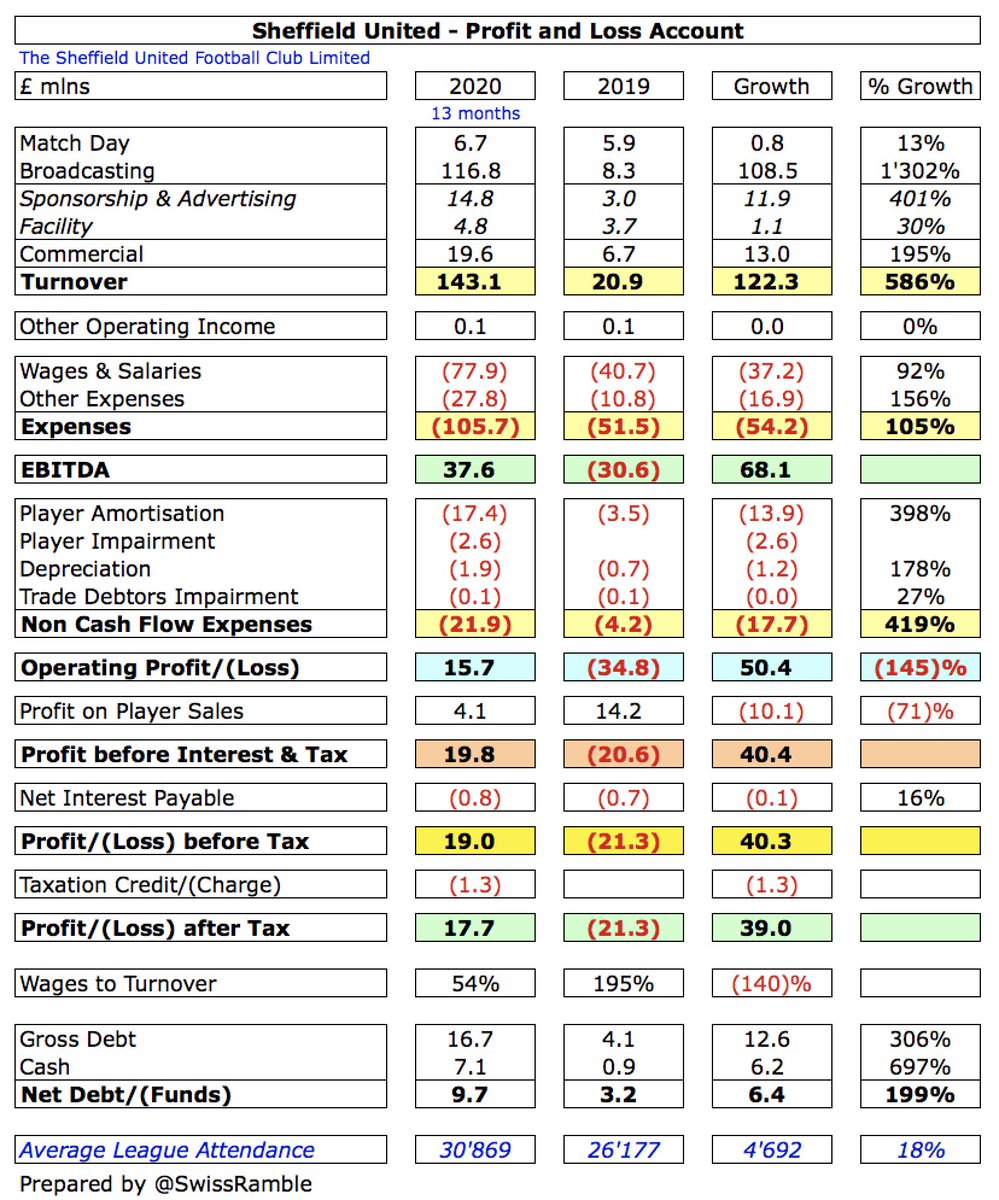

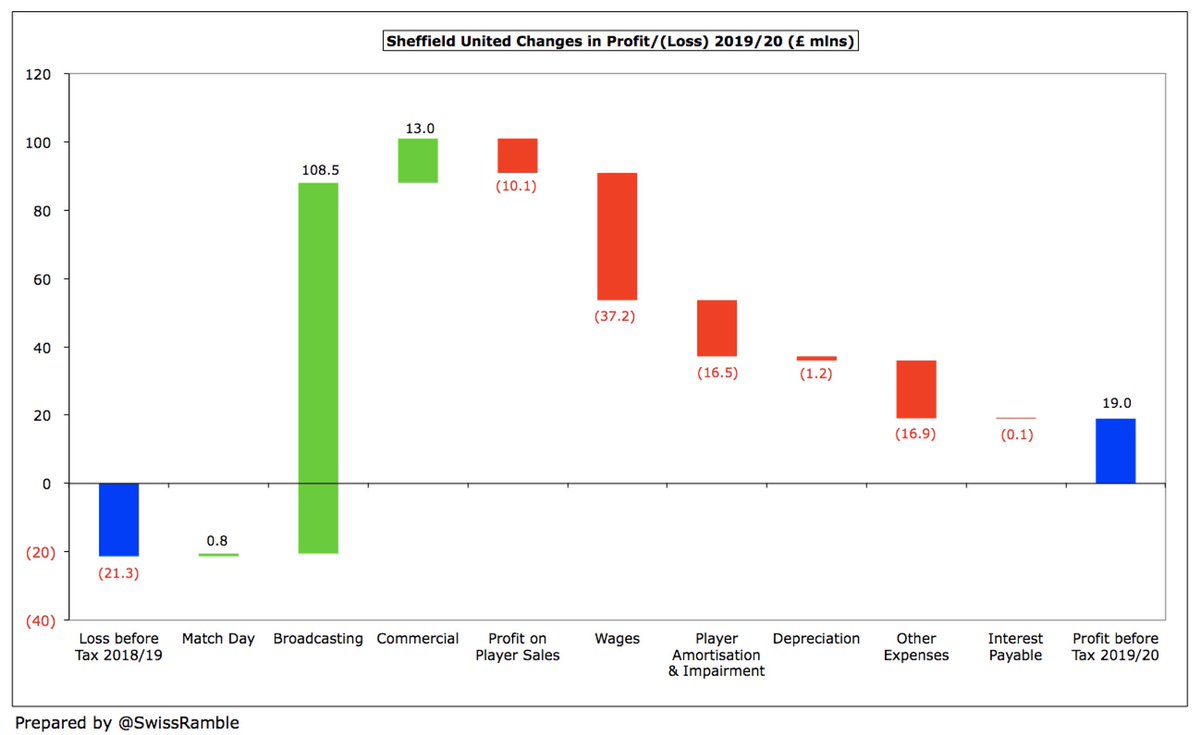

Following promotion #SUFC swung from £21m pre-tax loss to £19m profit, a £40m improvement, as revenue shot up £122m from £21m to club record £143m, though profit on player sales fell £10m to £4m and competing in the Premier League increased expenses by £72m. Profit after tax £18m

