A potential problem is looming, and the media are pursuing a new story that builds on the following chain of reasoning: 1) higher inflation is coming;2) if CBs increase interest rates debts will explode and recession may ensue; 3) CBs are caught in an impossible dilemma 1/12

It´s perhaps too complex for some tweets, but.. Registered inflation this year is bound to be higher than present forecasts, resulting from one-off price spikes and base effects That will not start a sustained high inflation process, but temporary higher inflation is possible 2/

For example, Euro Area inflation increased suddenly from several months at -0.3% to +0.9% in Jan. This jump resulted mostly from several base effects, especially the change to German VAT. Inflation expectations increasing but higher in the US than in the EA 3/

The major one-off base effect will come from oil prices that decreased abysmally in March 2020 and have recovered. Some estimates put US inflation in April reaching 4%! After vaccinations, later in the year, pent-up consumer demand will also increase prices.4/

Despite the increased spending of accumulated savings, the savings rate will remain higher than before Covid for precautionary reasons (Fig 1). No permanent spending spree will materialise. Wages will remain subdued for a while (Fig2). Higher but not high inflation is coming.5/

However, seeing a slight inflation increase, old hands will start to hyperventilate (wrongly) about high inflation, some even thinking about old monetarism (this monetarism would require another thread). They will increase pressure on Central Banks (CBs) 6/

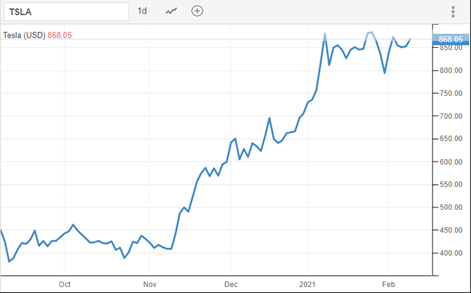

Temporary slightly higher inflation will increase bond yields, so investors must reduce or hedge duration.Higher yields tend to affect discount rates by more than the expectation of earnings-reaction to higher nominal growth & stock prices may suffer. (CBs shouldn´t intervene) 7/

CBs will not react to inflation going above 2% for a while. The FED already said it by adopting an average inflation targeting framework that allows for higher inflation offsetting the previous underperformance. The ECB & others will have to follow suit. 8/

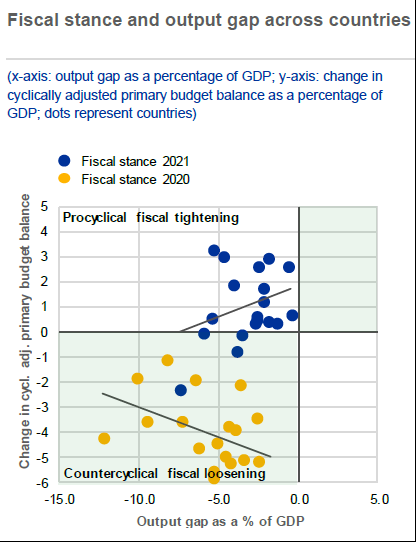

My 1st tweet media story would require that inflation goes PERSISTENTLY higher, e.g.>3%<4%, unlikely as it seems. But let´s assume that inflation obliges. Would CBs refrain from increasing policy rates? No. Would debt sustainability explode? It depends... 9/

Inflation is associated with many things that the basic story ignores. Going up, it´s accompanied by higher nominal GDP level and growth. That helps to absorb old debt in a lower ratio to GDP. Overall outcomes depend on policies & nominal GDP growth vs nominal interest rate.10/

It´s well known that after WW II, higher growth and inflation contributed to the absorption of the war debt. True, a bit of financial repression also helped, but that doesn´t imply unchanged interest rates. In many cases, there was no need for fiscal austerity. 11/

The situation is different now. We cannot count on the real growth rates like the ones after WW II as we are still in a secular stagnation phase. But then this means that without sustained higher growth, persistently high inflation becomes more unlikely.12/12

• • •

Missing some Tweet in this thread? You can try to

force a refresh