Amazing presentation from Pax Global on its FY 2020 earnings and fantastic Chairman's speech sharing his ambitious goal. Call transcript avaiable in the following link:

slideshare.net/GabrielCastroC…

slideshare.net/GabrielCastroC…

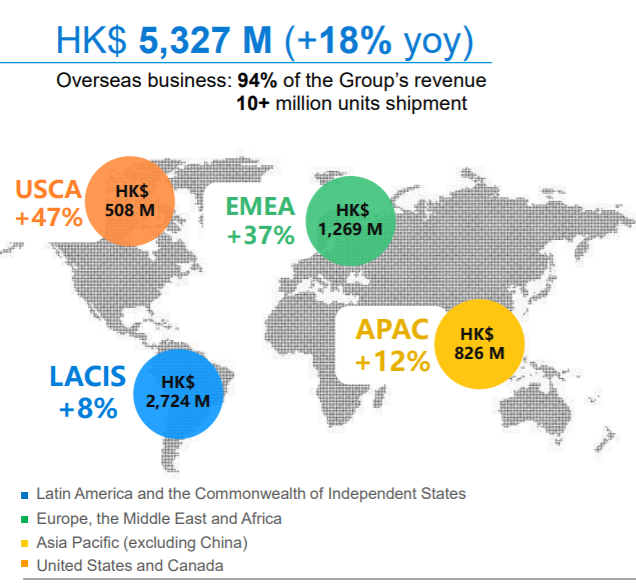

The company is beating the most optimistic estimates. Management is excellent. They left China avoiding the commoditization and price war before nobody predicted it and switched to geographies where they add real value. Their moat is growing day by day and the best is yet to come

The management is aware of the shareholders' needs. They know the stock is really cheap and will continue to unlock value through increasing shareholder reward

Brokers are increasing the Target Price, but they are still very far from a reasonable valuation. CMS raised Pax Target Price up to HK$ 12.1 from HK$ 10.1 as back in December I predicted. I bet they will raise the TP again this year

https://twitter.com/gabcasla/status/1340012333440131074?s=20

I will update the valuation and provide my thoughts during the week on a video, but I can reveal we are increasing our internal TP due to better capital allocation decisions and Pax still has >100% upside from here

youtube.com/channel/UCfZzQ…

youtube.com/channel/UCfZzQ…

• • •

Missing some Tweet in this thread? You can try to

force a refresh