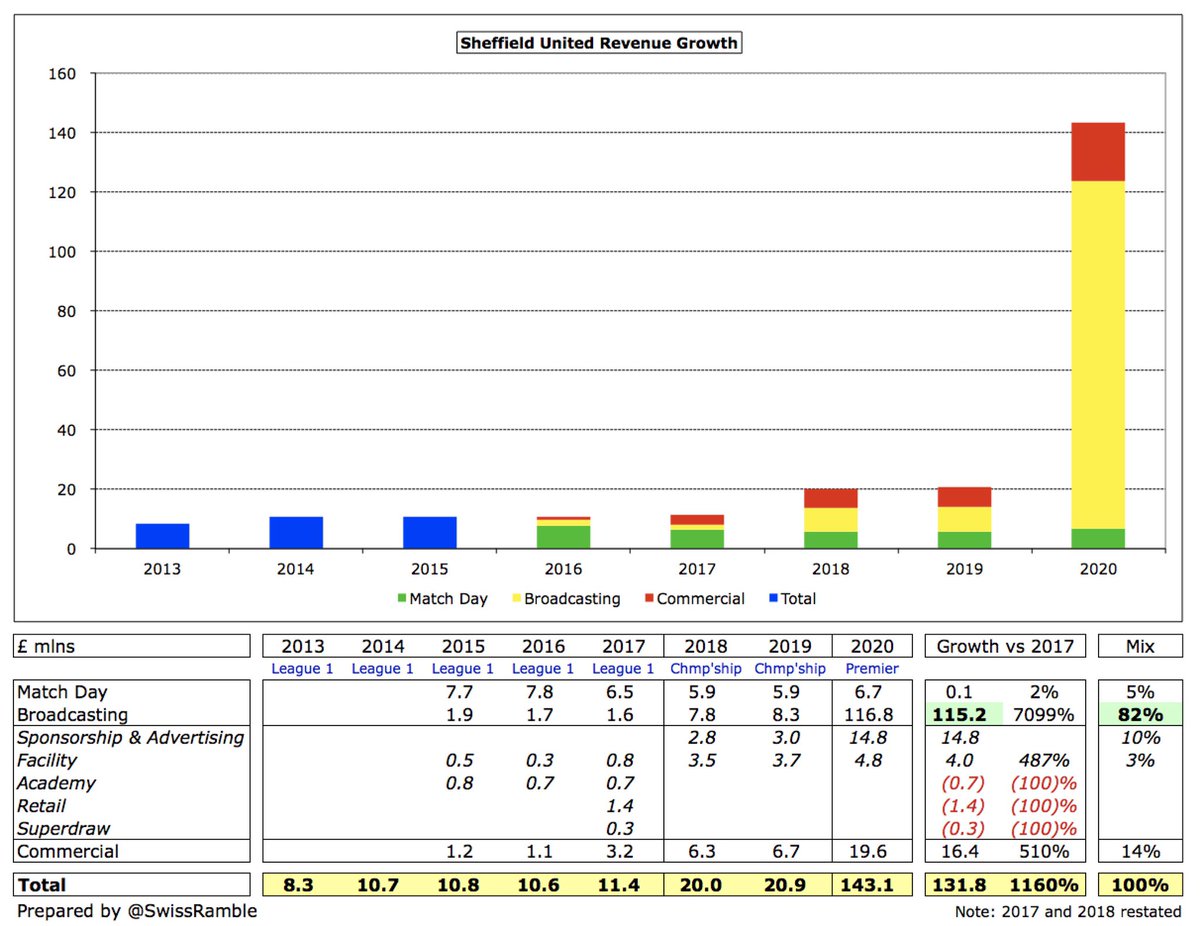

The main driver of the #SUFC £122m revenue increase was broadcasting, up £109m from £8m to £117m, due to the much more lucrative Premier League TV deal, though commercial also rose £13m from £7m to £20m, while match day was up £0.8m (13%) from £5.9m to £6.7m.

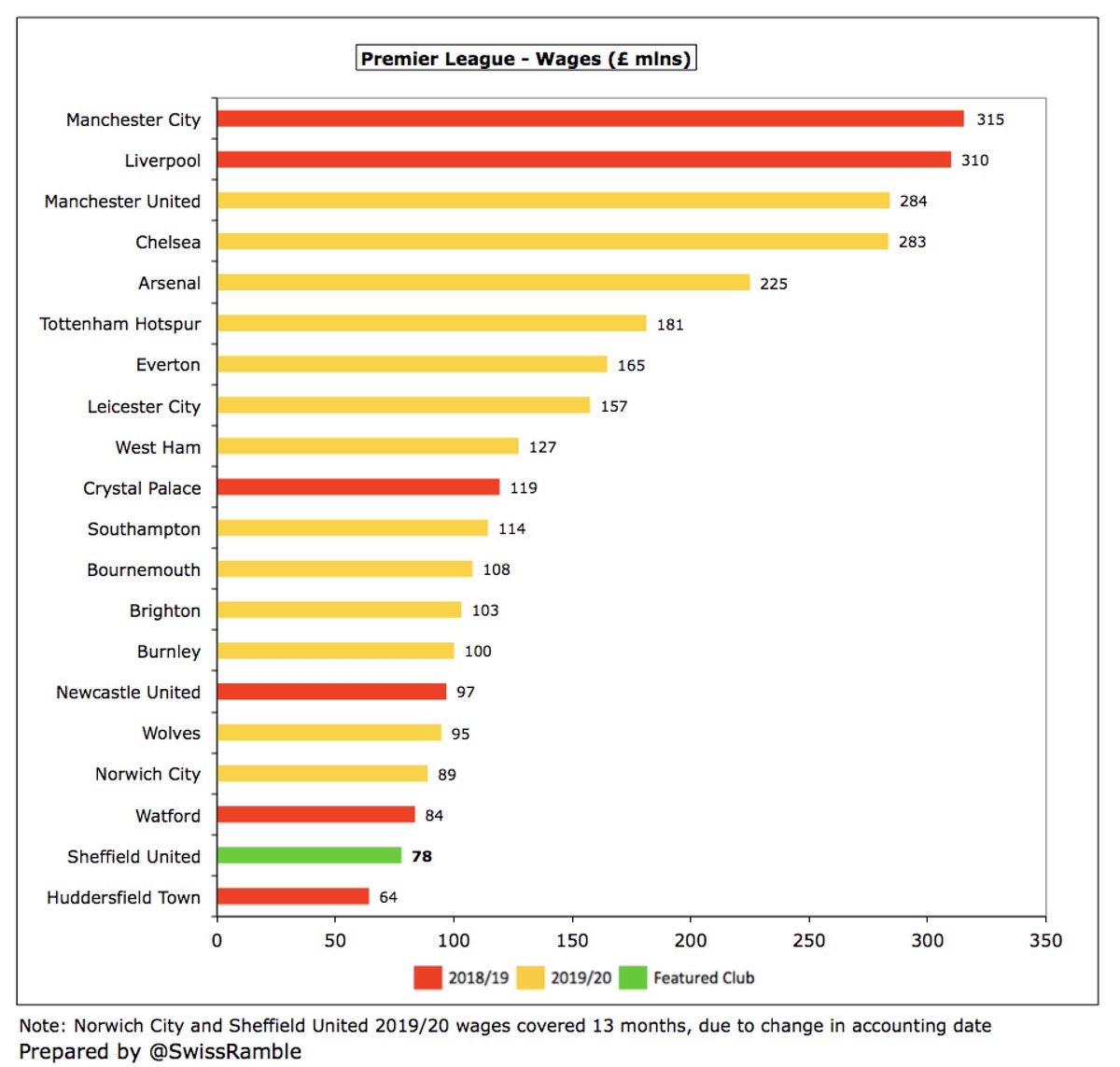

Investment in the squad meant big cost growth: #SUFC wage bill nearly doubled from £41m to £78m (prior year included significant promotion bonuses), while player amortisation and impairment rose £16m to £20m. Other expenses increased £17m to £28m.

