A day of victory for crypto-assets and for bitcoin in particular. It is also a day that establishes these blockchain-based crypto tokens as a Wall-Street adopted asset class in competition with other types of investment. They are not currencies. 1/

A new Exchange (Coinbase), specialized in crypto-assets was launched and traded in NASDAQ. It attained an initial value of ±100 billion dollars of capitalization. Much higher than the company that owns the NY Stock Exchange and not much below Blackrock (± 120 bn) or GE !! 2/

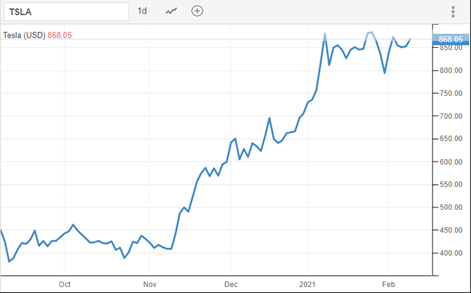

Bitcoin itself reached 64000 dollars per coin before dropping a bit. As I tweeted some time ago, bitcoin cannot be a full-fledged currency because it cannot be a stable unit of account or an usual means of exchange because the higher and higher valuations undermine that. 3/

To buy a car in September in the US priced at 100.000 USD we would have to spend 10 coins. However, if we would have waited until January, with 10 bitcoins we could have bought 4 cars and in mid-March 6 cars. This implies a big risk of spending bitcoins in current transactions.

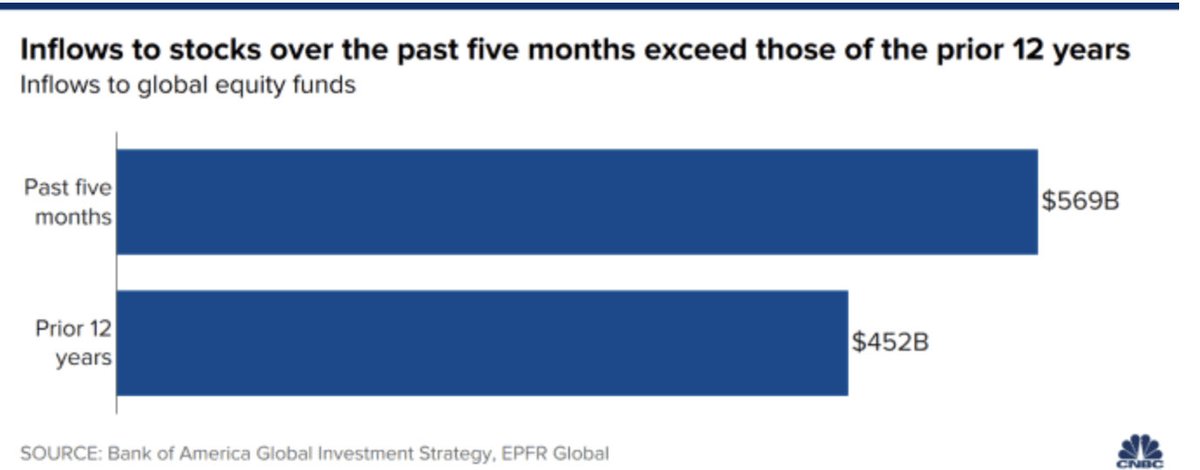

There is now a sort of American fever: the inflow of money into stocks in the past 5 months exceeds the amount in the past 12 years! An NFT (a non-fungible token in a blockchain)was bought for $68million but was already online and can be reproduced. NFTs may be exchange traded

Despite appearances this is not the roaring twenties of yore, which could be seen as a bad omen. Today, the earnings of the big US banks surpassed by far all market expectations The strength and growth of the US economy is now for real. Can it cover all those huge valuations? 6/6

• • •

Missing some Tweet in this thread? You can try to

force a refresh