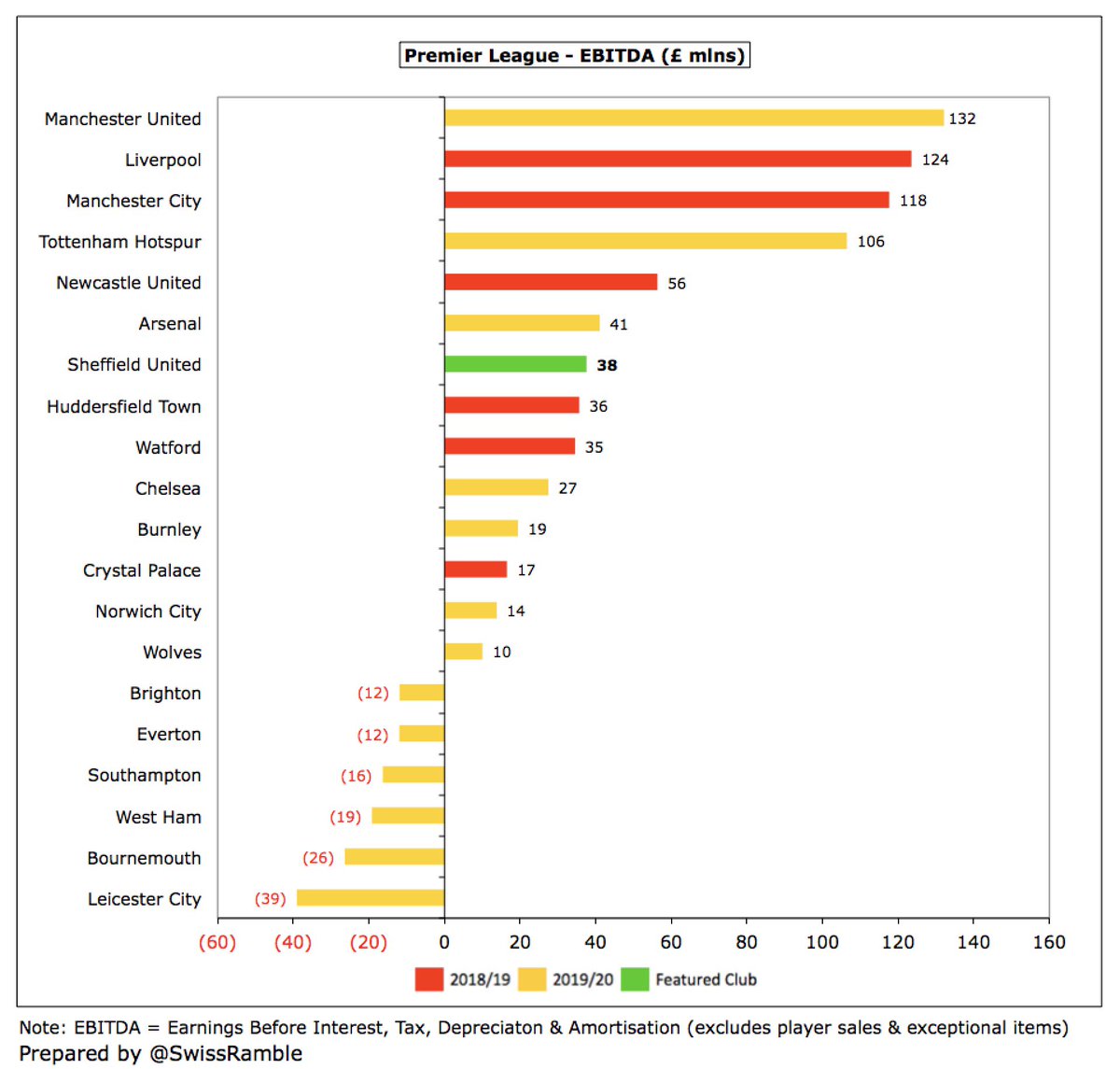

#SUFC £19m profit is the second best result reported to date in the 2019/20 Premier League, only surpassed by #CFC £36m. The scale of the achievement is emphasised by no fewer than 8 clubs posting losses above £50m. The other promoted club #NCFC made a much smaller £3m profit.

Without COVID, #SUFC revenue would have been £11.2m higher at £154m, due to £8.7m broadcasting rebate and £2.5m other lost income. Along with £0.5m additional costs incurred, this would have resulted in the club posting an even higher profit of £31m.

It is worth noting that #SUFC extended their financial reporting period to 31st July 2020, a period of 13 months, in order “to present complete and comparable financial results.” This mitigated some of the impact of the COVID-19 pandemic on the accounts unlike most other clubs.

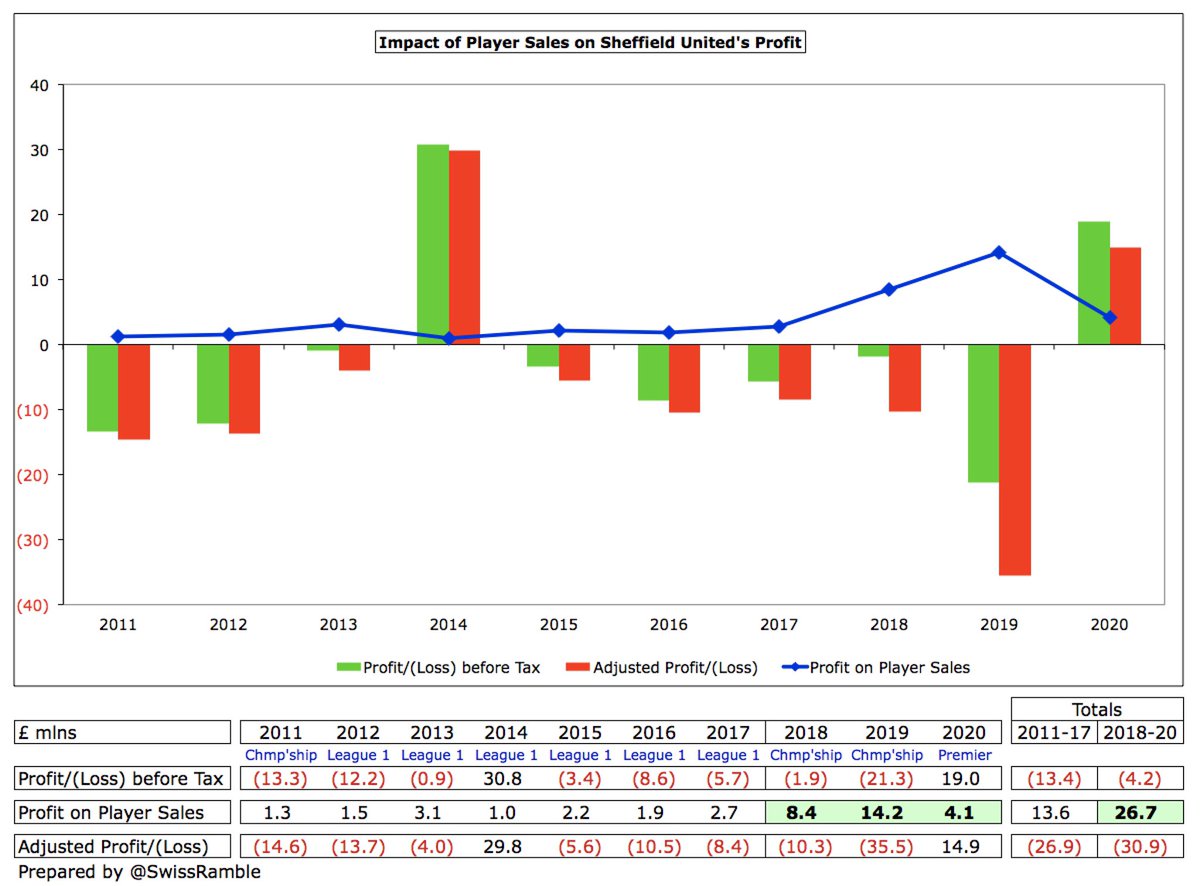

Furthermore, #SUFC only benefited from £4m profit from player sales, down from £14m the previous year. This is one of the lowest profits from this activity in the top flight, way below the likes of #CFC £143m, #LCFC £63m and #AFC £60m.

#SUFC stated that this was “the company’s first profit making period since 2008”, though this ignores the £31m profit reported in 2014, presumably as this was only achieved by McCabe writing-off a £35m loan before partnering with the Prince.

#SUFC profit from player sales has increased in the last 3 years, totaling £27m, including sell-on fees for Harry Maguire and Kyle Walker. This is twice as much as the previous 7 years combined. Very little profit in 2020/21 to date, though summer sales to come.

#SUFC EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), which strips out player sales and exceptional items, improved from £(31)m to £38m, one of the better performances in the Premier League, nearly three times as much as fellow promoted club #NCFC £14m.

#SUFC managed to post a £16m operating profit (i.e. excluding player sales and interest) in the Premier League, which is actually the highest to date in 2019/20, significantly better than most other clubs, e.g. three had losses over £100m: #EFC £175m, #LCFC £122m and #CFC £112m.

#SUFC revenue of £143m is an incredible 13 times as much as the £11m they reported in League One just three years ago with £115m of the £132m increase coming from broadcasting, which contributes 82% of total revenue. Also significant growth in commercial, up from £3m to £20m.

Following the growth, #SUFC £143m revenue was a very respectable 11th highest in the Premier League, ahead of clubs like #CPFC £141m and #WHUFC £140m. That said, this was still £200m below #AFC £343m, the lowest of the so-called “Big Six”.

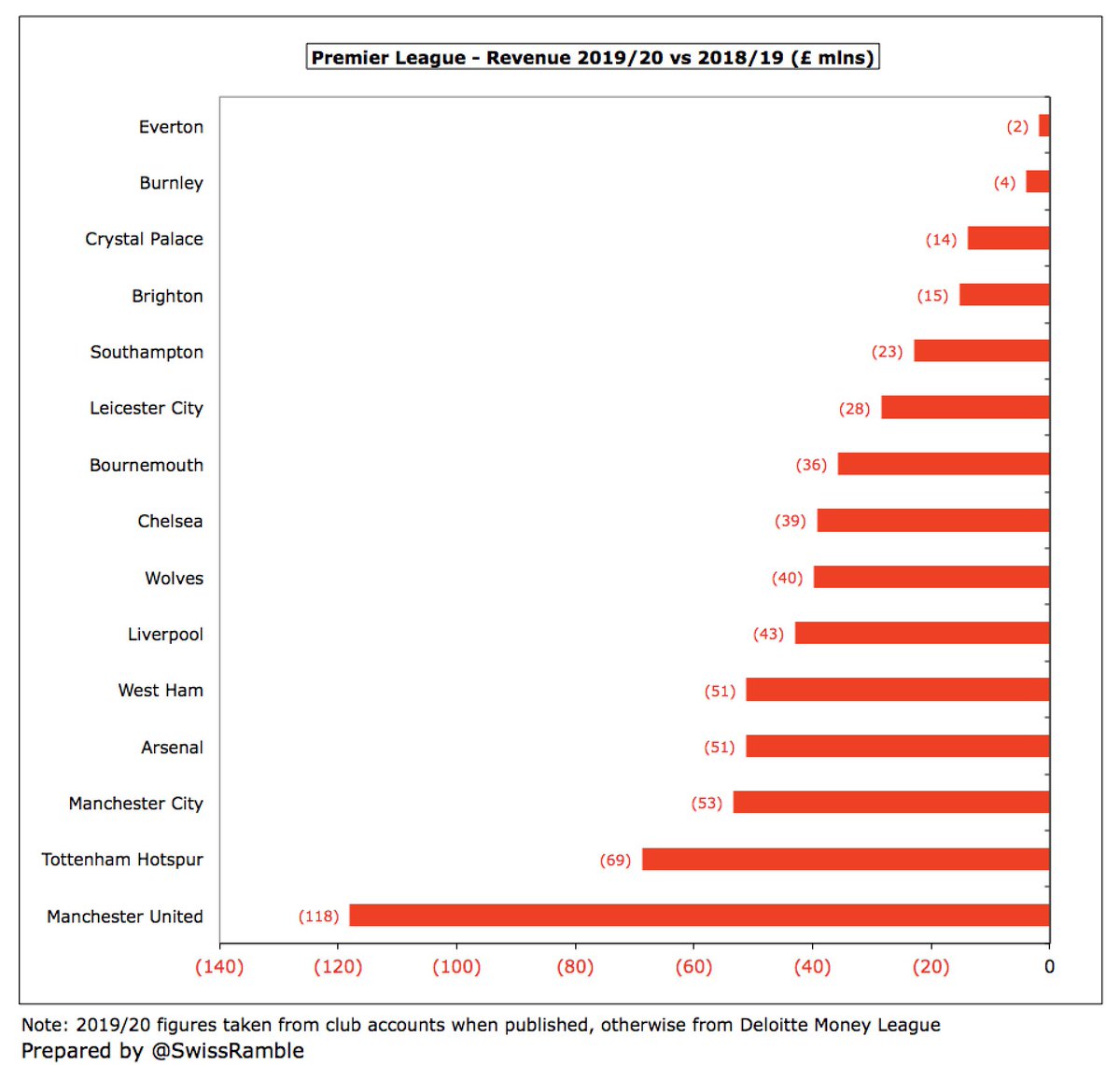

Most Premier League clubs’ revenue is significantly down in 2019/20, due to COVID-19 impact, averaging decreases of 13% and £39m. #SUFC have been protected to an extent by extending accounts to 31st July, whereas others with May and June closes have deferred revenue to 2020/21.

Another sign of #SUFC progress is their 28th position in the Deloitte Money League, which ranks clubs globally by revenue, just behind recent Champions League semi-finalists Ajax and ahead of Milan. Note: revenue here only £133m, as they have pro-rated from 13 to 12 months.

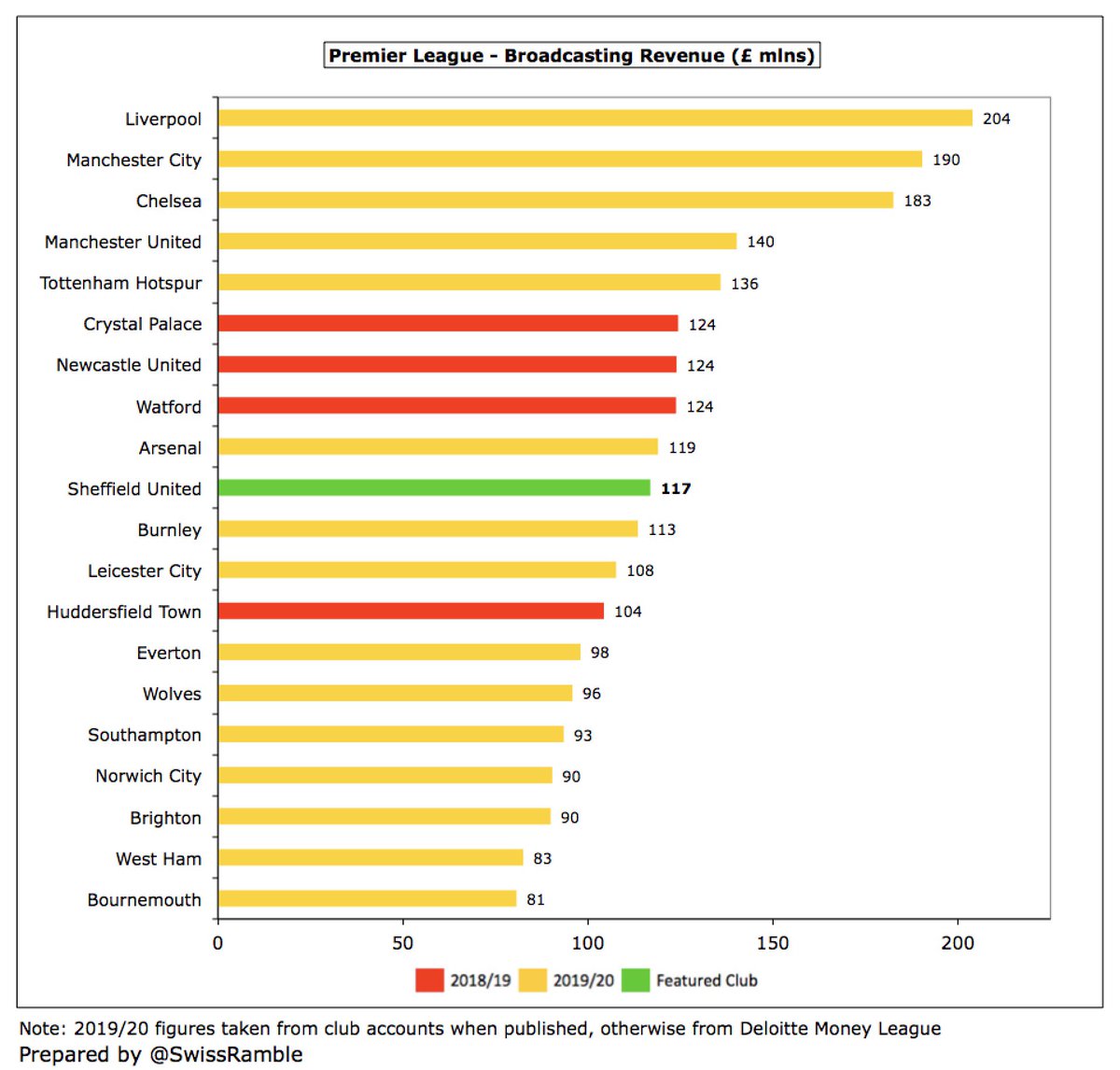

Following promotion #SUFC broadcasting income rose £109m from £8m to £117m (net of £9m rebate), around mid-table in Premier League. Other clubs adversely impacted by having to defer revenue into 2020/21, as season was extended beyond their 31st May & 30th June accounting close.

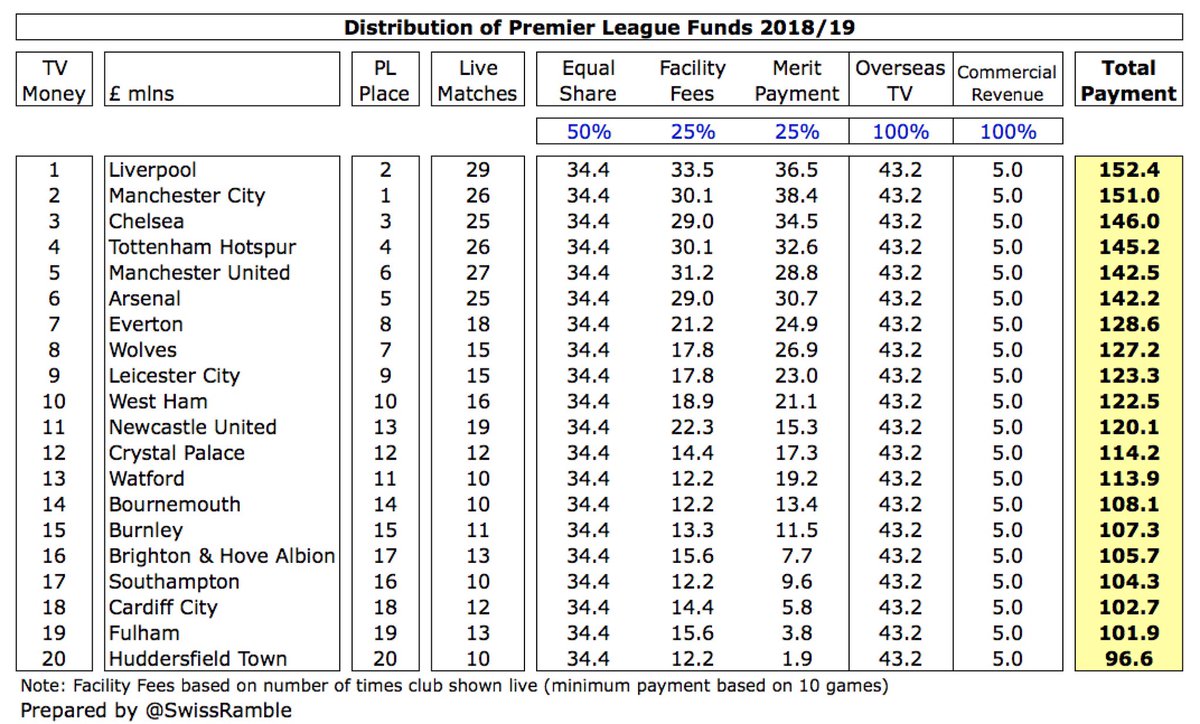

Much of Premier League TV deal is distributed equally, but part based on league position (merit payments, growth in overseas rights) and number of times team is shown live (facility fees). From 2019/20 each league place is worth around £3m, so #SUFC fall from 9th will be costly.

If #SUFC are relegated from the Premier League, TV income would fall significantly, albeit cushioned by £42m parachute payment, which would give them much higher revenue than most other Championship clubs. Parachutes fall to £35m in year 2 and £16m in year 3.

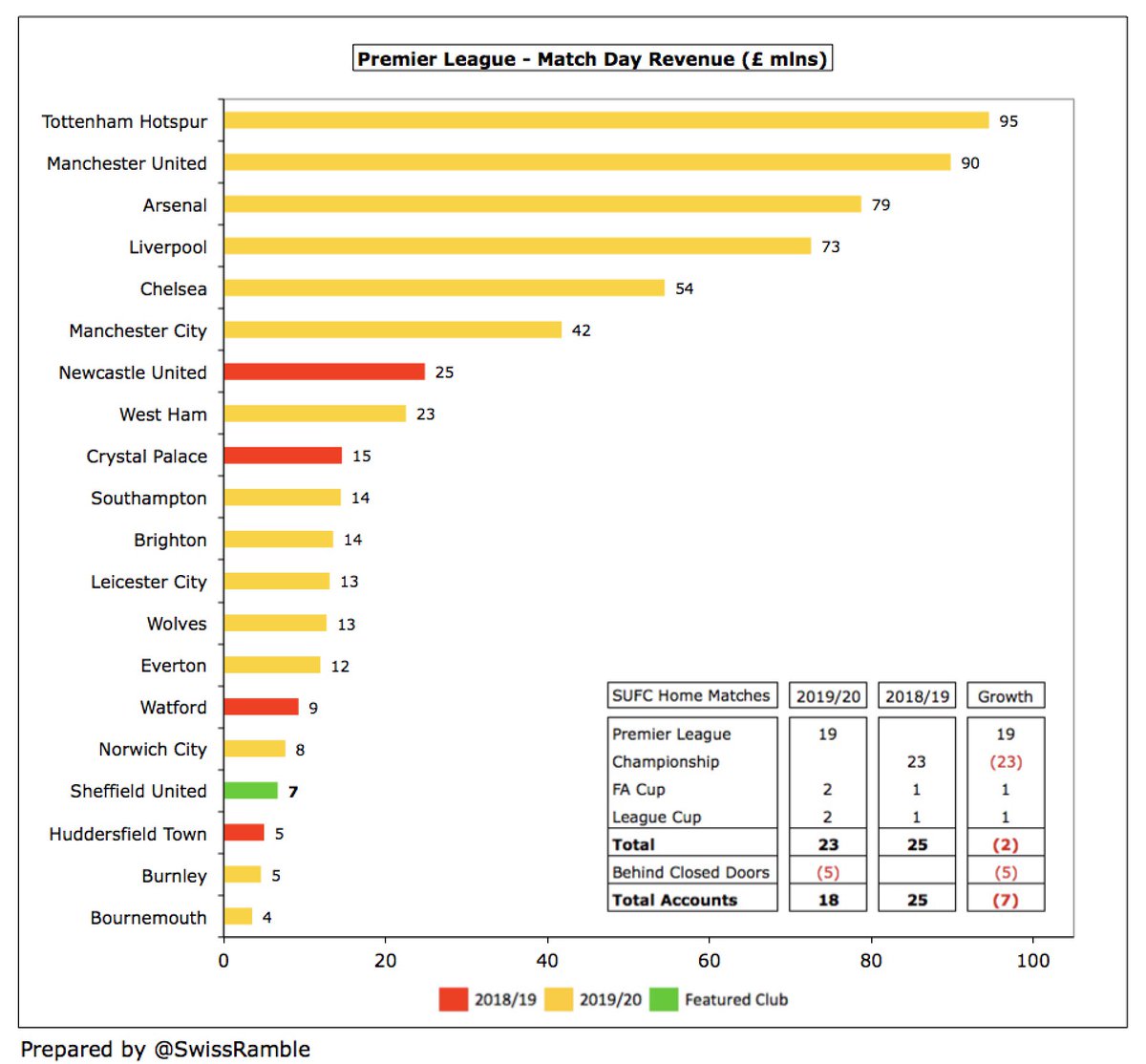

#SUFC match day rose £0.8m (13%) from £5.9m to £6.7m. Would have been higher without playing 5 home games behind closed doors (including FA Cup quarter-final against #AFC). One of the lowest in the top flight, just 7% of #THFC £95m for some perspective.

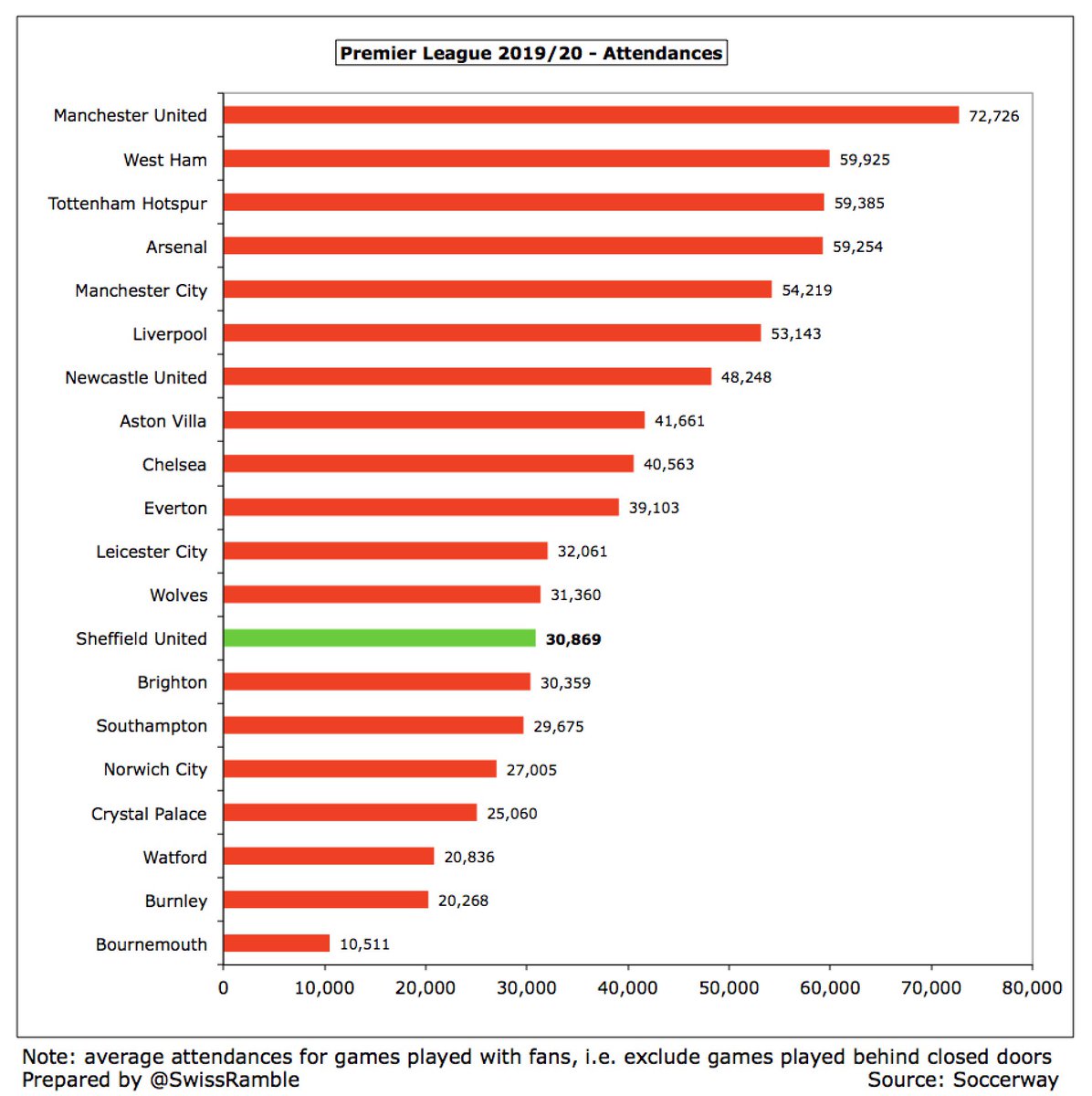

#SUFC average attendance increased from 26,177 to 30,869 (for games played with fans), around the same level as the last time they were in the Premier League in 2006/07. Ticket prices were increased by 11% following promotion, but still cheapest in the top flight.

#SUFC commercial income nearly tripled from £6.7m to £19.6m, comprising sponsorship & advertising £14.8m and facility £4.8m, taking advantage of what the Board described as “an enormous commercial revenue opportunity” in the Premier League.

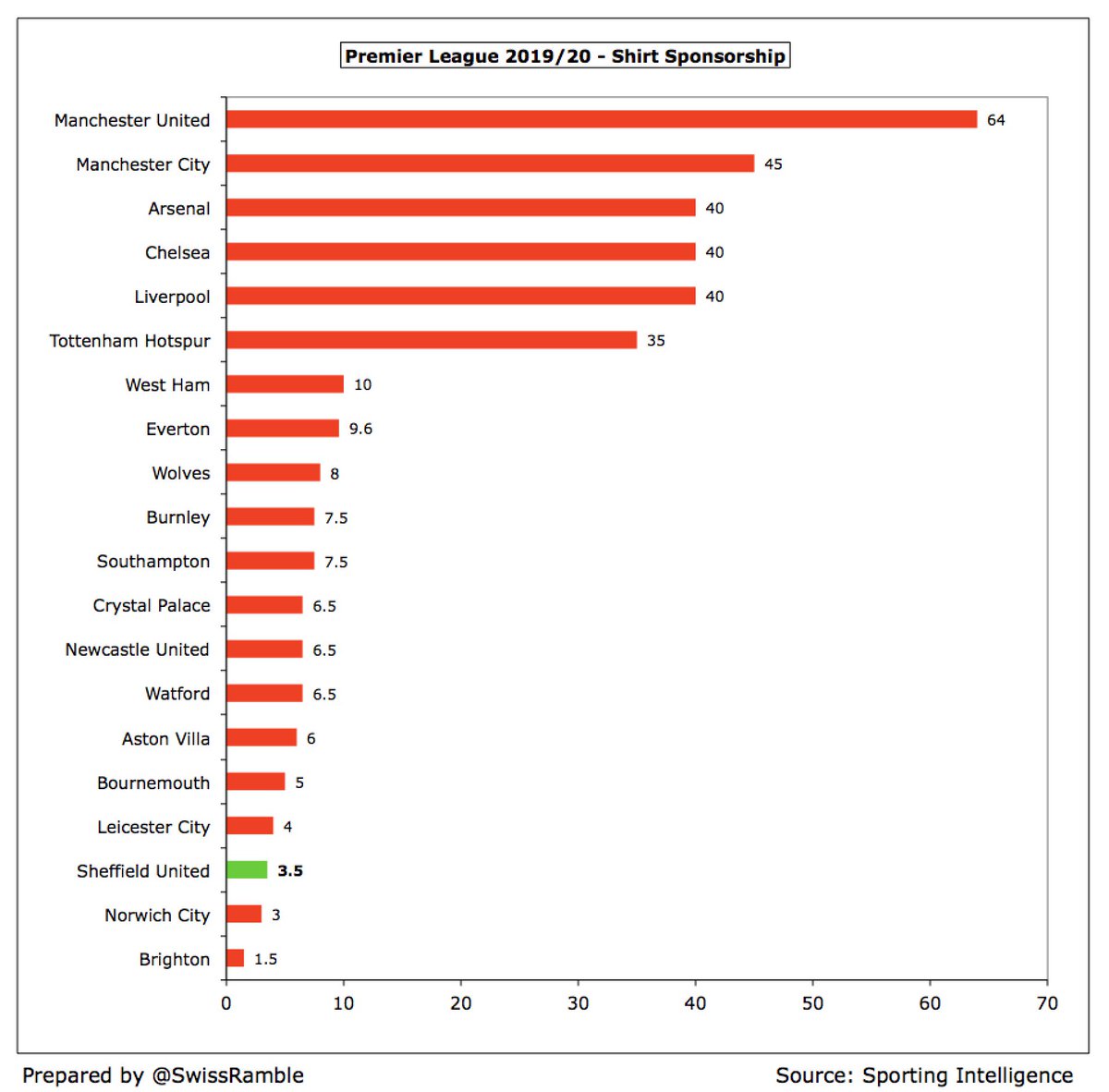

#SUFC had a new shirt sponsorship deal in 2019/20 with Union Standard Group, reportedly worth £3.5m a year (including sleeve), though this is one of the smallest in the Premier League. Also have long-standing kit supplier deal with Adidas, up for renewal the end of this season.

#SUFC wage bill nearly doubled from £41m to £78m. Prior season included hefty promotion bonuses, so wages were only £19m in 2017/18. This means that wages have grown £59m in the last two years, while revenue has increased £123m in the same period.

Despite the steep increase, #SUFC £78m wage bill is the lowest in the Premier League in 2019/20, around £11m less than the other promoted club #NCFC £89m. Players and manager deferred 10% of salaries for 6 months, but on the other hand accounts included 13 months.

#SUFC wages to turnover ratio improved from 195% in the Championship (including sizeable promotion bonuses) to only 54%, one of the lowest in the Premier League. Would have been just 50% if COVID impact excluded. Arguably, the club played it too safe.

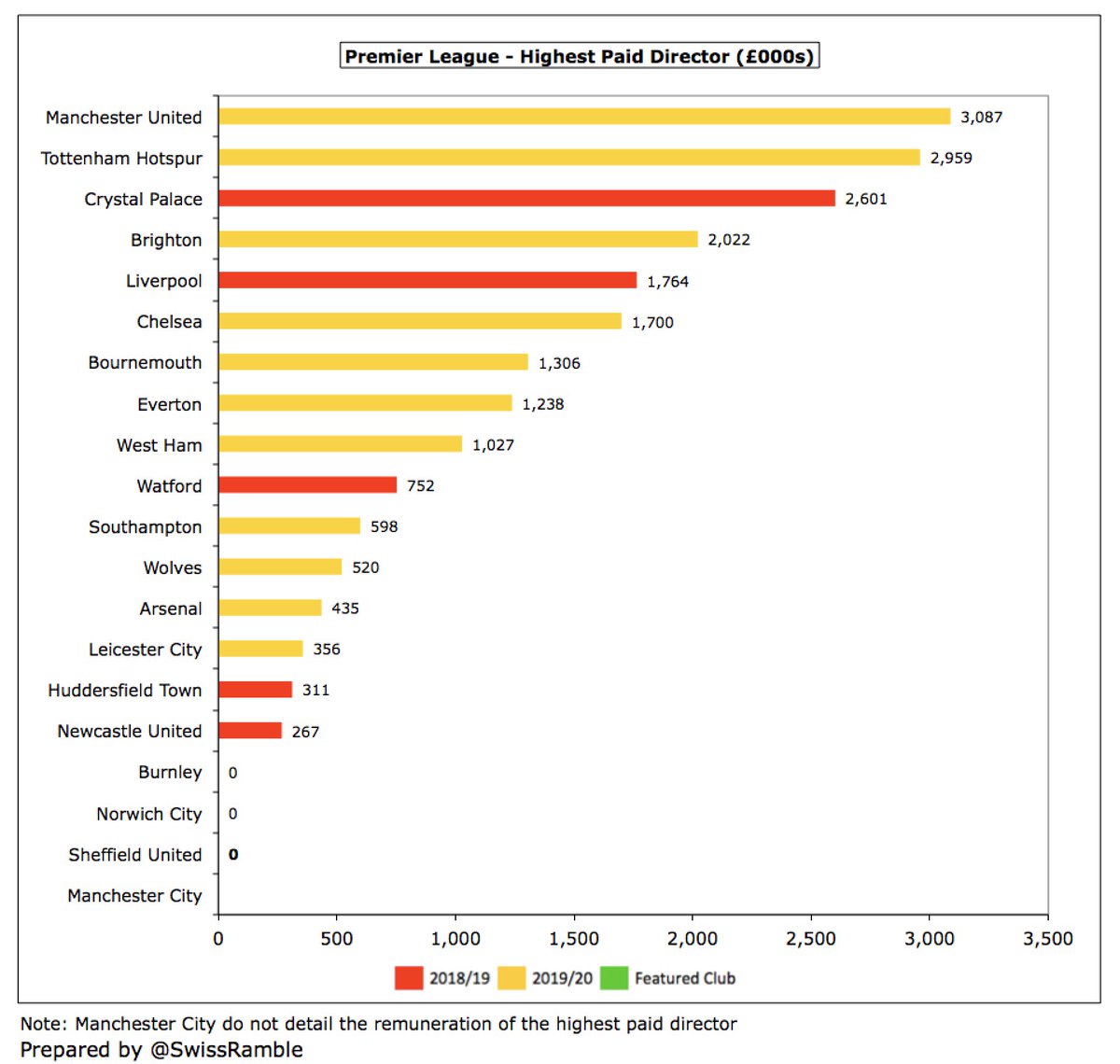

No #SUFC directors received remuneration, which is in stark contrast to the likes of Ed Woodward at #MUFC and Daniel Levy at #THFC, who both trousered more than £3m.

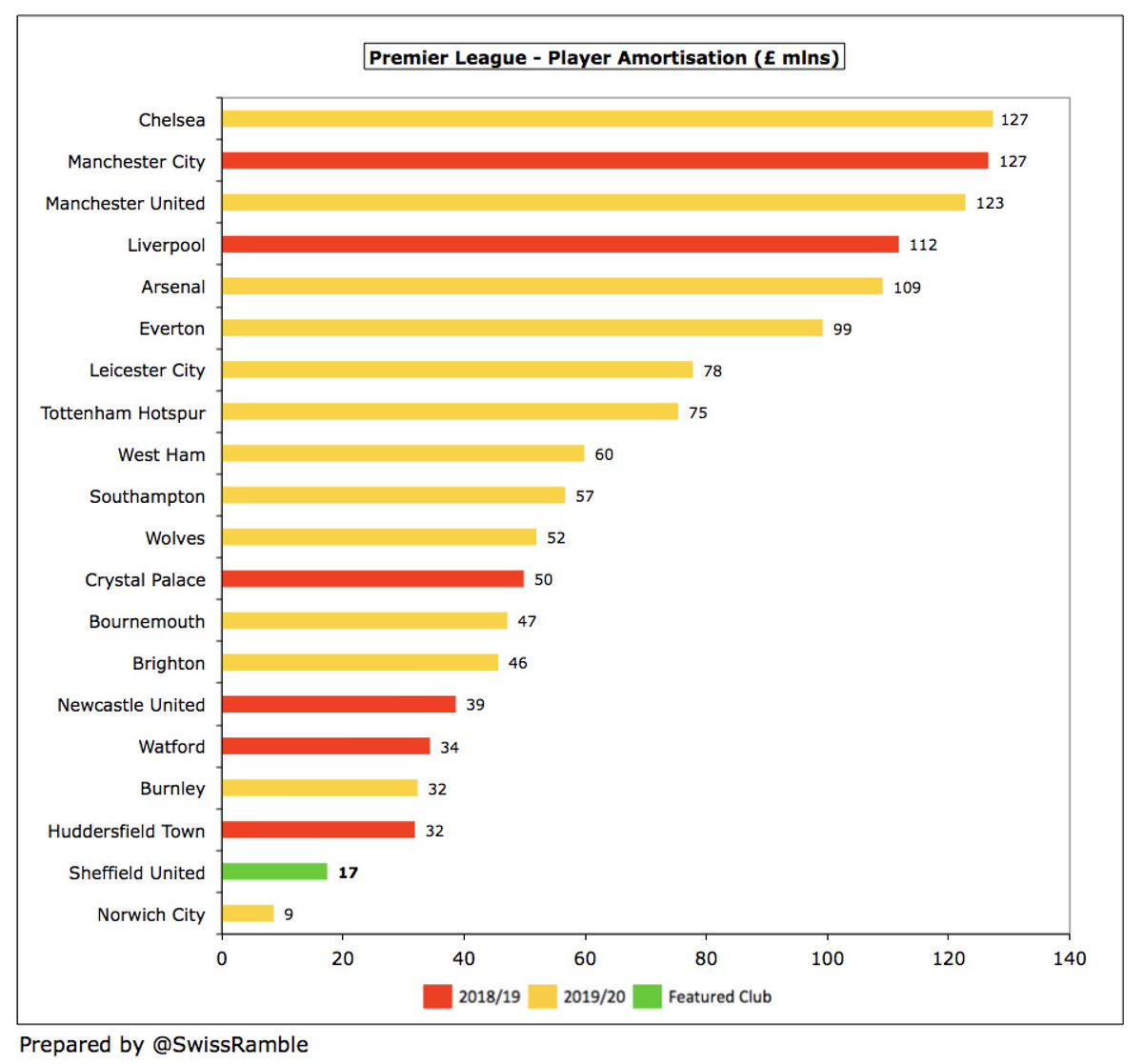

#SUFC player amortisation, the annual charge to expense transfer fees over a player’s contract, rose £14m from £3m to £17m following investment in the squad, though this was one of the lowest in the Premier League, only ahead of #NCFC £9m. Also booked £2.6m player impairment.

#SUFC spent £66m on player purchases in 2019/20, significantly more than prior season’s £7m, including Sander Berge from Genk, Oli McBurnie from Swansea City, Lys Mousset from #AFCB, Callum Robinson from Preston, Luke Freeman from QPR and Ben Osborn from #NFFC.

The £66m #SUFC outlay on player purchases last season was more than three times as much as the previous nine years combined (£21m). Club spent a further £44m last summer, mainly to bring in Rhian Brewster from #LFC and Aaron Ramsdale from #AFCB, so £110m since promotion.

#SUFC gross debt increased from £4m to £17m, mainly soft loans from shareholders. This would have been much higher without the owners writing-off £35m debt and converting £27m of debt to equity since 2014. Tax and social security debt up from £2m to £16m.

#SUFC £17m gross debt was one of the smallest in the Premier League, much lower than some other clubs, though many of these have taken on debt for new stadiums or training grounds, e.g. #THFC £831m, #MUFC £526m, #EFC £409m and #BHAFC £306m.

#SUFC paid £874k interest in 2019/20 on bank loans taken out by the holding company, Blades Leisure Ltd, significantly lower than the likes of #MUFC £20m, #THFC £14m and #AFC £11m.

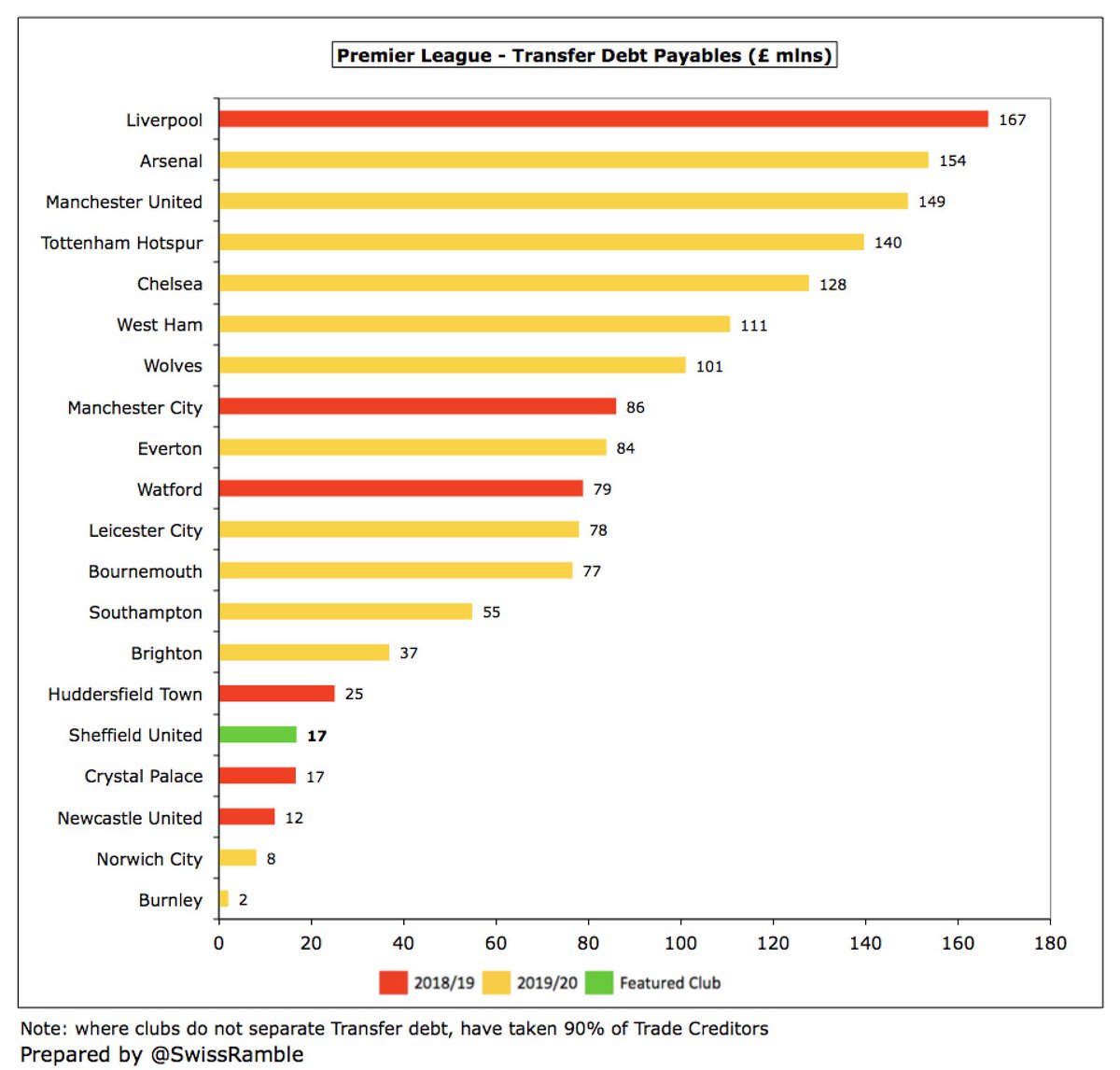

#SUFC transfer debt increased from £6m to £17m, partly offset by £2m transfer fees owed by other clubs, so net payable is £15m. On the low side for the Premier League, though also have £11m contingent liabilities (based on appearances and team performance).

#SUFC £16m operating profit improved to £105m operating cash flow by adding back £22m amortisation/depreciation and £68m working capital movements. Spent £62m on net player purchases, £49m capex (stadium, training ground, etc) and £8m investments. Owner provided £21m funding.

Since 2013 #SUFC’s available cash of £121m was split between operating activities £77m and owner financing £44m. Most of this went on infrastructure £54m with another £42m on players (purchases £85m, sales £43m), £8m investments and £9m loan/interest.

Note that the cash flow statement is from parent company Blades Leisure Ltd, as this is not included in The Sheffield United Football Club Ltd accounts. However, the revenue, wages, P&L and debt numbers are almost the same for these two companies, so it’s a reasonable proxy.

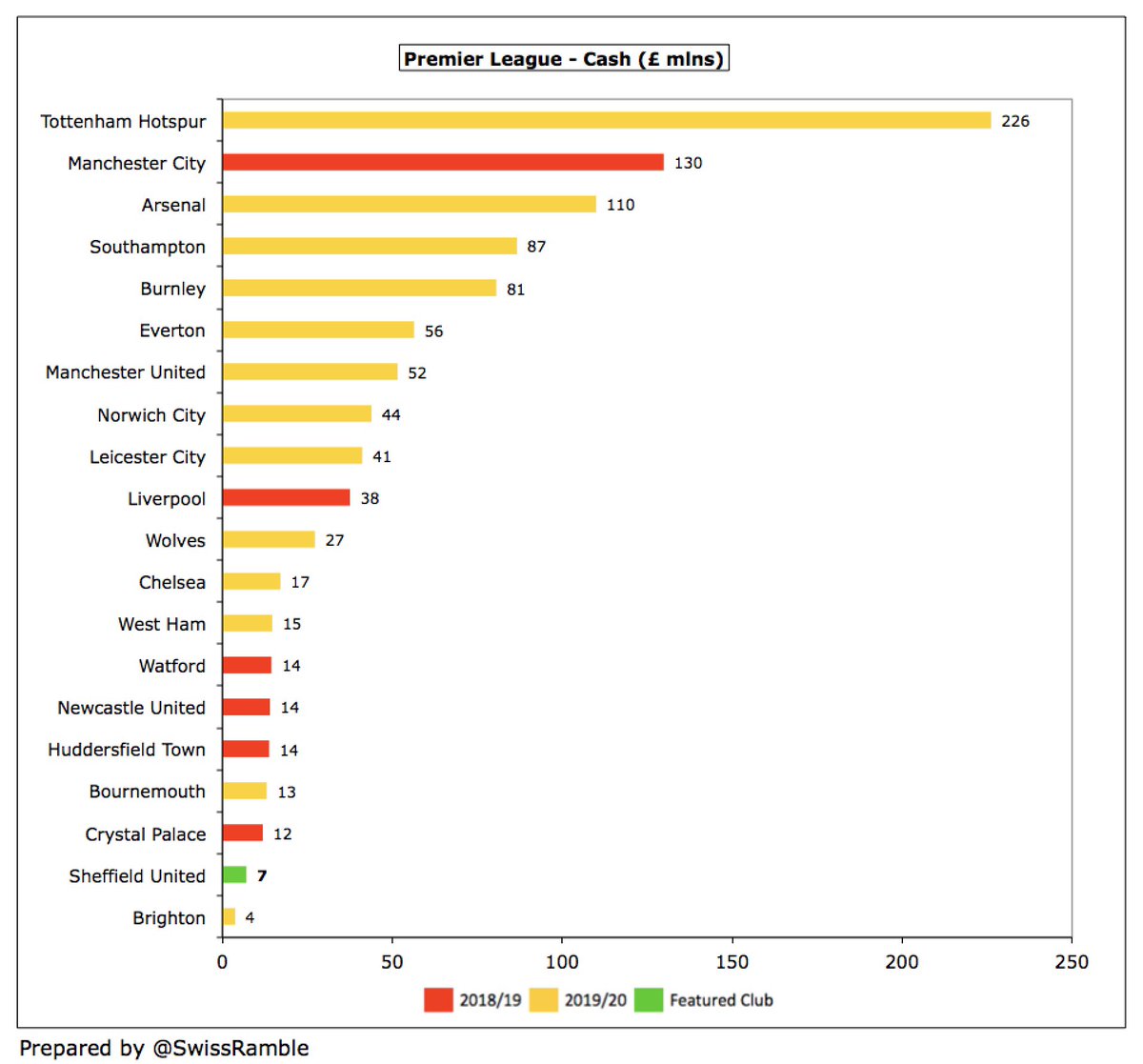

#SUFC cash balance increased from £1m to £7m, though still one of the lowest in the Premier League, only above #BHAFC £4m. This is not a great buffer during the current challenging environment.

So 2019/20 was as good off the pitch for #SUFC as their performance in the league (notwithstanding board room battles), though their finances will suffer this season following the fall from 9th place and will then take another hit if (seemingly inevitable) relegation follows.

• • •

Missing some Tweet in this thread? You can try to

force a refresh